One of the traditional investment assets that is considered a safe haven even today is gold. There are various factors that influence the gold price. However, on drawing the evidence from the past, it is found that the price of the yellow metal tends to fare up during any uncertainty or economic crisis while most of the other investment choices take a downward route. Let us learn how the economic crisis impacts the price of gold and look at a few examples from the past.

What happens during a crisis?

During any economic downturn fuelled by a financial crisis or a geopolitical crisis or any other causes, the economic activities like production, supply chain are disrupted which further leads to inflation, shrinking wages, currency depreciation among others. Economic crisis directly affects the stock market causing its downtrend making investors reluctant to invest.

How does the gold price fares during such a crisis?

The stock market, commodity market, and currency market are directly affected by economic activities. So, an economic crisis would lead the stock market, commodity market, and currency market to tumble. It is during those times, that investors turn towards safer investment avenues among which gold is the preferred one and second preferred is silver.

Economic crisis may give rise to inflation. Generally we have seen that inflation and gold have a direct relationship. Most other investment options fail to deliver inflation-beating returns making investors choose gold as the investment option.

If the central bank decides to reduce interests due to the crisis, investors don’t earn good interests on their deposits which again makes gold as one of the investment choices for conservative investors.

Though there are other assets, investors prefer gold at times of recession as it provides much-needed flexibility and liquidity. If you choose to invest in real estate over gold, then you may find it challenging to sell your holdings when needed. If you happen to choose debt instruments over gold, then you may not be able to sell your holdings until the lock-in period is completed. Therefore, even for the sake of liquidity, gold turns out to be the best option at times of economic crisis.

As gold is considered a safer investment avenue during adversities, the demand for gold increases during such times. By the demand and supply theory, when there is an increase in demand and the supply remains the same, the prices shoot up. Thus, the gold prices generally fares up during a crisis or uncertainty.

How gold has outperformed other investment avenues during crises?

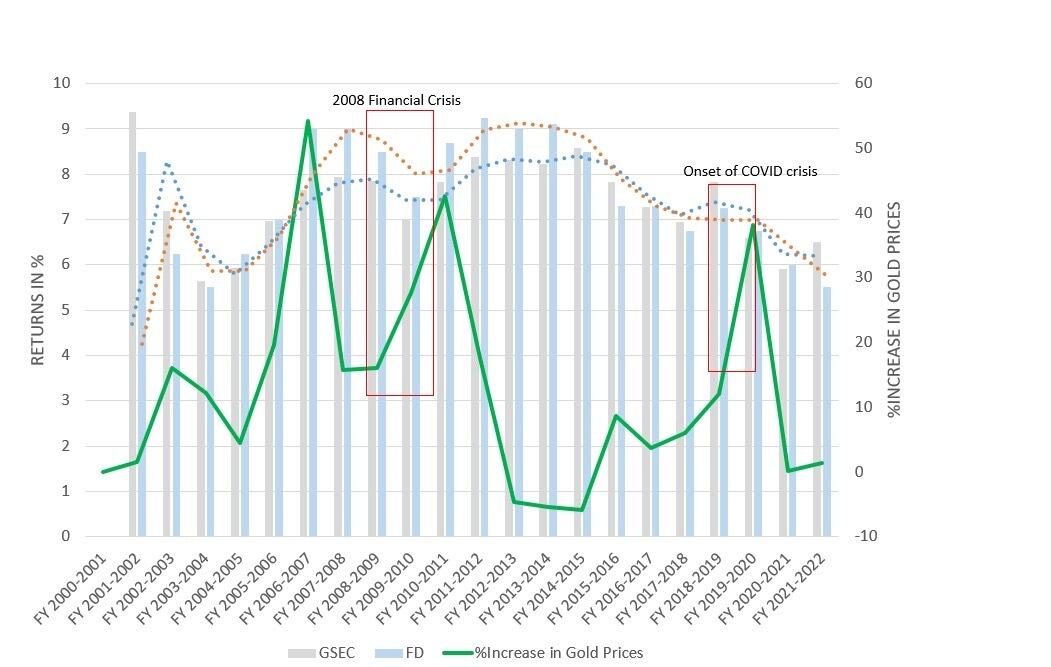

From the above graph, it is evident that the other investment avenues witnessed a downward trend during the crisis times( financial crisis of 2008 and COVID crisis of 2020)while gold witnessed a price hike during those times as highlighted in the graph.

