After trading for a few years in stocks, Srikant was now close to fulfilling some of his short-term financial goals. But, he wanted to diversify his portfolio further for creating a retirement corpus. He had heard about commodity trading, but was hesitant to invest. Then one day, he met his friend Rakesh, who explained to him that he could use a futures contract to invest in agro commodities.

Explaining the fundamentals, Rakesh said, “A futures contract can be used both for hedging and speculation. As an investor, you can research the market to speculate about the price of a particular agro product. If you are confident that the market is going to be bullish, just pay the margin amount, and purchase a futures contract.” Srikant was quick to grasp that futures in commodity trading could allow a lot of leverage, and careful trading could allow him to fulfill his investment objectives.

Understanding commodities:

A commodity is any essential product; either agricultural or non-agricultural, which can be exchanged or traded. In India, commodities are divided into two categories: soft commodities and hard commodities. Soft commodities include agricultural products, like sugar, wheat, rice, soyabean, corn etc. while hard commodities are typically mined. For instance, minerals, oil etc. come under the category of hard commodities.

Commodity trading in India:

Being a predominant agricultural economy, ample scope exists in India for trading in agricultural commodities. The beginning of agro commodity trading in India can be traced back to 1875, when the Cotton Trade Association was established in Bombay. Futures’ trading in commodities was suspended from 1952 onwards because of shortage of commodities for domestic consumption. Commodity trading recommenced again from 2002. At present, trading in agricultural commodities comprise around 12% of the total commodities trade.

Commodity trading exchanges in India:

You can trade in commodities – comprising livestock and meat, agro products, metals and energy – across six commodity exchanges in the country:

- - Multi Commodity Exchange of India Limited (MCX)

- - National Commodity & Derivatives Exchange Limited (NCDEX)

- - National Multi-Commodity Exchange (NMCE)

- - Indian Commodity Exchange (ICEX)

- - Ace Derivatives and Commodity Exchange Limited (ACEX)

- - Universal Commodity Exchange (UCX)

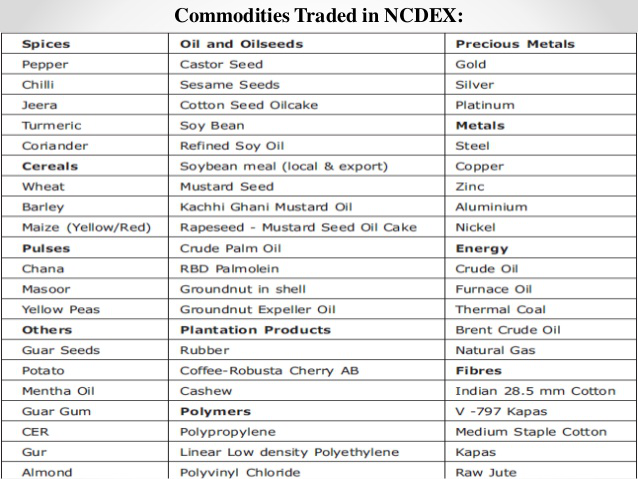

Out of these commodity exchanges, the NCDEX and NCME focus primarily on agricultural commodities trading.

Regulator for commodities trading:

The Forward Market Commission (FMC) was constituted in early 1950s to provide a regulatory framework for the commodities trading market in India. It was merged with the Securities Exchange Board of India (SEBI) in September 2015 to provide for a universal financial regulator of the market. Subsequently, the SEBI enhanced the operational functionality of the commodity market through a slew of measures, like introducing options contract in commodities trading, allowing stock brokers and some categories of Foreign Institutional Investors (FII) to deal/participate in commodity derivatives, permitting NSE and BSE to introduce commodity derivatives on their trading platforms etc.

Understanding trading in agricultural commodities:

You can start trading in agricultural commodities through a futures contract. This is simply an agreement to purchase or sell a specified quantity of a particular agricultural commodity at predetermined prices on a future date. You can also participate in the fluctuations of agricultural commodities through Exchange Traded Funds (ETFs) and Exchange Traded Notes (ETNs).

Benefits of trading in agricultural commodities:

- - Commodity tradinghelps to stabilise prices of agricultural products by acting as a link between future and spot prices. Future and spot prices have a direct relationship, and hedging can help mitigate the risks associated with unprecedented price fluctuations. While seasonal variations of prices are minimised, farmers/producers benefit because of stable prices.

- - Commodity tradingin agro products helps to develop efficient hedging and speculation strategies. For instance, if there is a marked change in future prices, because of existing spot prices, an efficient hedging strategy can be made. On the other hand, if changes in future price impact existing spot prices, an efficient speculation strategy can be formulated. Thus, on the basis of current trends in the market, it allows for finding future prices.

- - Trading in agricultural commoditiescan help arrive at an accurate, market-oriented price of agricultural products. This is of key importance as, at times, the Minimum Support price (MSP) fixed by the government and the wholesale prices fixed by farmers are not in sync with the existing market patterns.

- For both retail and corporate investors, trading in agricultural commoditiesprovides them an opportunity to diversify their portfolios. Trading in commodities has become as easy as trading in conventional stocks and securities. All you need is to open a Demat Account and a Trading Account, and complete the requisite formalities. For making most of your investments in agro commodities, industry experts suggest taking into account supply and demand-based factors along with seasonal and weather-related variables.

List of the top agricultural commodities traded in India:

There are 29 agricultural-based products which are traded across commodity exchanges. Here is a list of the top products:

- Condiments and sauces

- Cotton and fiber

- Beer ingredients

- Fresh fruits, like apples and grapes

- Pulses, like lentils and beans

- Snacks, like sugar confectionery, chewing gum, chocolates and biscuits

- Cereals

- Nuts like almonds

- Different types of spices

How to zero in on a commodity broker?

Selecting the right stock broker for trading in agricultural commodities is of vital importance. You must always remember to zero in on a stockbroker who can provide seamless trading platforms to trade across multiple commodity exchanges. Getting access to latest research reports can allow you to make informed decisions while trading in commodities. You can consider Angel One, among the most trusted and reliable stockbrokers in the country, which provides a free online Demat Account with zero AMC. You get access to various in-depth reports, like fundamental report, technical report and special report. Moreover, the online NCDEX and MCX margin calculator can help you ascertain the right trading margin.