Building long-term wealth doesn’t always require a massive upfront capital. Options like a Systematic Investment Plan (SIP) allow you to contribute fixed amounts to mutual funds at regular intervals. This strategy leverages the power of compounding and rupee-cost averaging, making it an effective tool for navigating market volatility while achieving financial goals like retirement or home ownership.

Whether you are a beginner looking to start small or a seasoned investor seeking flexibility through top-up or perpetual plans, understanding how SIPs work is essential. Explore this comprehensive guide to learn about SIP types, benefits, and how to start your investment journey seamlessly.

Key Takeaways

-

SIPs allow disciplined, periodic investing through automated bank deductions, helping investors accumulate units regularly based on changing NAV levels.

-

Different SIP types like top-up, flexible, and perpetual offer customisation based on income levels, cash flow, and long-term financial goals.

-

SIP benefits for investors include rupee-cost averaging and compounding, reducing market-timing risks and enabling steady long-term wealth creation.

-

All types of investors can use SIPs, choosing suitable funds based on goals, risk appetite, expense ratios, and investment horizon.

What is SIP (Systematic Investment Plan)?

A Systematic Investment Plan (SIP) is a way of investing in mutual funds where you invest a certain sum regularly, say weekly, monthly or quarterly. This can help you create long-term wealth by diversifying across market cycles. Understanding what is SIP is important because it helps build investment discipline and mitigate risks from market volatility.

How Does a SIP Work?

Once you opt into a systematic investment plan, the amount will be automatically debited at some predetermined interval from your bank account and invested in a mutual fund. Once the transaction goes through, you will be allocated units of your mutual fund that depend on its net asset value and your SIP amount.

With every investment into an SIP plan in India, any additional units will be added to your account as per the market rate. With every investment that is made, the amount that you earn returns on will be larger, as your earnings from previous instalments are reinvested.

Understanding SIP Through an Illustrative Example Below

Assume that you want to invest ₹1 lakh in a mutual fund of your choice, and accordingly, you set aside that amount. There are two ways in which you can choose to make this investment. You can either make a one-time payment of ₹1 lakh in the mutual fund of your choice, which is known as a lump sum investment.

Alternatively, you can break the ₹1 lakh into smaller amounts and choose to invest using an SIP. The steps will be as follows: Let’s assume you choose ₹500 and the current Net Asset Value (NAV) is ₹100, so you will be allotted 5 units of the fund.

| Month | Investment amount (₹) | NAV | Units allotted | Total units |

| 0 | 500 | 100 | 5 | 5 |

| 1 | 500 | 125 | 4 | 5 + 4 = 9 |

| 2 | 500 | 100 | 5 | 9 + 5 = 14 |

| 3 | 500 | 200 | 2.5 | 14 + 2.5 = 16.5 |

Following this, ₹500 will be deducted from your account each month and automatically credited into the mutual fund that you want to invest in at a certain fixed date every month. This process will continue for the duration you have selected for your systematic investment plan. As per the NAV, the number of units will be allotted to you every month.

Types of Systematic Investment Plans

Below are the different kinds of systematic investment plans you can consider investing in:

- Top-up SIP: This kind of systematic investment plan enables you to increase your investment amount periodically while also giving you the flexibility to invest more when you have a higher income that can be invested. This type of SIP also helps one make the most out of their investments by investing in the best as well as the most high-performing funds at regular intervals.

- Flexible SIP: As suggested by its name, this type of systematic investment plan carries the flexibility of the amount you want to invest in. The amount to be invested as per an investor’s cash flow and needs or preferences can be increased or decreased.

- Perpetual SIP: This type of SIP Plan enables you to carry out your investments without any end to the mandate date. Generally, a systematic investment plan carries an end date after one year, three years, or five years of investing. Hence, the investor has the freedom to withdraw the amount that is invested whether or not he wishes to invest in accordance with his financial goals.

Features of the SIP Investment Plan

An SIP investment plan has a number of investor-friendly features that make it the perfect long-term wealth-building tool. It lets you make small, regular investments, which will help you establish financial discipline. SIPs are not rigid. You can make contributions, pause them, resume them, or contribute more or less with impunity.

They have the advantage of rupee cost averaging, which is automatic as you purchase more units at low markets and fewer units at high markets and averages the long-term returns. SIPs also have the advantage of compounding, in which your previous returns are reinvested, which can lead to better returns over time. Additionally, with no need to invest large sums at the outset and easy online tracking, SIPs enable investors to achieve their financial objectives clearly and conveniently.

