As a trader, you can invest in many asset classes in India, including equities, commodities, currencies, derivatives, and more. The financial market is divided into different segments with unique trading rules to simplify investing in various categories. Hence, if you want to trade in agricultural commodities like cotton and coffee and the shares of ABC company, you can’t do it under one segment. You have to trade them separately in different exchanges from your broker’s platform or app, like Angel One. Separate categories facilitate trading and transactions. So, if you want to invest in multiple asset classes, you need to enable the segment in the Angel One app.

Types of Segments:

Following are the various segments of the stock market.

Equity Cash (Capital Market)

It classifies all the transactions involving buying and selling of shares listed on the exchange. In India, stocks from listed companies trade in NSE (National Stock Exchange) and BSE (Bombay Stock Exchange). So, you will have to activate the equity segment in the Angel One app to transact in the equity market.

Mutual Funds

Mutual Fund is a financial instrument in which funds are collected from multiple investors to invest in assets such as stocks, money market instruments (Certificate of Deposit, Commercial Paper, Treasury Bills, and Call Money), and bonds. With Angel One’s Mutual Funds segment, you can invest in various Mutual Funds either in lumpsum or through SIP.

Equity & Index F&O

An equity derivative is a class of financial contracts that invest in equities as the underlying asset (equity stocks/shares in the secondary market). For instance - Reliance Futures is an equity derivative. Its price varies with the movements of the Reliance Share Price. Similarly, for an index-based derivative, the underlying asset is a group of indices such as NIFTY, BANK NIFTY, and FINNIFTY. In this segment, you can trade only in the group of assets and not in the individual security.

Futures and Options are the two derivatives available for trading in this segment. In the Futures contract, an investor agrees to buy/sell a particular asset at an agreed-upon rate on a future date. However, in the Options contract, the investor has a right, but is under no obligation to buy/sell the underlying asset at a specific price on a fixed date. With Angel One, you can trade in futures and options in segment.

Commodities

Indian investors can diversify their portfolio by investing in various commodities like gold, crude oil, copper, cardamom, rubber, and energy in the Commodities market. MCX (Multi-Commodity Exchange) and NCDEX (National Commodity and Derivatives Exchange of India) are the two exchanges under the Commodity segment at Angel One. NCDEX has leadership in agro-products, while MCX predominantly leads the gold, metal, and oil markets.

Foreign Exchanges

If you want to invest in foreign currencies, you will have to activate the currency segment. It allows you to buy and sell foreign currencies at market rates electronically. One invests in the Forex market for various reasons - gaining exposure to the largest market in the world, portfolio diversification, and profit opportunities from fluctuating currency rates in the international market. Major participants in this segment are corporations, central banks, retail forex brokers, hedge funds, and individual investors. You can activate the NSE-FX segment at the Angel One platform to trade in the Forex market.

How Do I Check Which Segments Are Activated?

To check which segments are currently activated on your Angel One account, follow these steps:

- Go to your profile on the mobile app or web platform. You can use this link as well to directly access your segment details

- There you can see the activated categories under the ‘Manage Segment’ section.

Why Do We Need to Activate Segments?

The right mix of equity, future & options, commodities, and currency can help build a diversified portfolio while earning good returns. Activating various available segments will open more opportunities for you to invest. So, if you want to increase your market exposure, activate the different segments in the Angel One app.

Documents Required to Activate Segments

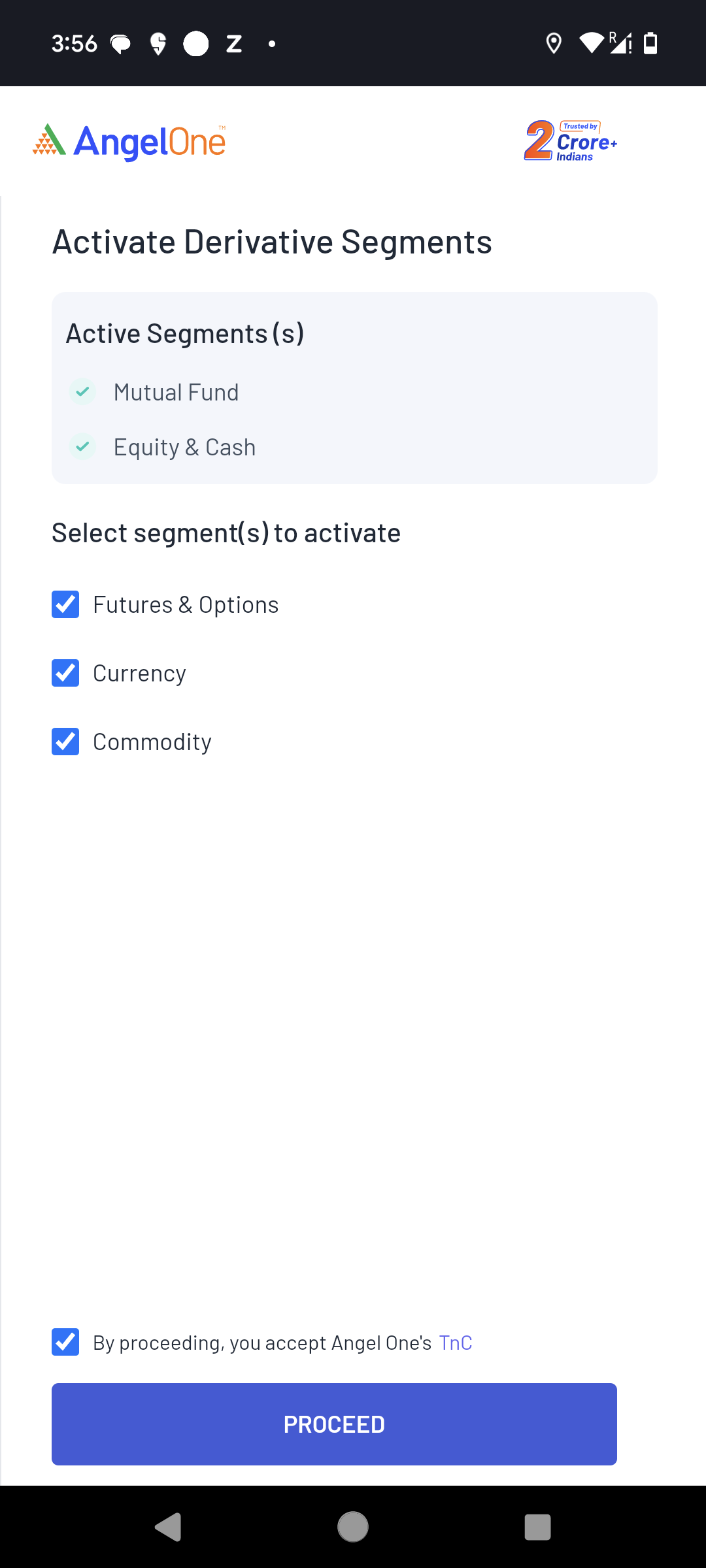

When you open an account with Angel One, the Equity Cash and Mutual Funds segment gets activated by default. However, if you want to activate another category, you need to submit an activation request.

