UAN Number

The Universal Account Number (UAN) is a unique identification number given to all salaried employees contributing to the Employee Provident Fund (EPF). The UAN number is generated by the EPF office and assigned by your employer. It is a 12-digit number that remains constant throughout the professional life of the employee, even when they leave or change jobs. When an employee joins a new office, the UAN gets transferred to the new employer. Nowadays, it has become easier to access and track your PF account using the internet on laptops and mobile devices. Hence, apart from knowing the UAN number, one must learn the other aspects of the UAN to use it more efficiently.

Getting a UAN Number

One can get a UAN number either through their employer or by registering through the UAN portal. Usually, the employer assigns you the UAN number when you join the organisation. Sometimes it is even mentioned on your salary slip. The other option is to log in to the UAN portal and generate the UAN number using the PF Number/Member ID.

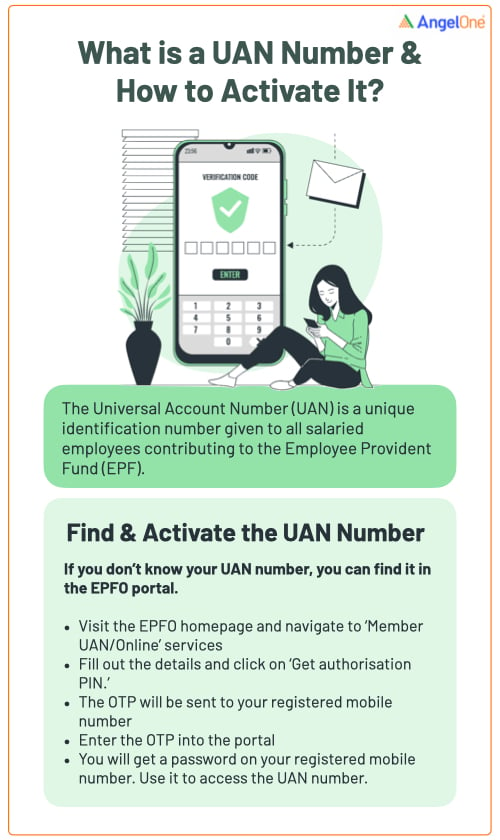

Find and Activate the UAN Number

If you don’t know your UAN number, you can find it in the EPFO portal.

- Visit the EPFO homepage and navigate to ‘Member UAN/Online’ services

- Fill out the details and click on ‘Get authorisation PIN’

- The OTP will be sent to your registered mobile number

- Enter the OTP into the portal

- You will get a password on your registered mobile number. Use it to access the UAN number

Documents Required to Open UAN

If you have just started on your employment journey, you’ll need the following documents to get the UAN number.

- Bank account details, including account number, IFSC code, and branch name

- Photo identification proof such as national identity cards, driver’s licence, passports, voter ID, Aadhaar, and SSLC Book

- Address proofs like a utility bill in your name, a rental/lease agreement, a ration card, or any of the identity documents

- PAN card

- Aadhaar card, as it is linked to your bank account and mobile number

- ESIC card

Services Offered by the Portal

The PF UAN login is required by both employees and employers to access the various features of the portal. The employee needs to log in to the account to access the PF account, check the balance, view or download the passbook, and change details. Employers need to access the UAN account to analyse activities of the account, meet compliance, and retain records of accounts. The UAN portal offers a unified report of all the actions in the account. You can access the following services offered by the UAN portal.

- Download the passbook and the UAN card

- Check membership details

- Check the status of withdrawals, transfer claims, or system-generated claims

- Change or update the email address and phone number

- Update or upload KYC documents

- View the contact information of the UAN helpdesk

EPF Management Through UAN

- You can manage your EPF account details and track all activities using the UAN. It is a unique number, attached to all your employers - current and previous. You can use it to check the balance and track if the employer is compliant with the PF norms.

- You can log in to the EPFO e-Sewa portal to download the UAN card

- You can meet KYC requirements by uploading scanned documents on the EPF portal

- You can use the UAN number to track your PF account activities and check the status of any claim or withdrawal

- Using the UAN number to log into the PF portal, you can check the balance in your account and download the passbook

Importance of Universal Account Number

The PF UAN is quite critical for both employees and employers. Here we have mentioned the essentialities of UAN.

- The UAN allows the EPFO to track changes in the organisation for the employees

- When an employee changes jobs, all they need to do is link the UAN to the new employer. It helps keep track of your employment history and provides a unified report on your PF account

- The UAN e-Sewa portal facilitates and renders critical UAN services online, making it easy to access the PF account and request transfers and withdrawals

- It helps centralise employee data and makes it easier for companies to verify employee details

- The introduction of UAN has helped reduce PF withdrawal requests

- The online availability of UAN helps confirm the authenticity of the employee provident fund account

- Employers can’t also withhold or delay PF deposits, as the details are available online

UAN Benefits to the Employee

- The introduction of UAN has significantly reduced employer involvement. Unlike before, employees can request a withdrawal or transfer online.

- After UAN, employees don't have to undergo the same process of PF account opening with a new organisation. All you need to do is give the UAN number to the new employer and get the accounts linked.

- UAN allows viewing and tracking of PF account activities online. One can also subscribe to SMS and missed call services to check their account balance.

- Employees can also download their UAN card using the online portal.

How to Withdraw or Transfer with the UAN Number?

You can choose to withdraw your PF account balance when you change jobs or to meet emergency cash requirements. Here are the steps to follow to request a withdrawal or transfer PF amount using UAN. To withdraw the PF using the EPF portal you'll need the following details

- UAN number and password

- Aadhaar card number, linked and verified with the UAN

- Bank account details for bank transfer

- Visit the EPFO e-SEWA portal and log in using your UAN number and password. Enter the captcha in the bar to proceed

- To make a withdrawal request, go to Claim in the Online Service section

- Enter bank account details

- You need to select a reason for withdrawal from the dropdown menu. It will only show options that apply to you.

- Enter the details and upload the documents. You will need to enter your complete address to proceed with the claim. Also, you may need to upload your bank passbook if you have requested an advance withdrawal.

- Click on the button to receive an OTP in your registered mobile number. Once you validate with OTP, your withdrawal claim will be processed.

Make sure that your KYC details are up-to-date. In case of any changes in KYC, update the details in the portal before processing a claim to avoid rejection.

UAN Customer Support

For any issue with your PF UAN account, you can reach out to the UAN customer support desk. It has separate desks dedicated to cater to different issues. The two main services provided by UAN customer support are help and claim. The help centre resolves queries related to EPFO office locations, UAN, Services, Grievances, etc., while the claim section is depicted to assist users with their claim processing.

Final Words

UAN is useful for employees and offers several advantages. The introduction of the Unified Account Number has simplified PF management and processing. Online services have significantly reduced the time required for obtaining services. Now that you have learned the various aspects of UAN, you can use it more efficiently and become more self-reliant.