When a lender offers a loan, there is always uncertainty if the borrower repays the loan. When a bank/company extends credit to customers, they may default on payments. A bond issuer may fail to repay its investors or satisfy contractual obligations. The uncertainty in the above cases is nothing but Credit Risk. The possibility of a loss due to a borrower's failure to repay debt or to satisfy contractual obligations is considered a Credit Risk.

Debt instruments are not free from credit risk. Debt instruments like bonds are nothing but a debt certificate and carry a potential credit risk. The backing of a debt instrument is usually the ability of the company or government to pay, which is assessed by various factors we will see further in the article.

What are the types of credit risk?

Default Risk

This is the simplest form of credit risk that arises when the issuers cannot meet their payment obligations or repay the debt. The likelihood of a default is considered Default Risk. Any credit transaction is susceptible to default risk- securities, bonds, loans, derivatives..

Credit Spread Risk

Credit spread is the difference between the yields of two debt instruments that are the same in all respects except their credit rating. For example, if a 10-year G-sec is trading at a yield of 4% and a 10-year corporate bond is trading at a yield of 7%, the credit spread is 3%.

When the financial conditions of an issuer deteriorate, the probability of default increases, leading to lenders or investors demanding higher compensation in the form of extra yield.

The risk that the bond price will decline due to an increase in the bond yield is measured by the Credit Spread. The higher the spread, the greater the risk. In other words, it’s the risk of alternative interest-bearing securities compared to a benchmark.

Downgrade Risk

Since the credit spread of a bond issue increases based on the increase in default risk, how does one measure the changes in default risk or the credit quality of a bond?

Credit Ratings are used to evaluate the creditworthiness of an issuer. When a credit rating agency lowers or downgrades the rating of an issuer, it again indicates the increase in default risk, thus widening the credit yield and leading to falling bond prices. Downgrade risk is the possibility of a fall in bond prices due to a decline in the issuer’s creditworthiness.

