XIRR (Extended Internal Rate of Return) and CAGR (Compound Annual Growth Rate) are two common parameters used to measure mutual fund returns. This might cause confusion in choosing the best metric to evaluate how your investment has performed over time.

While both metrics are useful, they have certain differences that can define your perception of your mutual fund's returns. In this article, learn about CAGR and XIRR, their differences, which one you should choose and when

What is CAGR in Mutual Funds?

CAGR measures the annualised rate of return of an investment over a specified period in terms of percentage. However, it is not a suitable tool for evaluating an investment which involves multiple inflows and outflows, as in a Systematic Investment Plan (SIP).

Calculating CAGR With an Example

A mutual fund investment’s CAGR can be calculated through the following formula:

CAGR = [(Current Value/Initial Value) ^ (1/Number of Years)] - 1

Assume you’ve initially invested ₹1,20,000 in a mutual fund. This investment grows to ₹1,80,000 after 5 years. The CAGR in this situation will be calculated as follows:

CAGR = [(1,80,000 / 1,20,000) ^ (1/5)] – 1 = 8.45%

It means an ₹1,20,000 investment needs to grow steadily at 8.45% every year for 5 years to grow to ₹1,80,000.

You can use Angel One’s CAGR calculator to compute returns on your investment instantly, as long as you know its initial value, maturity value, and tenure.

What is XIRR in Mutual Funds?

XIRR is the average annualised rate of return calculated for an investment with multiple inflows or outflows during a specified period. In short, it is an aggregate of all CAGRs earned on periodic cash flows made throughout the fund’s term.

To simplify, an XIRR will treat every cash flow as a separate investment and then calculate the return earned on this particular cash flow. This process will be repeated for all cash flows during a specified investment period and then be averaged out for the entire mutual fund investment. Investors prefer computing XIRR on their mutual fund investments made via SIPs to make a better judgement about the returns generated.

Calculating XIRR With an Example

The easiest method to calculate XIRR is through an Excel or Google Spreadsheet or XIRR calculator, as it includes multiple calculations for returns.

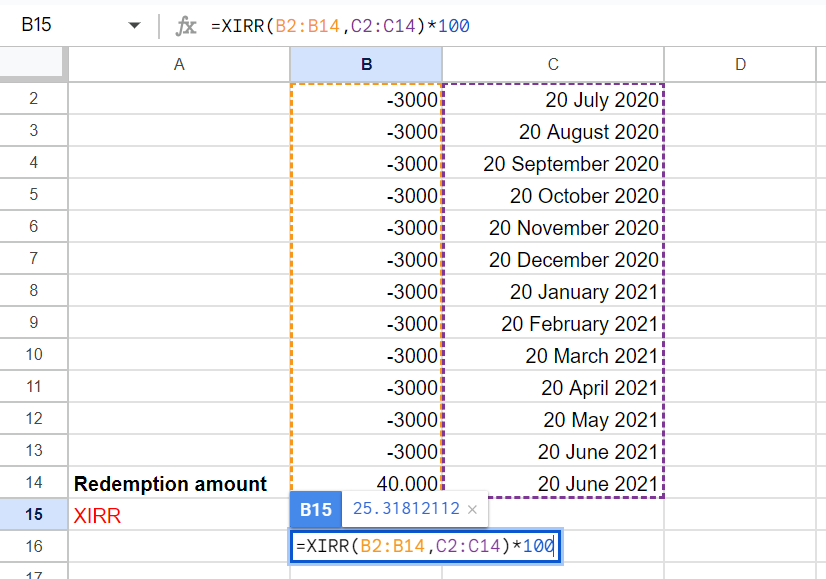

If you are calculating XIRR in Excel or Google Spreadsheet, you need to have all the details of your SIP mutual fund. For example, if you have invested ₹3,000 in SIP per month, follow the steps below on an Excel sheet to calculate.

- Enter your monthly SIP payments in column B. You need to enter the amount invested and additional repurchases with a negative sign. As per our example, you need to enter ‘-3000’

- Enter SIP dates in column C

- The redemption amount must be entered in the same column B with a positive sign.

- The formula is =XIRR (cashflow amount, cashflow dates, [rate guess]). The ‘rate guess’ is optional. Now use the formula “=XIRR(B2:B14,C2:C14)*100” and hit the enter button on your keyboard.

As per our example, the XIRR of the SIP investment is 25.31%.

CAGR vs XIRR Comparison

The primary difference between CAGR and XIRR lies in their consideration of cash flows. A CAGR return assumes all investments have been made at the beginning of the year, while XIRR considers periodic instalments as separate investments. Resultantly, XIRR provides an accurate picture of the mutual fund’s performance.

We elaborate on the difference between CAGR and XIRR in the table below.

| Parameters | CAGR | XIRR |

| Definition | Measures the annualised compounded return on investment for a certain period, assuming reinvestment of profits | Measures the average return earned by the investor after factoring in periodic cash flows separately during the stipulated period |

| Cash Flows | Considers only the initial and final investment amounts | Considers all cash inflows and outflows during the investment’s tenure |

| Formula | [(Current Value / Initial Value) ^ (1/Number of Years)]-1 | XIRR formula in Excel sheet

Or ∑CAGR of all instalments |

| Suitability | Ideal for long-term lump-sum investments without any additional cash flows | Suitable for all kinds of investments. Particularly suited to investments with numerous cash flows during the investment period |

| Accuracy | Less accurate as it doesn’t consider the value and timings of each cash flow | More accurate as it takes all the cash flows and timings into consideration |

| Advantage | Easy to calculate and gives a clear idea of the returns of a long-term investment | Takes each and every cash flow and timings into account, providing accurate results. |

| Disadvantage | It doesn’t consider multiple inflows and outflows. Also, as it assumes a steady rate of return, it can be misleading for highly volatile investments | As it calculates the annualised return of an investment over the entire investment period, it may not give a clear idea of the long-term performance of the investment |

XIRR vs CAGR: Which Return Should You Choose?

Though both CAGR and XIRR are used to analyse the performance of a mutual fund scheme, according to your investment type, you need to choose the right metric to evaluate the performance of your investment. For periodic investments like SIP, XIRR can give accurate results. In contrast, for lumpsum investments like fixed deposits, mutual funds, bonds, etc., CAGR can calculate long-term performance. Hence depending on your investment type and period, choose the right one.

Conclusion

To summarise, investors can use historical CAGRs to compare different mutual funds’ performances. However, before choosing to invest in a fund, an investor must determine whether they plan to go the lump sum route or a SIP. In the case of SIP investment, XIRR is a more accurate measure to get an authentic view of the fund’s performance.