A mutual fund is an investment asset in which many investors contribute their money together in securities such as bonds, stocks, short-term debts, gold, money market vehicles, and other assets. The investors earn returns on the investment made over a period of time. Gains or losses made on the fund are shared between all the investors and in the proportion of the investment made. The consolidated holdings of the fund are called a portfolio and are usually managed by a professional individual, called the fund manager or the portfolio manager.

Returns on Mutual Funds?

Mutual funds are an excellent way of diversifying one’s portfolio. The portfolio manager invests as per the investor’s financial goals, lifestyle, and risk tolerance. The returns are either from dividends, gain on capital or the profits from selling the shares. The returns are usually higher than the other investment vehicles that provide assured returns. The returns on mutual funds are associated with the market performance, i.e., if the market is doing well or is performing poorly, it is reflected in the fund’s value. In addition, mutual funds do not guarantee capital protection, so the investors must make an informed investment decision in the case of mutual funds.

Compound Interest and Mutual Funds

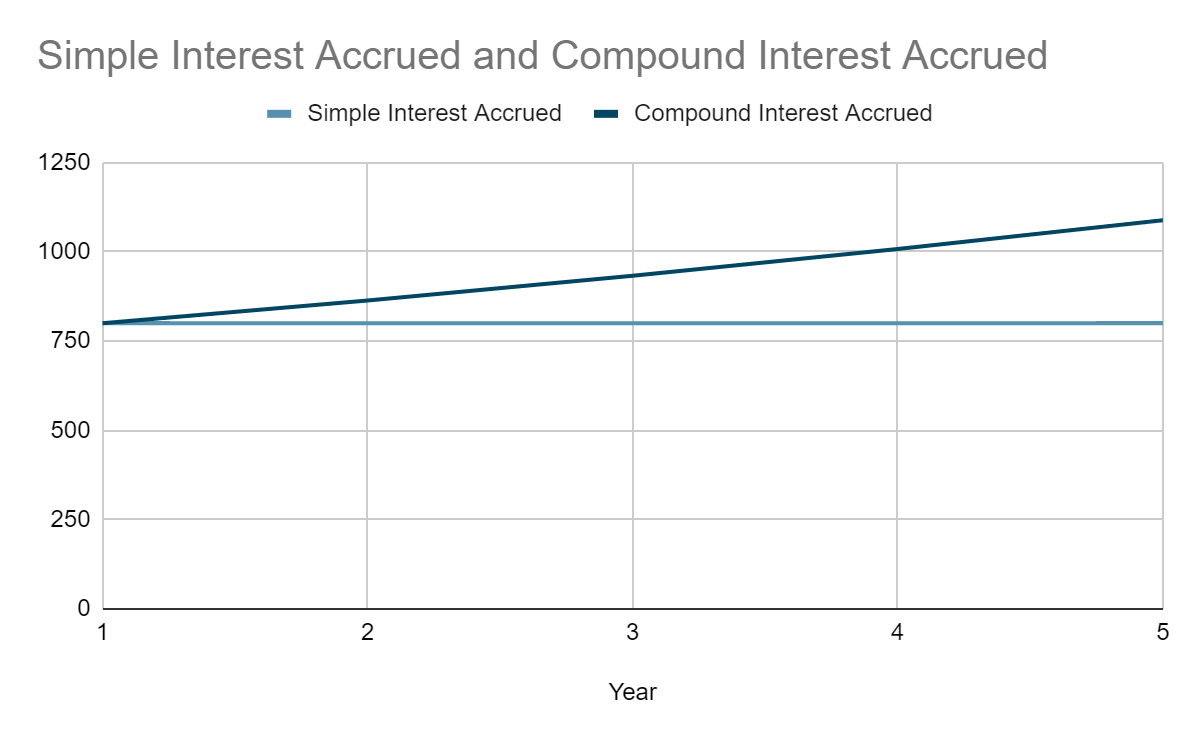

Compound interest is computed on the principal amount and the interest accrued, as well as any additional deposits made. It can also be perceived as interest on interest. The interest depends on the principal amount invested and the time period, i.e., the larger is the amount invested, and the longer is the period it is invested for, the larger is the interest rate accrued on it. So, the final amount received is greater in compound interest than simple interest for the same period.For example:If a customer invests Rs. 10,000.00 for a period of 5 years at an interest rate of 8% p.a., then, his returns would be as such:

| Year | Amount on which the return is calculated if Simple Interest | Amount on which the return is calculated if Compound Interest | Rate of Interest | Simple Interest Accrued | Compound Interest Accrued | Amount at the end of the year with Simple Interest | Amount at the end of the year with Compound Interest |

| 1 | 10000 | 10000 | 8 | 800 | 800 | 10800 | 10800 |

| 2 | 10000 | 10800 | 8 | 800 | 864 | 10800 | 11664 |

| 3 | 10000 | 11664 | 8 | 800 | 933.12 | 10800 | 12597.12 |

| 4 | 10000 | 12597.12 | 8 | 800 | 1007.77 | 10800 | 13604.89 |

| 5 | 10000 | 13604.89 | 8 | 800 | 1088.39 | 10800 | 14693.28 |

| Total interest accrued= | 4000 | 4693.28 |

Hence, we can see that when the returns are compounded, the amount is greater (Rs. 4693.28) than returns calculated as simple interest (Rs. 4000.00) by Rs. 693.28. So, it can be stated that compounding has a multiplier effect on the investments made and is more profitable in the case of mutual funds. Another way to increase the return is to reinvest the dividends gained from the initial investment- this enables the investor to buy more shares in the fund, and hence, more compound interest gets accrued.

Another way to increase the return is to reinvest the dividends gained from the initial investment- this enables the investor to buy more shares in the fund, and hence, more compound interest gets accrued.

Compound interest or compounding in the case of mutual funds has some advantages -

Greater Wealth Accumulation

If the interest paid is compound interest, the interest earned is on the investment amount and accrued interest. So, the return on mutual funds is greater if the interest is compounded, and also reinvesting this gain allows the investor to own more shares of the fund, thereby gaining a more significant return on the initial investment. When mapped, one can see a geometric progression of the returns on the wealth accumulated.

Keep in stride with inflation

We know inflation eats away one’s wealth, and compoundingis a very good solution to this problem. It is seen that the amount gained from compounding is in stride with the inflation at that point in time.

Helps achieve the target corpus

Compounding helps to earn that extra amount that helps people reach their target corpus, or at least an amount close to it.

What are the critical aspects for an investor to make the most out of compounding?

A patient investor

The returns on mutual fundsare greater than other investment vehicles, and compounding allows one to earn more, but it happens over time. Investors seeking quick money might be impulsive and make mistakes that could translate to huge losses. Hence, an investor must be patient and play the long game to reap the benefits of his investment.

Controlling expenses of the investor

The more a person cuts off their expenses, the more they save and thereby have more to invest. And, as we know, larger investments lead to larger returns.

An early investor

The earlier the investor starts investing, the longer the investment time period, leading to a higher return. Also, longer periods lead to lesser investment risks, as risk reduces over time.

A disciplined investor

An investor has to regularly monitor the market to make informed decisions rather than make hasty and abrupt decisions and suffer losses. Also, regular investments lead to higher savings and help develop investment discipline- A vital habit to achieve financial success.