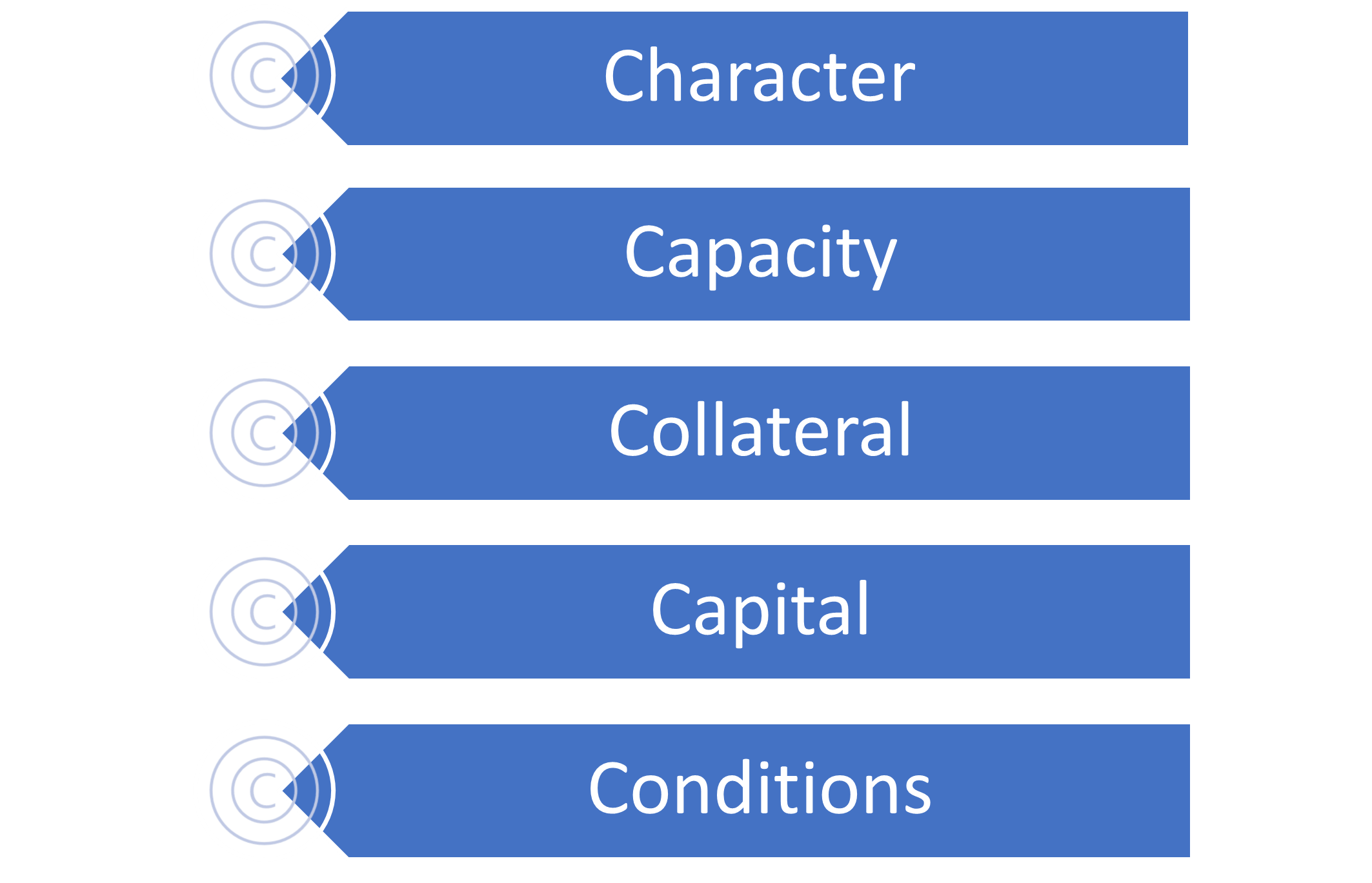

5Cs of Credit Analysis

How is credit risk assessed?

We know now that credit risk is assessed using credit ratings. Thus, a credit rating indicates the loan repayment capability of a company or organization of the borrowed money. Credit rating agencies evaluate a company's annual income, overall debt, business prospects, and profits and assign a ranking.

Lenders or individual investors use credit ratings to issue loans or assess the risk of investing. At the same time, the borrowers or issuers of debt instruments use their rating to raise funds/debt in the market.

ICRA, CRISIL, CARE, BrickWorks, India Ratings and Research, Informetrics Valuation , and Acuite are the 7 credit rating agencies in India. Each rating agency issues its ranking or grade as per the method in practice. Before assigning a grade, all the agencies consider a similar set of factors. Below are the credit rating scales used by India's major credit rating agencies.

| Rating Scale | ICRA | BrickWork | CRISIL | CARE | India Rating and Research |

| High Safety: Lowest Risk of Default | ICRA AAA | BWR AAA | CRISIL AAA | CARE AAA | IND AAA |

| High safety: Low default Risk | ICRA AA | BWR AA | CRISIL AA | CARE AA | IND AA |

| Low Risk | ICRA A | BWR A | CRISIL A | CARE A | IND A |

| Moderate safety: Moderate Credit Risk | ICRA BBB | BWR BBB | CRISIL BBB | CARE BBB | IND BBB |

| Moderate safety: Moderate Default Risk | ICRA BB | BWR BB | CRISIL BB | CARE BB | IND BB |

| High risk: High Default Risk | ICRA B | BWR B | CRISIL B | CARE B | IND B |

| High risk: Very High Default Risk | ICRA C | BWR C | CRISIL C | CARE C | IND C |

| Default: Defaulted or about-to-default instruments | ICRA D | BWR D | CRISIL D | CARE D | IND D |

In general, a bond with higher credit risk and lower price offers a higher yield.

Did you ever wonder why corporate bonds yield high-interest rates compared to G-secs?

The chances of companies defaulting on their debt are higher than the government bonds backed by the sovereign authority, which is why interest rates are high on corporate bonds.

Remember that in debt securities, the yield always moves in the opposite direction of the price. Now that you know credit ratings are used to assess the credit risk of debt instruments, make sure you check the credit ratings of an issuer before investing in debt securities. When it comes to debt funds, the portfolio manager will look into the interest-rate sensitivity and credit risk of the holdings in a portfolio.