What is Nasdaq?

Nasdaq (National Association of Securities Dealers Automated Quotations) is the world's second-largest stock and securities exchange, based in New York City, and behind only the New York Stock Exchange (NYSE). Nasdaq’s trades happen electronically (after being the first exchange going electronic in 1971) through dealers known as ‘market makers.’ As a result, it is known to attract more tech-oriented businesses than other exchanges. Equities on Nasdaq are generally seen to be more volatile than those traded elsewhere, but in turn, they offer more opportunities for a sound investment.

A Tech Behemoth

Nasdaq has been attracting some of the largest blue-chip companies in the world. It represents high-tech software, computer, and internet companies, although it has a fair share of other industries. Some of the stocks traded include, Apple, Microsoft, Amazon, Tesla, Meta (formerly Facebook), and Starbucks. Nasdaq attracts big corporations and growth-oriented companies, and its stocks are known to be more volatile than those on other exchanges.

As the world's second-largest Stock Exchange based on market capitalization, it trades listed stocks as well as many over-the-counter (OTC) stocks. The history of Nasdaq shows a track record of revolutionary achievements. Nasdaq has many firsts to its reputation. Not only was it the first to go electronic, but it was also the first to launch a website, sell its technology to other exchanges, and use cloud-based services.

In 2008, Nasdaq merged with Stockholm-based OMX ABO, an operator of Nordic and Baltic regional exchanges. The new company, NASDAQ Inc., offers to trade in exchange-traded funds, debt, structured products, derivatives, and commodities.

The inner workings

Nasdaq was designed to operate with automated quotations. Ever since its founding, it has been open to over-the-counter (OTC) trading, and it became famous for it. It was often referred to as an OTC market by trade publications and the media. It also added automated trading systems and was the first exchange to facilitate online trading.

Nasdaq is also a dealer’s market, and all the trades are conducted by market makers that deal directly rather than via auctions. Market makers provide Nasdaq with liquidity and depth while profiting from the difference in the bid-ask spread. The exchange is open for trading between 9:30 am and 4 pm and offers traders pre-market and post-market hours.

How to list scrips on Nasdaq?

For a company to list its securities on Nasdaq, the company must comply with the following rules and have:

- • At least 100,000 shares of public float

- • Total assets of $4,000,000

- • Shareholders’ equity of at least $2,000,000

- • At least two dealers/market makers

- • $3 minimum bid price of the company stock

- • Public float market value of a minimum of $1,000,000

- • Registered with the Securities Exchange Commission (SEC)

An application may take up to six weeks to get approved, post which the company will be listed in one of the three market tiers.

Global Select Market: This is made up of international companies and US stocks and is based on market capitalization. Any company qualifying in this tier has to pass Nasdaq’s stringent policies. Listings in another tier, namely Global Market, are surveyed annually by the exchange’s Listing Qualifications Department and, on eligibility, are moved to the Global Select Market.

Global Market: This is considered a mid-cap market, comprising stocks listed in the US and internationally.

Capital Market: This was once called SmallCap market by Nasdaq. This consists of a large list of companies that have smaller market capitalizations.

Indian companies that have made it into Nasdaq include, MakeMyTrip Ltd., Rediff.com India, Yatra Online Inc., Sify Technologies Ltd., Azure Power Global Ltd., and Freshworks.

What is the Nasdaq Composite Index, and how to invest in it?

This is a stock market index that comprises stocks that are listed on the Nasdaq stock exchange. Here are a few things to consider to be listed:

- • A stock must be listed exclusively on the Nasdaq market.

- • The stock must be a common individual company stock. Other stocks, such as exchange-traded funds (ETFs), and other types of securities, are excluded.

- • American depositary receipts (ADRs), real estate investment trusts (REITs), and shares of limited partnerships are eligible.

The most optimum way to invest in the Nasdaq Composite Index is to purchase an index fund, which is a mutual fund that tracks the index.

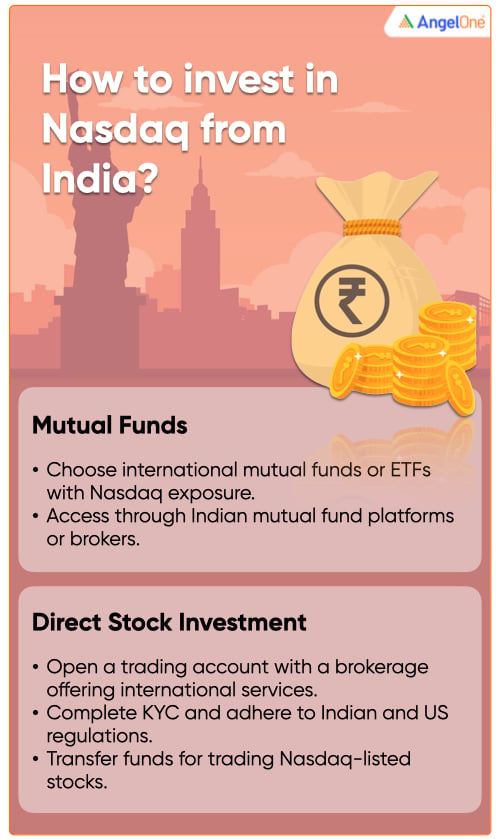

How to invest in Nasdaq from India?

A lot of Indians have been showing interest in investing in US stocks. This can be done in 2 ways:

- • Through mutual funds - Many mutual funds invest in US stocks from India. You can start by investing in these after doing due diligence. The types of funds that invest in the Nasdaq companies usually charge a management fee.

- • Direct investment in the US stocks - Many Indian brokers have connections with US-based brokers and can help you invest directly. There are a host of platforms available to do this. Apart from this, investors can also open a trading account overseas and trade in US stocks.

Conclusion

Nasdaq has made quite a name due to its all-electronic trading, which is considered an advantage to traders. It also plays a prominent role in the local and global economy.

Explore the Share Market Prices Today

| Tata Steel share price | Adani Power share price |

| PNB share price | Zomato share price |

| BEL share price | BHEL share price |

| Infosys share price | ITC share price |

| Jio Finance share price | LIC share price |

Disclaimer

- This blog is exclusively for educational purposes

- Investments in the securities market are subject to market risks, read all the related documents carefully before investing.