Benefits of SIP Investment

The benefits of SIP investment make it a popular investment strategy among both beginners and experienced investors. Some of these are:

-

Prevent the effects of market volatility by diversifying investments.

-

Promote disciplined investment in the creation of wealth steadily, even in times of unpredictable markets.

-

Harness the power of compounding, which gives investors the opportunity to grow small and frequent contributions over time.

-

Offer flexibility, such that investors may pause, adjust, or make top-ups when necessary.

-

Assist in settling investments with long-term objectives like children's education, retirement or purchase of a house.

-

Simplify the process of financial planning because they are automated with a simplified tracking system.

Check out Our, SIP Calculator

When To Invest in SIP?

Investing in SIPs can be a strategic decision that aligns with your financial goals and risk tolerance. It's essential to consider your investment horizon and the purpose of the investment. SIPs are well-suited for individuals with a long-term investment horizon who want to benefit from the power of compounding. If you have specific financial goals like buying a house, funding your child's education, or planning for retirement, starting a SIP early allows you to accumulate wealth gradually over time. Additionally, market conditions should not be the sole determinant for starting an SIP. Since SIPs involve regular and disciplined investing, they help smooth out the impact of market volatility through rupee-cost averaging. By consistently investing a fixed amount, you buy more units when prices are low and fewer units when prices are high. This systematic approach reduces the impact of short-term market fluctuations on your overall investment and can potentially lead to better returns over the long run.

Who Can Benefit From Systematic Investment Plans (SIPs)?

Systematic investment plans suit a wide range of investors. They help new investors start small and become disciplined investors. Automated investing is an asset for busy professionals, as they do not use active market monitoring. SIPs allow long-term investors to accumulate wealth to achieve objectives such as retirement or education. Rupee cost averaging and constant contributions make even the risk-averse investors feel safe. SIPs are also applicable when an individual wants to invest in a structured manner rather than a lump-sum investment.

Things to Consider Before Starting SIP

Decide on your financial objectives, investment timeframe and risk level before starting SIP. Make sure that you select funds that are related and align with your financial objectives. It is important to assess the expense ratio, fund performance, and consistency when you start investing in SIPs to establish a solid investment basis.

How To Choose a Good Mutual Fund for SIP?

Comparing long-term performance, expense ratios, and the fund manager's expertise is another factor to consider when choosing a mutual fund for SIP. Select funds based on your objectives - equity in case of long-duration, hybrid in case of balanced growth, and debt in case of stability. An ideal SIP mutual fund must have a good track record and steady returns in both good and bad market performance. Never exceed the risk capital levels for your risk tolerance and investment horizon.

Best Performing Mutual Funds

| Name | AUM (₹ in crore) | Expense Ratio | CAGR 3Y (%) | CAGR 5Y (%) |

| ICICI Pru Overnight Fund | 10,098.72 | 0.1 | 125.88 | 65.97 |

| Quant Small Cap Fund | 11,206.76 | 0.77 | 46.61 | 33.74 |

| Bank of India Small Cap Fund | 819.51 | 0.87 | 35.54 | 32.60 |

| Quant Infrastructure Fund | 1,130.39 | 0.77 | 41.92 | 32.04 |

| Quant ELSS Tax Saver Fund | 4,956.53 | 0.76 | 35.01 | 30.89 |

| Nippon India Small Cap Fund | 37,319.33 | 0.69 | 41.96 | 29.65 |

| Quant Mid Cap Fund | 3,267.99 | 0.76 | 36.04 | 29.08 |

| Axis Small Cap Fund | 17,915.66 | 0.52 | 31.55 | 27.98 |

| Quant Flexi Cap Fund | 2,162.68 | 0.77 | 32.65 | 27.93 |

| Tata Small Cap Fund | 6,345.75 | 0.3 | 37.86 | 27.87 |

Note: The list of best performing SIP mutual funds are as of January 1, 2024 and are selected based on the 5-year CAGR.

How To Invest in SIP With Angel One?

You can easily start a Mutual Fund SIP on the Angel One app by taking the following steps:

- Go to the Home page and click on ‘Mutual Funds’.

- Choose the Fund that you want to invest in from the section titled ‘Discover Mutual Funds’. You can start your search by clicking on ‘EXPLORE ALL FUNDS’. You can also narrow down your search by clicking on the categories of funds given.

- Once you have gone through the details of a mutual fund and chosen it, click on ‘INVEST’.

- Choose the SIP option and enter the monthly amount and date, i.e. the day of the month when the SIP payments will be made from your account.

