Introduction

Fueled by the recent events that took place during the scandal at Karvy stock broking, a number of underlying issues, ones specifically pertaining to trading accounts, have come to light. Since this is not the first time that trading accounts have been misused by those with malicious intent, the indian government has long been striving to further tighten rules and guidelines relating to trading accounts in order to prevent such mishaps and misuse from taking place. In this article, let’s take a look at what exactly your trading account is, what its uses are and more importantly, how you can reactivate your trading account in the time of your need.

The Difference Between a Demat Account and Trading Account

Chances are, that if you have opened a Demat account through a digital Depository Participant (DP) such as a discount or full-service broker, that you probably have never had to have been aware of the distinction between a Demat account and a trading account. Understanding this differentiation is key to assessing if and why you would want to have a trading account in the first place, or why you would look into how to activate trading accounts.

While a Demat account is responsible for holding the equity you purchase, a trading account is what facilitates your interaction with the stock market: the place where you purchase and sell stocks. One could perceive a Demat account to be akin to a wallet, while the trading account is your slip to access the counter to make your payment. Known more commonly as a ‘2 in 1’ offering, most digital DPs have this facility as a default offering, based on the assumption that you wish to buy and sell shares. Naturally one would gravitate towards asking, ‘well, can I have only a Demat account without a trading account?’. Technically, yes. If for instance, you wish to invest in an IPO then you do not need a trading account to buy the stocks and can open only a Demat account to hold the shares on allotment. If you wish to sell those shares, however, then you will have to open a trading account or look into how to activate trading accounts you had in the past, linking them to your Demat accounts.

Why Do I Have to Reactivate my Trading Account in the First Place?

The answer to this lies in the aforementioned events that have previously taken place in the stock market, and the government’s response to this in the form of tightening restrictions for trading accounts. Trading accounts are declared dormant if there has been no trading activity that has taken place through that trading account for a specific period of time. Previously, this time period could be set by the broker. However, in accordance with the new rules, this time period has been standardized to be one year. If a trading account does not see any activity within a year, the DP is obligated to mark it as inactive.

If you wish to trade in the stock market after a hiatus, you might want to reactivate your Demat account, making this one possible reason. Another reason could simply be the fact that you instead, want to close the account. Since your trading account is rendered dormant, you have to first clear all dues on the trading account (transaction fees) etc, before you can close the account. In order to carry out both the aforementioned actions, you will be required to activate your trading account first, before you can close it. Dormant Demat and trading accounts are a fishing ground for scammers looking to employ these accounts to anonymously carry out illegal actions in the stock market. Even if you do not wish to employ the trading account, it is recommended that you reactivate the account and close it, saving yourself and others a lot of potential trouble. Additionally, if you find yourself in a situation wherein you have opened a number of Demat and trading accounts that you find yourself not using though they continue to accumulate AMC charges among others, then you might want to look into how to reactivate trading accounts in order to shut them down as well.

How To Reactivate Your Trading Account?

While Demat accounts tend to accumulate charges over time that you are likely to have to pay off before you can reactivate your Demat account, trading accounts don’t always have this problem. However, there are certain procedures you have to follow.

The first thing that has been mandated in order to reactivate a trading account, is that the KYC process has to be repeated once again. While this KYC process can be done online, In-Person Verification (IPV) is often mandated as well. However, in recent times, especially given the covid 19 pandemic, in some instances it is permitted for the IPV process to be carried out over webcams as well, provided certain protocol is followed.

The specific procedure for how to activate trading accounts varies based on the DP, though the basics remain the same. The customer has to intimate their DP that they wish to reactivate their trading account, which can be done through sending a letter to the company’s head office, or availing of any digital alternatives for the same if they have been provided by your broker. Copies of identification such as PAN and Aadhar card will most likely be requested as well.

Points to Note

- If you are an individual account holder, you can reactivate your Angel One account online.

- If you hold a non-individual account such as HUF, Joint, Corporate, Minor, or NRI, you can reactivate it by raising a ticket here (Create Ticket—> Select Account Details under Category—> Select Profile Details under Sub-Category) and attaching the filled-in and signed reactivation form.

- All holder’s names and signatures will be required in the offline form.

- For minor account holders, the signature of the guardian will be required.

