The Securities and Exchanges Board of India (SEBI) had announced under the circular SEBI/HO/MIRSD/RTAMB/CIR/P/2021/601 dated 23rd July, 2021 that all existing eligible Trading and Demat account holders shall provide a choice of nomination as per the option given in paragraph 2 above, on or before March 31, 2022, failing which the Trading and Demat accounts shall be frozen for debits.

However, they later extended the deadline whereby the provision of freezing of accounts would come into effect only after 30th September 2023(the deadline had earlier been extended to 31st March 2023 already, after which it has been further extended). Therefore, the deadline to add nominees to your Demat account currently stands at 30th September 2023.

Let us look at the process of adding a nominee to a Demat account.

What is the Demat account?

The Demat account is used in dematerializing or converting physical shares into an electronic format. The two organizations that are supposed to maintain every Demat accounts are:

- NSDL (National Security Depository Limited)

- CDSL (Central Depository Services Limited)

To know more about Demat accounts

Adding Nominees to Demat Account

Like in your bank’s savings account, you can add a nominee to your Demat account. You can authorise a person who will be a legal heir(s) of your investments in case of any unfortunate event whereby you cannot handle the account. The person authorised to own, benefit from and handle the account in such a situation is known as a nominee.

How many nominees can be appointed?

You can appoint a maximum of 3 nominees to your Demat account. Additionally, you can also assign percentages to each nominee in your account. For example, if you want to add three nominees, you can give 50% to nominee 1, 30% to nominee 2 and 20% to nominee 3, as per your preference.

Who can be a nominee?

Consider the below points while choosing your nominee(s).

1. Nominee can be your father, mother, spouse, siblings, children or any other individual. A minor can be added as a nominee, provided details of their guardian are also added

2. You can’t appoint non-individuals like a corporation, Karta of HUF, or the society as a nominee.

Process of Adding Nominees to Your Demat Account

The process of adding nominees to your Demat account can be both offline and online.

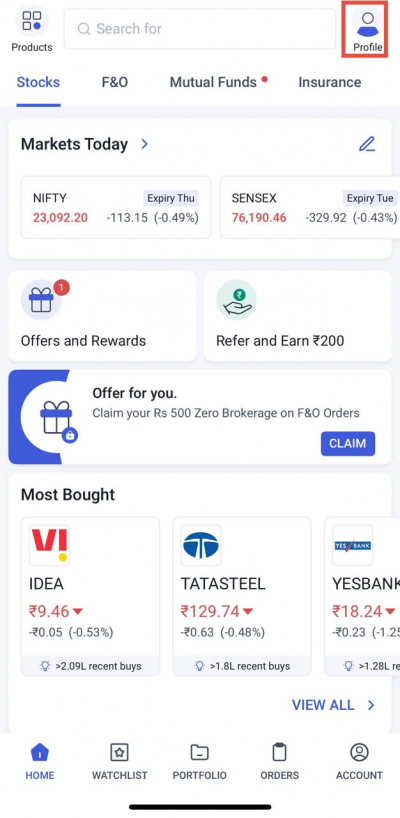

Online Process to Add Nominees via Angel One

Step 1: Accessing the “Update Nominee” option:

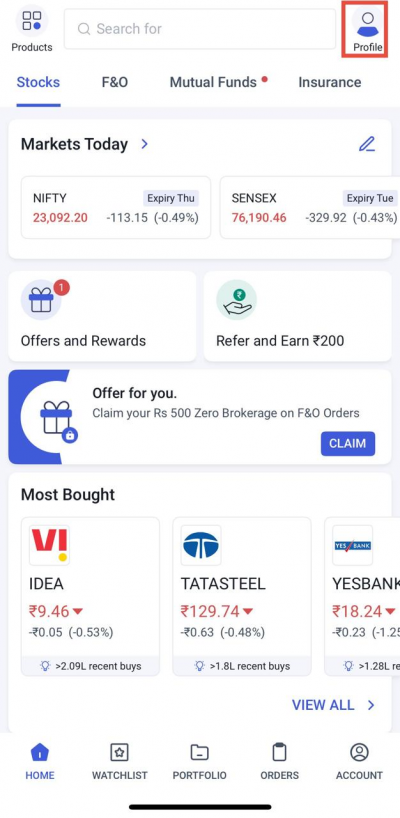

- Log in to the Angel One app, access the Profile section from the home page. Use your mobile number/client ID and OTP to login.

