How to Analyze Companies Playing Financial Numbers (Expenses Side) – Part 2

In the first blog of the series covering ‘How to find out companies playing with financial numbers’, we had categorically mentioned that there are companies tweaking the numbers and accounting policies to showcase higher profits. We had given two Examples where numbers were not posted in P&L statements and were capitalized as fixed assets over a period. A few companies would have posted losses if the actual treatment was given according to accounting standards. While we have given examples of lowering expenses, there are other ways as well where the companies show such expenses in P&L but then nullify the expenses through further accounting entries.

Nullifying the Expenses from P&L

One would be wondering how any expense if shown in the P&L would not impact the profitability. However the world of accounting is really amazing, and hence needs to be scrutinized with a close eye. In simple terms what happens is, the companies show a particular expense in the P&L but simultaneously show a transfer entry shifting an amount from the reserves to the P&L, which is usually exactly equal to the mentioned expense. The net result is that the transfer from the reserves overcomes the impact of reduction by the expense. This may look complicated as we read it. But as given certain examples it looks a bit simpler. As a result, the profit of the company remains unaffected as if the expense simply did not happen.

Let’s see a few of such examples where the expenses were shown in the P&L but then similar effects are given in the reserve and surplus.

Example 1

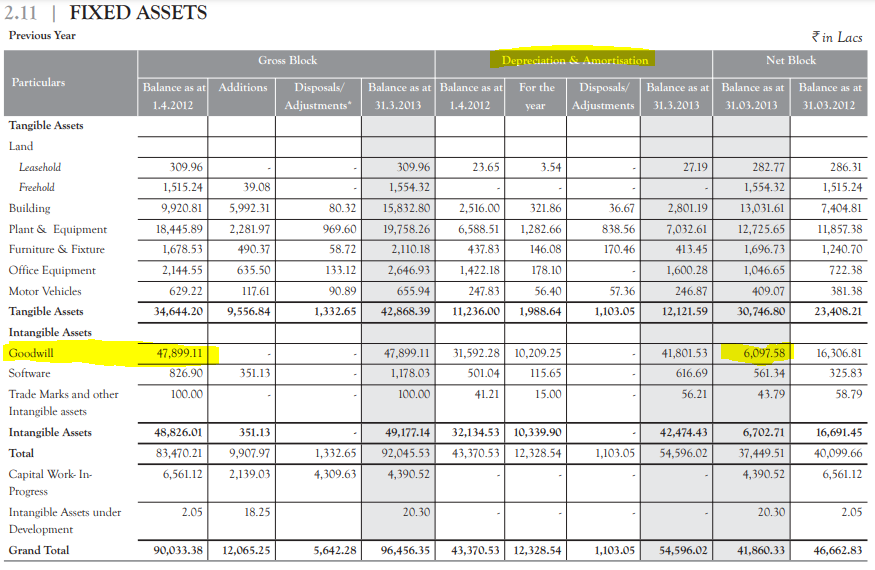

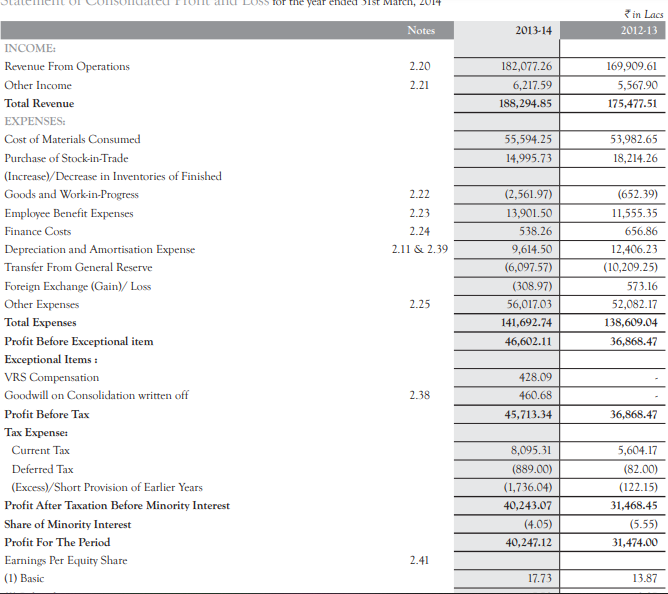

There is one FMCG company in India which is also engaged in the manufacturing of Personal & Cosmetic under different bands. The company usually known for its prudence accounting policies had made such one arrangement. While analyzing the annual reports of the company, an investor notices that from FY2013 to FY2014, the net intangible assets decreased from Rs 67 crore to Rs 7.78 crore. This was primarily due to the decline in goodwill by Rs 60.97 crore.

The decline in goodwill is a regular amortization charge by which the company has been decreasing its gross goodwill of Rs 478.99 crore over the years. In the previous years, it has been amortizing the goodwill at about Rs 100-102 Crore per annum.

