Global warming and climate change have now shifted the focus towards alternative energy sources and curbing of carbon emissions like never before. The notable sector that is pacing up its transformation towards green energy is the Automobile sector with the infusion of Electric Vehicles (EVs). With EVs emerging as the future of the industry, the automobile sector key players are investing billions in this emerging technology, governments are promoting EVs through various methods like offering benefits to buyers. After the Internal Combustion Engine, the increase in penetration of EVs is looking like a game-changing revolution in the field of automobiles. Do these signs of the potential market for EVs in the near future make it a good investment choice?

Read along to find the answer.

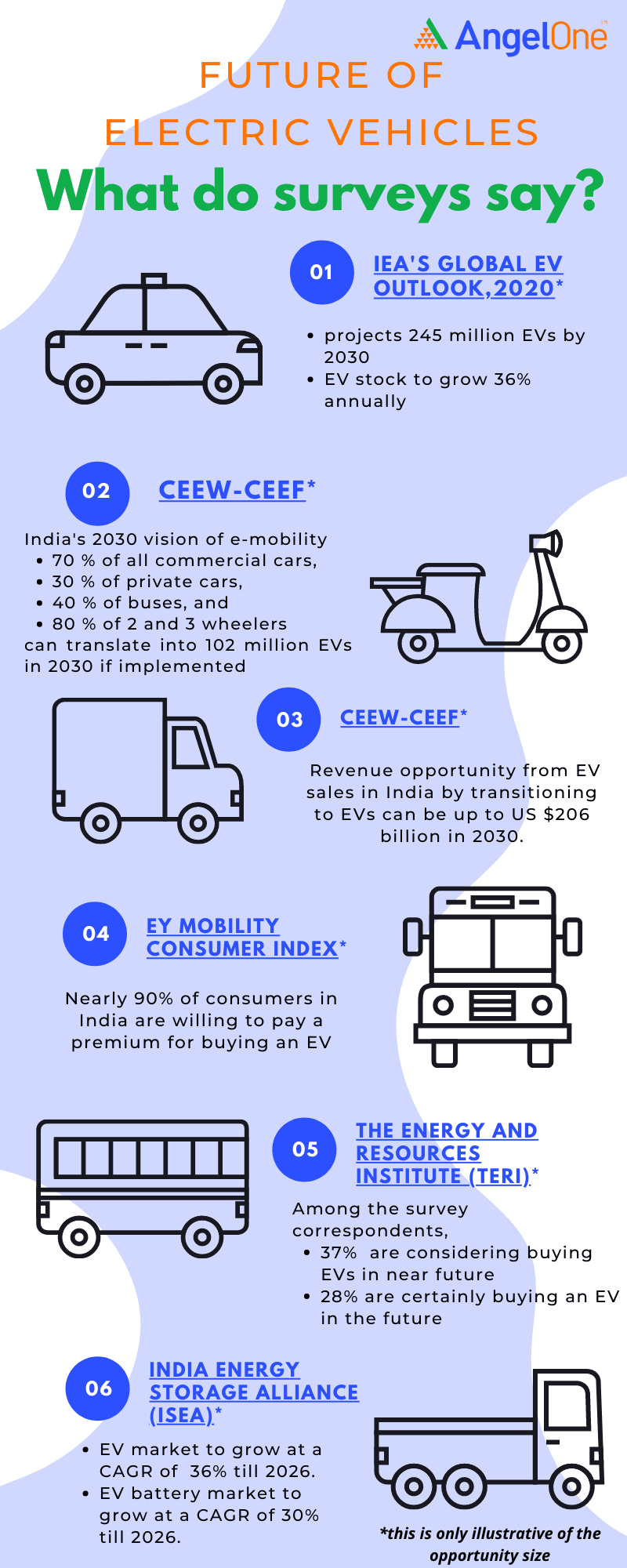

What do surveys say?

