The National Savings Certificate scheme is readily available at all Indian post offices and enjoys the backing of the central government. Its core objective is to encourage small and medium-scale savings while also providing tax benefits. Delve into this article to gain a comprehensive understanding of this investment scheme.

Who Should Invest in NSC?

For those seeking a secure investment, the National Savings Certificate is an attractive choice. It offers stable interest earnings along with tax savings, although it doesn’t promise high returns due to its fixed-income nature. NSC is primarily designed for individuals. It is not open to trusts, Hindu Undivided Families, NRIs, or private and public limited companies. Key eligibility criteria include being an Indian citizen, no age restrictions, and the ability for adults to purchase NSC on behalf of minors or jointly with another individual.

Advantages of NSC

Let’s explore some key advantages of NSC:

- Steady Interest Rate: NSC offers a fixed annual interest rate, currently at 6.8%, ensuring a dependable income source.

- Maturity Period: NSC has a 5-year maturity period since the discontinuation of the 10-year option.

- Accessibility: Easily purchase, transfer, or switch NSC between individuals or post offices without affecting maturity or interest.

- Flexible Investment: Invest as little as ₹100, with no upper limit, providing investment flexibility.

- Tax Savings: NSC qualifies for tax deductions of up to ₹1.5 lakhs annually, offering tax benefits.

- Compounding: Interest compounds annually but is paid only at maturity.

- Premature Withdrawal: Possible in case of the investor’s death or a court order.

- Maturity Payout: Receive the entire corpus on maturity, with no TDS; tax is payable during ITR filing or in advance.

- Loan Facility: Accepted as collateral for loans from banks and NBFCs.

- Nomination Option: Allows nomination of a family member, including minors, to inherit the NSC in the event of the investor’s demise.

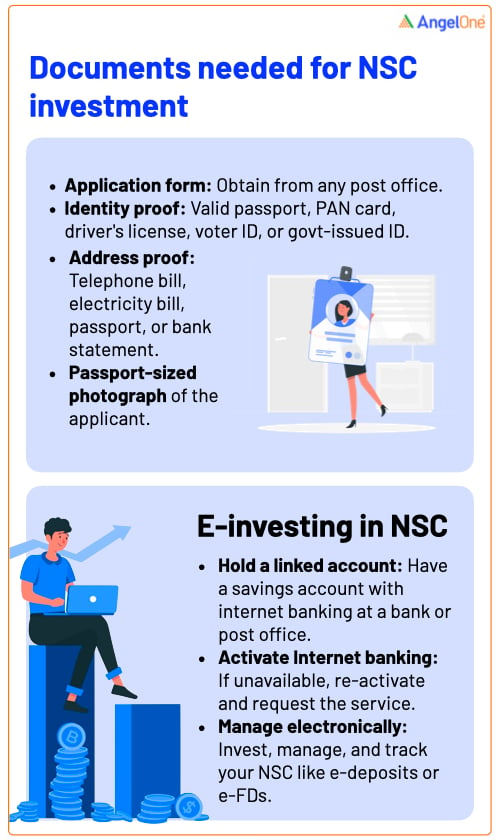

Documents Required to NSC

To invest in the NSC scheme, you should have the following documents ready:

To invest in the NSC scheme, you should have the following documents ready:

- The National Savings Certificate application form.

- Proof of identity, such as passports, PAN cards, driver’s licence, voter ID, or any government-issued ID.

- Proof of residence, like a telephone bill, electricity bill, passport, or bank statement.

- A passport-sized photograph of the applicant.

How to Invest in NSC through electronic mode?

Individuals holding a bank or post office account can opt for electronic investment in the NSC scheme. To do so, you must have internet banking enabled for your savings account. If your savings account lacks this feature, you can reactivate it and request internet banking. This will allow you to conveniently manage your National Savings Certificate electronically, similar to e-recurring deposits or e-FD.

Investing Through Passbook Mode

If you prefer not to use the online method, you can invest in the National Savings Certificate using the passbook mode. Similar to a bank passbook, all transactions are recorded in the NSC passbook, which can be done manually or electronically. The passbook includes the physical signature of authorised individuals. If you decide to switch to electronic mode, the passbook pages will be cancelled, and the passbook itself will be collected and disposed of by officials. The post office or bank branch will also handle your passbook receipts. If you happen to lose your physical NSC, you will receive a pre-printed NSC or a passbook with your old National Savings Certificate number mentioned on it.

Tax Benefits for NSC investment

Investments in NSC at post offices up to ₹1.5 lakh offer a tax rebate. The interest earned is reinvested into the principal amount, ensuring eligibility for the tax benefit. For instance, when you buy ₹1,000 in NSC you can claim a tax rebate on the initial investment in the first year. In the second year, you can claim tax on the NSC investment of that year, along with the interest earned in the first year, due to annual compounding. Both salaried individuals and businessmen eligible for income tax assessment can access NSC tax benefits. The interest from NSC can be categorised as “income from other sources,” and to calculate the taxable amount, you can use an NSC tax calculator.

Premature Withdrawal and Maturity Period Under the NSC

Premature withdrawal from NSC is allowed under the following circumstances:

- In the event of the certificate holder’s death.

- When the certificate is forfeited, however, the pledgee must be a Gazetted Government Officer.

- When a court of law has ruled that the invested amount can be withdrawn.

Regardless of whether the withdrawal occurs before or after the maturity period, you must provide the following documents:

- The original NSC document.

- The NSC encashment form.

- Proof of identity, such as Voter ID, driver’s licence, passport, or equivalent.

- If the NSC was purchased on behalf of a minor, attestation by the guardian is mandatory.

- In the case of the certificate holder’s demise, the nominee can encash the investment by submitting Annexure 1 and Annexure 2 forms.

If a withdrawal occurs within a year of the investment, no interest will be paid, and a penalty fee is imposed for early withdrawals. The maturity amount is disbursed via a check.

Comparing NSC with Other Tax-Saving Investments

Here are key details about various tax-saving investment options as compared to NSC: Public Provident Fund (PPF): Sponsored by the Indian government under section 80C, PPF has a 15-year lock-in period. The interest rate is fixed and tax-free, allowing investments of up to ₹1.5 lakh annually. Fixed Deposits: With a 5-year maturity period, they’re eligible for tax exemptions under section 80C but have taxable interest. Early withdrawals negate tax benefits. Equity Linked Savings Scheme (ELSS): Popular for tax savings and potential returns, ELSS invests primarily in equity securities, offering high returns. It has a 3-year lock-in period, with tax advantages including capital gains below ₹1 lakh and tax-free principal investments below ₹1.5 lakh. National Pension Scheme (NPS): A systematic retirement investment with a deduction of up to ₹1.5 lakh on principal. Salaried individuals can contribute up to 10% of their salary (section 80CCD), while self-employed individuals can claim an additional ₹50,000 benefit (section 80CCD 1B). NPS allows partial reinvestment in equity schemes based on investor discretion.

Conclusion

All in all, the National Savings Certificate serves as a tax-efficient, low-risk investment option with fixed returns. It provides a secure avenue for small to medium-scale savings and tax benefits for Indian investors.