What is an annual report?

An annual report is a yearly book published by a company that contains a variety of information for the investors. The information ranges from the remuneration of key personnel and profit and loss to management’s outlook for the company and its past performance. The annual report is considered sacrosanct as all the information is directly provided by the company. Any wrong data in the annual report, provided intentionally or unintentionally, can be held against the company. The annual report is primarily aimed at existing shareholders and potential investors. It is advisable to rely on the annual report for information related to a company rather than third-party media sources.

Please note that all the data in the annual report pertains to March 31 of the recently ended financial year. Companies typically start releasing the annual report from May. The annual report is a bulky document and requires substantial time to compile, so a majority of large companies release the annual report in June. The annual that will be released in 2020 will contain information related to the financial year 2019-20.

The annual report is uploaded on the website of the company to provide easy access to investors of all categories. To get the annual report visit the website of the company and go to the ‘Investors’ section. Generally, there is a column as ‘Financial and Reports’ or ‘Financial Reports’ in the investors’ section. You can download the PDF version of the annual report from the reports section. Alternatively, you can also contact the company to get a hard copy of the annual report.

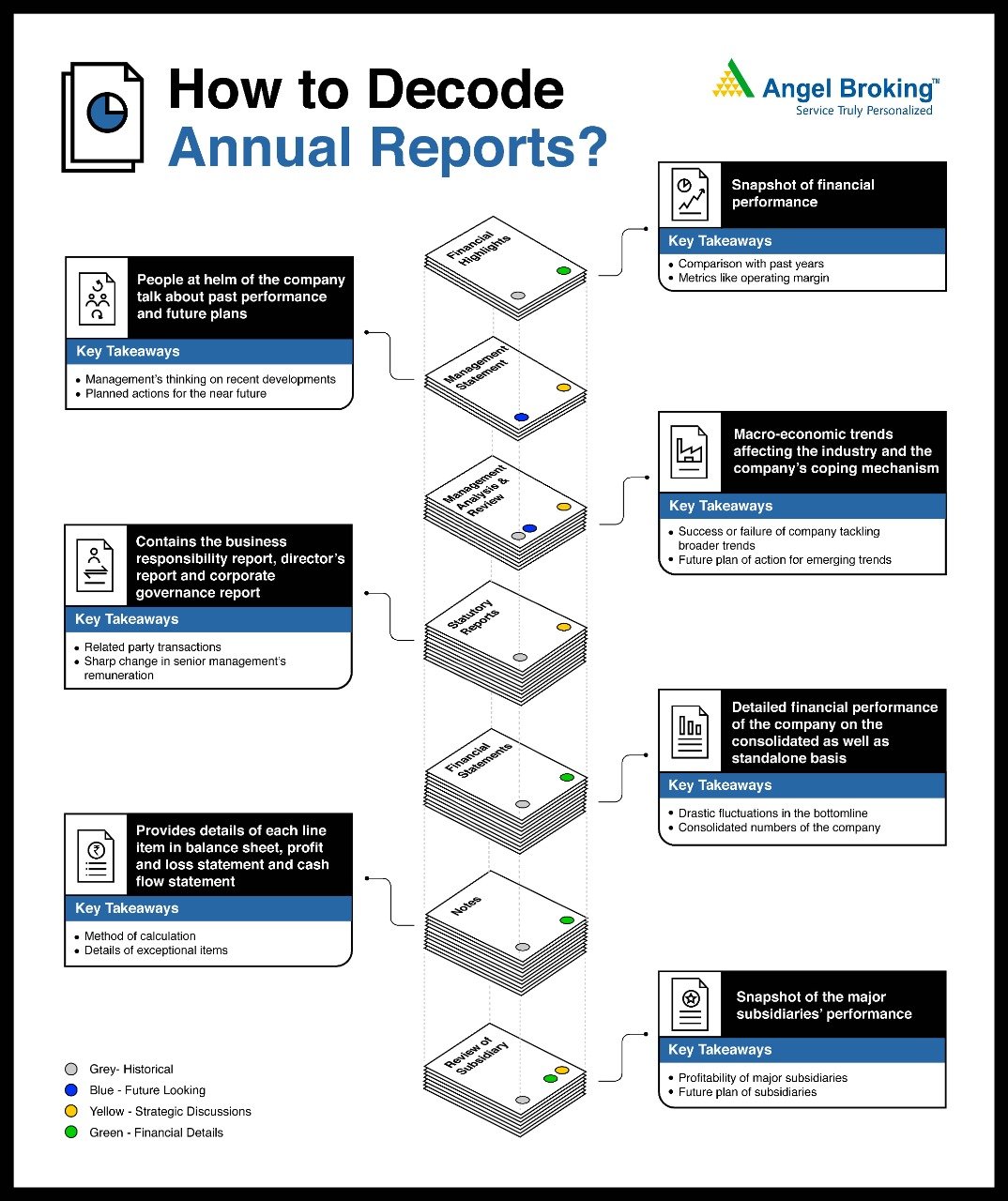

Different sections of an annual report

The annual report is a comprehensive document with information and data of all kinds. While the information provided in an annual report is assumed to be true, you have to be careful of how the information is presented. Companies will not lie in the annual report but will try to highlight positive information and bury negative data under technical jargons. The key is to read the annual report carefully and try to separate meaningful information from feel-good marketing content. For better understanding, we will take the annual report of Eicher Motors Ltd as an example. The company manufactures the well-known Royal Enfield motorcycles along with commercial vehicles under the Eicher brand. Link to the annual report: https://www.eicher.in/uploads/1563260440_eicher-motors-annual-report-2018-19.pdf