The amortization of goodwill in the normal course of business and accounting is an expense in the profit and loss statement just like depreciation expense for tangible assets. As a result, the profit of any company declines accordingly on the amortization of goodwill.

However, one important thing that an investor would notice while analyzing the amortization of goodwill by the company is that it is transferring an amount equal to the yearly goodwill amortization from its general reserve to profit & loss statement every year. This entry nullifies the impact of goodwill amortization on its profits. Eventually if it does not impact the overall cash position of the company.

Extract from the Annual Report

If the company was not following this practice of transferring amounts from general reserve to profit & loss statement, then its profit before tax (PBT) would have been lower by an equal amount every year. Though the company had disclosed this practice in its significant accounting policies, the investors usually forget to adjust the financial performance.

Another factor is, in the normal course of business, it might amount to overstating of profits, however, as explained by the company in the Annual Report, it is doing the same as per the scheme of the arrangement, which we assume that would have been approved by any competent authority (in most cases a court of law) that would have allowed the company to adjust goodwill amortization directly against its reserves without impacting profit & loss statement.

Example 2

There is one textile player, which has a significant share in the home textile segment. It has got a significant share in the USA retail markets.

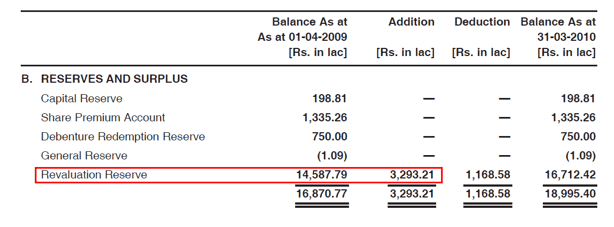

While analyzing the annual reports of the, an investor comes across an interesting case of revaluation of assets by the company. In FY2016 annual report the company had done revaluation of its assets in 2008 and 2009:

We all know that the assets are depreciated over the life of assets. It impacts the profits of the company as depreciation is a non cash expense. However not All assets are available at the cost they were bought a Few years earlier. Just imagine a land or a property purchased years ago – now is surely enjoying a better price. Rather as compared to the cost of acquisition shown in the annual reports of the company. And hence on a periodic basis revaluation of such assets is needed. Eventually this results in showing the right book value.

The practice hold true for assets where the value appreciates, However, what is surprising in the revaluation done by company is that they have revalued assets like building, plant & machinery, diesel generator (DG) sets as well and valued them at a higher valuation than acquisition cost despite using them for their operation for some time.

While the land and building may witness appreciation but then plant and machinery result in wear and tear. Eventually this results in depreciating value over the years. Where on the earth we have seen that the companies selling the old plant and machinery at higher than the original purchase cost. Therefore, an investor should analyze further to understand the peculiar nature of mentioned diesel generator sets, plant & machinery and the building that they are increasing in value with usage over time.

By analyzing the FY2010 annual report, the investor would notice that the company has revalued its above-mentioned assets by about Rs 178.7 Crore.

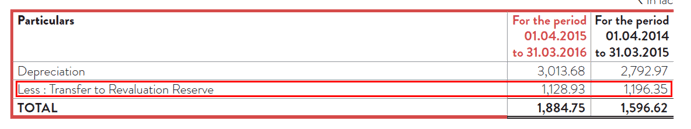

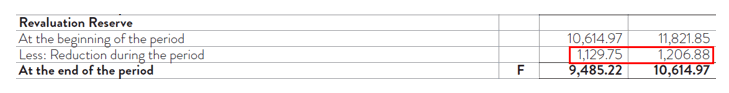

In simple terms the company was eventually showing higher profits. The investor would understand the importance of analysis of the extent of revaluation reserve when that person notices that the company has been reducing its depreciation expense every year by adjusting a part of the revaluation reserve against it in the P&L statement, which was eventually leading to lower depreciation expense and thereby higher profits.

A look at the notes to the accounts under the depreciation section of the FY2016 annual report would indicate that the company has used about Rs 11 crore in the FY2016 and Rs 12 crore in FY2015 respectively from the revaluation reserve and reduced its depreciation expense by the same amount. The net impact of the above transaction is that in FY2015 the profit before tax (PBT) becomes higher by about Rs 12 crore and in FY2016, the PBT becomes higher by about Rs 11 Crore when compared to a scenario when the company would not have revalued its diesel generator sets, plant & machinery and building and such revaluation reserve would not have been there.

The analysis of revaluation reserves section of the FY2016 annual report indicates that by FY2016, the company has already utilized about Rs 84 Crore worth of revaluation reserve and about Rs 94 Crore worth of revaluation reserve still remains to be adjusted, which would be adjusted in coming years. So playing with numbers results in inflated profits over the years. Unless analyzed with a detailed eye, such tweaks are not possible to be cached.

Therefore, an investor would appreciate that while analyzing companies, she should read every line of the disclosures in the financial statements, so that Investor is able to identify cases where companies attempt to show higher profits using such conventions.

Learn Free Stock Market Course Online at Smart Money with Angel One.