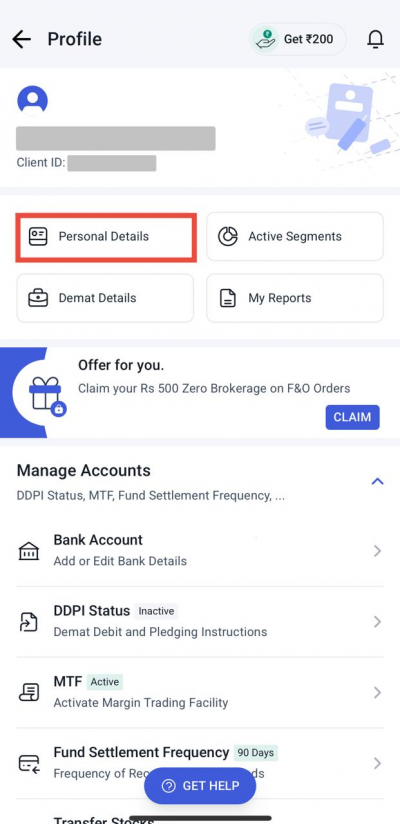

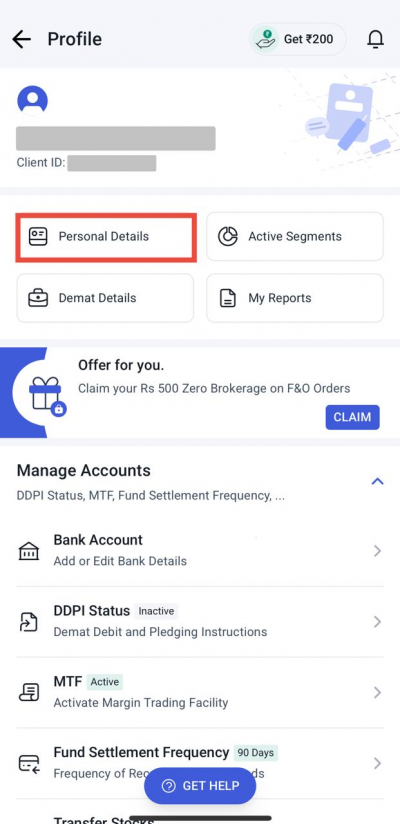

Step 2: Click on “Personal Details”.

