If you have started reading about the stock market, you must have come across the term ‘market capitalisation’. It is a basic yet very important term to note for a stock market investor. Understanding market capitalisation is essential for any investor venturing into the stock market. It provides valuable insight into the size and valuation of a company, which eventually helps you in making informed investment decisions. In this article, learn about market capitalisation, its formula, importance, types, top 10 companies in India based on market capitalisation and more.

Market Capitalisation Meaning

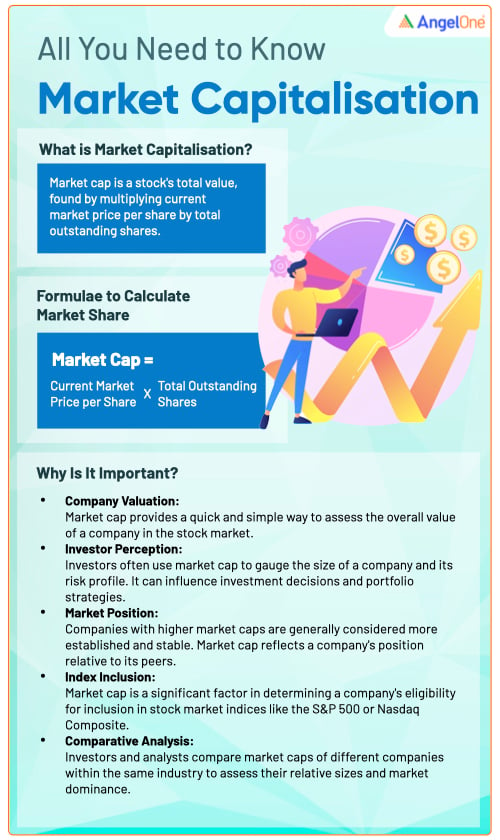

Market capitalisation, or market cap, measures the total value of a company in the stock market. It is calculated by multiplying the current share price of a company by the total number of outstanding shares. Market capitalisation represents the market's perception of a company's worth and indicates its size and significance in the financial markets. Companies with higher market capitalisation are generally considered larger and more established, while those with lower market capitalisation are often smaller or emerging companies.

What Is the Market Capitalisation Formula?

The formula to calculate the market capitalisation of a company is

Market capitalisation = Current Share Price x Total Number of Outstanding Shares

Where,

- • The current share price refers to the price at which the company's shares are currently trading in the stock market. This price keeps fluctuating throughout the trading day and is determined by the supply and demand for the stock.

- • The total number of outstanding shares means the total number of shares issued by the company that are available for trading in the stock market.

By multiplying these two parameters you get the market capitalisation of a company.

Let us consider an example to understand this better. Suppose the current price of a company is Rs. 50 and the total number of shares available for trading in the stock market is 100.

The market cap of the company = 50 * 100 = Rs. 5,000. The value of the company is Rs. 5,000. And this keeps changing according to the current price of the stock.

What Is the Importance of Market Capitalisation?

- • Company size: Market capitalisation indicates the size and scale of a company. It helps you understand the company's relative position in the market compared to its peers.

- • Investment categorisation: It is often used to categorise stocks into different segments, such as large-cap, mid-cap, and small-cap. These categories help investors assess the risk and potential returns associated with different investment options.

- • Market perception: Market capitalisation reflects the market's perception of a company's value. It is influenced by various factors, including financial performance, growth prospects, industry trends, and investor sentiment.

- • Index inclusion: Many stock market indices, such as the Nifty 50 and Sensex select companies for inclusion based on their market capitalisation. Being included in these indices can have significant implications for a company's visibility, liquidity, and investor interest.

- • Portfolio construction: Investors can choose to diversify their portfolios by including stocks from different market capitalisation segments, aiming to balance risk and potential returns based on their investment objectives.

Different Types of Companies Based on Market Cap

The companies can be classified into 3 categories based on their market capitalisation.

- Large-cap companies: Large-cap companies are those with a relatively high market capitalisation, from Rs. 20,000 crores and more. These companies have a significant market presence and are considered more stable and established. Large-cap stocks are known for their relatively lower volatility and are often favoured by conservative or long-term investors seeking stability and steady returns.

- Mid-cap companies: These companies have a market capitalisation ranging from Rs. 5,000 crores to Rs. 20,000 crores. The mid-cap companies are generally characterised by their potential for growth and may operate in emerging sectors. These stocks can offer a balance between stability and growth opportunities, attracting investors with a moderate risk appetite who seek higher growth potential than large-cap stocks.

- Small-cap companies: The market cap of small-cap companies is up to Rs. 5,000 crores. These are the companies often in their early stages of growth or exploring new business models. Small-cap stocks have the potential for significant growth, but they also carry higher risks and volatility. Investors who are willing to take on higher risk and seek higher returns often show interest in small-cap stocks.

Factors That Can Impact Market Cap

- • The right balance of demand and supply for a particular product or service provided by a company can impact its market cap.

- • Economic conditions, industry conditions, emerging markets, and disruptive technologies can drive investors’ sentiment impacting the market cap of a company.

- • The reputation of the company can impact the market cap of a company.

- • A company's competitive advantage, market share, and ability to outperform peers can contribute to a higher market cap.

Other Ways To Evaluate a Company’s Value

Apart from the market cap, there are other ways to evaluate the company’s value. Those are,

- • Equity value: It is calculated by considering the company’s assets. The assets considered here are the ones that belong to the common shareholders i.e. equity investors.

- • Enterprise value: In this, the value is calculated by considering the assets that are important for the company’s core business. Here all the shareholders, i.e., equities, debts, preference shares, etc., are considered.

Top 10 Companies in India Based on Market Capitalisation

Here is a list of the top 10 Indian companies' market cap:

| Name | Sub-Sector | Market Cap (Rs. in crore) |

| Reliance Industries Ltd | Oil & Gas - Refining & Marketing | 17,51,447.14 |

| Tata Consultancy Services Ltd | IT Services & Consulting | 12,10,725.21 |

| HDFC Bank Ltd | Private Banks | 9,66,373.11 |

| ICICI Bank Ltd | Private Banks | 6,60,973.57 |

| Hindustan Unilever Ltd | FMCG - Household Products | 6,34,389.64 |

| ITC Ltd | FMCG - Tobacco | 5,80,114.57 |

| Infosys Ltd | IT Services & Consulting | 5,56,625.80 |

| Housing Development Finance Corporation Ltd | Home Financing | 5,34,108.77 |

| State Bank of India | Public Banks | 5,25,882.76 |

| Bharti Airtel Ltd | Telecom Services | 5,00,937.52 |

Note: The data of the top 10 companies according to their market cap is as of 5th July 2023.

Conclusion

It's important to note that market capitalisation is just one factor to consider when evaluating a stock or making investment decisions. It should be analysed along with other fundamental and technical factors to gain a comprehensive understanding of a company's potential. Therefore do a thorough evaluation of the company before investing.

To start your investment journey, it is important to have a Demat Account. Open a Demat Account on Angel One for free.

Disclaimer: This article has been written for educational purposes only. The securities quoted are only examples and not recommendations.

Explore the Share Market Prices Today

| IRFC share price | Suzlon share price |

| IREDA share price | Tata Motors share price |

| Yes Bank share price | HDFC Bank share price |

| NHPC share price | RVNL share price |

| SBI share price | Tata Power share price |