Several surveys have presented the opportunity sizes EVs hold for in the future, a few of them are illustrated below

Sources: 1. Global EV Outlook 2020, IEA 2.CEEW-CEF

3. CEEW-CEF 4. EY5. TERI 6. IESA

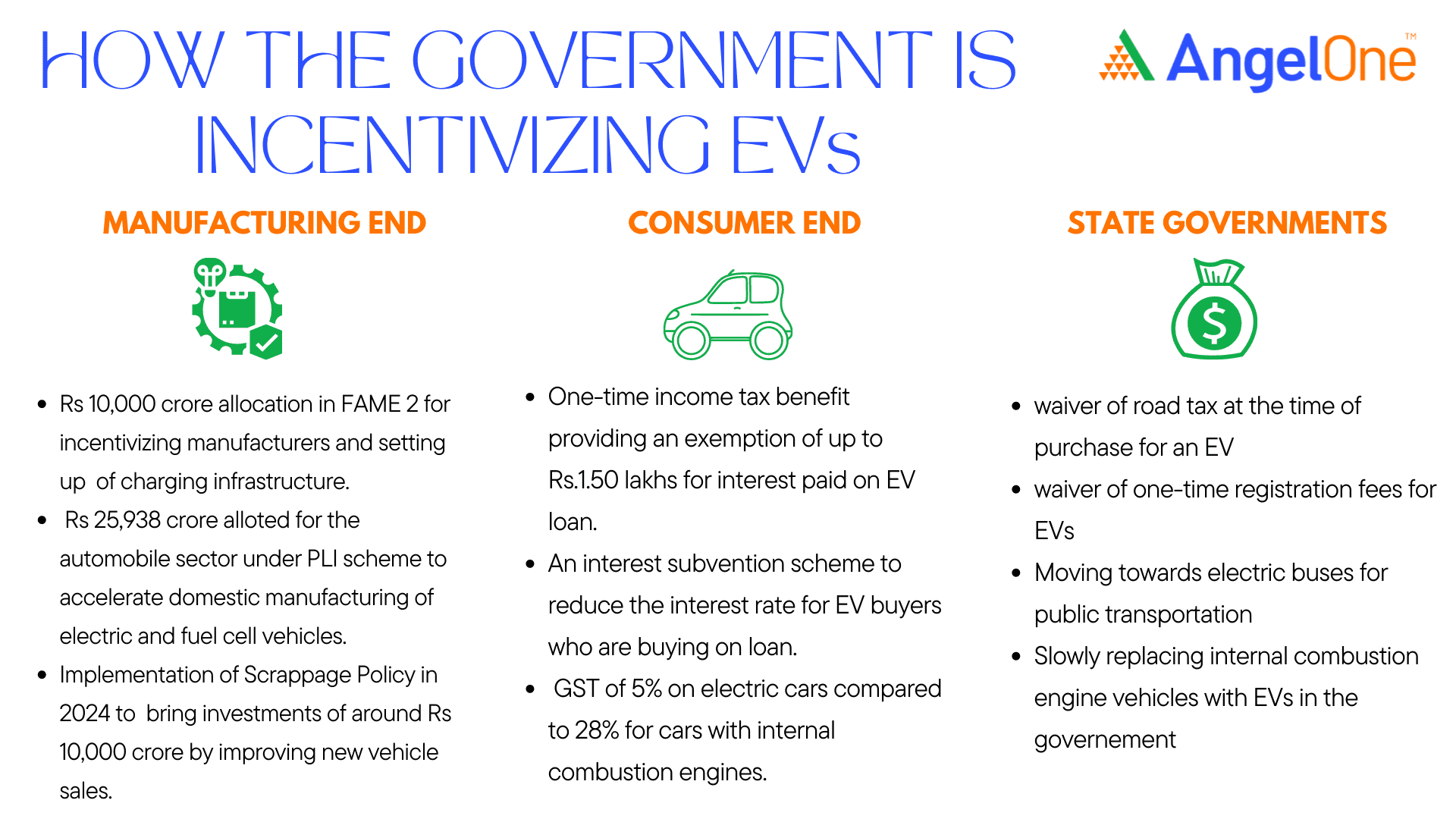

How the government is incentivizing the EV segment?

*source: BEEE

Conclusion

The rising demand to mitigate the rising global temperatures has led countries to take actions to curb carbon emissions. With the automobile sector being one-third of the contributor to carbon emissions, governments are leaving no stone unturned for faster adoption of EVs. On the other hand, the spiking prices of fuel in India have made people turn towards EVs. Crossing the 3 lakh mark, India hit the highest ever annual volumes in EVs in the year 2021 and more than doubled when compared to 2020.

Though at macro-level EV segment can be considered as a potential investment sector, we need to know that the implementation at micro-levels and various other factors play a key role. The growing trend of EVs strongly pushed by global climatic and political factors is giving a promising market capture of EVs in the coming days. Make wise investment choices by seizing the opportunities.

Disclaimer: This blog is exclusively for educational purposes and does not provide any advice/tips on investment or recommend buying and selling any stock.

Learn Free Stock Market Course Online at Smart Money with Angel One.