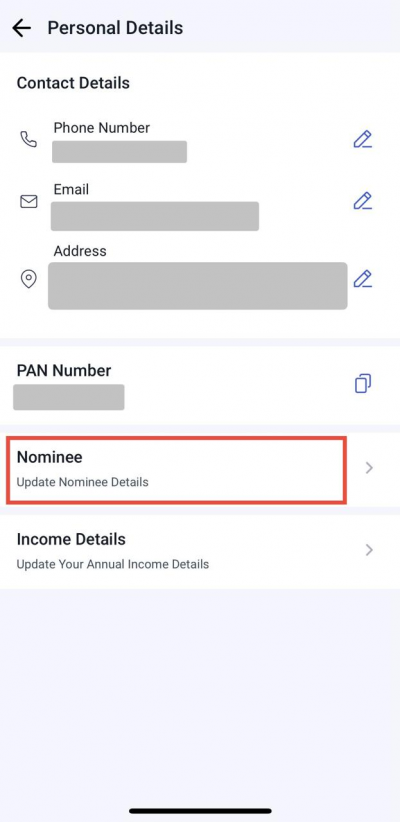

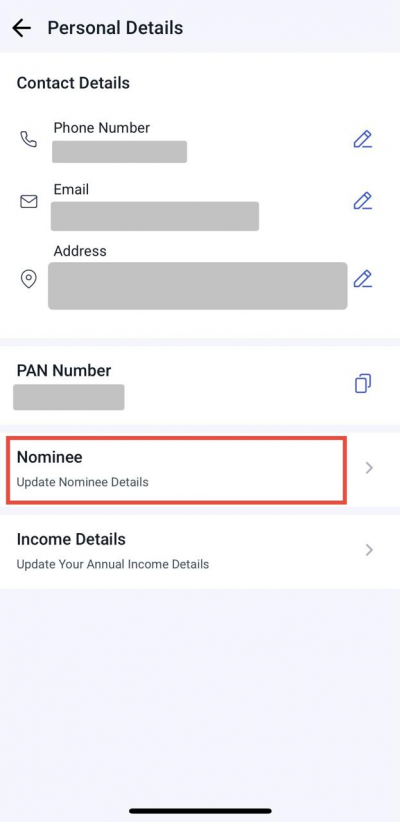

Step 3: Click on Nominee

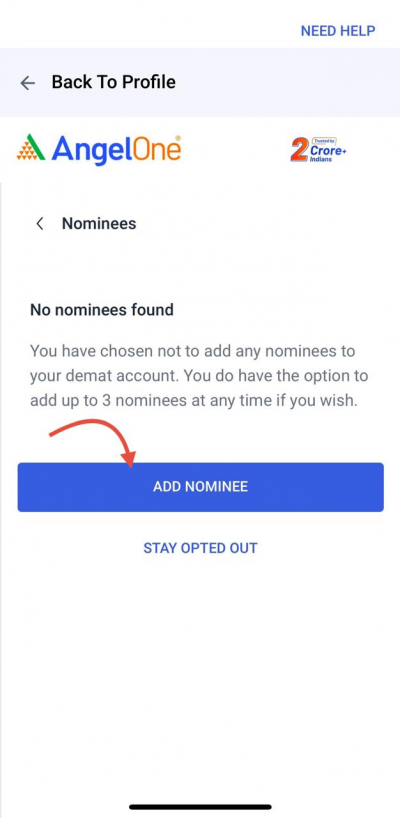

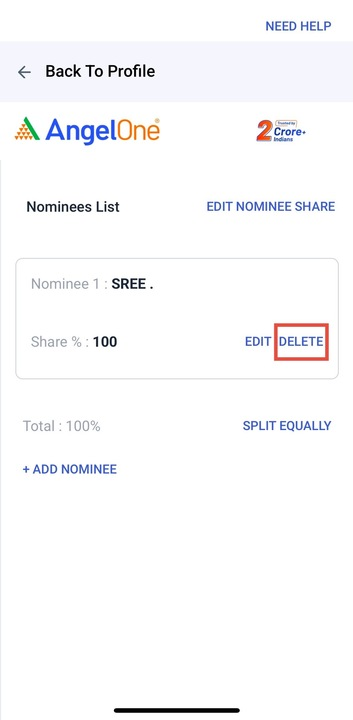

Step 4: Click on ‘Add Nominee’ and enter Nominee details.

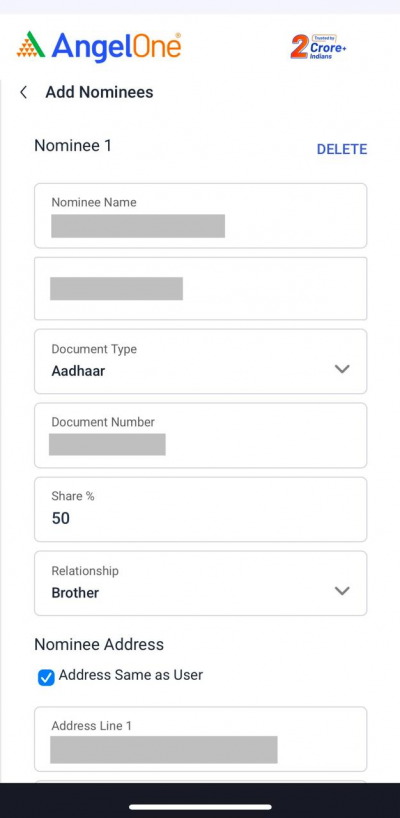

Step 5: A form to enter nominee details will appear. Please fill in all the required nominee information.

