Switching your mutual fund investments to a new broker using a Change of Broker (COB) request should ideally be smooth. But in some cases, even after the COB is completed, users on the Angel One platform notice that some mutual fund units are not visible, and they are unable to place withdrawal or switch requests. This guide explains why that happens, when it happens, and what steps you need to take to resolve it.

Why You Might Not See Your Mutual Fund Portfolio After a Broker Transfer (COB)?

The Problem: Missing Portfolio or Blocked Withdrawals

Even after completing the COB to Angel One, some investors face the following issues:

- Certain mutual fund schemes are not visible in the app

- Withdrawal or switch options are disabled or result in an error

- In some cases, even after a switch is processed, the withdrawal remains blocked

These situations can be frustrating, especially when the COB appears to have gone through.

When Does This Happen?

These issues typically come up after the broker code has been successfully updated with the Registrar and Transfer Agent (RTA), but the following gaps exist:

- The mutual fund units are still lying in your old broker’s Demat account

- The app is expecting to find units in your Angel One Demat account, but they are not yet transferred

- You submitted a Delivery Instruction Slip (DIS) to transfer units, but did not complete the mandatory offline COB form, so the transfer was never executed

- The investment is actually held in physical mode, but was incorrectly treated as Demat, causing the system to look in the wrong place

How Does This Happen?

Let’s walk through a few real scenarios:

Case 1: Units Still in Old Brokers Demat (ICICI Example)

- The COB request was successfully processed, and the broker code was updated to Angel One

- However, the actual mutual fund units were not moved from your ICICI Demat account to Angel One

- As a result, when you try to initiate a transaction from the Angel One app, it fails due to absence of units in the target Demat account

Case 2: DIS Submitted but COB Form Not Submitted

This is a common oversight:

- The investor submits a DIS, assuming it’s sufficient for the transfer

- But the required offline COB form is not submitted to the Depository Participant

- Without this form, the unit transfer request is rejected, and the units stay with the old broker

- The Angel One platform cannot detect these units, and any transaction attempt fails

Case 3: Folio in Physical Mode Treated as Demat

- The COB was processed for a mutual fund scheme that was actually in Physical mode

- However, the folio was mistakenly interpreted as Demat mode

- The app tried to locate units in the Demat account, found nothing, and blocked the withdrawal request

- Once the holding type was correctly identified as Physical, transactions could proceed normally

What Should You Do?

Here is a clear path based on your situation:

If Units Are Still with the Previous Broker

- Submit a Delivery Instruction Slip (DIS)to initiate a transfer of units from your old broker’s Demat account to Angel One’s Demat account

- Make sure you also complete and submit the offline COB formrequired for processing the DIS

- Until both these steps are completed and the units appear in Angel One’s Demat, transactions like withdrawal or switch will not work

If the Investment Is in Physical Mode

- If the app does not allow withdrawal or shows units as unavailable, but you know the investment was not in Demat, it may be a classification issue

- In such cases, the holding type will need to be verified with the RTA

- Once confirmed to be Physical, the system will reflect this correctly, and you will be able to place a redemption request

Other Scenarios to Be Aware Of

Folio Is in Physical Mode but Treated as Demat

Incomplete or incorrect data from the RTA may cause folios to be wrongly identified. If this happens, the app expects to find units in the Demat account, and when it does not, blocks the transaction. Once the folio is correctly recognized as Physical, you can proceed with redemptions.

Units Not Transferred Despite COB Completion

A common misconception is that completing COB also transfers the units. In reality:

- COB only updates the broker code with the RTA

- The actual transfer of units requires a DIS

- And the DIS will only be processed if the offline COB form is also submitted

- Skipping any of these steps means your units remain with your previous broker, and Angel One will not show them in your portfolio.

