Business partner is an entity that partners with different stock brokers to facilitate the buying and selling of stocks on behalf of their clients. business partner operates under different business models. These business models form the different types of business partner. For individuals looking to get into the world of stock trading, a business partner is a smart- first step. But which type of business partner should you choose to become? Individuals looking to try their hand at being a business partner need to understand the different types of business partner and where their skills fit in best. And no, it’s not always about where you make the most amount of money.

This article takes readers through the different types of business partner, their responsibilities and helps you decide which type of business partner is right for you.

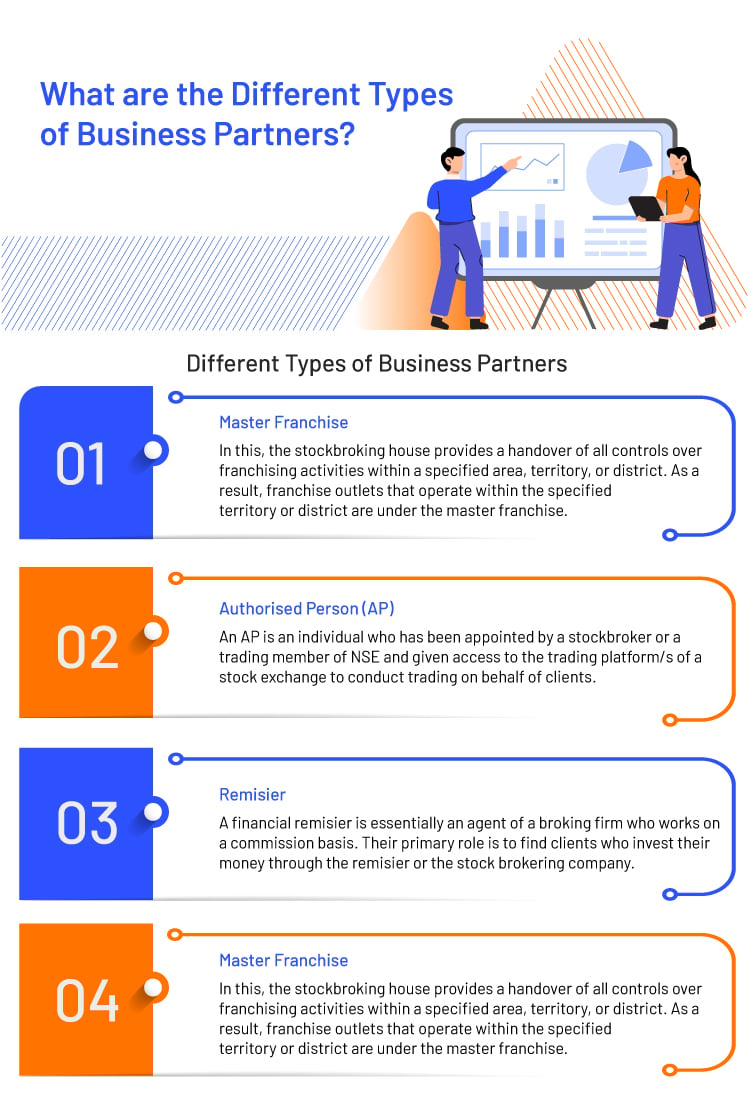

Master Franchise

The Master Franchise is the first and possibly the most popular form of sub broking undertaken widely across India. In this form of business partner, the stockbroking house provides a handover of all controls over franchising activities within a specified area, territory, or district. As a result, franchise outlets that operate within the specified territory, or district are under the master franchise. The master franchise will receive a stipulated percentage as a franchise fee. This fee is decided at the commencement of the franchise where both the franchise owner and the master franchise sign a franchise contract.

To understand master franchise better, let’s look at an example:

Let’s say that individual A is a master franchise with a prominent stockbroking firm in the country. Individual A has control over his territory and as per the agreement with the stockbroking firm A is paid 40% of every franchise outlet that opens in his territory. So, if Individual B decides to open a franchise outlet in the same territory, B must pay 40% of the total franchise cost to A. Let’s say that the total cost of opening a franchise is Rs. 50,000, B will have to pay Rs 20,000 as franchise fee to A.

The master franchise will also be entitled to a royalty. The royalty is a specific percentage of the total broking generated over a specific period of time. The royalty amount differs from one firm to another and is based on the agreement signed in agreement with the master broker.

Authorized person (AP)

An AP is an individual who has been authorized or appointed by a stockbroker or a trading member of NSE. The AP is given access to trading platform/s of a stock exchange to conduct trading on behalf of clients. the Authorized Person is registered with the stockbroker and is categorized as an Authorized person for the broking firm. The only difference between an Authorized person and an AP is that a sub-broker has to register with SEBI, while an AP has only to seek registration from the exchange concerned.

Remisier

A financial remisier is essentially an agent of a broking firm. Unlike traders who receive a fixed remuneration, a remisier works on commission basis. A remisier’s primary role as an Authorized person is to find clients who will invest their money either through the remisier or the stock brokering company. The remisier earns a percentage of the revenue generated as broking. In many cases, the remisier receives a 30% commission, however, this percentage generally varies between one firm to another. In this way, the remisier can choose to work with multiple stock broking companies or deal with a single broking house. In the latter, the broking company provides a private space from where the remisier can work out from.

The remisier has end-to-end accountability for the clients that they bring to the broking firm. This includes being responsible for the security deposit, as well as, fees segregation in various segments on behalf of a client. To enroll as a remisier for a broking firm, an individual has to sign an agreement with the respective broking firm. Additionally, the remisier must pay a security deposit to that broking firm, which is refundable at the time of exit.

Introducer

Just like a remisier, an introducer is a great way to earn money by working with a stockbroking firm. The introducer simply acts as an agent for a broking firm by providing references of prospect clients looking for various products or services offered by the firm. An introducer is valued based on the quality of prospect clients they provide. In the event that a prospect client buys into the broking company’s products or services the introducer earns a healthy commission.