The stock market is also susceptible to uncertainties just like weather, health, traffic, etc. The uncertainty in the stock market is the erratic movement of share prices. This uncertainty puts all the stakeholders of the market at risk. Thus, Margins are used in the stock market to sustain the risks that arise due to uncertainty.

Key Takeaways

-

Margin is a small amount you pay to take a bigger position. It protects both the trader and the broker from sharp market moves. It also helps manage overall risk.

-

Equity margin includes VaR and ELM. If the combined rate is below 20%, a minimum 20% margin applies. Volatile stocks require higher margins to cover potential losses.

-

F&O margin includes SPAN and Exposure. SPAN is updated several times a day. Traders can use a margin calculator to check the exact requirements.

-

MTM margin covers daily profit or loss on open positions. If intraday losses reach 80% of available funds, the broker may square off positions to reduce further risk.

What is margin?

Suppose you are trading intraday and want to purchase 1000 shares of ‘XYZ’ company at ₹100/- on a trading day, say ‘T’ day. You need to pay ₹1,00,000/- (1000 x 100) to your broker who in turn pays the amount to the respective stock exchange you are buying shares from.

What if you don’t have the total amount of ₹1,00,000/- to buy the shares at that moment? You can pay a portion of the total amount of ₹1,00,000/- as advance to the broker at the time of placing the buy order. Stock exchange in turn collects a similar amount from the broker upon execution of the order.

This initial token payment is called Margin. In the above example, assume that the margin is 15%. You have to pay ₹15,000/-(15% of ₹1,00,000/) upfront to place your order. The margin required differs from share to share depending upon the volatility, segment to segment depending upon the settlement/time of expiry. In this article, we will let you know how margins are calculated for the equity and derivatives segment.

Margin calculation for Equity Segment

Daily Margin for an equity share comprises the sum of Value at Risk (VaR) Margin and Extreme Loss Margin(ELM).

- VaR estimates the risk of loss in investments. It calculates the percentage of an investment you might lose in a set period given the normal market conditions.

- ELM aims at covering the losses that could occur due to the possibility of erratic market movements beyond regular risk estimates.

Click here to learn about the above margins.

Calculation of VaR

To arrive at VaR margin rate, all the securities are divided into 3 categories based on how regularly their shares trade and liquidity

Category |

Number of days traded in the previous 6 months | Impact Cost (measure of liquidity) |

| Group-1 | >80% of trading days | <1% |

| Group-2 | >80% of trading days | >1% |

| Group-3 | All the other shares that are not under Group-1 and Group-2 | |

Exchanges calculate VaR margin and ELM for the above categories and circulate the same to the registered brokers And the brokers charge the same to you.

As per the exchange rules, If (VaR Margin+ ELM)= X%, the margin requirement is at X% or 20%, whichever is higher.

For instance, if (VaR+ELM)=17%, Angel One considers the margin requirement as 20%. For instance, if (VaR+ELM)=28%, Angel One considers the margin requirement as 28%.

The applicable margin will be collected upfront while you place your buy/sell order. Note that Angel One doesn't charge margin for selling of securities if you are selling from your Angel One's demat account. Also, Angel One gives you the credit for sale up to 80% of the sale on the 'T' day itself.

Margin Calculation for Derivatives(F&O) segment

For the F&O segment, the total margin collected comprises the sum of SPAN margin and Exposure Margin

- SPAN is short for Standardized Portfolio Analysis of Risk. SPAN Margin calculator helps you to determine the Margin required by simulating 16 distinct scenarios. SPAN margins are revised six times a day, so the calculator will give different results depending on the value of the underlying asset.

- Exposure margin is an ad-hoc amount over and above SPAN, collected as protection against investor’s liability that may arise from erratic market swings.

