Buy at low, sell at high - A fundamental investing strategy. But the question is what exactly is low and when should you buy, right? There’s one technique that will help you find out the answers to these questions. This technique or strategy is called - buying the dip and is used by seasoned traders. If you are new to the market, it would be a new strategy for you. Read on to understand what is buying the dip, how it works, and things you must consider while using this technique.

What is buying the dip?

It means buying the stock when the price has dropped with the assumption that it will rise again. It follows the basic principle of buy low, sell high, but with a more targeted approach. However, you must note that the stock you are planning to buy should be fundamentally strong so as to benefit from buying the dip strategy. Two requisites for buying the dip are:

- A sharp decline in the stock price

- An indication that the price will go up again

- Fundamentally stock company

But when will the prices drop? There may be multiple external factors such as unexpected news in global as well as domestic markets, natural disasters, political changes, exchange rate fluctuations, and more and company-specific reasons like the impact of government policy change on the company, rise in manufacturing costs, profit margin, and more which may lead to a sudden fall in the prices of stocks. Some of the real-life situations like the Russia-Ukraine War, US monetary policy, change in Repo Rate/Reverse Repo Rate, increase in crude oil prices, hike in the raw material cost, labour strike, and more affect the stock market. But in such cases the change is short-lived and once the market and companies overcome the change, stock prices are expected to rise again. In such situations, buying the dip strategy might work for traders if they choose stocks wisely and time the market correctly.

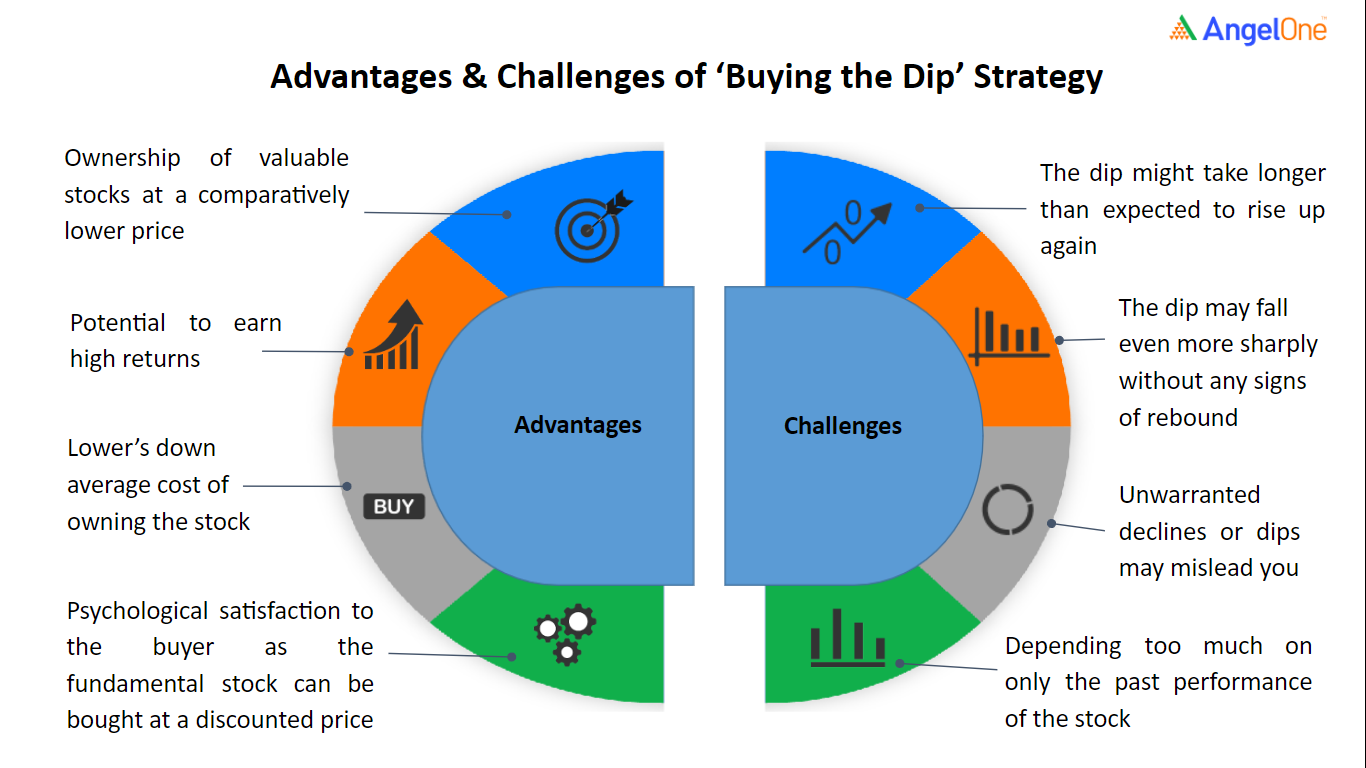

Benefits and challenges of buying the dip technique

Things to be considered while buying the dip

The idea of buying low and selling high while timing the market sounds lucrative but blindly following it isn’t the right thing to do. Following are the things you must consider while buying the dip:

- Identify whether the dip is short-term or long-term as it will help you understand if the dip will recover in the near future or the company needs to do fundamental changes to bounce back

- Identifying the reason for the dip means whether the dip is due to company-specific reasons or because of the external factors such as natural disasters, political changes, exchange rate fluctuations, and more

- Focusing on the stocks that had strong past performance and underlying fundamentals

- Choosing the stocks that suit your risk profile

- The time horizon of the investment

Conclusion

Buying the dip is an investment strategy that relies on buying the stock at a fair price while assuming that the price will rise again. If you are able to time the market perfectly to buy the shares at a low price just before they rally, you can earn a good return. However, there are a few things you need to take special care of while buying the dip - identifying fundamentally strong companies or sectors, finding out the reason behind the dip, and timing the market. When you are fully confident of all these factors, you can buy at the dip and enjoy benefits like value investing and better returns.

Explore the Share Market Prices Today

| IRFC share price | Suzlon share price |

| IREDA share price | Tata Motors share price |

| Yes Bank share price | HDFC Bank share price |

| NHPC share price | RVNL share price |

| SBI share price | Tata Power share price |

Disclaimer: This blog is exclusively for educational purposes.