Stock buyback- What is it?

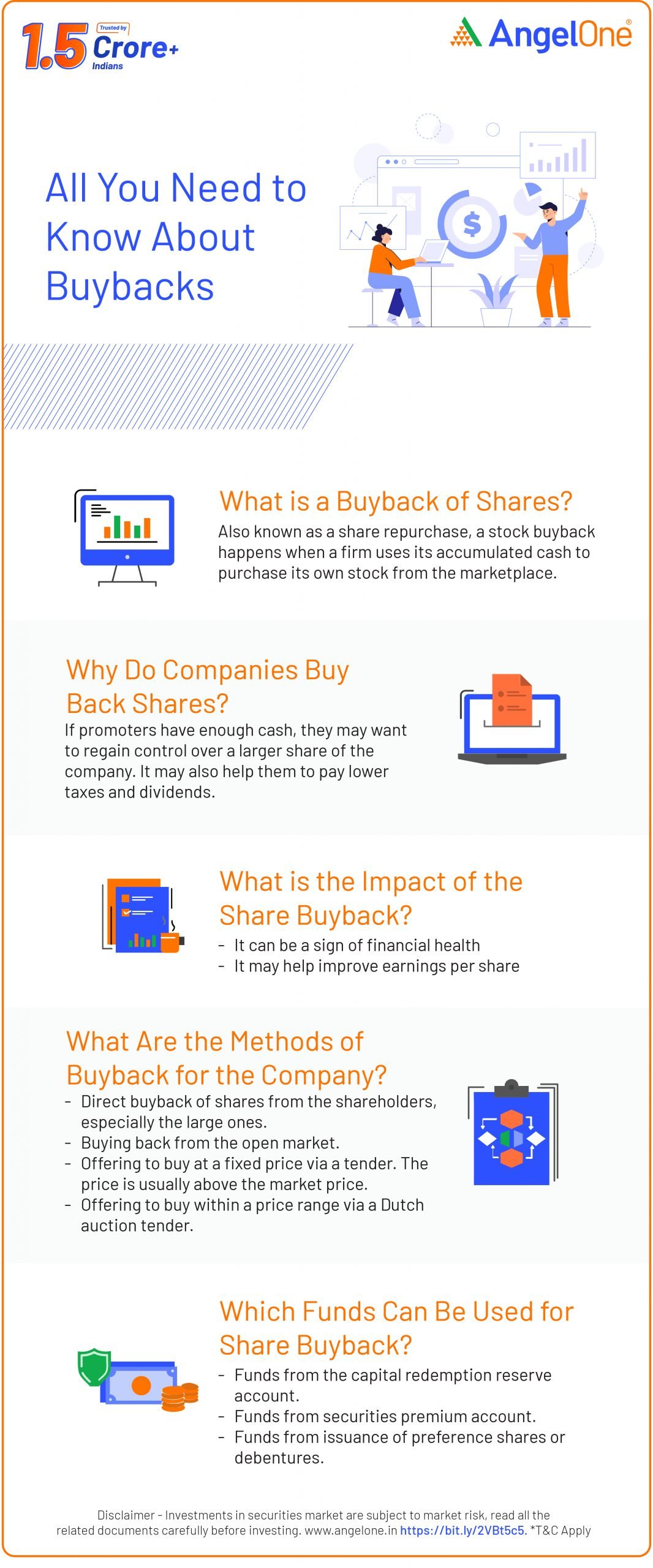

A stock buyback happens when a firm uses its accumulated cash to purchase its own stock from the marketplace. It is also known as a share repurchase,

A stock buyback usually happens in two ways:

– The company can buy back stock from the existing shareholders through a fixed price tender where the shareholders have the option to submit their shares to the tender offer within a stipulated time and receive a premium as compared to the market price in the respective current time.

– The company can directly buy back stock from the open market over an extended period without paying a premium.

Stock buyback leads to reinvestment by the company by reducing the number of outstanding shares in the stock market while increasing the proportion of share ownership of a company.

Why share repurchase?

Many companies try to reward their shareholders through a steady increase in dividends and regular share buybacks. There are several reasons why a company initiates a share buyback. Here are seven of them:

- It could have excess cash on its balance sheet.

- It might not have an alternate investment option.

- It might opt for repurchase as a confidence-building measure to check the fall in prices.

- It may want to reduce the market cap, thereby increasing EPS strategically.

- It may want to lower dividend payout to shareholders, thereby resulting in lower taxes for the company.

- It may want to get a higher return on equity (RoE), leading to higher valuations.

- It may want to increase its undervalued stock or to prevent a hostile takeover.

What is the impact of stock buyback?

