Looking for investment options that help you build corpus while beating inflation? Options trading is a good option investment option if you use it effectively after gaining proper understanding and knowledge about it.

Apart from this, you must know that for all the versatility, flexibility, and returns, it provides, there are certain challenges. All you need to learn is how to smartly and efficiently manage this risk. Read on to know a few things before you dive deep into options trading.

Challenges associated with the options trading

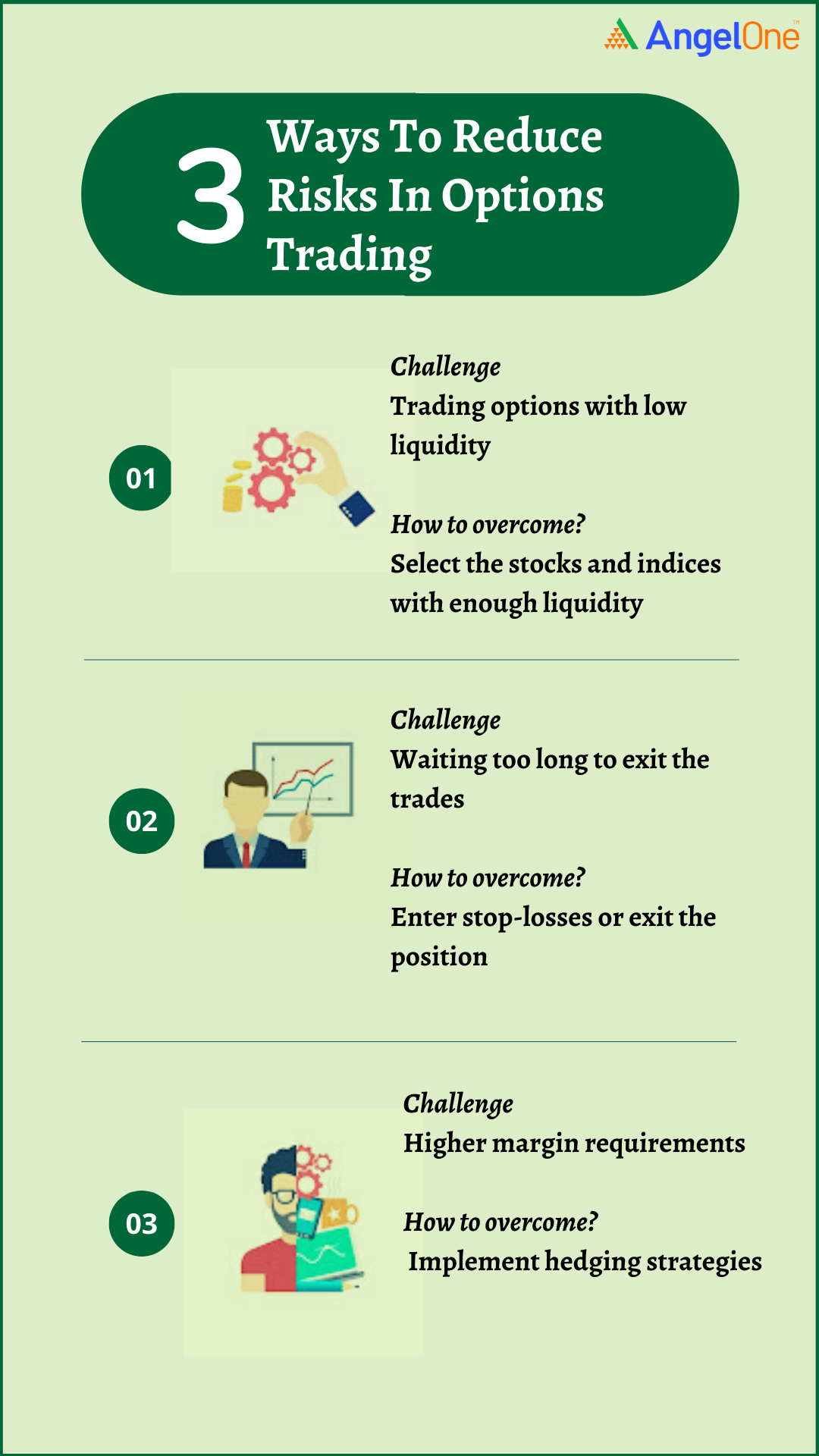

Below is the list of risks in trading in options along with an idea of how to overcome them.

1. Trading options with low liquidity

Liquidity in the stock market means the probability that the trader will be able to execute the next trade at the same price as the last one. Trading in stocks is more liquid as compared to options trading as you have a plethora of contracts to choose from with different expiration dates and strike prices.

How to overcome it?

As a trader, you should only select the stocks and indices with enough liquidity to have easy entry and exit while trading in options. For instance, you can trade in stocks of large companies which have comparatively better liquidity as they are traded more frequently. Apart from this, you can also keep the strike price near the actual stock/index price of the underlying asset as it will make it easier for you to enter and exit the trade.

2. Waiting too long to exit the trades

Far too often, option buyers hold their trades with the hope that there will be a big boom even though the premium keeps falling. Sometimes, in such trades, the premium goes to zero and the options expire as worthless.

How to overcome it?

You can overcome this challenge by deploying strict stop-losses, or by existing the positions at low value rather than losing the full premium. Another route to mitigate this risk is to use strategies that reduce the premiums like Bull Call Spread and Bear Put Spread.

3. Higher margin requirements

Just like other trading strategies, trading in options also requires margin. However, the margins required in trading options are comparatively high in order to protect the investors who are investing their hard-earned money.

How to overcome it?

The best way to avoid these hefty margin requirements is to implement hedging strategies. This is because, with appropriate hedges in place, you can limit your losses in case of any adverse price movements.

Conclusion

Trading options is a great way to diversify your portfolio - when executed efficiently. However, there are some common challenges that options traders may face but you need to be careful. The best way is to familiarize yourself with these challenges, so you are ready to identify and deal with them. The next time you trade in options, use the ways stated above like hedging, bull call spread, and others to mitigate the risks associated with it.