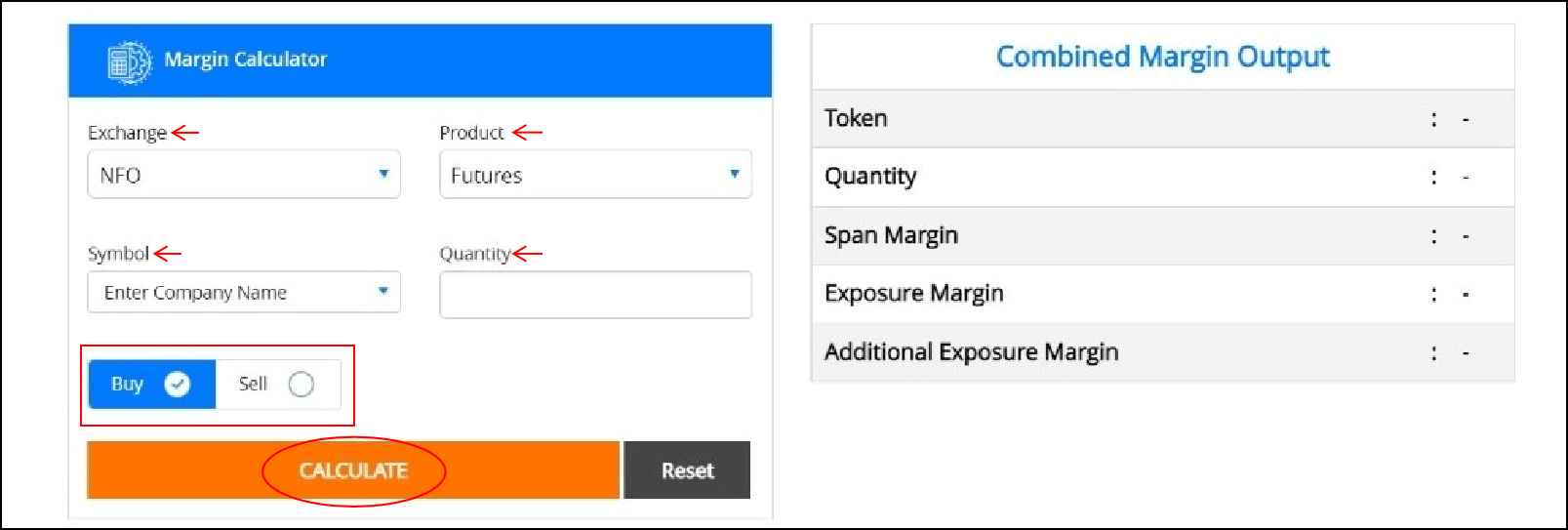

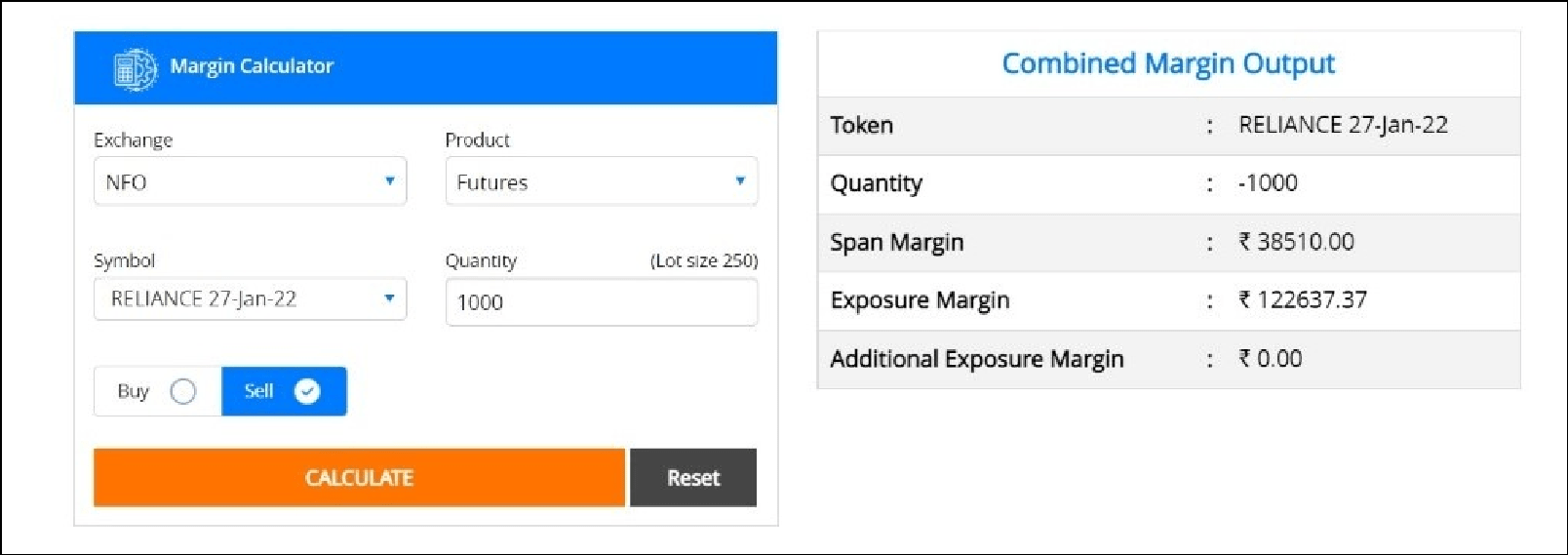

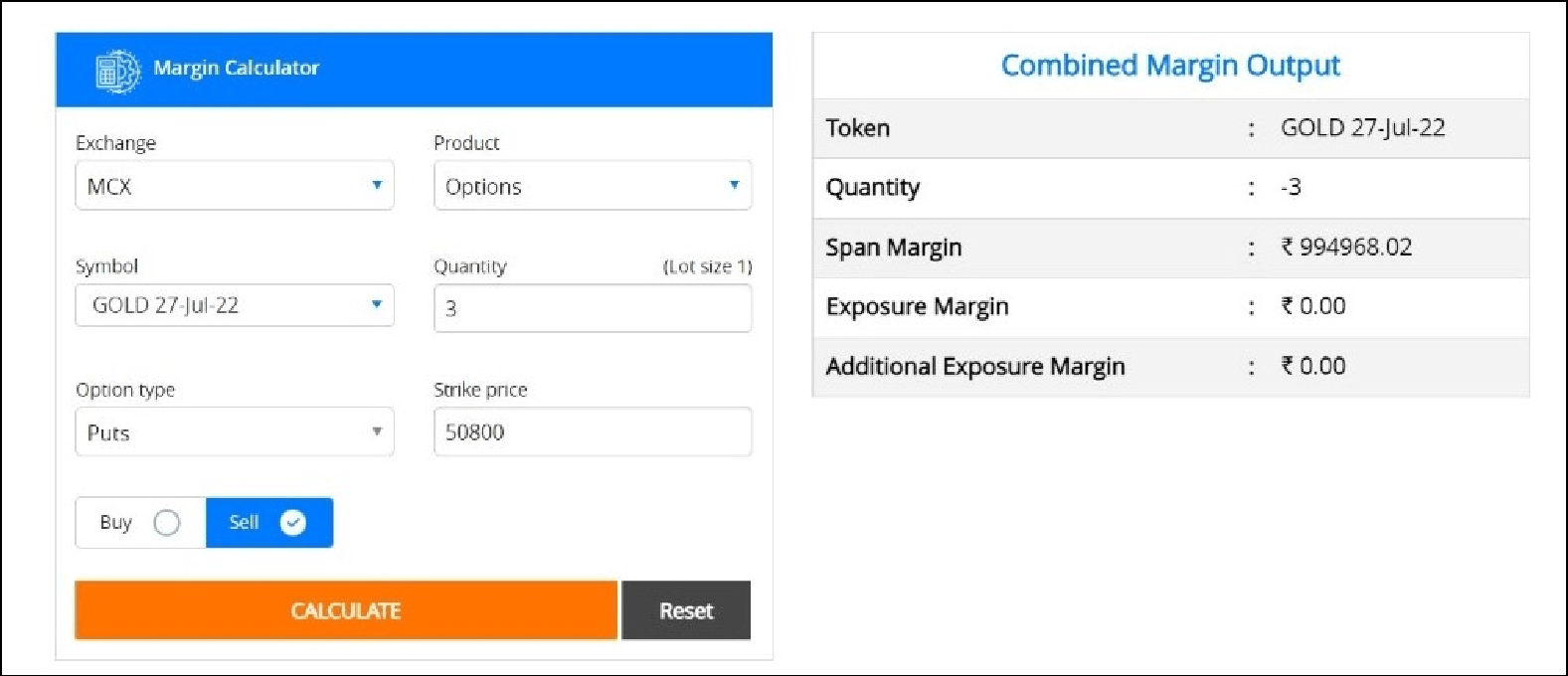

Click here to know more about SPAN and Exposure Margins. A margin calculator is available to calculate the margin for each F&O scrip. Click here to access the F&O margin calculator on Angel One. A F&O margin calculator looks as follows  You need not worry about the math involved in calculating the SPAN and Exposure Margins. The calculator does it for you. All you have to do is enter the required inputs for your trade and get the results as illustrated below

You need not worry about the math involved in calculating the SPAN and Exposure Margins. The calculator does it for you. All you have to do is enter the required inputs for your trade and get the results as illustrated below

If you are a F&O trader, the margin calculator comes in handy to analyse your trade before you place an order. Also, the margin calculator can be used to arrive at the margin while placing multiple counter positions and verify if you have any margin benefit if you place such positions.

If you are a F&O trader, the margin calculator comes in handy to analyse your trade before you place an order. Also, the margin calculator can be used to arrive at the margin while placing multiple counter positions and verify if you have any margin benefit if you place such positions.

MTM Margin

One of the margins you must be aware of when you are trading is the MTM margin.

MTM margin, short for Mark to Market Margin, is calculated at the end of the day on all open positions by comparing the transaction price with the stock’s closing price for the day.