– Easy fix for the financial statements

Stock buyback can have a good impact on the overall financials of a company as the wealth spent can be found in the cash flow statement and statement of retained earnings. Investors who conduct their due diligence while buying the company’s stock take this as a sign of the company being financially healthy.

– Improvement in earnings per share

The company’s annual earnings are divided by a lower number of outstanding shares as it is reduced due to the stock buyback. This automatically increases the Earnings per share (EPS) of the company. Earnings per share are usually considered an essential component while purchasing the stock in the market.

– Elevating the company’s portfolio

Stock buyback leads to an increase in the company’s reputation. This can open many avenues for the company ranging from expansion, increased net income, and increased investment potential.

– Positive impact on shareholder value

A steady EPS portrays a company’s income-generating and growth potential for the shareholders. Since share buyback leads to a considerably increased EPS, it gives the shareholders a strong position in the stock market and benefits from the changed pricing.

How do buybacks benefit me as an investor?

The purpose of buyback or repurchase is to raise the company’s stock price, which shareholders gain indirectly. By removing the number of shares from circulation, the value of the remaining shares will increase. It may not always work out exactly that way in practice because on one hand, even before the company has purchased any shares, the announcement of a share repurchase program is enough to raise the stock. There might be some unfavorable news or a shift in the market during the process of repurchasing, which may trade lower. But over time, a share-repurchase program will raise the stock’s price. This is because buybacks generally improve some of the indicators that investors use to value a firm, not solely because of the reduced supply of shares.

What is the downside of a buyback?

Buybacks are usually intended to be bullish in nature for their stock prices, but there are reasons for concerns. After a period of success, when a company has plenty of cash, it is common for it to repurchase shares. This indicates that the corporation is repurchasing stock at a premium price. The company can end up buying its shares at a cyclical peak price, gaining a smaller stake, and having less liquidity on hand when business slows.

If the buyback is motivated by management’s desire to boost its value measures (or, simply put, to manipulate it), investors should act cautiously. For example, a firm that exploits buybacks to show rapid earnings per share growth may not be one worth investing in.

Methods of Buyback

Direct buyback

Many companies take up direct buyback of shares in India from their shareholders. This is one of the buyback of shares methods wherein the company negotiates share prices with some big shareholders and buys from such individuals. A company buys back shares from shareholders but there are several other transaction methods when it comes to buyback of shares in India. The other methods are below:

Open market

Shares need not necessarily be bought back from the individual shareholders. One of the buyback of shares methods is via the open market. The shares buyback is carried out over a lengthy period because usually a huge number of shares are bought. Also, the company can cancel the repurchase programme whenever it chooses to.

Fixed price tender offer

In this method of buyback of shares in India, the company approaches shareholders via a tender. Shareholders who wish to sell their shares can submit them to the company for sale. As the name suggests the price is fixed by the company and is over and above the prevailing market price. The tender offer is for a specific period and is generally a short time.

Dutch auction tender offer

This is much like the fixed price tender but instead of a price that the company allocates in the fixed price tender, here the company provides a range of prices that shareholders can pick. The minimum price of the stock is higher than the market price prevailing then.

The open market and fixed price tender are used more by companies.

What are the buyback modes available?

- – Companies could use free reserves for shares buyback. The capital redemption reserve account is one such that is maintained by a firm. The account deals with redeemable shares. When a company buys back shares from free reserves, the amount equal to share nominal value would need to be transferred to the capital redemption reserve.

- – Another mode of buyback is securities premium account. This is the additional money that has been gained when a company that sells shares over their fair value.

- – Companies cannot make use of any proceeds that have come through equity shares issuance to repurchase equity shares. Companies can use preference shares or proceeds from debenture issues to buy equity shares.

Buybacks in India

Tata Consultancy Services (TCS), Wipro, are a few companies that frequently engage in stock buybacks. In FY21, there were a total of 61 companies that offered to repurchase shares worth nearly Rs 40,000 crore. This was led by software companies, with TCS at Rs 16,000 crore and Wipro at Rs 9,500 crore.

Conclusion

Though most blue-chip companies buy back shares regularly, investors should do their due diligence well before making any investment. They should ideally watch out for companies that offer lucrative or expanded buybacks. Amateur investors could refer to the S&P 500 Buyback Index to identify companies that have been aggressively buying back their shares.

Stock buybacks are considered to be a definite way to build one’s net worth. To get a broader picture, investors should become more familiar with its impact on the company, share prices and future earnings.

If you would like to read more stock strategies like this one, you could start with an Angel One trading account!

Learn Free Stock Market Course Online at Smart Money with Angel One.