A portfolio is a collection of different kinds of assets owned by an individual to fulfill their financial objectives. Today, there are diverse types of financial assets that you could include in your portfolio from equity shares, mutual funds, debt funds, gold, property, derivatives, and more. A diversified portfolio immensely reduces risk and gives much greater returns on your investments.

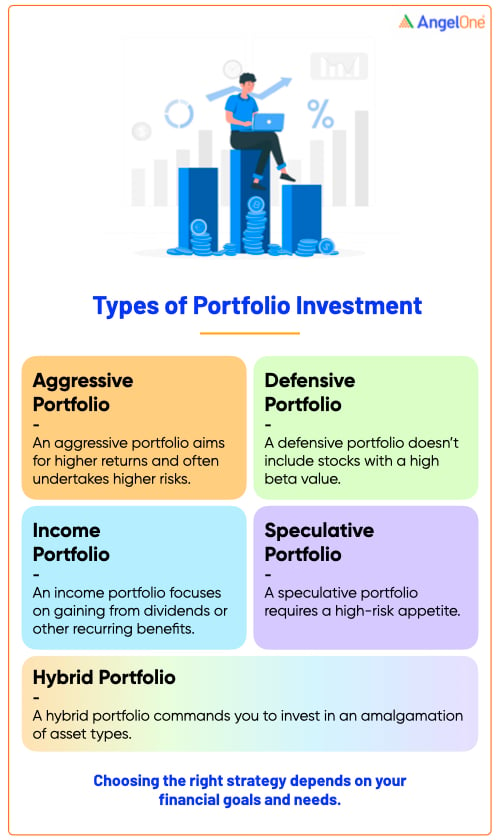

But first, let's explore the different portfolio types available to an investor. Multiple factors such as your financial goals, risk appetite, investment horizon needs to be considered before choosing the right portfolio type for yourself.

Here is a list of popular portfolio types. However, remember that one portfolio type may not meet all your financial needs. You may need to mix and match specific types of portfolio investments to arrive at the combination, which is ideal for you.

1. The Aggressive Portfolio

Aptly named, an aggressive portfolio is aggressive because it aims for higher returns and often undertakes higher risks to achieve this objective. Generally, this portfolio includes several high beta stocks. These stocks show higher fluctuations as compared to the overall market. Take, for instance, a stock with a high beta over 1.5 or 2.0. Such shares will move higher or lower almost twice as the market's shift, which means you could double your profits or losses.

Aggressive investors don't always go for household names in stocks or financial assets. They often prefer companies that are still in their initial growth stages and have a unique value proposition that can garner spectacular returns for the commensurate risks.

If you want to build such a type of portfolio, it is a good idea to lean towards sectors like the technology sector that offer enormous upswing opportunities. Yet, it would be best if you employed your rationality here as well. While aiming for the highest returns, make sure that your losses don't outnumber your profits.

2. The Defensive Portfolio

On the contrary, a defensive portfolio doesn't comprise of stocks with a high beta value. Such shares generally stay unaffected by market movements. These stocks are pretty safe to invest in as they involve minimal risk. Neither do they give extravagant returns in upswings nor excessively crash during the business cycle's lows. For instance, even in times of an economic downturn, the companies that make survival essentials or daily needs products like food, utilities are likely to weather the storm as customer demand remains strong.

It is pretty easy to boil down on a choice of assets in a defensive portfolio. Think about the products that are an absolute must for you throughout the day and invest in the companies which make them. A defensive portfolio is a safe bet for risk-averse investors.

3. The Income Portfolio

An income portfolio focuses on gaining from dividends or other recurring benefits provided to shareholders. Though it has quite some commonalities with a defensive portfolio, one significant difference is that it banks on stocks with relatively higher yields.

Real estate is an excellent example of the same. It provides a higher share of profits along with favourable tax benefits in return. One advantage of investing in stocks in the real estate sector is that you can enjoy all the benefits of investing in such a booming industry without breaking a sweat over owning property. However, one drawback here is that real estate isn't very resilient during economic downturns.

If you want to build this portfolio type, you should look out for such stocks which are not so common yet provide pretty good dividends. You can also hunt for FMCG, utilities, and other stable industries. If you are looking for your portfolio to act as an active supplement to your monthly paycheck or something that will back you up during your retirement days, this is a pretty good option.

4. The Speculative Portfolio

The speculative portfolio requires a high-risk appetite, so much so that it is often compared to gambling. Here, the portfolio is not just aggressive but is also a bet on what product or service offering could work very well in the future. Initial Public Offers (IPOs) or takeover targets fit well into the speculative portfolio type. Technology firms or health care firms working on cutting-edge research or breakthrough discoveries also fall into this category.

Not every investor has such a high-risk appetite. Financial advisors recommend capping speculative assets in a portfolio at 10 percent or lower. Moreover, first-time investors must take a call prudently. It requires massive research and experience to know the companies you can count on to deliver phenomenal returns.

5. The Hybrid Portfolio

As the name suggests, such a type of portfolio commands you to invest in an amalgamation of asset types with varying fundamentals to earn the best of both growth and dividend-yielding investments. Such a portfolio provides maximum flexibility. A hybrid portfolio is a balance of high-yield equity returns and fixed income instruments such as debt funds and bonds.

Conclusion

While there are several types of portfolios, investors must be prudent in selecting the right assets to achieve their investment objectives. Take time to research every asset type's fundamentals and figure out the most suitable combination of investments to hold in your portfolio to generate maximum returns.

Learn Free Stock Market Course Online at Smart Money with Angel One.