It is not possible to explain each and every line of an annual report, but you will get a broad idea of what to look at in an annual report. Annual reports differ in style and content and their interpretations can also be different. One can develop his/her understanding by reading multiple annual reports over the years and comparing the data with the actual performance of the company. Let us start with the various sections of Eicher Motors’ annual report for 2018-19.

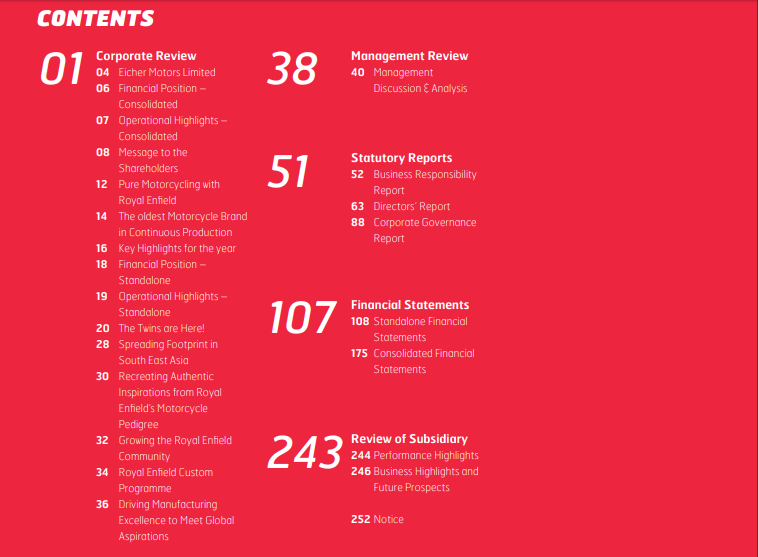

The company has divided the annual report into five broad categories with various sub-sections.

- Corporate Review: It includes financial highlights, message to the shareholders (also called management statement or chairman’s message) and the company’s activities in the last year.

- Management Review: It contains management analysis and discussion

- Statutory Reports: It consists of business responsibility report, a corporate governance report and director’s report.

- Financial Statements: It has the standalone as well as the consolidated financial statements.

- Review of Subsidiary: The performance and business highlights of subsidiary companies are provided in the section.

The annual report of Eicher Motors starts with the corporate review. The company provides the financial highlights of consolidated operations, which means it includes the sales and profits of subsidiary companies. We will discuss standalone and consolidated financials while discussing financial statements. Eicher Motors has provided data only for two years, but many companies give performance highlights of 5-10 years. It is not of much relevance, but you can use it to analyse the company’s performance over the years.

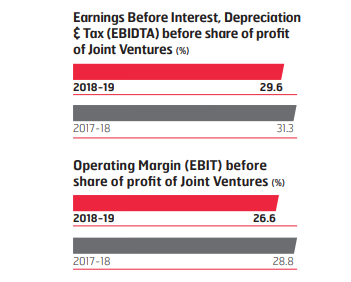

If you notice a sudden fall or rise in profits in a certain year, try to find the reason for it. The context of the information provided in an annual report is very important. Without the context. The data is meaningless. For instance, the operating margin before share of profit of joint ventures of Eicher Motors has declined by 220 basis points in a year. Without the share of joint ventures means the decline is in the margin of the motorcycle business. You have to find the reason for the contraction in the margin.

