Vanguard was founded in 1975, and from the beginning, it has stood out as an investment firm like no other. A revolutionary idea that prompted Vanguard's founding was that mutual funds should not be owned by outside parties. Vanguard was created by founder John C. Bogle as a mutual fund company owned exclusively by its clients without any outside intervention.

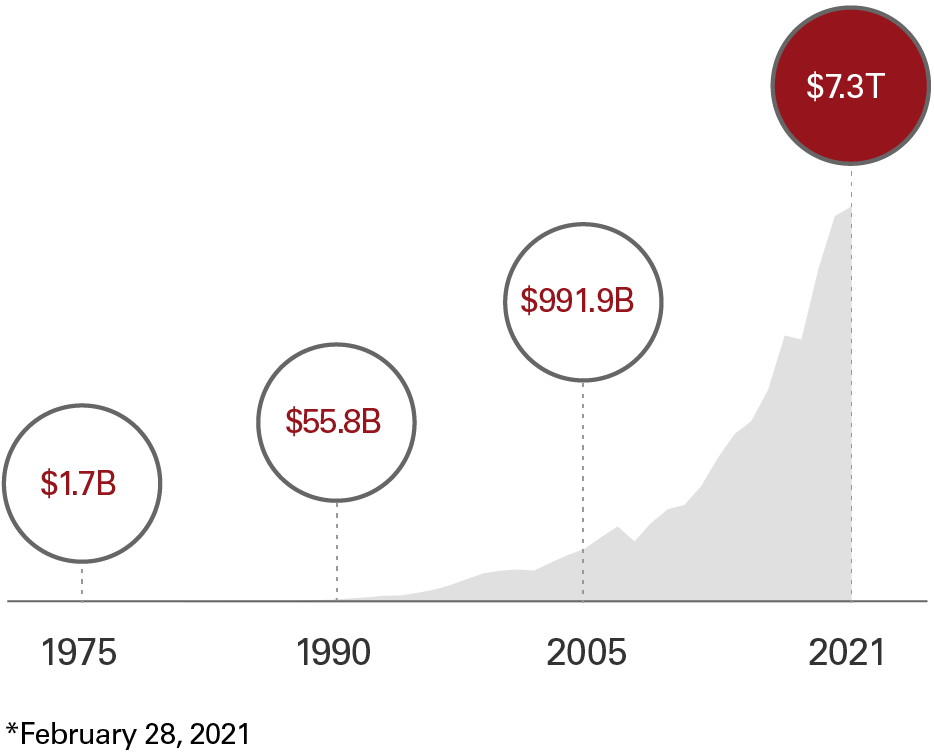

Vanguard assets under management from 1975-2021 are as shown.

Source: https://about.vanguard.com/who-we-are/a-remarkable-history/

Let's take a closer look at Vanguard funds.

What is Vanguard Mutual Funds?

A mutual fund is an investment vehicle for pooling investor funds for the purchase of stocks, bonds and other assets. Invest in them to create a diversified portfolio without the hassle of selecting and managing the assets yourself, spread out across multiple investments instead of a single one.

The Vanguard mutual funds provide excellent diversification since you can invest in hundreds or even thousands of securities at once. Among Vanguard's most notable accomplishments are launching the first index mutual fund for individual investors. These funds match the performance of market indices, such as the S&P 500 and Dow Jones industrial average.

Vanguard offers mutual funds in more than 130 asset classes, including:

Money market funds:

Money market funds invest in short-term investments issued by U.S. corporations, state, local, and federal government agencies.

Bond funds:

Bond funds are riskier than money market funds but can be an excellent supplement to stocks in terms of stability.

Stock funds:

These funds help you to invest in companies of any size anywhere in the world.

Target date funds:

The target-date funds invest in a variety of asset classes, such as stocks and bonds. In order to mitigate risk, the fund becomes increasingly conservative as you approach your target date.

Pros of investing with Vanguard funds

Low Costs:

Its relatively low costs make Vanguard a popular choice. According to the company, the average expense ratio - how much you shell out for administrative and operational costs - is 0.10%, which is less than the 0.60 % industry average.

Fee-free investing.

You can invest in exchange-traded funds, mutual funds, options, and some stocks without paying for commissions.

Variety of options:

The Vanguard no-load mutual fund lineup offers a wide range of fund shares, with no sales fees on either the front or back end when buying or selling. The options include IRAs, education savings, trusts, and brokerage accounts.

Superior Returns:

Vanguard's mutual funds are renowned for their steady performance. Over the past decade, 87% of its no-load funds have outperformed its peer-group averages.

No minimum investment:

With Vanguard, there is no minimum investment amount to begin investing in some ETFs, stocks, and bonds, unlike most mutual funds, which require a minimum of $3,000 to get started.

A greater level of personal attention:

As your account grows, you can expect to see costs decrease as well as more personalization and advice.

How to buy Vanguard Mutual Funds?

If you want to buy shares of Vanguard mutual funds, you have three options:

1. Open an Account with Vanguard

You can open a Vanguard brokerage account online. You can choose from taxable investments, individual retirement accounts, solo 401(k), SEP IRAs, SIMPLE IRAs, UGMA/UTMAs or 529 college savings accounts. Your bank account can be linked to your Vanguard account, or you can transfer funds from another investment account. The process takes only a few minutes. Through the Vanguard account dashboard, you can buy and sell mutual fund shares once the account has been opened.

2. Buy Vanguard Mutual Funds for Your Retirement Plan

Vanguard mutual funds may be available for purchase through a retirement plan your employer sponsors, such as a 401(k) or 403(b).

3. Open an Online Brokerage Account

Alternatively, you can open a brokerage account at TD Ameritrade, Fidelity, ETrade, or Charles Schwab. Online brokerage accounts let you purchase Vanguard mutual funds, exchange-traded funds (ETFs), and individual stocks. If you are planning to open a brokerage account online, make sure you research the minimums and fees before you enroll.

Who Is Vanguard Best For?

If you are a new investor or don't want to spend a lot of time managing investment accounts, Vanguard is for you. Vanguard allows you to make minimal adjustments to your investment accounts without spending a lot of time doing it.

Is Vanguard a safe company to invest in?

With a history dating back to 1975, Vanguard is well known among most passive investors. Being amongst the top five prominent investment managers, Vanguard has a good reputation. A company is regulated by FINRA and the Securities and Exchange Commission (SEC). Due to its long track record and oversight by top-tier regulators, Vanguard is considered safe.

Is it worth investing in Vanguard?

Most investors can find a Vanguard fund that fits their long-term goals and needs since Vanguard offers such a wide variety of investment options. However, when choosing an investment plan, it's worthwhile to consult a financial advisor - either through Vanguard Personal Advisor Services or with an independent provider in order to verify that the plan matches your financial goals.

In short,

Vanguard has low-cost investing at its core, which makes it an excellent choice for retirees and buy-and-hold investors. Despite its $0 stock trading commission, the broker fails to impress active traders due to the lack of a solid trading platform.