In India, the RBI is responsible for maintaining the health of the country's economy. Among its roles, controlling the flow of money in the economy is a primary one. RBI uses instruments such as the Cash Reserve Ratio, Statutory Reserve ratio, Bank Rate policy, Repo Rate, and Reverse Repo Rate to meet its objectives.

CRR, or Cash Reserve Ratio, refers to the percentage of cash reserve that a bank must maintain with the RBI. In this article, we will define Cash Reserve Ratio along with its formula, objective, and implications.

What Is CRR?

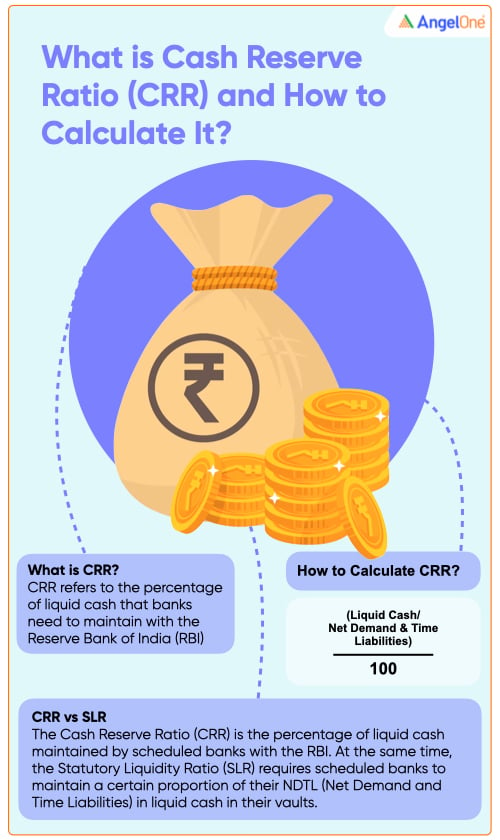

CRR refers to the percentage of liquid cash that banks need to maintain with the Reserve Bank of India. The RBI requires banks to maintain CRR to tackle situations like heavy withdrawals. Banks don't earn any interest on the CRR amount. They also can't use it for lending purposes. It enables the RBI to use CRR as a monetary policy to control the circulation of money in the economy.

When the RBI increases the rate of CRR, it reduces the lending capital available to the bank, which reduces the supply of money in circulation. Similarly, when the CRR is adjusted to a lower rate, the cash flow in the economy rises.

Let’s understand CRR with an example.

The current CRR is 4.5%, meaning for every additional deposit of Rs. 100, the bank has to keep aside Rs. 4.5 as CRR.

As per the RBI mandate, scheduled banks must ensure that their bi-weekly liquid cash reserve with the RBI doesn’t fall below the 4.5% level based on their total Net Demand and Liabilities (NDTL). So, if a bank’s NDTL is Rs. 10,00,000 and the CRR rate is 4.5%, it will have to keep aside Rs. 45,000 as liquid cash with the RBI.

RBI increases or decreases the CRR level depending on its monetary policy. Changes in CRR impact the broader economy by affecting the amount of money used for lending in the economy, the interest rate on loans, and the level of economic activity.

Objectives of CRR

CRR is critical for implementing monetary policies.

- The CRR is used to control inflation. During high inflation periods, the RBI usually increases the CRR rate to control the flow of money in the economy. This leads to a lower availability of credit in the market.

- CRR helps banks meet their solvency requirements. It ensures that the bank has enough liquid funds to meet the requirements of its customers if there is a rise in withdrawal demand.

- Banks use the CRR as a base rate for determining the interest rate on their loans. The interest rate on loans is always higher than the base rate.

- If the RBI needs to increase the supply of money in the economy, it can do so by lowering the CRR requirement.

How Is Cash Reserve Ratio Calculated?

CRR formula represents CRR as a percentage of the bank’s Net Demand and Time Liabilities (NDTL). The NDTL of the bank includes the following:

- Savings account deposits, current account deposits, demand drafts, and the balance in overdue fixed deposits together represent the demand liabilities of the bank.

- The bank’s time liabilities include all fixed deposits, where the customer can't withdraw the money before the maturity date, staff security deposits, and the time liability portion of the savings accounts.

- Bank’s other liabilities encompass market borrowings, certificates of deposit, interest deposits in other banks, dividends, etc.

The CRR is calculated as a percentage of the bank’s available liquid cash divided by the total NDTL.

The CRR formula is:

CRR= (Liquid Cash/ NDTL ) *100

CRR vs SLR

CRR and SLR are two common terms that you will often hear during bank transactions. Like CRR, SLR (Statutory Liquidity Ratio) is another component of the RBI’s monetary policy.

RBI uses the SLR to have control over bank credit. SLR requires scheduled banks to maintain a certain proportion of their NDTL in liquid cash in their vaults. Without SLR, banks may face over-liquidation issues when the CRR rate goes up.

SLR confirms that the commercial bank maintains its solvency requirements. Here are the key differences between CRR and SLR.

| CRR | SLR | |

| Definition | A percentage of the bank’s total NDTL that the bank needs to deposit with the RBI | Expressed as a percentage of total NDTL and maintained in the form of liquid cash, gold, and government securities |

| Purpose | Used by RBI as an instrument to control the supply of money in the economy | To ensure the liquidity of the bank |

| Maintained with | RBI | Bank |

| Instructed/Regulated by | RBI | RBI |

| Applied to | Scheduled commercial banks, local area banks, small finance banks, cooperative banks, and payment banks | Scheduled commercial banks, local area banks, small finance banks, cooperative banks, and payment banks |

| Used for | Reduces liquidity of the bank | Provides a buffer against a sudden rush in withdrawal and loan defaults |

| Limits | After 2006, there is no limit on CRR | RBI can increase SLR up to 40% |

| Penalty | Banks get penalised.

If the bank fails to maintain 90% of the CRR level on all days for a period of 14 days the bank is penalised on the amount by which it has failed to meet the target |

Banks get penalised.

If the bank fails to maintain the SLR, RBI will charge a 3% penalty annually over the bank rate |

| Effectiveness | CRR is comparatively less effective to control the money supply in the economy | SLR is a more effective measure |

Why Is Cash Reserve Ratio Changed Regularly?

The RBI introduced CRR to allow the banks to maintain additional funds to meet any sudden rise in demand for liquidity. However, the CRR is also an instrument in the hands of the RBI to control the supply of money in the market. RBI reserves the power to change the CRR rate when it feels the need to intervene in the country’s economy.

Whether you are a commoner or an investor, it is important to know ‘what is CRR?, as you can see the ripple effect of any changes in the CRR rate in your daily transactions.

The RBI uses CRR as a tool to control inflation. So, when inflation rises in the market, the RBI increases CRR to bring down liquidity. As the bank’s liquidity reduces, it is left with fewer funds for lending, which makes loans expensive. Similarly, if the RBI wants to improve liquidity in the market, it reduces the CRR rate.

Final words

CRR, directly and indirectly, affects every aspect of a country’s economy. Hence, understanding CRR is crucial for everyone interested in learning about finance and investing.

Explore the Share Market Prices Today

| IRFC share price | Suzlon share price |

| IREDA share price | Tata Motors share price |

| Yes Bank share price | HDFC Bank share price |

| NHPC share price | RVNL share price |

| SBI share price | Tata Power share price |