Process to Reactivate Account Online

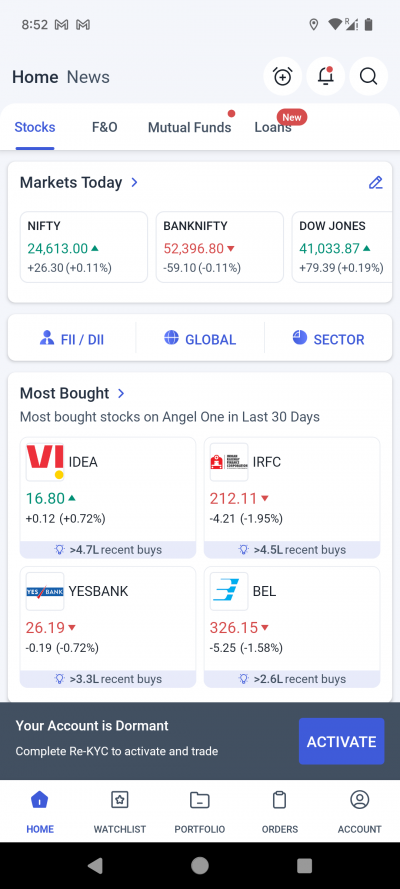

Step 1. Login to the app using the correct credentials

- Use this link to reactivate your account

- Alternatively, log in to the Angel One app and click on the Activate icon.

- Use your mobile number/client ID and OTP to login

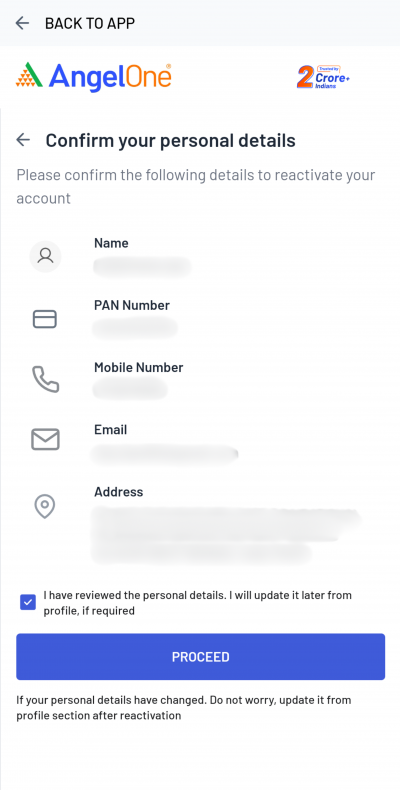

Step 2. Check all the personal information and click on proceed

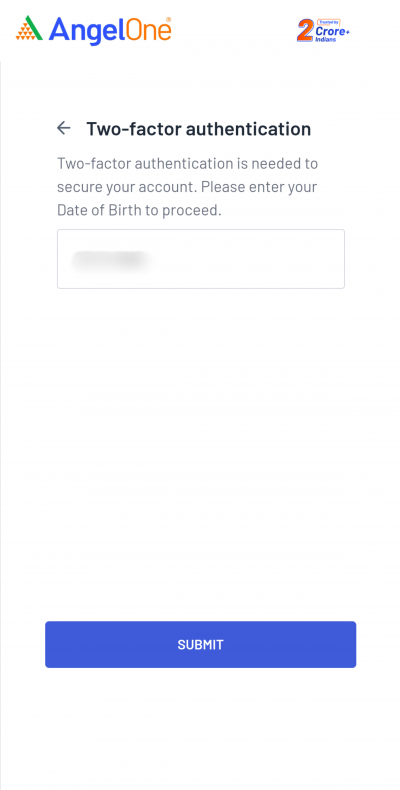

Step 3. Enter your DOB and click on submit

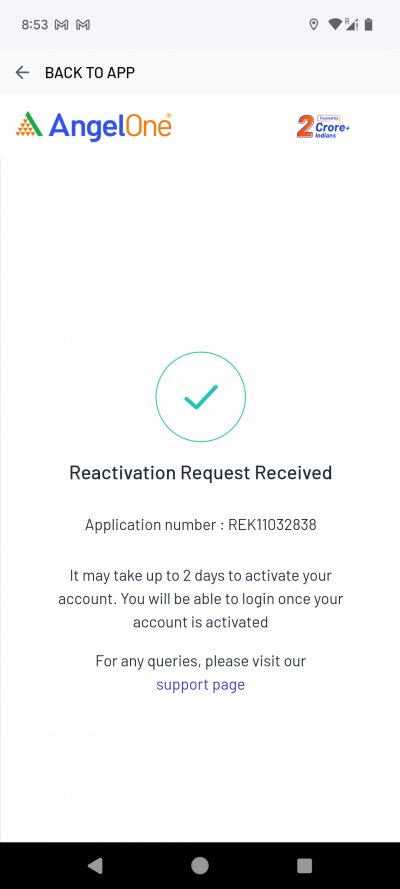

Step 4. The request will be processed in 2-3 working days.

Conclusion

The world of trading can be immensely exciting and tantalizing, making us feel the need to capitalise on all possible opportunities. However, experienced traders will tell you that the goal in fact is instead, to make the most out of each opportunity possible, making your investment process more efficient and devious of exceeding opportunity costs. Therefore, if you have multiple trading accounts that are linked to Demat accounts that you find yourself not making use of, you could reactivate and subsequently close down the account, to maintain a simplistic workflow and reduce costs. If you wish to revisit the world of trading in equity once again, then you can reactivate your dormant trading account following the aforementioned purpose to begin your trading endeavours once again.