What is NSE?

Established in 1992, the National Stock Exchange of India Limited (NSE) is the first dematerialised electronic exchange institution in the Indian stock market. NSE was the first modern, transparent, and fully automated platform, facilitating seamless electronic trading. It is one of India’s premier exchanges and ranks fourth globally in terms of the trading volume metrics.

The first stock exchange successfully integrated all the investors under a single roof supporting equity, derivatives, and debt instruments. This feat was possible since it was the first stock exchange in India, providing electronic trading facilities.

What is the benchmark index of the National Stock Exchange of India?

S&P CNX Nifty (Nifty 50) was introduced as the benchmark index of NSE in 1996. The CNX Nifty signifies the weighted average of the top 50 companies across 17 sectors.

With a base period of November 1995, NIFTY50 has a base value of 1000 and a base capital of Rs. 2.06 lakh crore (USD 27.28 billion). The stocks included in the NIFTY50 represent a significant portion of the NSE market capitalisation as they contribute to over 50 percent of stocks traded in the exchange in the last six months.

What is the trading process of the National Stock Exchange of India?

The trading process is based on market orders. Computer terminals match these orders, and there is no involvement of market makers. The investor directly places a market order and is allotted a unique trading number. The trading computer then matches it with a limit order instantaneously. Both the buyer and seller remain anonymous during the entire transaction.

If a match is not found, the order is added to a list. The order sequence is determined on price-time precedence. The exchange prioritises the order with the best price. If two orders are at par, then the one with the earlier timestamp is matched first in such cases.

Benefits of the trading process of the National Stock Exchange of India

- The order driven mechanism provides objectivity and invokes investor confidence in both buyers and sellers.

- The entire procedure being automated offers transparency and efficiency in executing trade transactions and processing settlements

- The volume of trading activity on the stock exchange incentivises buyers and sellers to participate, which results in higher liquidity.