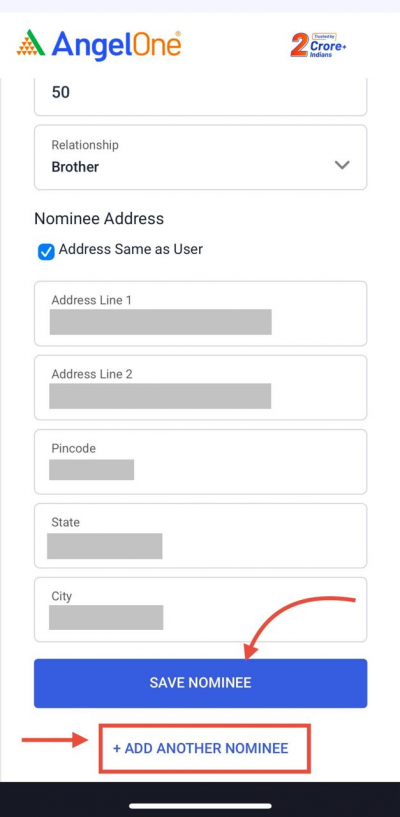

Step 6: After providing all the nominee details, click on “Save Nominee”. If you want to add more nominees, click on “Add another nominee”. You can add up to 3 nominees

- "If you are adding more than one nominee, ensure that the total percentage share across all nominations adds up to 100%

- If the nominee is a minor (under 18 years of age), you will also need to provide the guardian's details

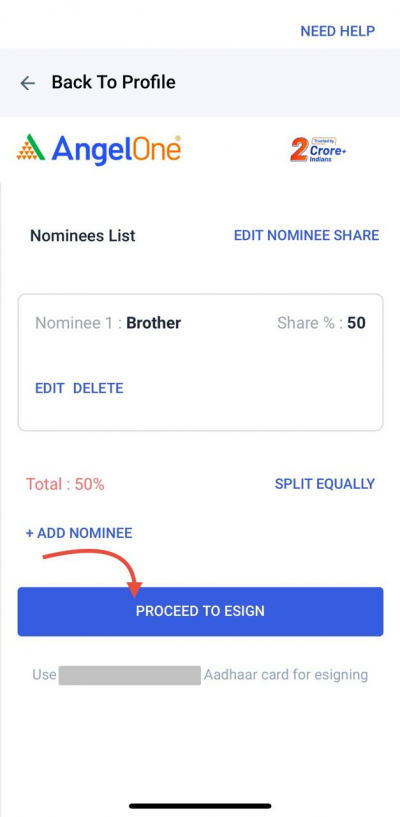

Step 7: Click on ‘Proceed to eSign’ to continue.

