Passive investing is a long-term investment strategy in which investors buy and hold a diversified asset class mix. The idea in this investing style is not to beat the market but be with the market.

What is Passive Investing?

As the name suggests, passive investing is about avoiding active selection when it comes to investment. Passive investing is based on the fundamental theory of buying and holding an asset for the long term. It is based on the idea that the stock market is generally efficient. This means that information dissemination happens rapidly, and thus the positive and negative news is captured in the stock price. This school of thought also further mentions that since markets are efficient, there is nothing like an opportunity to buy an under-priced stock or sell an overpriced stock.

Globally, passive funds manage a lot more money compared to active funds. There are sizable mutual fund houses like Vanguard, which thrive on passive funds management.

Features of passive investing

The ultimate goal in passive investing is the gradual creation of wealth instead of quick money, as in the other cases. Some of the critical characteristics of passive strategy are -

1. Optimistic outlook

The fundamental principle underlying passive investing strategy is that investors can count on the fact that the capital market will likely go up over the long term. Thus, by mirroring the market, a portfolio is likely to generate market equivalent returns in the long term. For example - In February 2006, Sensex touched the 10,000 mark. If an investor had invested Rs 10,000 in companies that are a constituent of Sensex, the investor would have had a portfolio worth over Rs 55,000 today. That's a 5.5x growth in 15 years.

2. Low costs

Passive investing has a slow and steady approach. Thus, the cost involved is on the lower side. Since passive strategy doesn't need a large research team, such strategy's management fees are meagre. For example, Sachin Bansal's Navi has launched a Navi Nifty 50 Index Fund, a passive investment instrument at a fee of 0.06% only, whereas active funds have as high as 1.25%.

3. Diversified holdings

Passive strategy also inherently provides an efficient and inexpensive route to diversification. Look at an Index that defines the market - say Nifty. It comprises 50 companies from different sectors, and these companies are of different sizes. Thus, a very well-diversified portfolio.

Pros and Cons of Passive Investing

Let’s see the Pros and Cons of Passive Investing -

Pros

1. Lower maintenance

Tracking the performance of an investment is time-consuming. As a passive investor, there is no need of checking the portfolio multiple times a day, given your long haul. Since you are riding the way, the highs and lows of the market don't impact you.

2. Steady returns

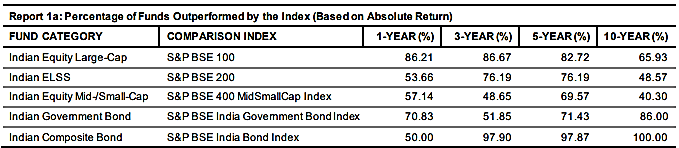

According to the S&P SPIVA report, the passive funds have outperformed active funds in the long term in India. The scorecard compares the performance of active Indian mutual funds with its respective benchmark over a multi-trailing time of 1-year, 3-year, 5-year and 10-year horizons. The report outlines three actively managed equity categories and two actively managed debt categories. From the report of H1 2021 (As of June 30, 2021), it is seen that despite a strong run-up in the market in the first half of 2021, most active funds in the large-cap and mid-/small-cap fund categories lagged their respective benchmarks.

Source: S&P SPIVA Scorecard 2021

3. Lower capital gains taxes

Since you hold assets for the long-term, you tend to pay less taxes.

4. Lower Risk

Passive investing has lesser risk as you invest in a broad mix of asset classes, and your risk is at the market level. Since you are not going active, the risk doesn't move beyond the market level.

Cons

Limited investment options

You cannot handpick each investment or drop companies in a passive instrument. Also, since the goal is to match the market, you do not chase above-market returns.

Passive investing strategies

There are many ways to be a passive investor. However, the most commonly used way is to buy an Index Fund or an ETF. Both Index Fund and an ETF are mutual funds - instruments that pool in investors' money to buy a range of assets.

Passive vs Active investing

Active investing strategy is the opposite of passive investing. In the case of active investing, an investor engages infrequent or regular transactions (buying and selling) of securities to either book profits or losses (as the case may be). The fundamental idea here is to outperform the market by regular involvement.

| Active | Passive | |

| Fund Manager’s involvement | High | Low |

| Management Fees | High | Low |

| Emotions and Bias | High | Low |

| Performance Relative to Benchmark | 50%+ Funds underperforming* | Same as Benchmark |

| Risk | High | Same as market |

* As per SPIVA Scorecard of H1 2021; Source: S&P SPIVA Scorecard

Suitability

The passive strategy core belief is that, over the long haul, the market's rise will reap financial benefits for those who wait. Also, the belief is that minimal trading yields maximum returns. Passive investing is better suited for investors with long-term horizons and objectives, such as saving for retirement, children's education, etc. Also, it is suitable for the first-time or new investors looking to participate in the equity market without taking a very high risk of going active.

Conclusion

There is no clear answer to the long-standing debate of active vs passive. Currently, the Indian market is in its infancy and has inefficiencies in the small and mid-cap spaces. Thus, the market still offers the opportunity to generate alpha (excess returns over the market returns). Thus, the penetration of passive funds has been low in India. However, it is likely that as markets mature and alpha opportunities reduce, passive investing will become more prominent. An investor can look at 20-25% of the portfolio allocated to passive investing as a starting point. A large-cap segment is a great way to expose passive funds as its active counterpart is losing its shine due to declining alpha opportunities.