At Angel One, you don’t have to submit any documents to activate the segment if you have holdings in your account, as the same will suffice as financial proof. So to activate the segment, all you will have to do is authorize the activation request by providing esign.

Points to Note

- The following segments at the mentioned exchanges are available for trading -

-

- Futures & Options - NSE, BSE

- Currency - NSE, BSEThe following segments at the mentioned exchanges are available for trading -

- Commodity - NSE, MCX, NCDEX

- Equity and Mutual Funds are the default trading segments activated for all the users with a demat account

- Segment activation process will take 2-3 working days

- Online segment activation is available for the individual account holders. Individual can activate segment online by directly using this link

- Please have your Aadhaar card ready when placing an online segment activation request to e-sign the application.

- Ensure that your Aadhaar card is linked to your mobile number to complete the process.

Conditions for Segment Activation

1. Individual Accounts -

- Providing financial proof is mandatory for activating derivative segments

- Any proof provided should be in the name of the angel account holder

- The proof must contain the logo and seal of the concerned authority

- If there are any holdings in the angel one account, segments will be activated without any additional proof in online segment activation process

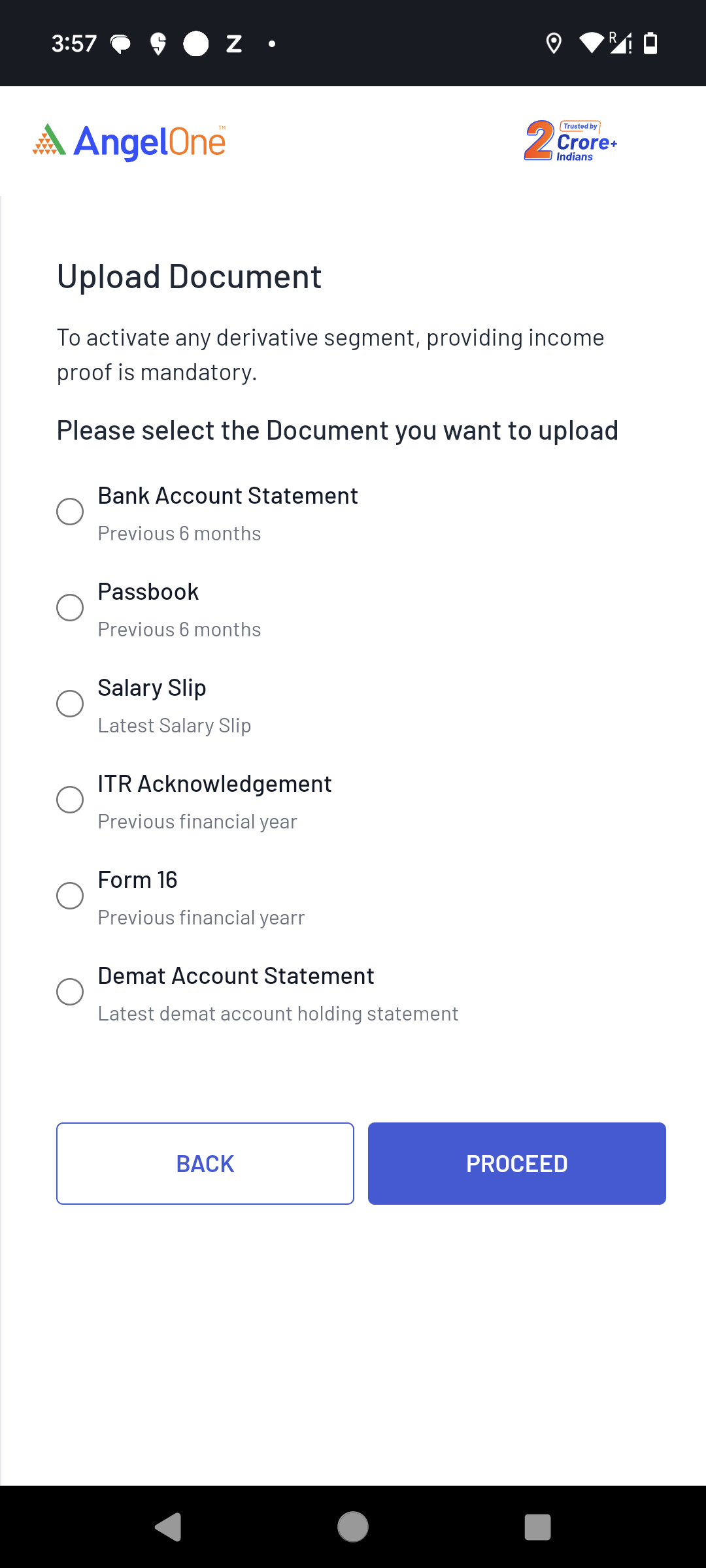

- If there are no holdings,financial proof needs to be provided. Any of the documents from the below mentioned list are accepted as valid income proof:

- Last 6 months bank account statement

- It should have at least one transaction from every month

- Passbook

- It should have first page and last 6 months of transaction details

- Salary Slip

- Last month’s salary slip needs to be provided

- ITR acknowledgement form

- It should be from latest/previous financial year

- Form 16

- It should be from latest/previous financial year

- Demat Account Statement

- Latest Holdings statement

- Last 6 months bank account statement

2. Non-individual accounts (Joint, HUF, Corporate) -

- Currently there is no online process of segment activation for non-individual accounts.

- For activating derivative segments, you can raise a ticket here (Create Ticket —> Select Account Details under Category —> Select Segment Activation under Sub-Category) and attach the filled in segment modification form along with any income proof.

