Managed by professional fund managers and offering diversification, Mutual Funds (MF) eliminate the need for considerable expertise to invest in the securities market, making it a popular choice of investment among first-time investors. If you wish to invest in mutual funds, here is your guide to investing. If you already hold mutual funds in your portfolio, this article is to let you know what should you do in case of a MF merger.

What is a mutual fund merger?

Mutual fund merger is when mutual fund schemes are either merged into some existing scheme or merged with another existing scheme to form a new scheme.

One of the major reasons for mutual fund mergers in India is the regulatory guidelines by SEBI that restricts asset management companies (AMCs) from having overlapping similar schemes to avoid clutter for investors. The other reasons for mutual fund mergers can be

- Cost rationalization

- Underperformance of a scheme

- Consolidation

- Redemption fear, etc.

Why does a mutual fund merger affect the investor?

When there is a merger, there is a change in the fund management and also one of the schemes or both the schemes ceases to exist which will have an impact on the investors.

Case1: If one of the schemes merges into an existing scheme, the investors in the transferor scheme will be issued units in the transferee scheme i.e, the scheme into which it is being merged.

Case 2: If both the schemes cease to form a new scheme, the investors in both the schemes will be issued the units of the new scheme.

To improve transparency and protect investors’ interests, SEBI has laid a few guidelines for the asset management companies to follow during a merger which you should be aware of. Also, as an investor, there are certain dos and don'ts you should heed when your fund or asset management company is involved in a merger.

SEBI’s regulations during a MF merger

- The option to exit should be given to the investors with a notice period of 30 days

- Investors should be provided with the relevant information which includes the following to make an informed decision

- The latest portfolio of the concerned schemes.

- Details of the financial performance of the concerned schemes since inception along with comparisons with appropriate benchmarks.

- Information on the investment objective, asset allocation and the main features of the new consolidated scheme.

- Basis of allocation of new units by way of a numerical illustration

- Percentage of total NPAs and percentage of total illiquid assets to net assets of each scheme(s) as well as the consolidated scheme.

- Tax impact of the consolidation on the unitholders.

- Any other disclosure as specified by the Trustees.

- Any other disclosure as directed by the Board.

- If an investor chooses to exit, then he/she can do so without paying an exit load

What should an investor do in case of a MF merger?

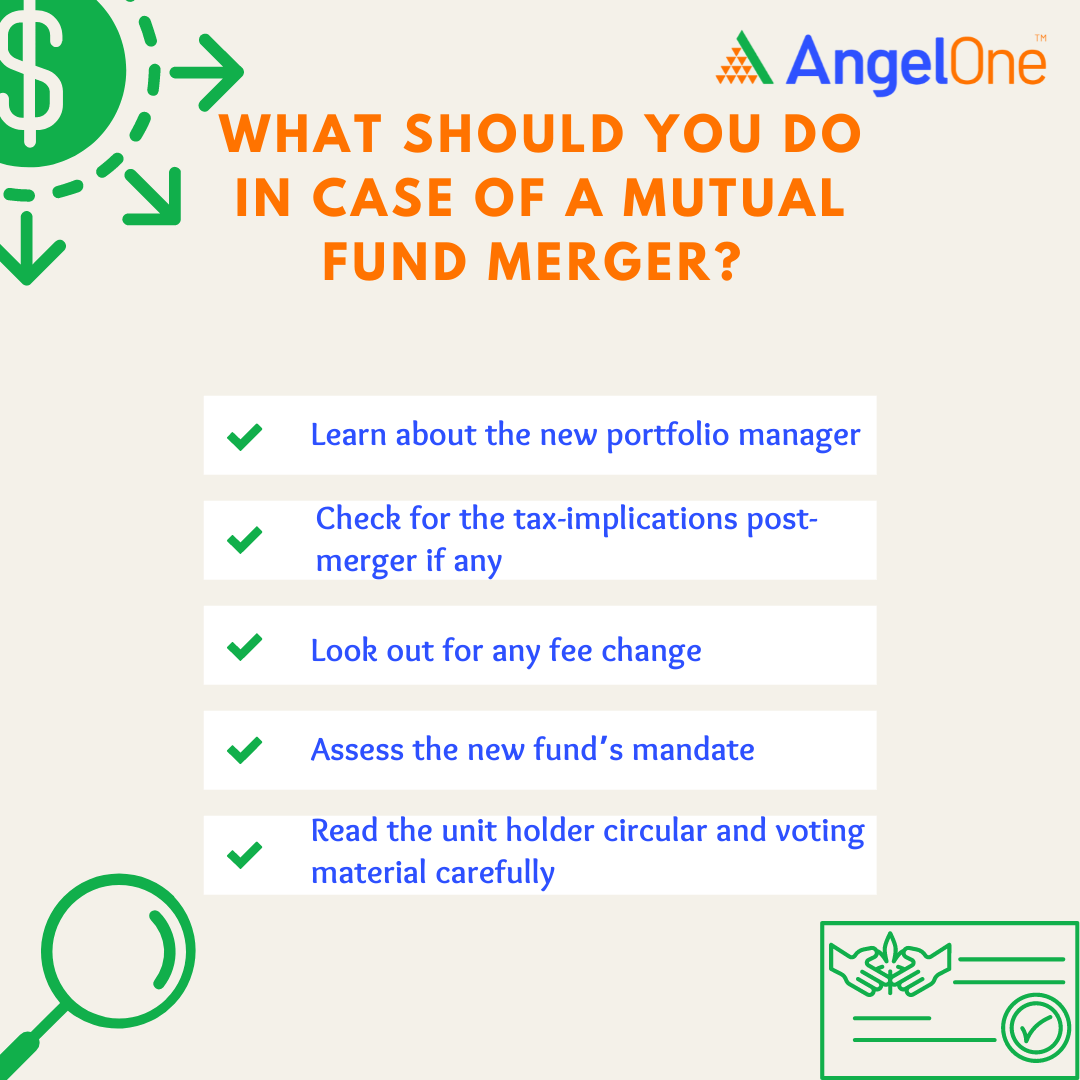

- Learn about the new portfolio manager: If there is a new portfolio manager, review their track record and investment philosophy to make sure their objectives are in line with yours.

- Check for the tax-implications post-merger if any: Read about the methodology of the merger and pay close attention to potential tax consequences the merger could have.

- Look out for any fee change: Any change to fees would require a unitholder vote before it could come into force. Clearly identify any fee changes to ensure that the fund provides good value and a competitive cost structure.

- Assess the new fund’s mandate: One has to look into the performance, strategy, and investment philosophy of the new/transferee scheme and check if the new mandate suits their investment needs

- Read the unitholder circular carefully: Read the documents related to mergers carefully and understand the impact of the merger to ensure that the new/transferee scheme will fulfill your investment objectives

Once you are aware of the relevant information regarding the merger, the new fund and its mandate and other implications, you can decide in 30 days whether to continue with the transferee scheme or exit the scheme and divert the funds towards any other schemes you find better. A thorough review and comparison of the transferor and transferee schemes along with other schemes in the market may help your reach a decision along with ticking every checklist.

Disclaimer: This blog is exclusively for educational purposes