As unfortunate as it may seem, unclaimed money or forgotten savings are very common. There are many reasons that people don’t claim their invested amount on time, some of the common reasons being - long investment tenures, having multiple accounts, outdated contact details, misplaced physical documents, being unaware of investments by parents/spouse, etc.

What happens to this unclaimed money? After a fixed number of years, if there is no claim on these funds they are then moved to various welfare and awareness funds. For instance:

- Unclaimed money from bank fixed deposits is moved to the Depositor Education and Awareness Fund (DEAF),

- Unclaimed insurance, PPF, and EPF money is moved to the Senior Citizen’s Welfare Fund (SCWF), and

- Unclaimed money from mutual funds is transferred to the Investor Education and Protection Fund (IEPF).

Since Bank fixed deposits, insurance policies, PPF, EPF, and mutual funds, are some of the most popular saving and investment schemes in India, let us learn about how we can get back any unclaimed money from these institutions.

Bank Deposits

Unclaimed deposits are funds that have remained inoperative or dormant for more than 10 years.

How to find if you have any Unclaimed Money

As per RBI regulations, every bank is required to publish details of unclaimed deposits on its website. Hence you can check the respective bank’s website for the same.

How to claim your money

You need to visit the branch where you have the account with the following documents:

- Self-attested copy of your ID proof along with the original

- Self-attested copy of your latest address proof along with the original.

- Details of account number/deposit that are in your name and are included in the list above, along with a copy of the passbook/deposit receipt.

- A letter requesting to re-activate your account.

In the event that the original account holder has expired, and you are the legal heir or nominee, you will need the deposit receipts, identity proof, a copy of the death certificate of the account holder, and a legal heir proof or succession certificate when you visit the branch.

Insurance Policies

Every responsible investor begins their financial plan with a life insurance policy so that in the unfortunate event of his death, his dependents can be taken care of financially. Hence, it is assumed that a policyholder would tell his family/beneficiary when he buys an insurance plan. Yet, the maturity proceeds of millions of policies are lying unclaimed with insurance companies, completely unknown to the people for whom this protection was bought.

How to find if you have any Unclaimed Money

It is mandatory for insurance companies to display details of unclaimed amounts on their websites if the amount exceeds ₹1,000. You can log on to your insurance company’s website and enter details such as policy number, PAN of the policyholder, name and date of birth of the policyholder to know the unclaimed amounts with the company.

How to claim your money

- Contact customer care or visit the nearest office of the insurance company.

- Submit the policy details and necessary documents and complete your KYC.

- Once your identity has been validated as the beneficiary of the policy, the unclaimed amounts shall be credited to your account.

Mutual Funds

Since open-ended mutual funds don’t have any maturity date, technically, a mutual fund can never ever become dormant. However, when an investor fails to encash a redemption or dividend cheque before it becomes invalid, the amount is categorized as unclaimed. This could happen due to various reasons, such as name mismatch in a bank account, not depositing the cheque within time, or change in address of the investor, etc.

How to find if you have any Unclaimed Money

You can check for unclaimed dividends by simply entering your folio number on the mutual fund’s website. You can also visit the website of the registrar (CAMS or KFintech) to check for the same.

How to claim your money

Contact your Mutual Fund house either via email or in-person and submit a duly filled ‘Unclaimed Redemption/ Dividend Claim Form’ along with updated bank details.

EPF

Previously, PF accounts were not portable. Hence, employees would usually open a new account when changing jobs. This resulted in most people having multiple PF accounts. Over time most of these accounts were forgotten.

How to claim your money

- Visit the Help Section of the EPFO website and raise a query via their Tollfree Number or Email support

- In case the primary holder has died:

- His nominees will get the money in the percentage specified by him. However, there is a time limit here. A nominee or EPFO member can apply within 25 years of the amount going into the Senior Citizen Welfare Fund.

- If there is no nominee, the legal heir must provide a succession certificate.

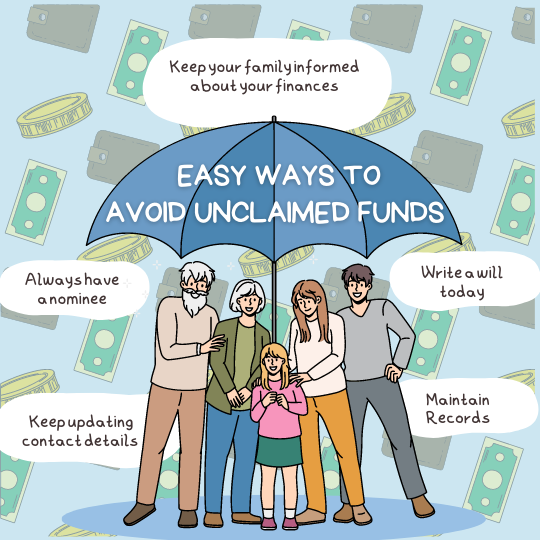

Considering the hassle that is involved in getting your unclaimed funds back, and the risk of losing out on your savings, it would be ideal to avoid placing yourself or your dependents in such a situation to begin with. Here are some helpful points on how you can avoid unclaimed investments.

Learn Free Stock Market Course Online at Smart Money with Angel One.