- Any of the documents from the below mentioned lists are valid income proof:

- Last 6 months bank account statement

- It should have at least one transaction from every month

- ITR acknowledgement form

- It should be from latest/previous financial year

- Form 16

- It should be from latest/previous financial year

- Demat Account Statement

- Latest Holdings statement

- Mutual Funds Statement

- Latest Holdings statement

- Net worth certificate

- Last 6 months bank account statement

- If you are an HUF account holder, then Karta’s signature and HUF stamp is required on the form.

- If you are a corporate account holder then a corporate stamp is accepted in place of a signature.

- If you are a joint account holder then all holder’s signature will be required on the form.

- For Minor and NRI account holders, segment activation is not allowed.

Process to Activate Segment Online

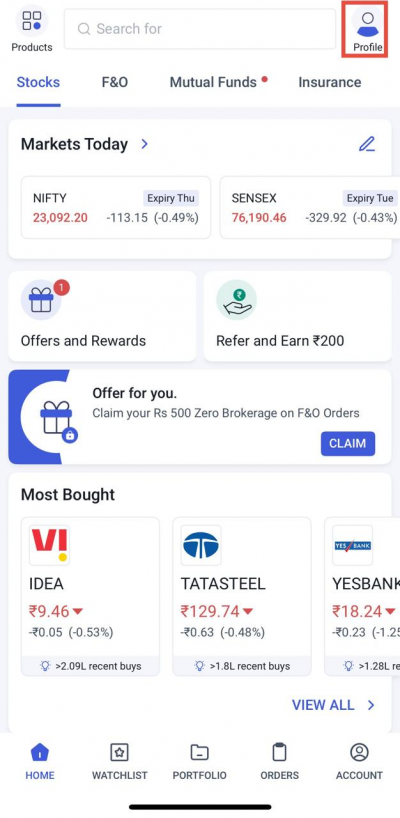

Step 1: Process to Activate Segment Online: Use this link to access segment activation

log in to the Angel One app, go to the Accounts page, and click on the Profile Widget. Use your mobile number/client ID and OTP to login

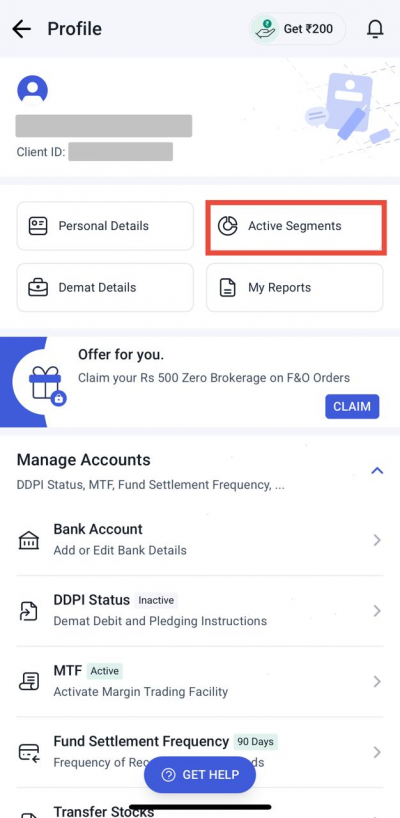

Step 2: Click on “Active Segments”.

Step 3: Select the segment(s) to be activated.

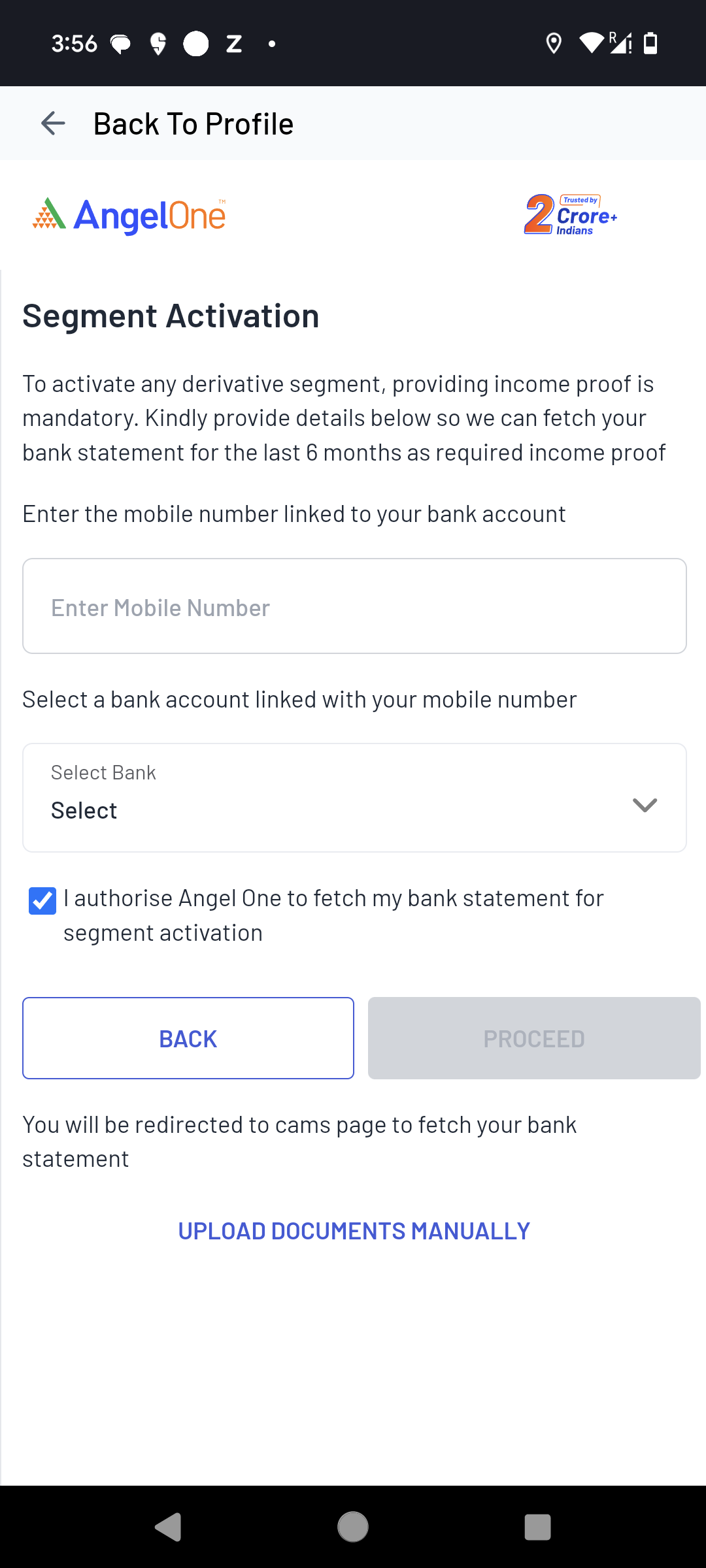

Step 4: Provide financial proof

- Allow system to automatically fetch last 6 month bank statement by entering the bank name and mobile number linked to your bank account

