When it comes to investing in the stock market, understanding the balance between risk and return is very important. Investors always want to know how much profit they can expect from their investments and what level of risk they are taking.

The Capital Asset Pricing Model (CAPM) is a popular tool that helps explain this relationship. It provides a clear formula to estimate expected returns based on how risky an investment is compared to the overall market. In this article, we will explore what CAPM is, how it works, and why it remains useful for investors despite some criticisms.

What Is the Capital Asset Pricing Model?

CAPM, describes the link between expected returns on one’s assets and systematic risk associated with them, with a focus on stocks in particular. Throughout finance, CAPM is regularly used to price risky securities while generating the expected returns for any assets while keeping in mind the cost of capital and the risk of those assets.

Understanding the CAPM formula

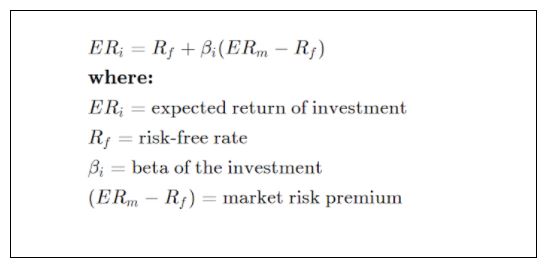

To understand the CAPM model better, let’s take a look at the CAPM formula. See the image below to better understand what the CAPM formula looks like.

As per this formula, investors are looking to be compensated for the time value of money as well as the risk associated with investing. The time value of money is accounted for by the risk-free rate symbol part of the CAPM formula. The investor taking on any additional risk is accounted for by the other components of the CAPM formula.

When it comes to the amount of risk a particular investment will add to a portfolio that looks like the stock market, this is accounted for by the ‘beta’ in the CAPM formula. When a stock is riskier than the market, its beta will exceed one. When a stock is assumed to reduce the amount of risk in a portfolio, its beta will be less than one. This number is multiplied by the market risk premium. This is the return expected from the market above the risk-free rate.

Then the beta of the stock, the market risk premium, and the risk-free rate are all added up. The final result of this formula should provide the investor with the required return they can use to estimate the value of an asset. Alternatively, it can also give the investor the discount rate needed to find this value. Hence, the goal of the CAPM formula is to help an investor evaluate how fairly valued a certain stock is. Specifically, it can show how well its risk and time value of money are compared to the expected return one can see on it.

As an example, suppose that an investor is contemplating buying a stock that is currently worth ₹100 which pays a yearly dividend of 3%. From the beta of the stock, we can see whether it is riskier than a market portfolio or not. Let’s assume the beta of this stock is 1.3, making it a risky choice for the market portfolio. Now say, the investor expects to see a rise in value by about 8% with a risk-free rate of 3%.

The CAPM will help calculate the expected return seen of the stock as follows:

3% + 1.3 times ( 8% — 3% ) = 9.5%

This final result is the expected return on the stock which can further be used to discount one’s capital appreciation and expected dividends on the same stock over one’s anticipated holding period. In case the discounted value of future cash flows from the stock equals to ₹100, CAPM has helped indicate that the stock is valued fairly relative to any risk associated with it.

Role of Beta in CAPM

The ‘beta’ in CAPM plays a key role in determining how much risk a specific stock adds to an overall portfolio. A beta greater than one signals that the stock is more volatile than the market, while a beta less than one suggests it is more stable.

This helps investors understand whether adding the stock to their portfolio will increase or reduce overall market risk. By using beta, CAPM adjusts expected returns based on how much systematic risk the investor is willing to accept.

How does CAPM Benefit Investors?

- Helps estimate expected returns based on measurable risk

- Supports better investment decisions by showing the link between risk and return

- Allows easy comparison between different stocks and assets using a standard method

- Aids in building balanced portfolios and managing risk effectively

- Considers both the risk-free rate and market performance to judge if an asset is fairly priced

Drawbacks of CAPM

- Relies on assumptions that may not match real-world market behaviour

- Assumes securities markets are efficient and competitive, where all investors get the same information quickly, which is often not the case

- Assumes investors are always rational and risk-averse, while markets can be influenced by emotion or sentiment

- Market reactions to company changes can be delayed or unpredictable

- Uses volatility to measure risk, even though price movements in both directions are not equally risky

- Risks and returns on a stock are not always evenly spread

- Despite its flaws, CAPM is still commonly used because it is simple and helps compare investment options easily

Criticisms of the CAPM model

As with most stock market predictors, the capital asset pricing model is not perfect. Several of its assumptions haven’t been shown to not hold in reality. The modern-day financial theory relies on many systematic assumptions. The first is that securities markets are highly efficient and competitive. This assumption further signifies that investors assume that any relevant information about a company is distributed and absorbed equally and quickly by everybody.

The second assumption is that markets are primarily made up of risk-averse and rational investors who operate with the goal of maximising satisfaction from the returns on their investments. Both these assumptions are inaccurate. Markets can be slow to catch on to company announcements and changes in corporate structure that affect stocks. Markets can also be populated with sentiment-oriented investors which is often seen during periods of volatility.

A third assumption is that a stock's risk can be measured solely by its volatility in price. However, any price movements that go in either direction are not evenly risky. In fact, both the risks and returns on a stock are not equally distributed. Yet, despite these criticisms regarding assumptions, the CAPM model is still widely utilised as it is simple and helps easily comparing one’s investment alternatives.

Conclusion

The CAPM is a widely used financial tool that helps investors understand the link between risk and expected returns. By using factors like the risk-free rate, market returns, and beta, CAPM provides a simple way to estimate how much an investment should earn.

While the model has its limitations and relies on certain assumptions, it is still helpful for comparing different investment options and making more informed decisions. Understanding CAPM allows investors to better manage their portfolios and judge whether a stock is fairly priced for the risk it carries.

Learn Free Stock Market Course Online at Smart Money with Angel One.

Explore the Share Market Prices Today

| IRFC share price | Suzlon share price |

| IREDA share price | Tata Motors share price |

| Yes Bank share price | HDFC Bank share price |

| NHPC share price | RVNL share price |

| SBI share price | Tata Power share price |