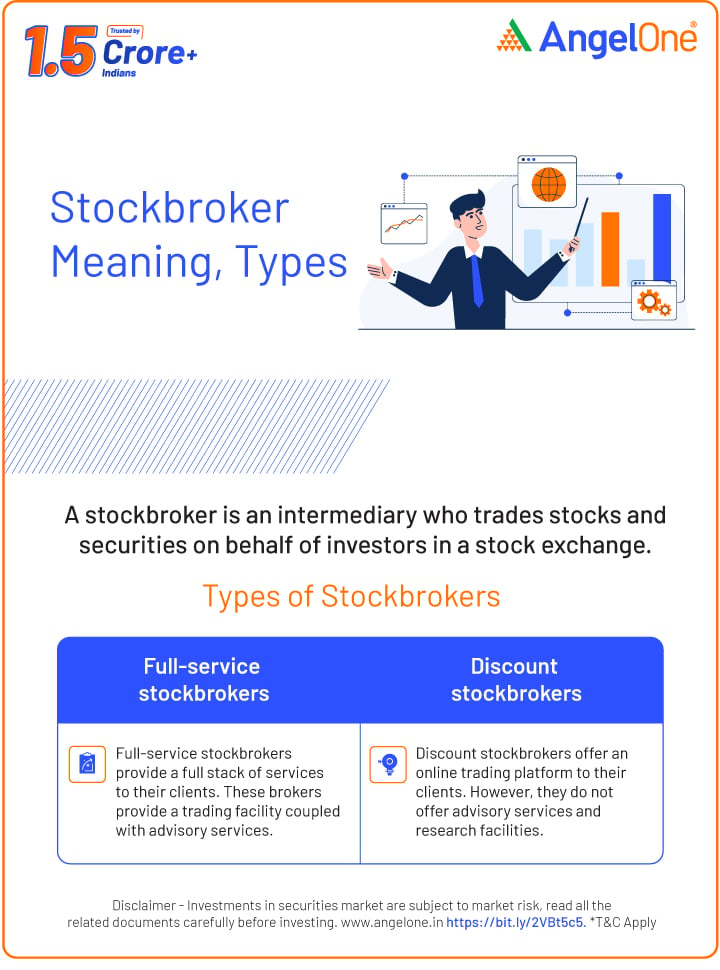

A stock broker is an intermediary authorised to buy and sell stocks for investors. They provide advisory, portfolio management, and transaction services. They can be full-service or discount, and are regulated by SEBI.

Stock brokers are the link between investors and market, as they act on behalf of the investors to buy and sell securities listed on the stock exchanges. Apart from this transaction execution, stock brokers also provide market research, portfolio management, and advisory services to facilitate smooth and regulatory-compliant trading. Understanding the functions, types, and qualifications of a stock broker is the first step toward navigating the stock market effectively.

Key takeaways

-

A stock broker is a SEBI-authorised and licensed intermediary who can buy and sell securities on behalf of the investors.

-

Core functions of stock brokers include executing trades, providing market advice and research, managing client portfolios, and handling paperwork.

-

There are two types of stock brokers: full-service brokers, who offer comprehensive advisory services and research, and discount brokers who provide a cost-effective, tech-driven platform.

-

In India, it is mandatory for a stock broker to be registered with SEBI and be a member of both stock exchanges.

Who is a Stock Broker?

A stock broker is a middleman who has the authority to buy and sell stocks and securities in a stock exchange on the investor’s behalf Stocks are traded through exchanges. However, an investor cannot directly trade in stock exchanges. To buy a stock or sell a stock through exchanges, you need an intermediary who will help you with the transaction. This middleman can be a person or a company who is authorised to buy and sell stocks and other securities on your behalf. Such a person or a company is known as a stockbroker. Stockbrokers are generally associated with a stockbroking firm, but they can also be an independent person. For providing this service, a stockbroker charges a commission or a fee. When understanding stockbroker meaning, one should note that a stockbroker is performing a service for the investor. The role of a broker is to buy and sell shares for a client. Stockbrokers also play another vital role; they provide information that helps an investor make correct investment decisions.

Functions of Stock Brokers

Let us look at the services a stockbroker traditionally provides to its clients in greater detail.

- Stockbrokers give accurate advice on buying and selling stocks and other securities. Since they know the markets, they can advise a client on what stocks to buy and sell and when to buy or sell them. They thoroughly research securities before making such recommendations

- Stockbrokers buy and sell shares on behalf of their clients and handle the associated paperwork. They also act as a record keeper and keep records of all transactions, statements and so on

- Stockbrokers manage the client’s investment portfolio and provide regular updates to their clients about their portfolios. They also answer investment questions that a client may have

- Stockbrokers inform their client about any new investment opportunity in the stock market

- Stockbroker also helps a client to make changes in investment strategies depending on the market conditions

How are they regulated?

Stockbrokers are governed under the Securities and Exchange Board of India Act 1992, Securities Contract Regulations Act, 1956, and also the Securities and Exchange Board of India (Stockbrokers and sub-brokers Regulations), 1992. Stockbrokers are also regulated under other rules, regulations and bylaws that SEBI may issue from time to time. Every stockbroker in India needs to be a member of stock exchanges and also requires to be registered with SEBI. Stockbrokers display their registration details on their websites and even on official documents. One can also visit the Sebi website and find details of registered stockbrokers.