For instance, if you buy 100 shares of ‘X’ at ₹100 at 11 AM on a trading day ‘T’ and if the closing price of the shares on that day happens to be ₹75, then you will face a notional loss of ₹2500 on your buy position. This loss is termed as MTM loss and is payable on ‘T+1’ day before the opening of the market.

However, if the MTM loss on “Intraday” positions reaches the trigger of the total funds available, then the broker closes all the open positions across all segments on a best effort basis. The Risk Management System of Angel One (RMS) will constantly monitor the “Intraday” positions for the Clients and close them out accordingly. Before that, the broker informs you to add the required margin as you approach the trigger.

Margin will always be collected upfront as per regulatory guidelines. Margin collected will act as a cover against the potential risk of adverse price movement. That’s why certain scrips require a high margin, and others, a lower one.

Conclusion

Understanding margin is the key to being a confident trader. It helps you manage the risk and plan your trades better, thus helping you avoid unexpected losses. Once you learn how to calculate margin, you can judge whether a trade fits within your budget and risk level. There are obvious differences in how equity and F&O margins work, but both aim at protecting you from sudden market changes.

Tools like the margin calculator make things simple by giving you clear figures before placing an order. Keep in mind that margins are always collected upfront and may change with market conditions. Keeping track of these requirements and using the right tools is what will let you be responsible and make better, well-thought-out decisions.