The Indian taxpayers are assigned a 10-digit identification number that is used to track all tax payments and financial activities of an individual or business. The PAN or Permanent Account number, is a unique number assigned by the Income Tax Department of India. It serves as your proof of identity, primarily for tax and other financial purposes. The PAN card has lifelong validity and remains unchanged. In this article, we provide an explanatory guideline for all the charges levied when you obtain a PAN card.

PAN Card Fees & Charges

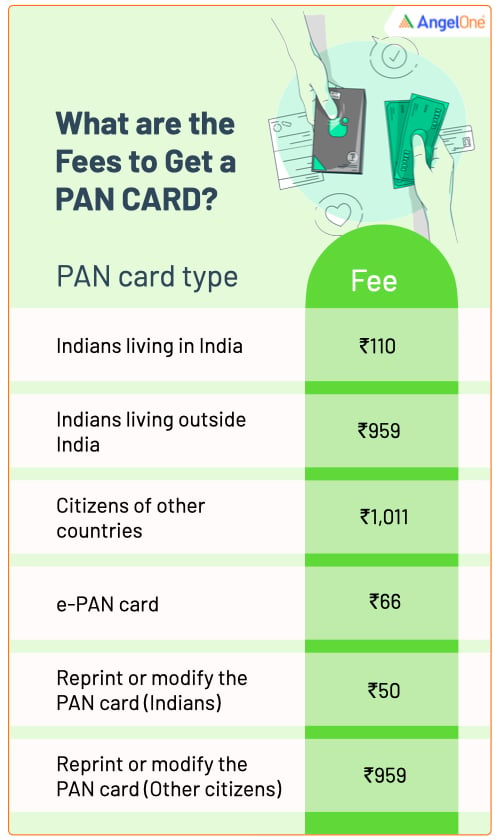

A PAN card is mandatory for all individuals who engage in some kind of financial transaction. To make it affordable for all and curb the number of unauthorised transactions, the government has set minimum fees for obtaining a new PAN card. PAN card application fees depend on the address of the applicant as the charges are higher if you are located outside India.

Please find the PAN card charges for 2023.

| PAN card type | PAN card charge |

| PAN card for Indians living in India | ₹ 110 (Processing fee +18% GST) |

| PAN card fees for citizens of other countries | ₹1,011.00 (Application fee + Dispatch Charges ₹857+ 18% GST) |

Earlier, there were discrepancies regarding PAN card charges within the country. However, the government has simplified the process and introduced a uniform fee for all applicants living within the geographical boundaries of the country.

PAN Card Fees for Foreigners

The booming Indian economy has attracted many foreign players who are interested in conducting business in the country. A PAN card is mandatory for these entities as well. The government has a different rate slab for foreign applicants. The PAN card application fee for foreigners is ₹1,011.00. It includes the application charge, dispatch charge, and 18% GST, or service charge.

Foreign entities must submit Form 49AA, along with all supporting documents (the document requirements can be different for foreigners and Indians), and the fees to obtain a PAN card.

It is important to note that foreign entities carrying Indian PAN cards must only use them for transactions carried out in the country.

For Individuals Residing Abroad

For individuals wanting to carry out transactions in India, the PAN card application method is the same. However, the government imposes a different charge slab for the non-resident category. The PAN card charge for these entities is ₹959 (application fee + GST).

E-PAN Card Fees for Indian & Foreign Residents

As per the amendments to the Income Tax Act, clause (C) of subsection (8) of Section 139A, and sub-rule (6) of Rule 114, an e-PAN card is a valid document. To obtain an e-PAN card, one needs to pay a fee of ₹66 (Application charge + GST). Only Indian citizens, apart from minors and individuals falling under Section 160, can obtain an e-PAN.

PAN Card Fees to Re-Print or Modify a PAN Card for Indian Residents

If you find yourself in a position where you need to reprint or modify the PAN card, you can apply for a reprint. The facility is available to all taxpayers for a fee. If the communication address is in India, the PAN card fee online is ₹50, including tax.

Read More About PAN Card Mobile Number Change

PAN Card Fees to Re-Print or Modify a PAN Card for Foreign Residents

Foreign entities wanting to carry out transactions in India need to obtain a PAN card. In case they need to modify or reprint a PAN card, they must pay a charge of ₹959, including taxes.

Benefits of Pan Card

These are the benefits of a PAN card:

- A PAN card is essential for opening any kind of bank account: savings, current, fixed deposits, etc.

- A PAN card serves as proof of identity when filing an ITR. Before the PAN card, taxpayers had to file various documents to prove their identity. The PAN card has made it easy for the IT Department to track your financial transactions.

- Using the PAN card, banks and lending institutions can check your CIBIL. The CIBIL is a score that depicts your creditworthiness.

- Quoting your PAN card number is mandatory for all financial transactions above ₹50,000.

- You need to provide your PAN card while buying stocks, mutual funds, and other financial instruments.

- If you are trying to register a business, you must get your PAN card done in advance. It is mandatory to get your PAN card before registering your business.

- You must provide a PAN card if you receive or send money abroad. It is necessary under the Prevention of Money Laundering Act.

- A PAN card is necessary to make a loan application and for its approval. If you apply without a PAN card, your loan application may get rejected, resulting in a dent in your credit score.

Know More About PAN Card Download

Final Words

The PAN card is a critical document for all your financial transactions. The Income Tax Department has simplified the PAN card application process by making it available online. Now that you know the PAN card fees online, you can make an informed decision regarding your PAN card application.

Having a PAN card is an important step towards opening a demat account. Open a Demat account today and start your journey into trading and investing!