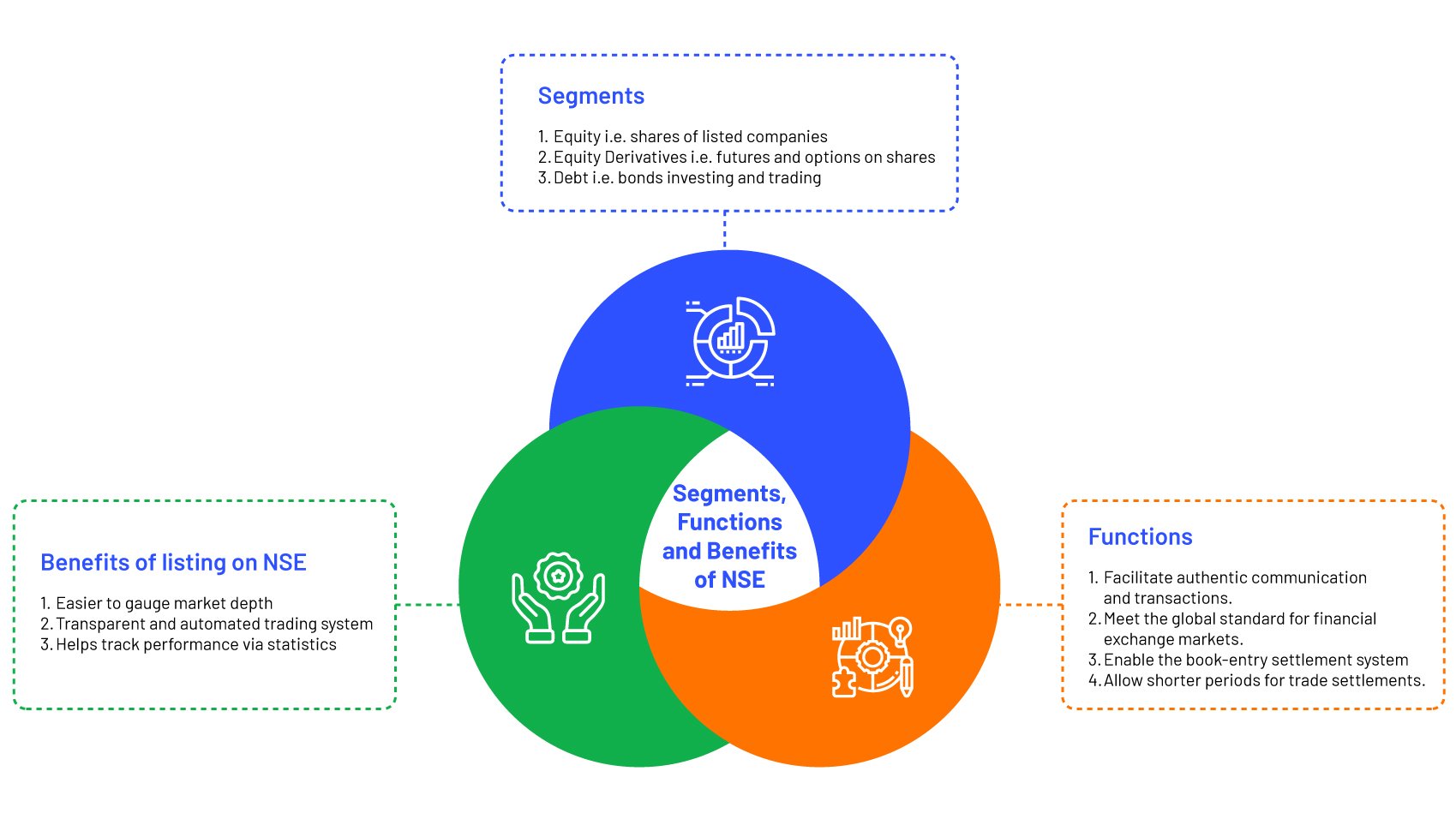

Functions of NSE

- To establish an accessible trading facility for investors across the nation dealing with debt, equity, and other asset classes.

- To act as an equal opportunity communication channel for all interested investors

- To establish a trading platform that meets the global standard for financial exchange markets.

- To enable the book-entry settlement system and allow shorter periods for trade settlements.

NSE Listing Benefits

Easy to gauge the market depth

There is a lot of trading and post-trading information provided on the platform. Moreover, you can also look up the top buyers and sellers effortlessly. The total number of securities available and the top buy and sell orders are visible for each transaction. Thus, NSE provides comprehensive visibility of the market depth.

Transparency

There is a large volume of trading activity bringing down the impact cost. Thus, the burden of trading expenses on investors is less. Also, the trading system is automated, which boosts visibility and transparency in trading.

Trade statistics

The listed companies are provided trading statistics each month. They are highly beneficial for tracking the performance and the market sentiments of the company.

Investment Segments

National Stock Exchange of India includes the following investment segments within its fold–

Equity

Such investments include equities, mutual funds, indices, and others.

Equity derivatives

Derivates trading on the NSE began with the launch of index futures in 2002. Subsequently, the Dow Jones Industrial Average and S&P 500 were launched in 2011 on this platform. With these methods, the exchange made remarkable traction in equity derivates trading.

Debt

The core asset holding in such investment comprises various short-term and long-term bonds, security products, and more.

The NSE launched India’s first debt platform on 13th May 2013. It aimed to provide investors with a digital, transparent, and liquid platform for all the debt-based instrument trading.

NSE Objectives

- To provide an all-encompassing platform for trading of securities, such as stocks, derivatives, etc.

- The NSE's second purpose is to provide equal access to the Indian stock market for all Indian and foreign investors.

- NSE aims to facilitate capital formation and economic growth by offering fair and accessible trading opportunities to investors.

- NSE meets the trading standards of global trading platforms.

- To ensure quicker and fairer settlement of trades through T+1 settlement cycle and book settlement

Features of NSE

- Advanced Technology: NSE is known for its cutting-edge technology infrastructure, providing high-speed and reliable trading platforms that support a wide range of financial instruments.

- Transparency: NSE emphasises transparency in its operations, ensuring that market data, price information, and trading activities are readily available to investors.

- Diverse Product Offerings: NSE offers a comprehensive array of financial products, including equities, derivatives (futures and options), currencies, and debt securities, catering to a broad spectrum of investor needs.

- Market Indices: The Nifty 50 and Nifty Bank are prominent market indices that reflect the performance of top companies listed on the exchange, serving as benchmarks for investors and fund managers.

- Robust Regulatory Framework: The exchange operates under the regulatory oversight of the Securities and Exchange Board of India (SEBI), ensuring compliance with market regulations and safeguarding investor interests.

- Liquidity and Efficiency: The exchange's large trading volumes and liquidity ensure efficient price discovery and execution of trades, reducing market volatility.

Advantages and Disadvantages of NSE

The National Stock Exchange (NSE) offers numerous advantages to investors and traders, fostering a positive environment marked by improved liquidity, transparency and accessibility.

The varied investment options on the NSE enable better risk management and portfolio diversification. The exchange stands out with advanced trading systems that equip traders with sophisticated decision-making tools. Nonetheless, obstacles like market volatility, regulatory limitations, and technological concerns continue. To effectively overcome these challenges, investors must stay educated, perform extensive research, and execute appropriate risk management measures.

Alternative investment channels like the Bombay Stock Exchange (BSE), commodity exchanges, mutual funds, and direct investments in real estate or startups offer supplementary diversification across various asset categories. This enriches investors' capacity to manage risks effectively and optimise returns.

Key Factors Affecting NSE

The National Stock Exchange is subject to various pivotal factors influencing its performance. Economic elements, both domestic and global, encompassing GDP growth, inflation rates, and interest rates, wield a substantial impact on overall market sentiment and trading activities. The realm of politics and regulations introduces a dynamic dimension, with policy reforms and government decisions carrying both positive and negative repercussions for the market.