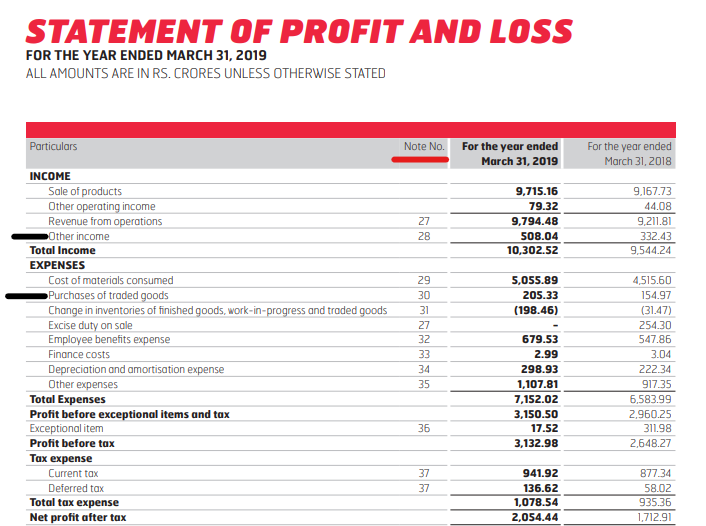

The primary reason, in this case, is the rise in the cost of raw materials. If you go through the standalone profit and loss statement of the company, you will observe a sharp rise in the cost of materials consumed and employee benefits expenses. To get a balanced view, compare the rise in the cost of input materials and the contraction in margins of other motorcycle manufacturers in India. The margin is provided on page 3, but the reason is on page 119 in the financial statement section. One has to connect the dots to derive meaning from an annual report.

After a snapshot of financial performance, Eicher Motors has given a brief of its business units, dealership network, shareholding pattern and number of vehicles sold. It can be helpful for new investors of the company. The company provides the consolidated financial position and operational highlights. Don’t spend too much time reading the highlights as detailed numbers are given in the financial statement section of the annual report.

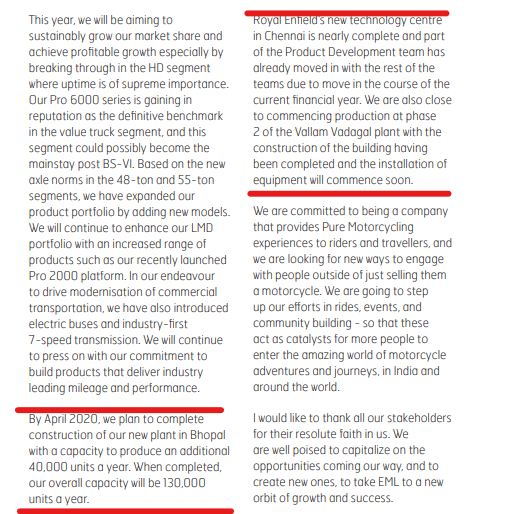

The next section is the ‘message to the shareholders’, also known as ‘management statement’. The section gives a sneak-peek into the head of the people in control of the company. Generally, the chairman or the managing director talks about the performance of the company, the challenges faced and how they plan to cope with the challenges. You should read the management statement very carefully as sometimes it gives valuable insights into the future action of the company. One can also judge the quality of the management through the management statement. Read the past statements and compare them with the actual performance, you will know if the person at the helm is all bluster or has a sense of ground.

In Eicher Motors’ case, Managing Director Siddhartha Lal talks in detail about the capacity addition of the company. With the commencement of a new facility in Bhopal, Eicher Motors’ commercial vehicle manufacturing capacity will rise by 40,000 units. The company also increased its motorcycle production capacity. Despite a slowdown in the broader commercial vehicles and premium bikes segment, the company is continuing with its capacity addition plans. It means Lal expects the slowdown to be temporary and a surge in demand in the future. You will have to watch out for the company’s sales data and capacity utilisation in the future.

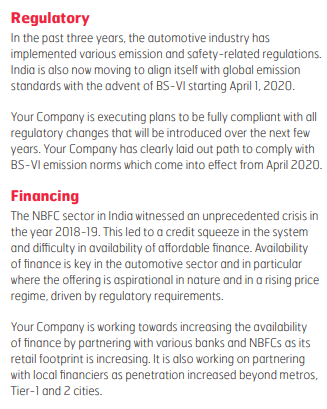

The management statement is generally followed by management discussion and analysis. It is one of the most important segments of an annual report. Companies generally start the management discussion section with a snapshot of macro-economic factors affecting the company. If the company operates in the international markets, it will also discuss global factors. The management of Eicher Motors talks about the slowdown in the two-wheeler segment in the second half of 2018-19. Keep an eye on the business review of the company, product launches and new store additions. With the information, the company will also list the steps it is taking to expand into new markets.

The company will discuss various problems faced by it and the steps it is taking to tackle them. The later parts of the management review shift the narrative from broad trends to specific steps being taken by the company. Read the management discussion and analysis very thoroughly to get a clear idea of the company’s future actions.

Companies will also try to hide negative developments in the management discussion and analysis. With a keen eye, you can spot developments that are materially negative. One such instance is workers strike and loss of production for Eicher Motors.