Types of stockbrokers

Now that you know what is a stockbroker and also how they are regulated, let us take a look at the types of stockbrokers. Based on types of service provided, there are two types of stockbrokers- full-service stockbroker and a discount stockbroker. Full-service stockbrokers: Full-service stockbrokers offer a full stack of services to its clients. They are traditional brokers who provide a trading facility coupled with advisory services. For this reason, the fees charged by full-service stockbrokers are high, and the brokerage they charge is based on the total amount of trades that are executed by the client. Full-service brokerages are established players who have branches located all over the country. Clients can visit these branches for service and advice. Discount stockbrokers: Discount stockbrokers have come into existence due to the increased use and availability of the Internet. These brokers provide an online trading platform for their clients. However, discount brokers do not offer advisory services and research facilities. For this reason, discount brokers also charge fewer commissions, which is mostly a flat fee. All brokerages now provide services online where a customer can log in with a username and password and execute trades. Online stockbroking services are faster since transactions can be done with the help of the Internet, and the broker can also connect with the client through chat rooms, emails and provide real-time updates. When knowing what is a stockbroker, it is also essential to understand the meaning of a sub-broker. A sub-broker is a person or agent who is appointed by brokers to act on their behalf. A sub-broker is not a member of the stock exchange. Sub brokers need to register with SEBI without which they do not have the permission to deal in securities.

Full-Service stock brokers

Full-service stock brokers are traditional brokers who provide comprehensive investment and trading solutions to their clients. They not only facilitate the buying and selling of securities but also offer personalised advisory services, portfolio management, research reports, and financial planning support.

These brokers often assign dedicated relationship managers who guide clients through investment strategies, asset allocation, and market analysis. Because of the added expertise and human interaction, their brokerage fees are higher, usually calculated as a percentage of the transaction value.

Full-service brokers have physical branch offices in key cities, and investors can avail of personal advice and services in addition to online trading platforms. They specifically serve investors who like to get a full-spectrum and guided investing experience, including regular market analysis and personalised advice.

Discount stock brokers

The discount stock broker emphasised offering cost-effective, technology-based trading platforms that allow investors to trade on their own. They do not provide personalised advice or research-based recommendations as full-service brokers do. Instead, they provide easy-to-use online interfaces where investors can buy and sell stocks, derivatives, ETFs, and mutual funds at low costs.

Their brokerage structure is flat-fee, meaning traders pay a small, fixed fee per order regardless of trade size. Discount brokers appeal to tech-savvy, self-directed investors who prefer low fees and full control over their trades. These brokers prioritise speed, transparency, and accessibility, offering seamless mobile and web platforms with tools for charting, analytics, and portfolio tracking.

Difference Between Traditional Stockbroker and Discount Broker

| Aspect | Traditional Stockbroker | Discount Broker |

| Services Provided | Comprehensive suite including trading facilities, advisory services, and research | Online trading platforms without advisory or research services |

| Fee Structure | Relatively high fees often based on total trades executed | Lower commissions, typically flat fees, appealing to self-directed investors |

| Accessibility | Branches nationwide for in-person assistance | Operates online, accessible remotely via internet |

| Transaction Speed | Transactions may take longer due to in-person interactions | Faster transactions facilitated by online platforms |

| Communication | Personalised assistance through in-person interactions | Communication primarily through online channels such as chat rooms, emails |

| Sub-Brokers | May employ sub-brokers to act on their behalf | Operates solely through online platforms |

There are two other subtypes of stock brokers who operate in the stock market. These are:

Jobbers

Market Makers (MMs), historically referred to as "Jobbers" in floor-based systems, are specialised firms or large institutions that facilitate trading by continuously quoting both buy and sell prices for a specific stock. They operate electronically and help ensure market liquidity as well as reduce price volatility.

MMs are proprietary traders; they trade using their own capital and profit from the bid-ask spread (the difference between their buying and selling price). They are not typically client-facing stock brokers but play a vital role in maintaining an orderly and efficient market.

Arbitrageurs

Arbitrageurs capitalise on price discrepancies for the same security across different markets or exchanges to generate low-risk profits. They may decide to purchase a stock at a lower price in one exchange and sell it at a higher price in another exchange. Arbitrageurs also improve the efficiency of the markets, as they align price distortions and bring fair value to trading markets.

Also Read, What Type of Brokerage Account is Right for You here.

Qualifications of a stock broker

To become a licensed stock broker in India, individuals must meet the following qualifications:

-

Educational Background: A bachelor’s degree in finance, business administration, commerce, or economics is preferred.

-

Regulatory Certification: Must clear SEBI-recognised exams like NISM Series VII claSecurities Operations and Risk Management or NISM Series VIII Equity Derivatives Certification.

-

Registration: Mandatory registration with SEBI and a recognised stock exchange (NSE, BSE, etc.).

-

Skills Required: Strong analytical ability, financial acumen, communication skills, and client management expertise.

-

Continuous Learning: Regular upskilling through market updates and regulatory training to maintain certification and compliance.

How the Advent of the Internet Has Impacted the Stock Market

With the introduction of the Internet, investing in the stock market has been revolutionised as it has become quicker, more transparent, and open to all. Trading in the past was done only in person and manually, but now, with online trading, a few clicks can enable a person to buy or sell a security in real time.

Live information, online research platforms and mobile investment applications have enabled investors to have information that previously was only accessible to experts. It has also decreased the cost of brokerage, extended market participation and provided worldwide access to financial markets through this digital revolution. Besides, advanced technologies such as algorithmic trading, AI analytics, and internet-based education have streamlined the trading process, making it more data-driven. On the whole, the Internet has democratised investing and put a gap between retail and institutional traders.

In Summation

A stock broker becomes not only your execution partner but also a market intelligence source and strong trading infrastructure. That’s why choosing an authorised and trusted stock broker is key to having smooth access to the markets and making sound investment choices. Make sure the broker you choose is transparent about fees, technologically well-equipped, and regulated.