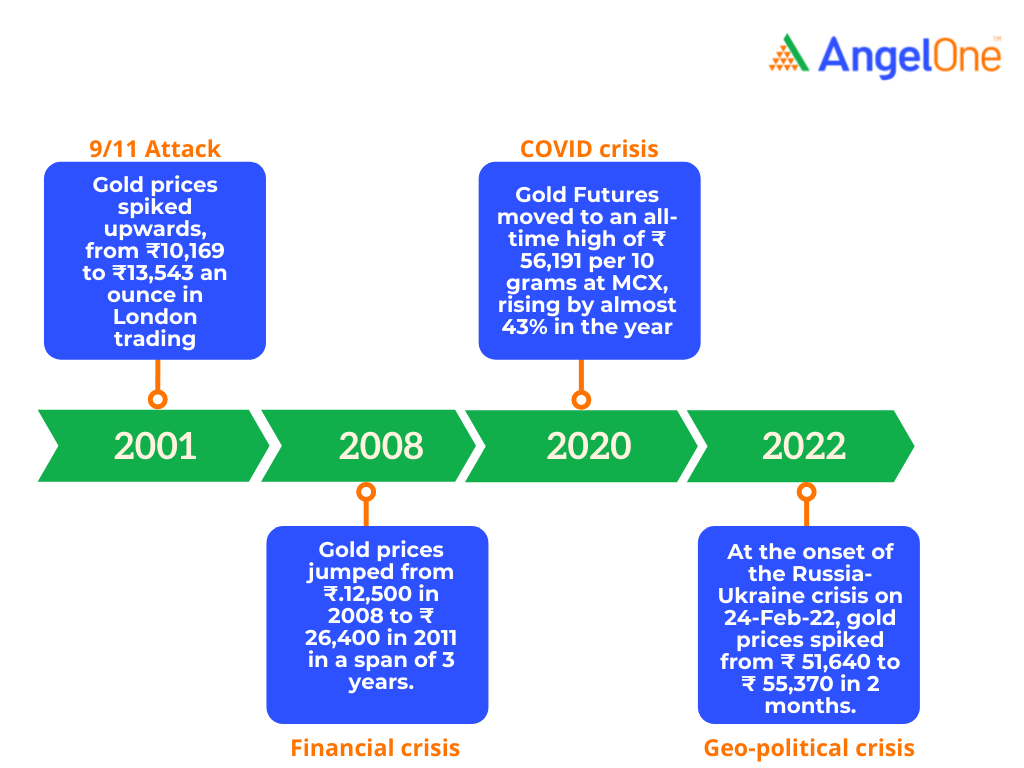

Gold rallying during crisis times: Examples from past

source:GoldHub

Gold has remained an all-weather investment option since times withstanding the uncertainties of war, pandemics, economic turmoils, etc. This has made gold a preferred investment choice for a conservative investor. The investment options in gold are also varied from Physical Gold to Gold ETF to Sovereign Gold Bonds. Given the stability tagged with gold prices even during volatility, one can allocate gold a place in their diversified portfolio.

Explore the Share Market Prices Today

| IRFC share price | Suzlon share price |

| IREDA share price | Tata Motors share price |

| Yes Bank share price | HDFC Bank share price |

| NHPC share price | RVNL share price |

| SBI share price | Tata Power share price |

Disclaimer: This blog is exclusively for educational purposes and source for statistical data and note approval is valid for 180 calendar days from date of approval.