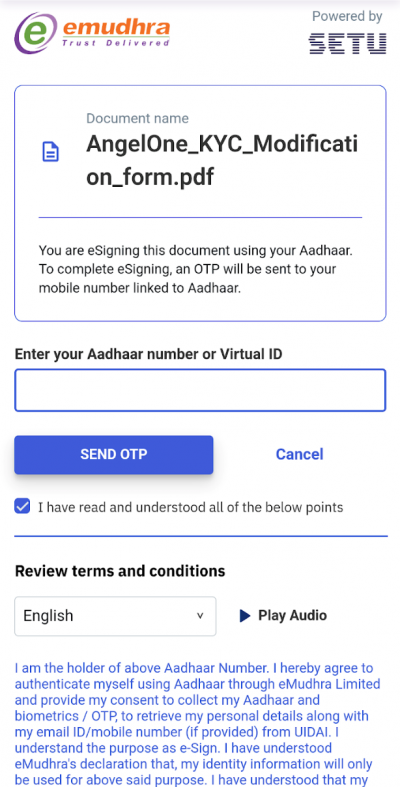

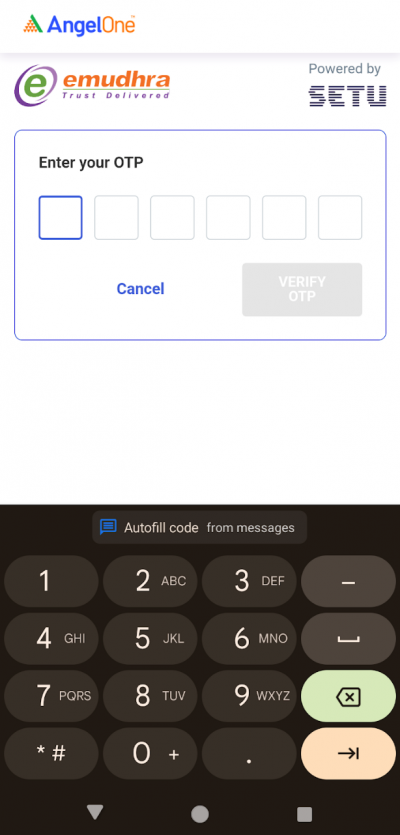

Step 8: You will be redirected for e-signing the request. Enter the Aadhar details & OTP sent on the mobile number linked to the Aadhaar card.

- Make sure to use your own Aadhar card for e-signing

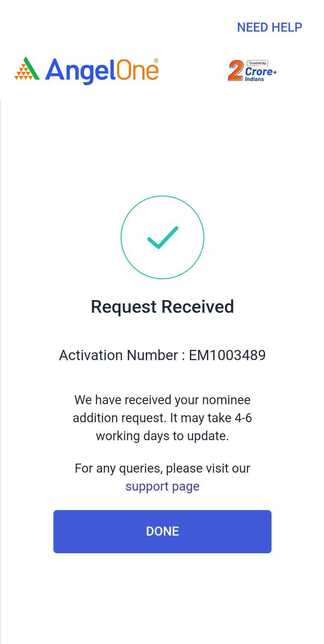

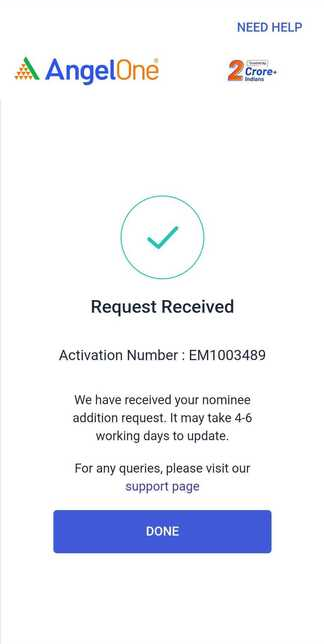

Step 9: The request will be processed in 4 - 6 working days.

How to delete a nominee?

Step 1: Accessing the “Update Nominee” option:

- Log in to the Angel One app, access the Profile section from the home page. Use your mobile number/client ID and OTP to login.

Step 2: Click on “Personal Details”.

Step 3: Click on Nominee

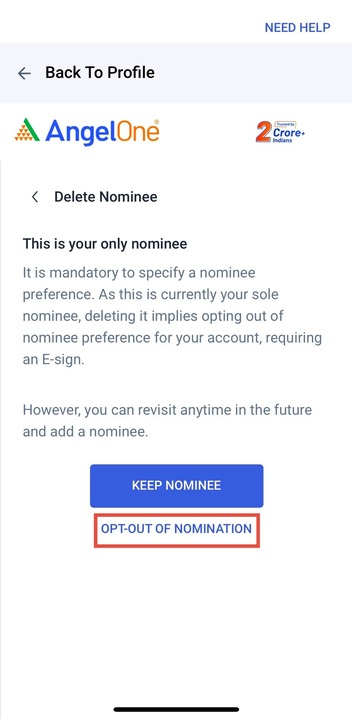

Step 4 : Delete Nominee

Step 5 : Select Opt - out of nominee option.

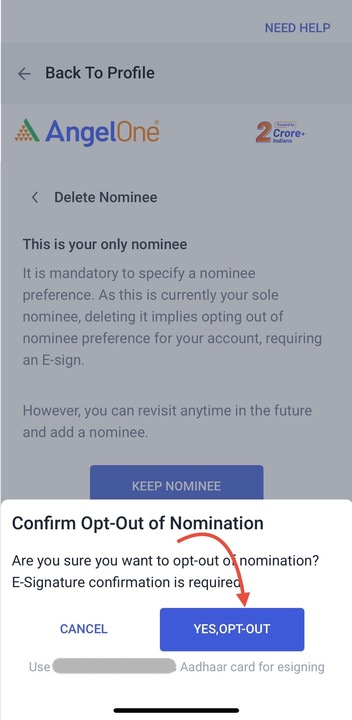

Step 6 : Select ‘Yes opt out’