- Alternatively, select “Upload documents manually” option to upload the income proof yourself

Step 4a: Automatically fetch bank statement

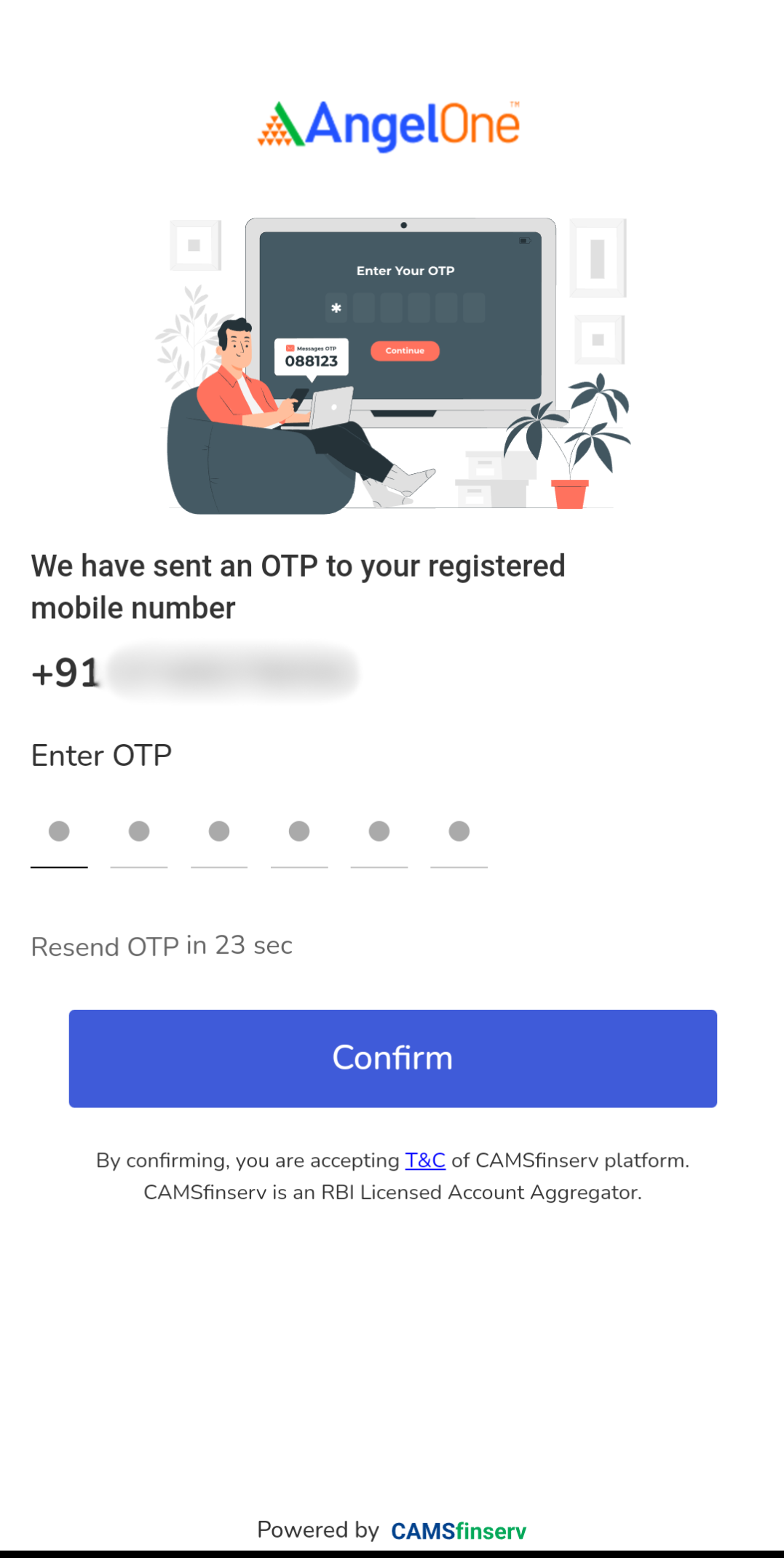

i) Enter the OTP sent by CAMSfinserv to your registered mobile number

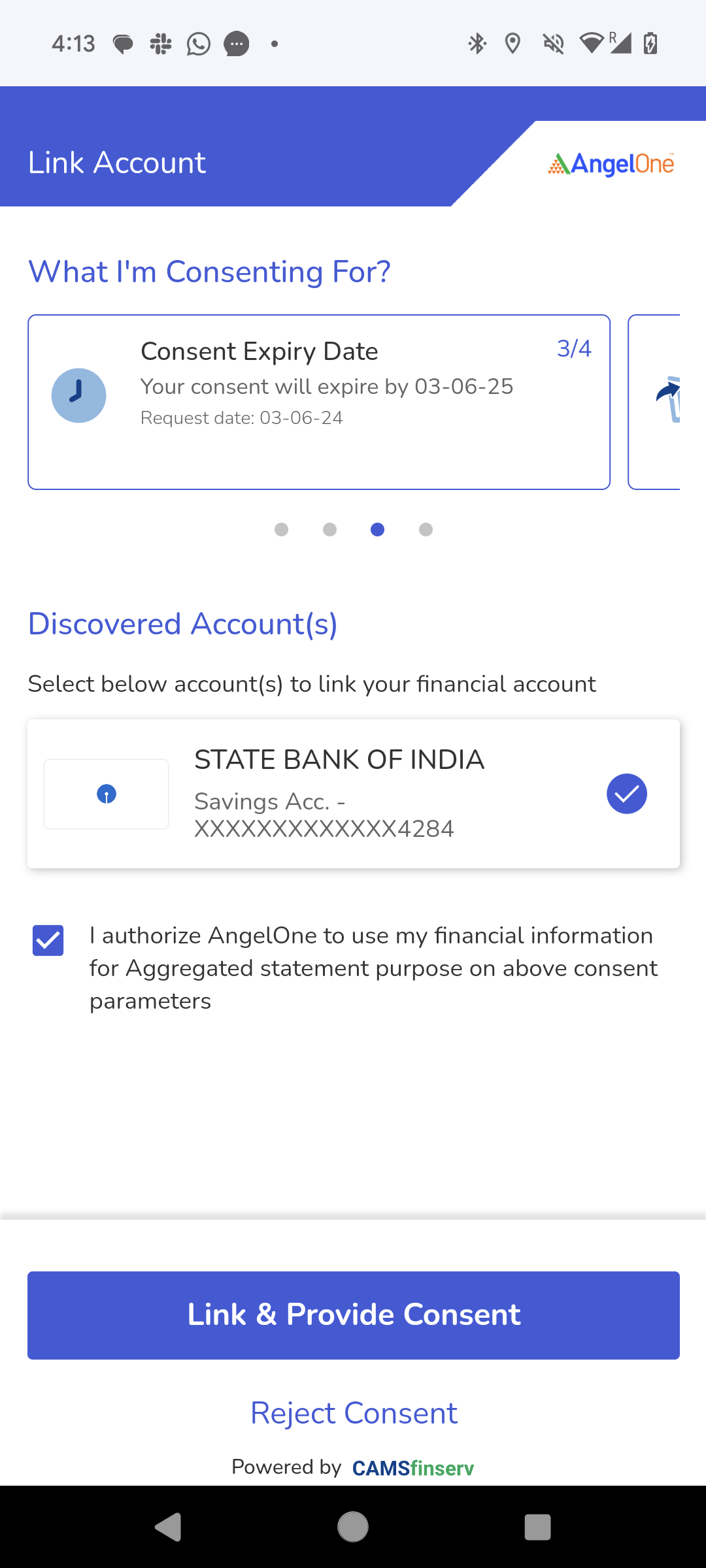

ii) Bank accounts linked with the mobile number will be fetched

- Select the bank account you want to use to provide last 6 months bank statement