Required Documents

- Change of Broker / ARN Request Form

- Self-attested ID Proof (Aadhar Card and PAN card)

- Portfolio Statements

Step-by-Step Process

1. Download the “Change of Broker / ARN” form.

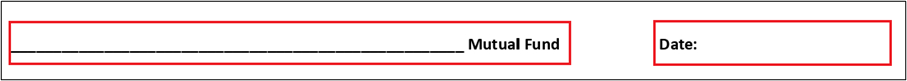

2. Fill in the required details, including:

- Mutual Fund and Date

Enter the Mutual Fund name and date of submitting the change of broker form.

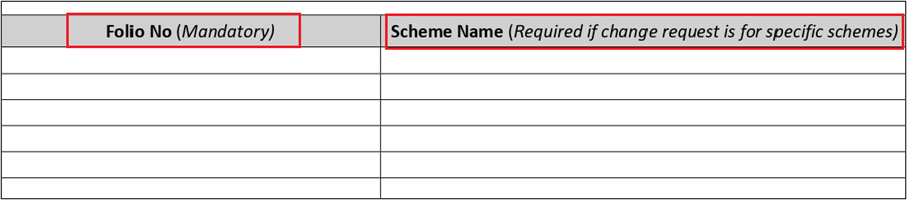

- Folio number(s) and Scheme Name

Enter the Folio number in which you have units and the Scheme name in the below space. (Mandatory fields)

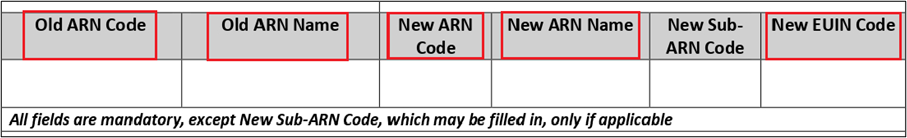

- Old ARN and new ARN (Code and Name)

Enter the Old ARN Code, Old ARN name, New ARN code, New ARN Name and new EUIN code in the space below.

The new Sub ARN Code is not mandatory; it is only filled if applicable.

Angel One Broker Details for Reference:

Regular Plan ARN: ARN-77404

Direct Plan ARN: INZ000161534

If you want to map your scheme under a sub-broker, the EUIN number of the sub-broker needs to be mentioned.

In the case of a direct scheme, there is no requirement of an EUIN number.

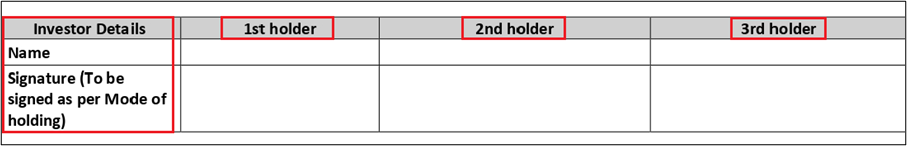

- Investor Name and Signatures of all holders

The holders should enter their Name and do their complete signature in the order of their names in the account.

- A self-attested copy of your Aadhar Card or PAN card must be attached with the filled Change of Broker form.

- Submit the form at the Angel One Head Office. Below are the Courier address details.

Angel One

5th Floor, Akruti Star

MIDC, Chakala Road

Andheri East

Mumbai – 400093

- Processing Time: Approximately 10-12 business days

RTA process:

- Upon receiving the request, AMC/RTA will send an SMS on T+1 dayto the investor.

- If no complaint is received by T+11 from investor about Change of Broker, the change will be processed. Confirmation will be sent to the investor through Email/SMS and to both the Mutual Fund Distributors (source and target) via Mail.

Important Notes

- As per AMC guidelines, a separate Change of Broker form is required for each AMC.

- Requests with incomplete signatures or mismatched details may be rejected.

- If scheme is under the lock-inperiod, the change of broker will not be processed.

Final Thoughts

Completing a COB request is an important first step, but it does not automatically move your mutual fund units. For your investments to show up correctly in Angel One and to enable transactions:

- Make sure the broker code is updated

- Submit both the DIS and the offline COB form

- Confirm that your folio is correctly classified as Demat or Physical

If you have already taken these steps and still face issues, our support team can help you trace the unit status, resolve classification errors, and guide you through any pending action. Understanding these backend processes helps ensure your investments remain visible, accessible, and transactable without unnecessary delays.