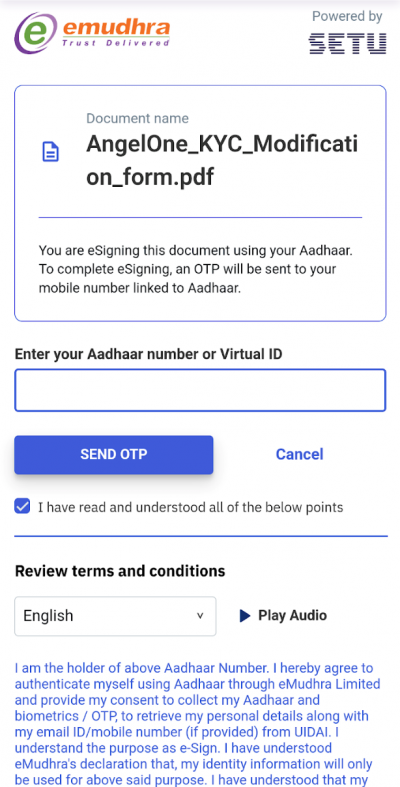

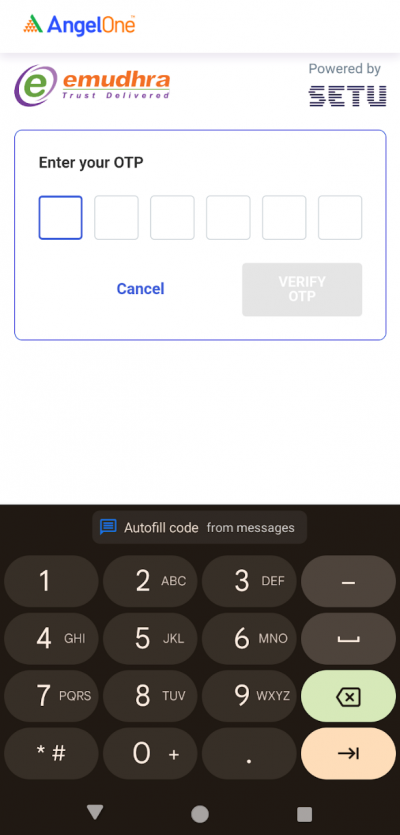

Step 7 : You will be redirected for e-signing the request. Enter the Aadhar details & OTP sent on the mobile number linked to the Aadhaar card.

- Make sure to use your own Aadhar card for e-signing

Step 8: The request will be processed in 4 - 6 working days.

Offline Process to Add Nominees

You have to fill in the form of nomination (with the account-related details and your physical signature) and courier it to the address of the head office of your broker (e.g.: Angel One) along with a copy of ID proof. When your Demat account nominee will be added, a similar nomination will even be applicable for all your assets under the Demat Account.

Switching a nominee for Demat account

The steps involved in replacing your Demat account nominee include the following:

- While switching a nominee you will have to pay charges of Rs. 25+18% GST.

- You also have to provide the nomination form’s hard copies along with the form of account modification.

Benefits of appointing a nominee

Below are some reasons to add a nominee to your Demat account:

- In case of an unpredicted incident, the presence of a nominee makes the transfer of securities held in a Demat account such as shares, bonds, mutual fund units, G-Secs, etc. easy

- Saves your family members from long-winded procedures (and legal battles) of collecting and submitting multiple documents like NOC (No Objection Certificate) and affidavits to the concerned authorities

Appointing a nominee can save a lot of trouble for you and your relatives in case of an untimely demise of a primary beneficiary. Generally, people select a nominee while opening their Demat account. If you haven’t already done so, you can also add a nominee later on by logging on to Angel One’s web portal.

Conclusion

Nominee helps to ensure a smooth transfer of your investments to your legal heir in the event of an unfortunate incident. It saves a lot of time and trouble for your family members and keeps them financially secure. If you are a new investor, add a nominee while completing the onboarding process. And in case you are an existing Demat account holder, click here to add nominee(s).

With the help of Angel One, you can easily open Demat account and start trading within 5 minutes. You can also visit the official website of Angel One to clear any queries you have with your Demat account.