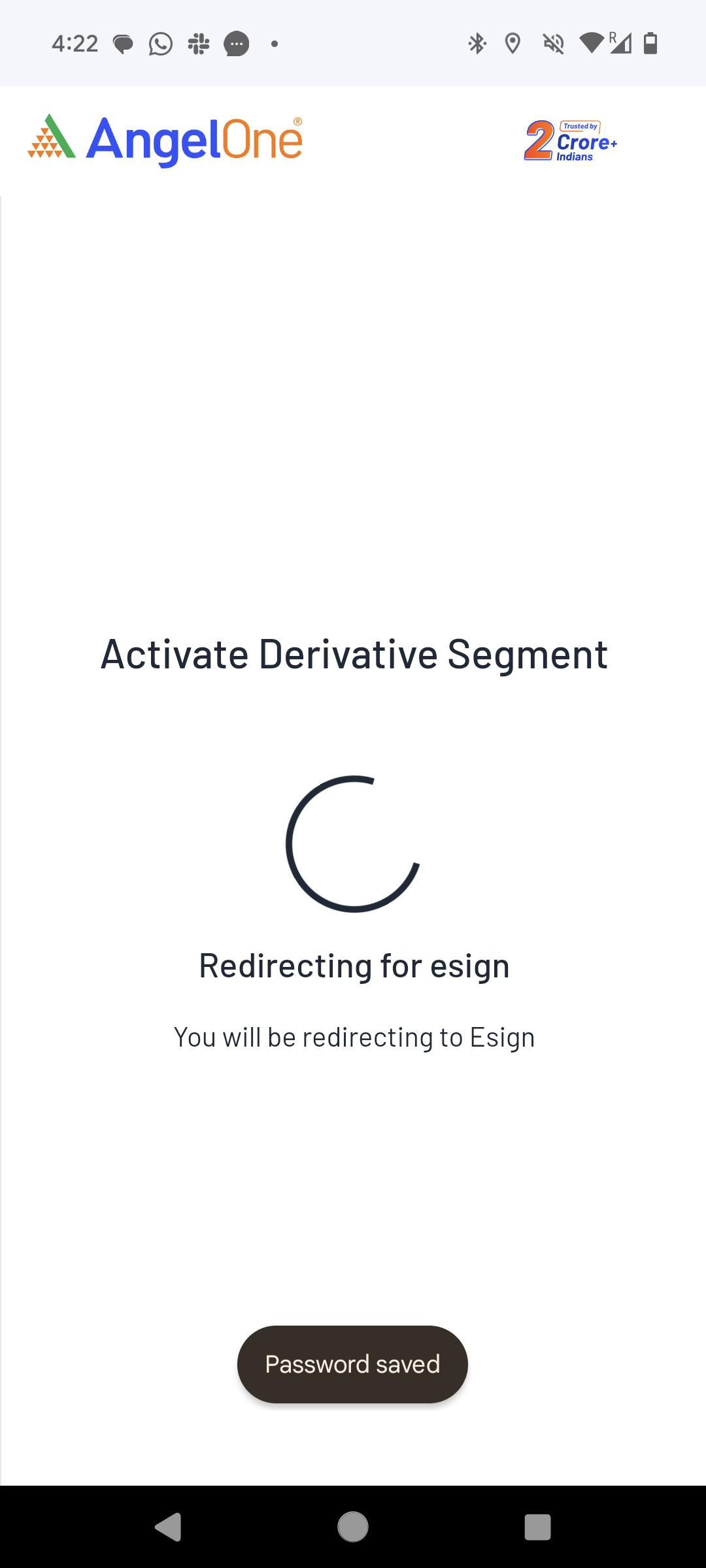

iii) User will be automatically redirected forthe e-signing

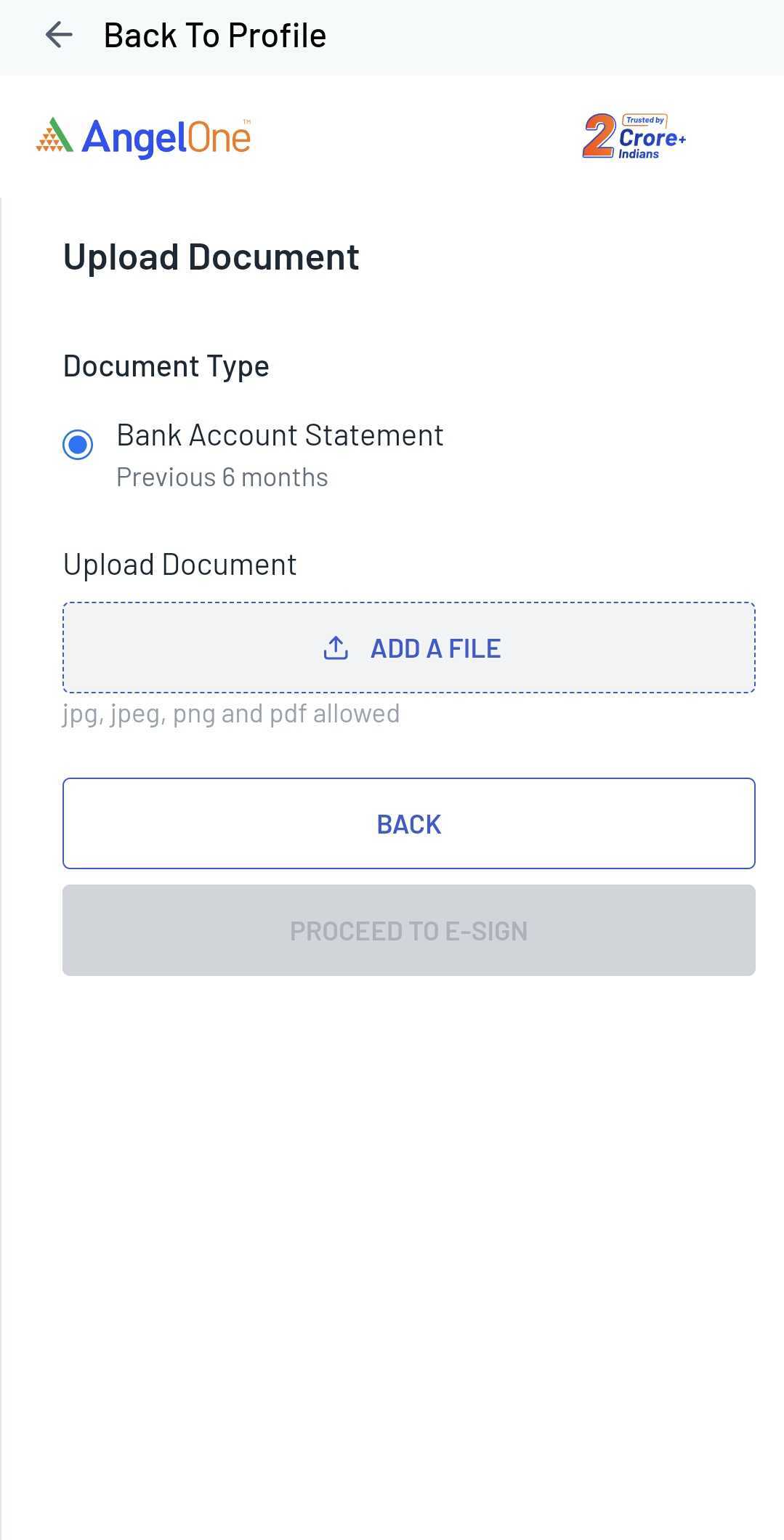

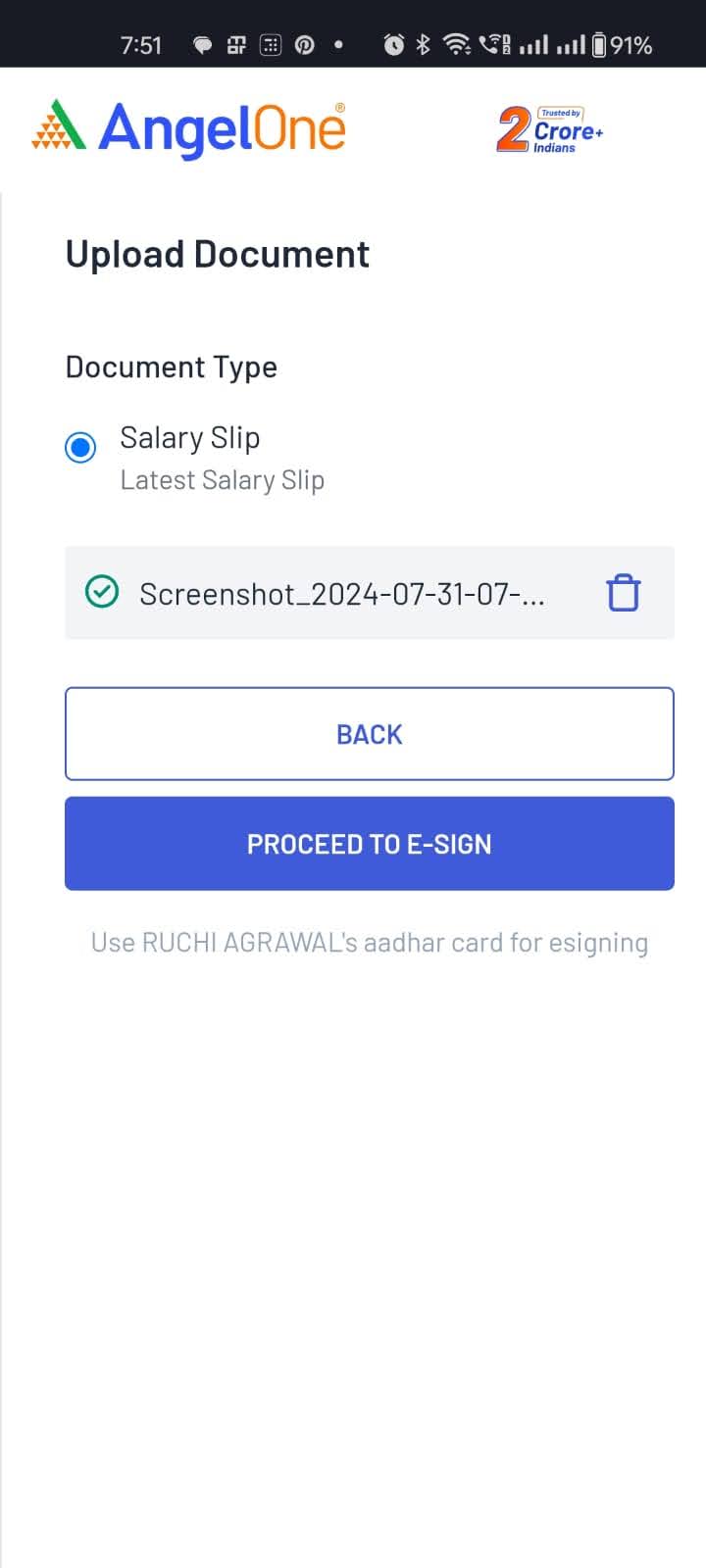

Step 4b: Manually upload documents

i) Select the document from the list you want to provide as the financial proof

ii) Click on “Add a file” box. Select the file you want to add from your device.