- Choose the mode of payment, for example, UPI.

- Click on ‘START SIP’ to start the SIP process.

- You can choose to make your first SIP payment right away as well by checking the box next to ‘Make first SIP payment now’.

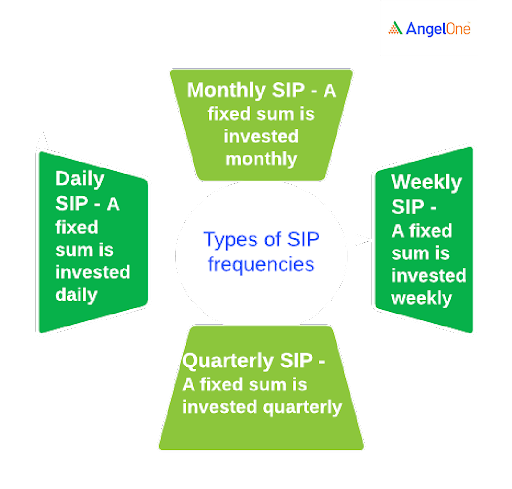

Types of Frequencies for an SIP

There are different frequencies available for SIP investments, each offering its own advantages and disadvantages depending on your financial goals and risk tolerance. This diverse range of SIP frequencies ensures investors can comfortably participate in the market based on their financial planning and cash flow patterns. The frequency of an SIP investment is weekly, monthly or quarterly. You can decide the right frequency based on your income, expenses, ongoing EMIs, financial goals, the scheme you are investing in, etc. Talking to a financial advisor can also help you choose the right frequency for your particular needs.

There are different frequencies available for SIP investments, each offering its own advantages and disadvantages depending on your financial goals and risk tolerance. This diverse range of SIP frequencies ensures investors can comfortably participate in the market based on their financial planning and cash flow patterns. The frequency of an SIP investment is weekly, monthly or quarterly. You can decide the right frequency based on your income, expenses, ongoing EMIs, financial goals, the scheme you are investing in, etc. Talking to a financial advisor can also help you choose the right frequency for your particular needs.

Points You Must Consider While Selecting Your SIP Frequency

- Effect of volatility: Depending on the volatility of the investment avenue, you should decide on the frequency of your SIP. Suppose the volatility of the mutual fund or stock SIP is higher. In that case, you can invest in a higher frequency SIP to benefit from the market volatility by averaging out your investment over a period of time and vice-versa.

- Frequency of your cash inflows: If you are a salaried professional and earn income on a monthly basis, it is advisable to invest in a monthly SIP. If you work on a contract basis where you receive income every few months (for example – construction business, interior designing, etc.), you can choose to invest in a SIP on a quarterly basis. You can plan to invest in weekly SIPs when you earn on a fortnight or a weekly basis (for example – internship, task-completion basis, etc.)

- Ease in tracking instalment payments: It is easier to track your income and expenses monthly, and thus, investments can be planned better on a monthly basis. You won’t have to track how much was debited throughout the month, as the instalment amount will be debited once every month. On the other hand, in the case of daily and weekly SIPs, the number of instalments is higher, leading to difficulty in keeping track of all the payments.

Common Myths About SIPs

SIPs are often misunderstood, leading many investors to misconstrue them. Some of the myths are:

-

SIPs are risk-free - Though SIPs are less risky, they do not promise profits.

-

Beginners are the only users - Sisciplined wealth creation has been an activity of experienced investors as well.

-

SIPs only work in volatile markets - Can work across all market cycles through cost averaging.

-

Demand long-term commitment - SIPs are not fixed and offer flexibility. You can decide the frequency and the period for which you want to invest. You can also pause, add to the amount, or stop SIPs at any time.

-

Greater the amount of SIP, the greater the performance - While it can lead to good returns if the market performs well, it isn’t a guarantee. In fact, even modest contributions increase significantly through the power of compounding.

Conclusion

SIPs provide the methodology of investing based on discipline, flexibility and long-term wealth generation. The capabilities of the SIP investment plan, including rupee cost averaging, compounding, and the convenience of contributing to it, make it an intelligent financial planning tool.

Systematic investment plans (SIP) can be used by investors with varying age categories, beginners, long-term and professionals alike. The goals, risk selectiveness, and fund consistency should be considered prior to the initiation of SIP. The demystification of SIPs would help investors get a better idea of how SIPs actually work. So, it is all about SIPs, making it easy to create wealth and get into it systematically with confidence to have a better financial future.

|

Mutual Funds Calculator |

|