Thousands of shares are listed on the NSE (National Stock Exchange) and BSE (Bombay Stock Exchange) which makes it tough to track the movement of each listed share and assess the market change. The Indian stock market thus came up with a better way to give investors a fair idea about how the market is moving. They introduced stock market indices that give an overview of the performance of the whole market or a particular segment. An index is created by grouping listed stocks from the same group.

The most commonly heard stock market indices in the headlines are NSE NIFTY 50 and BSE Sensex. These are broad-based stock market indices. But did you know that indices can be segregated based on sectors, market, strategy, and themes as well? In this article, we will talk about 2 of these indices by NSE - sectoral indices and thematic indices.

What are sectoral indices?

Sectoral indices are indices that reflect the performance of specific sectors in the Indian stock market. Top sectors like banking, auto, IT, telecommunications, financial services, media, and more are identified to define these sectoral indices.

What are thematic indices?

The NSE indices that exhibit the performance of companies that belong to specific investment themes such as social, economic, digital, or more are known as thematic indices. For instance, if person X is interested in investing in stocks of the energy sector, then he can track the companies that are a part of NIFTY Energy sector and take his investment decisions accordingly.

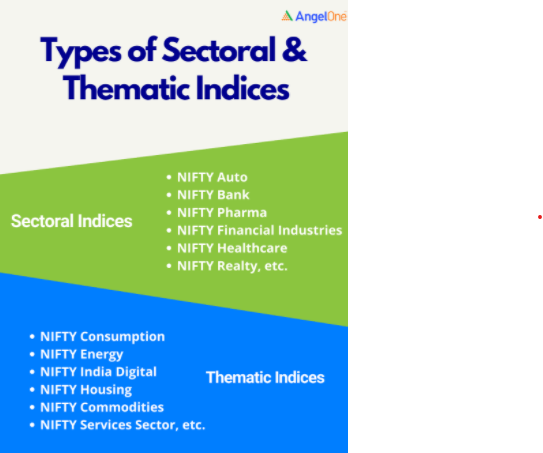

Types of sectoral and thematic indices

A few of the sectoral and thematic indices by NSE are classified as under.

Get the complete list of sectoral as well as thematic indices here.

Sectoral indices vs thematic indices

The below mentioned table will give you better clarity about the difference between these two indices.

| Criteria | Sectoral Indices | Thematic Indices |

| Meaning | Tracks the performance of a particular sector | Give an overview of all the companies belonging to a specific theme |

| Scope | Aims at specific sectors

For example - NIFTY Healthcare covers all the companies that belong to the healthcare category |

Broader than the sectoral index as it covers multiple sectors related to a common theme

For example - NIFTY India Consumption Index covers companies that represent the domestic consumption sector (includes Healthcare, Auto, Telecommunication, Pharmaceuticals, Media, and more) |

| No. of Constituents | Generally, no. of constituents for each index lies between 10-20 | For a thematic index, no. of constituents vary according to the theme. For example - no. of constituents for NIFTY Commodities are 30, while for NIFTY Energy it is 10. |

| Diversification | They are diversified under only one sector as all the companies belongs to the same sector | These are diversified across various sectors but are well-defined around a theme |

Conclusion

Apart from NIFTY 50 and Bank NIFTY there are a multitude of other indices by NSE such as sectoral and thematic indices that can be used for your investment decisions. While sectoral indices consist of companies from the same industry, thematic indices include companies belonging to various sectors but have the same theme. If you want to diversify your portfolio, you can consider investing in sectoral and thematic indices as they offer better diversification than an individual stock. However, it is advisable that before investing based on the sectors and themes, you must consider your risk profile, analyse company details and follow due diligence rather than just looking at their historical results.

Disclaimer: This blog is exclusively for educational purposes and does not provide any advice/tips on investment or recommend buying and selling any stock.