- If your document is password protected, you will be asked to provide document password in order to verify the document

- Once the file is uploaded, click on “Proceed to E-Sign” button

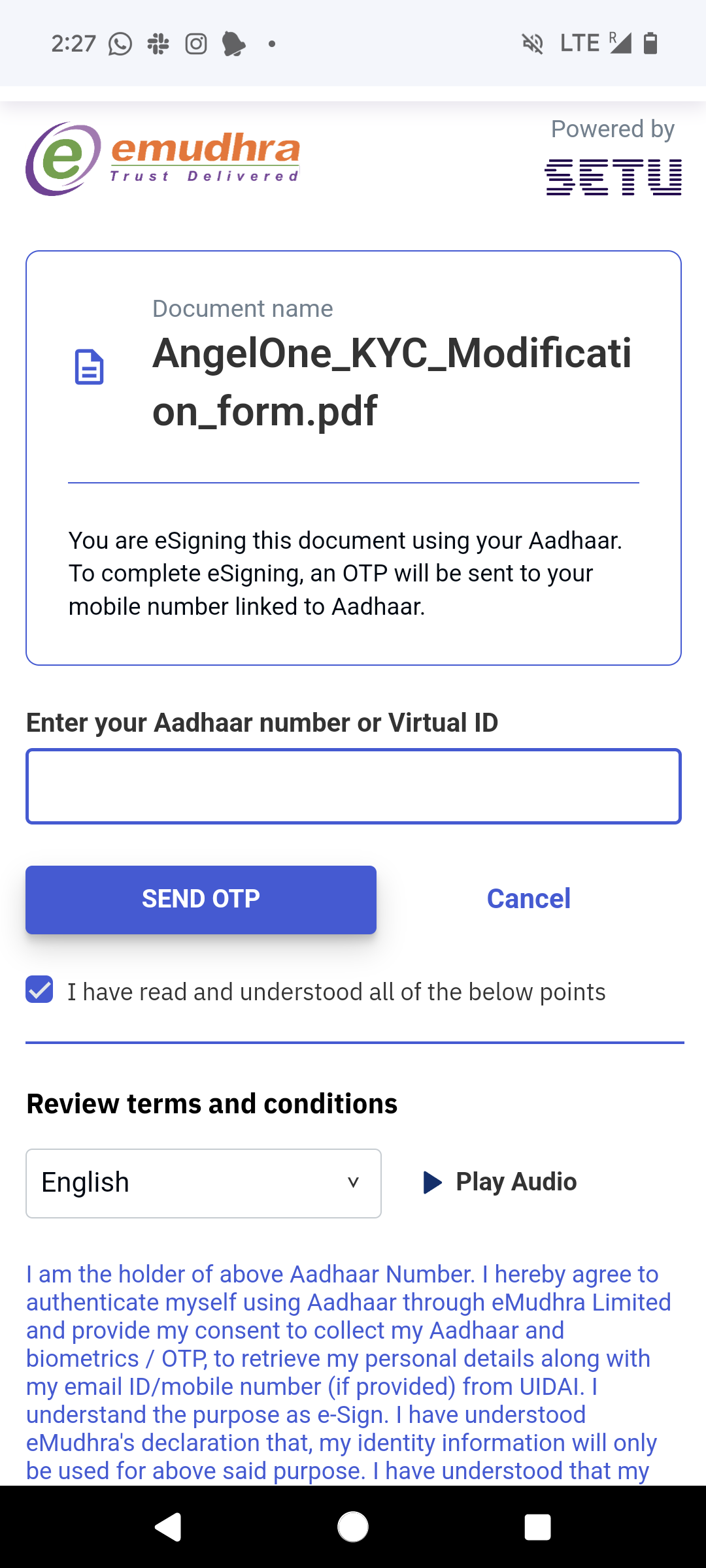

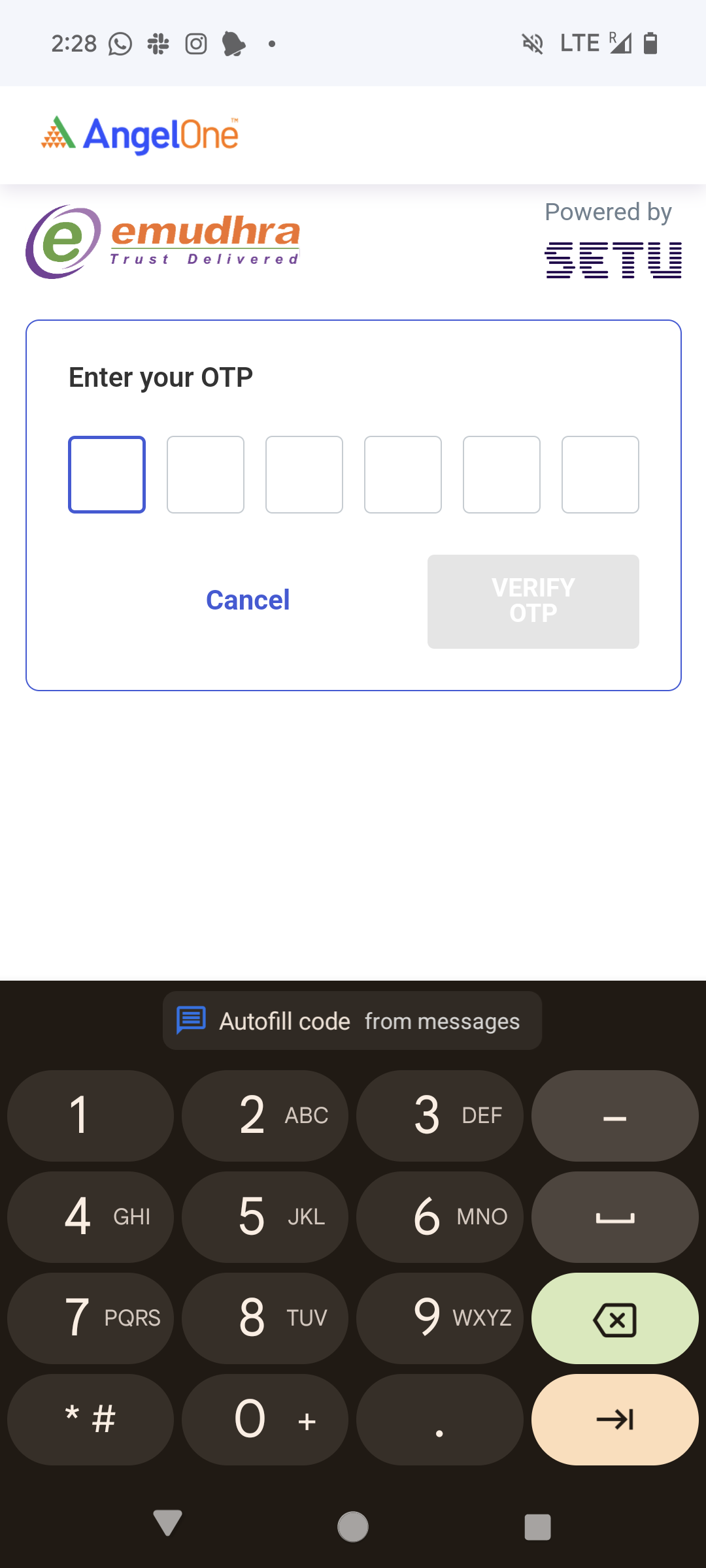

Step 5: You will be redirected for e-signing the request. Enter the Aadhar details & OTP sent from Adhaar on your mobile number

- Make sure to use your own Aadhar card for e-signing