The management discussion is generally followed by a number of reports like the business responsibility report and corporate governance report. You can find the details of subsidiaries, the remuneration of key management personnel and the company’s CSR activities in these reports. These reports can also contain details about related party transactions. You should look out for any hint of related party transactions in these reports. The remuneration of key management is also an important factor. A consistent rise in the remuneration of officials without a similar growth in sales or profits should be a huge negative for investors.

- Financial Statements

The financial statements of the company consist of three statements

- The profit and loss statement

- The balance sheet statement

- The cash flow statement

You will encounter the words consolidated and standalone multiple times in the ‘financial statements’ section. It is better to have a clear idea of what consolidated and standalone means. It is common for large global companies to operate through multiple subsidiaries. There can be varying reasons for having several subsidiaries from taxes and corporate governance rules to acquisitions.

Some of the subsidiaries of Eicher Motors are Royal Enfield, VE Commercial Vehicles, Royal Enfield America Ltd and Royal Enfield Thailand Ltd. Some subsidiary companies have their own subsidiaries, which are called step-down subsidiaries. Royal Enfield Canada Ltd, VECV Lanka (Private) Ltd are some step-down subsidiaries of Eicher Motors.

Eicher Motors has demarcated its business into two separate units through its subsidiaries. Its motorcycle operations are housed under Royal Enfield and commercial vehicle operations under VE Commercial Vehicles. Though the commercial vehicle arm VECV is a JV between the company and Volvo Group, Eicher Motors has listed it as a subsidiary due to its majority shareholding in the JV.

The consolidated financials of a company include the financial performance of the subsidiary companies. In the case of Eicher Motors, the consolidated financial highlights include the financials of subsidiaries like VECV, Royal Enfield America, etc. You will have to take into account the consolidated financials of a company to get a better idea of its business. However, if you want to focus on the primary business or the domestic business of some companies, take into account the standalone statement.

There are various aspects of how to evaluate consolidated and standalone figures of a company. For instance, selling Royal Enfield motorcycles is the primary business of Eicher Motors. Consider a hypothetical situation where Royal Enfield earns a profit of Rs 200 crore only and its subsidiaries report a profit of Rs 1000. The consolidated profit and loss statement will show a profit of Rs 1200 crore, but will it be a correct metric to judge the company? Weakness in the primary business may not be a good sign for the future.

There may still be two aspects of higher profits from subsidiaries. In the case of Eicher Motors, subsidiaries include the commercial business as well as the overseas motorcycles business housed under companies like Royal Enfield America. If the bulk of the profits attributed to subsidiaries has been contributed by the commercial vehicle arm, then it is a confirmed sign of weakness in the primary motorcycles business. But if the overseas subsidiaries are doing well, it could mean that Royal Enfield is gaining market in lucrative foreign markets. In a nutshell, there can be various interpretations of data and it can be perfected over time by reading annual reports of companies in the same sector.

Note that each figure in a financial statement is known as a line item (marked by black lines in the picture). For clarity, line items are accompanied by ‘notes’ or ‘schedules’ that provide the detail of that particular figure (underlined by the red line). Let us take the example of the cost of raw material in the standalone profit and loss statement of the company. As discussed earlier it had an impact on the company’s operating margins.

The details of the cost of materials consumed are given in note 29.

In the review of the subsidiary section, Eicher Motors has given a detailed analysis of its biggest subsidiary VE Commercial Vehicles Ltd. The subsidiary is a significant business segment of Eicher Motors and so it’s found a separate mention in the annual report. The section follows a similar trajectory as the broader annual report. It talks about the financial metrics and the performance of the business.

- Frequently Asked Questions

1. Where can I find the annual report of a company?

The annual report of a company can be easily downloaded from the ‘Investors’ section of its website.

2. Can I find about all the subsidiaries of a company from the annual report?

Yes, companies list the names of all its subsidiaries in the annual report. Separately, companies mention the number of subsidiaries added in the year as well as the companies that ceased to be subsidiaries.

3. Are annual reports reliable?

Annual reports contain information directly provided by the company. Any wrong information provided in an annual report can be held against the company. Investors can rely on the information and data given in an annual report.

4. Is data on a company’s debt available in the annual report?

The level of debt is an important factor to consider before investing in a company. The debt of a company can be found under the head ‘Indebtedness’ in the annual report. The increase or decrease in debt should be compared with previous years and seen in the context of the increase or decrease of sales. If the company is taking on debt to increase capacity or enter new markets but is not able to grow sales accordingly, it means the company is not utilising capital efficiently. There can be various other interpretations too.

5. When do Indian companies release their annual report?

There is no fixed date for the release of the annual report. Indian companies have to dispatch the annual report at least 21 days before the annual general meeting. The annual general meeting has to be held within six months of the last date of the previous financial year. Most companies release the annual report between May and August.

Learn Free Stock Market Course Online at Smart Money with Angel One.