Bonds and other debt instruments are considered the chosen investments of risk-averse investors. However, there are risks associated with debt instruments. Interest rate fluctuations affect all those investment products that earn interest, but debt investments are primarily concerned. The change in interest rates affects the bonds' market value, exposing investors to various other risks.

Let us look into interest rate risk, how it affects debt instruments, and what measures prevent interest rate changes from affecting your investments.

What is Interest rate risk?

Interest rates influence the yield rates or coupon rates of a bond. Therefore, the potential for value depreciation of bonds or any other debt instruments due to changes in interest rates is termed Interest Rate Risk.

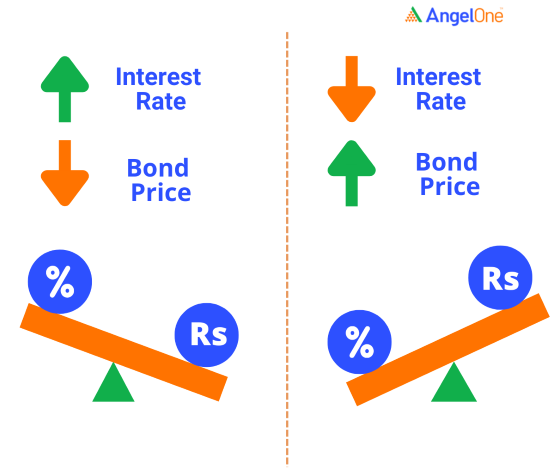

Interest rates and bond prices have an inverse relationship. As interest rates rise, the bond's market value falls and vice versa. Let us look at the inherent risks associated with rising interest rates.

Suppose you bought a 10-year bond with a coupon/interest rate of 5%. However, due to a rise in interest rates, new bonds offer a yield of 7%, creating opportunity costs. Furthermore, if you decide to invest in new securities providing high yield rates, you may face a reinvestment risk as the new instruments with high yield rates decrease the appetite for older bonds that pay lower yields at the same risk. Thus, the decrease in demand depreciates the price of previous bonds with lower yields.

Example of Interest Rate Risk

Consider an investor holding a 10-year government bond with a fixed coupon rate of 6% per annum. If the interest rates in the market rise to 8%, new bonds will be issued with a higher yield, making the older 6% bond less attractive to investors. As a result, the market value of the older bond decreases since investors prefer bonds that offer higher returns.

Similarly, if interest rates fall to 4%, the previously issued bond paying 6% becomes more valuable, increasing its market price. This fluctuation in bond value due to interest rate changes exemplifies interest rate risk.

Types of Interest Rate Risk

There are different types of interest rate risks that investors must be aware of:

- Price risk – The risk that the price of a bond will decline due to rising interest rates.

- Reinvestment risk – The risk that cash flows from an investment, such as coupon payments, will be reinvested at lower interest rates.

- Call risk – The risk that bonds with a callable feature will be repaid before maturity, forcing investors to reinvest at lower rates.

- Credit spread risk – The risk that the difference between government bond yields and corporate bond yields will widen, affecting bond prices.

- Liquidity risk – The risk that an investor may not be able to sell a bond quickly at fair market value due to lack of buyers in the market.

How Does Interest Rate Risk Work?

Interest rate risk arises because of fluctuations in interest rates, which impact the value of debt securities. Here is how it works:

- Inverse relationship between interest rates and bond prices – When interest rates increase, bond prices fall, and when interest rates decrease, bond prices rise.

- Market conditions influence risk – In a rising interest rate environment, existing bonds with lower yields lose value as new bonds offer higher returns.

- Impact on fixed-income investments – Investors in fixed-income securities, such as bonds and debt mutual funds, experience fluctuations in portfolio value due to changing interest rates.

How can you manage Interest rate risk?

You cannot eliminate the Interest rate risk. However, one can manage it with options like,

- Short tenure debt instruments: Duration is the measure of the sensitivity of bonds to changes in interest rates—the longer duration of bonds, the more susceptible they are to interest rate fluctuations. Debt instruments with shorter maturity tenure are less exposed to interest rate risks. Investing in short-term debt instruments may help avoid interest rate risk.

- Floating rate bonds: As the name suggests, floating-rate bonds pay variable interest rates throughout the tenure, mostly tied to market fluctuations. Thus, when there is a rise in interest rates, the rate of return increases. However, the downside of these bonds is when the interest rate falls, the rate of return falls along with it.

- Diversification: Diversification is the key to mitigating risks in any investment. When investing in debt securities, one can diversify the portfolio by investing in high-yielding bonds such as corporate bonds, but they come with high credit risk.

- Hedging through IRFs: If you hold G-secs and anticipate a rise in interest rates or a fall in bond prices, you can hedge by taking an opposite position to avoid losses incurring from Interest rate risk.

- Holding the bond till maturity: On holding a bond till maturity, the total return will be positive along with the principal repayment on maturity. If you avoid panic selling a bond during a market downturn, you can reduce the impact of interest rates on your investments.

Interest rate risk affects debt funds as much as bonds. When interest rates spike, the value of the fund’s existing bond price falls, affecting the fund's overall performance. As an investor, you must be aware of the other risks associated with the debt instruments and make informed decisions weighing the pros and cons of the investment, keeping in mind the duration of investment, risk appetite, rate of return, and other factors.

Several factors influence interest rate risk, including:

- Monetary policy – Decisions by central banks, such as repo rate changes by the Reserve Bank of India, impact interest rates.

- Inflation – Rising inflation rates often lead to higher interest rates as central banks aim to curb inflation.

- Economic growth – A strong economy may push interest rates higher, while a weak economy may lead to lower interest rates.

- Government borrowing – Higher government debt issuance can influence bond yields and interest rate trends.

- Global market trends – Changes in United States Federal Reserve rates, crude oil prices, and geopolitical risks can impact interest rate movements.

Conclusion

Interest rate risk affects debt funds as much as bonds. When interest rates spike, the value of a fund’s existing bonds falls, impacting the fund’s overall performance. As an investor, you must be aware of the risks associated with debt instruments and make informed decisions by considering the investment duration, risk appetite, and expected rate of return.

Explore the Share Market Prices Today

| IRFC share price | Suzlon share price |

| IREDA share price | Tata Motors share price |

| Yes Bank share price | HDFC Bank share price |

| NHPC share price | RVNL share price |

| SBI share price | Tata Power share price |