Events specific to companies, such as earnings reports, mergers, and acquisitions, exert direct influence on individual stock prices, thereby shaping the broader market landscape. Moreover, the NSE's dynamics are significantly moulded by market sentiment and investor behaviour, propelled by factors like news, market trends, and overall investor sentiment.

Top Companies Listed on NSE by Market Capitalisation

| Company Name | Market Capitalisation in ₹ crore | Current Market Price ₹ | 5-year CAGR % |

| Reliance | 15,84,066 | 2,340 | 16 |

| TCS | 13,09,261 | 3,577 | 11 |

| HDFC Bank | 11,59,883 | 1,531 | 9 |

| ICICI Bank | 6,69,669 | 956 | 25 |

| Infosys | 6,11,890 | 1,474 | 15 |

| HUL | 5,81,759 | 2,476 | 9 |

| ITC | 5,51,838 | 443 | 9 |

| SBI | 5,30,211 | 594 | 18 |

| Bharti Airtel Ltd. | 5,31,591 | 910 | 23 |

| Bajaj Finance | 4,73,364 | 7,820 | 28 |

*All data as of September 25, 2023.

Major Indices in NSE

| Index | Price in ₹ |

| Nifty 100 | 19,606.85 |

| Nifty50 | 19,674.55 |

| Nifty Bank | 44,766.10 |

| Nifty Midcap 100 | 40,405.70 |

| Nifty Next 50 | 45,070.95 |

**All prices as of September 25, 2023.

- Nifty 100

The Nifty 100 comprises the top 100 companies listed on the National Stock Exchange (NSE) based on their market capitalisation. It is a diversified and comprehensive benchmark index that represents various sectors of the Indian economy. Nifty 100 includes large-cap companies, offering investors a broad view of the overall stock market performance. It tracks a combined portfolio of Nifty50 and Nifty Next 50 companies, representing approximately 76.8% of the free-float market capitalisation of the stocks listed in NSE.

This index is considered a reliable indicator of the Indian stock market's health and is often used by investors, fund managers, and analysts to assess the performance of India's most influential publicly traded companies.

2. Nifty 50

Nifty 50 is the flagship stock market index of the National Stock Exchange of India (NSE). It consists of the top 50 actively traded and well-established companies from various sectors of the Indian economy. The Nifty 50 serves as a key benchmark for the Indian stock market, reflecting its overall health and performance. It is widely used by investors, fund managers, and analysts to gauge the Indian equity market's trends and to make investment decisions. Nifty 50's diversified composition offers a snapshot of India's economic landscape and helps investors track the performance of its most influential publicly traded companies.

3. Nifty Bank

Nifty Bank comprises the top banking and financial sector companies listed on the National Stock Exchange (NSE). Nifty Bank is designed to reflect the performance of the banking industry, which is a critical sector in India's economy. It includes both public and private sector banks, making it a comprehensive gauge of the financial sector's health. Investors, traders, and analysts use Nifty Bank as a key indicator to assess the performance and trends within the banking and financial services segment of the Indian stock market.

4. Nifty Midcap 100

The Nifty Midcap 100 tracks the performance of the top 100 mid-cap companies in terms of market capitalisation listed in the NSE. Midcap companies have medium-sized market value, larger than small-cap stocks but smaller than large-cap stocks. Nifty Midcap 100 offers investors exposure to a diverse range of mid-sized companies across various sectors, making it a valuable benchmark to assess the performance and trends within this segment of the Indian stock market.

5. Nifty Next 50

Nifty Next 50, also known as Nifty Junior, is a broad market index that tracks the next 50 companies ranked after the top 50 companies in Nifty50. Nifty Next 50 represented about 10% of the total market capitalisation of companies listed on the NSE in 2019. Nifty Next 50 companies are considered potential candidates for inclusion in the Nifty 50 in the future. Nifty Next 50 provides investors with exposure to a diversified group of mid-cap stocks, offering a broader view of India's equity markets beyond the large-cap universe. It serves as a valuable benchmark for tracking the performance and trends in the mid-sized segment of India's stock market.

How Does the National Stock Exchange (NSE) Operate?

NSE operates through a fully automated screen-based trading system called the National Exchange for Automated Trading' (NEAT+). NSE follows an order-driven system instead of a quote-driven system, which means that when a trader places an order to buy or sell, the order is matched using an electronic trading platform. The system eliminates participation from specialists or market makers who can influence the price, making the system efficient and transparent even for small traders.

The NSE online trading system displays all buy and sell orders, leading to efficient price discovery and allowing investors to make informed decisions.

Conclusion

The National Stock Exchange is India’s leading stock exchange offering everything from exchange listings to trading services, clearing and settlement services, indices, and more.

If you are planning to trade on the National Stock Exchange of India or have any other queries related to it, feel free to reach out to us. We would love to guide you through the entire process.