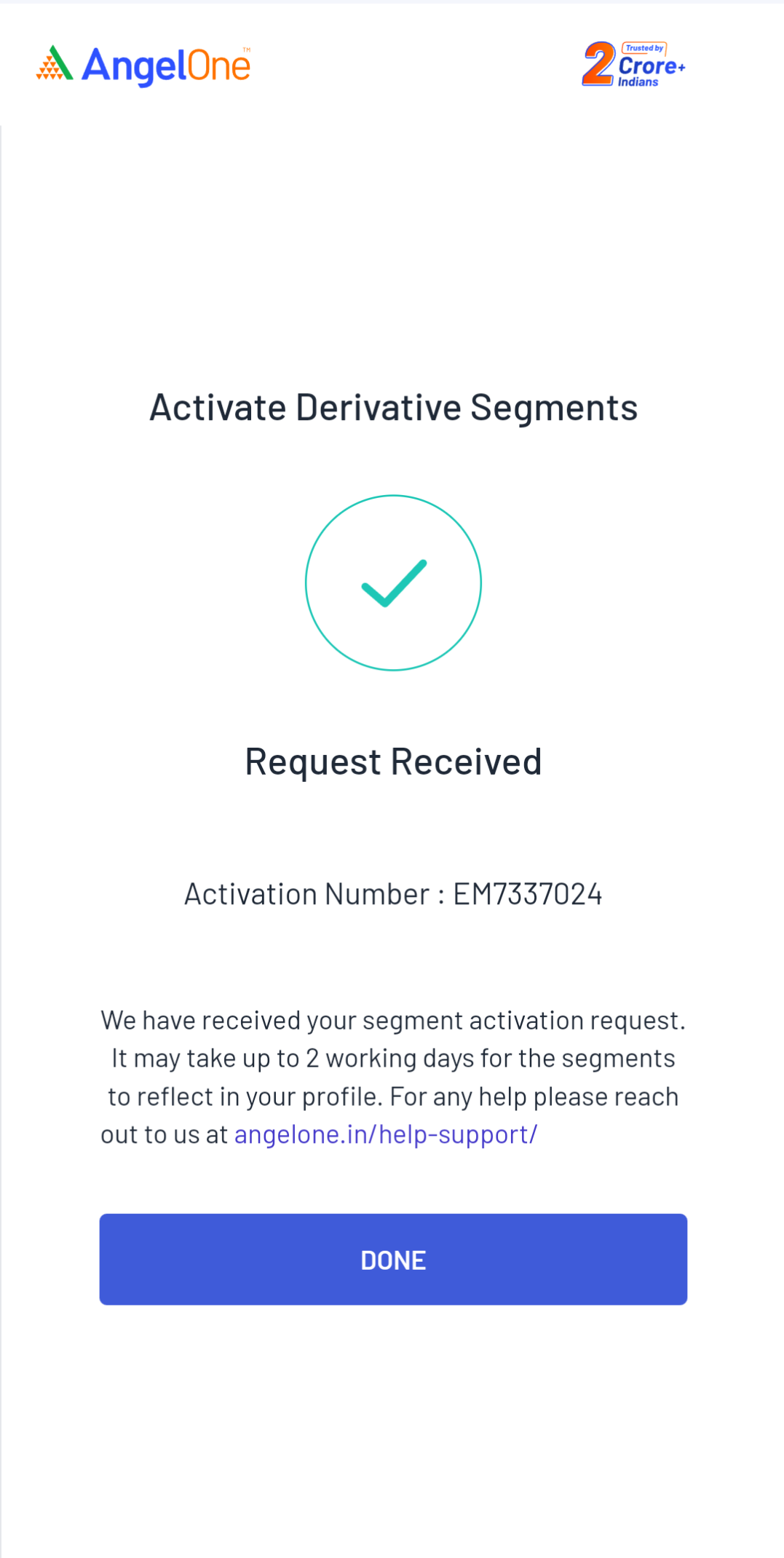

Step 6: The request will be processed in 2-3 working days.

Conclusion

Now that you know about the different categories of trading and investing in the stock market, activate all the segments you want to invest in. This segmented trading will help you in diversifying your portfolio and achieving your financial goals. Use Angel One mobile app to activate these segments and conveniently enhance your investment strategy.