There once was a time when trading and investing were considered an exclusive investment opportunities. However, with the introduction of online tools and platforms in the stock market, trading and investing have become accessible to everyone familiar with the internet and tech. To begin investing, all you need is a Demat account, trading account, an all-in-one stock market app like Angel One, time, and money. Before we proceed, let’s quickly recall what a Demat account is.

An account that holds all the investments made by you either in stocks, bonds, government securities, ETFs, mutual funds, and more in an electronic form is known as a Demat account. However, there are common misconceptions about a Demat account that we have addressed in the article, along with the facts behind them.

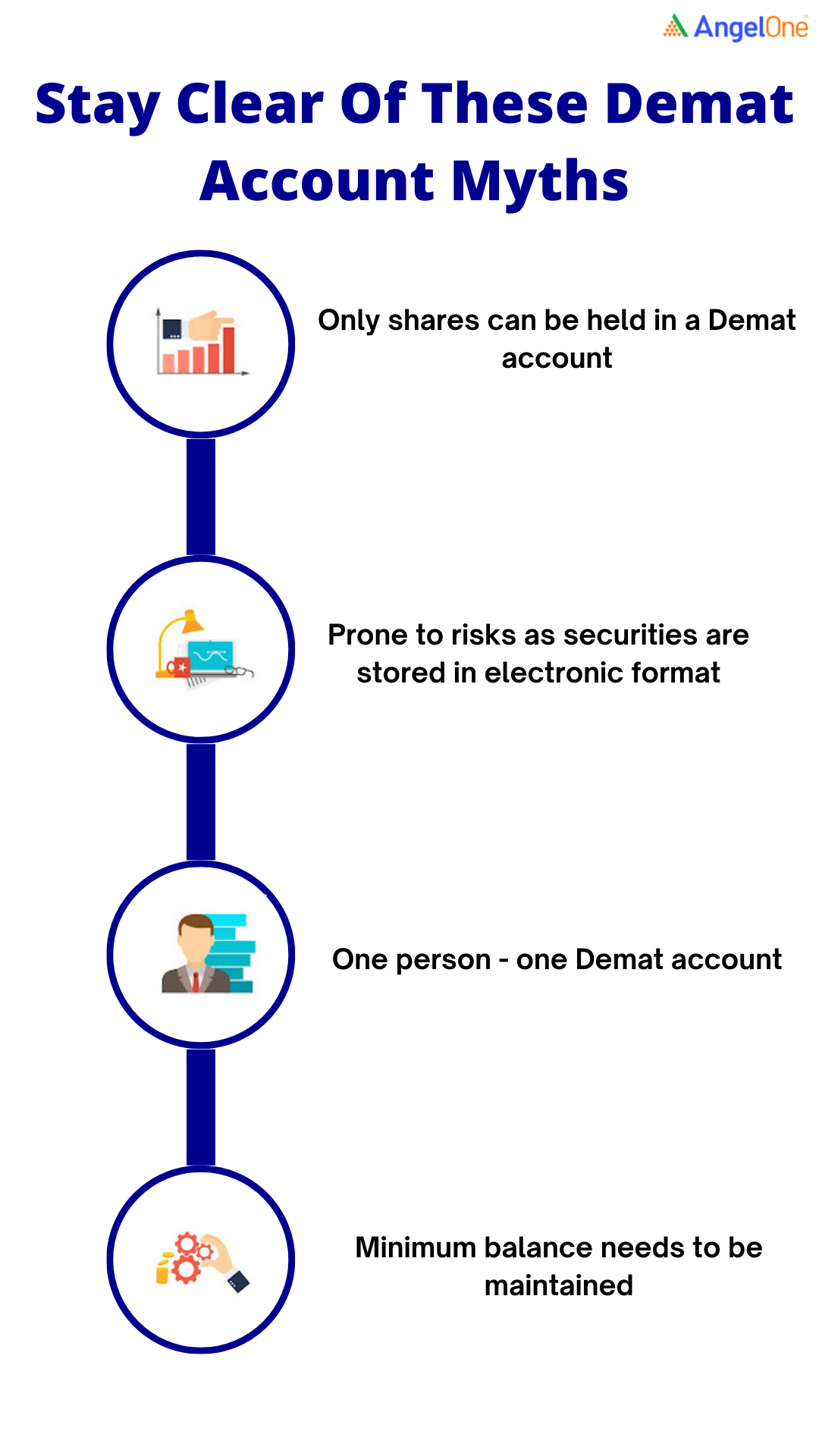

Myths about a Demat account

Myth 1: Only shares can be held in a Demat account

Most investors believe that the Demat account in India is meant to hold shares only, and no other securities can be held.

The fact is the Demat account can be used to hold a variety of securities. So whether you want to invest in stocks, mutual funds, government securities, ETFs, or bonds, the Demat account houses all your securities in one place.

Myth 2: Prone to risks as securities are stored in electronic format

People believe online trading can expose crucial information as it is easier to hack digital data. Thus, they tend to resist trading through online platforms.

However, one must know that trading through your Demat account is safe and secure. To protect investors’ interests, SEBI has mandated every broker to add robust firewalls to secure their trading activities. Apart from this, every broker has additional layers of security to keep your data secured. Regulatory bodies like SEBI, NSE, and BSE check the cyber security and resilience framework of brokers from time to time. This way, brokers and regulators work together to protect your data and transaction details.

Myth 3: One person - one Demat account

Many investors are under the impression that they cannot create multiple Demat accounts and can only run a single account.

However, this is not true. The regulatory body has not set any limitations on the number of Demat accounts a person can open. Traders can create Demat accounts with different depositories like NSDL and CDSL using a single PAN card. In case SEBI wants to review your account, they can do so using your PAN number linked to Demat accounts.

Myth 4: Minimum balance needs to be maintained

Investors presume that, just like savings accounts, they need to keep a minimum balance in their Demat account as well to keep it functional.

On the contrary, the fact is, you don’t need to maintain a minimum balance in your account. Even if your Demat account has zero balance, it will continue to be functional, and it is not mandatory to hold investments in your account at all times.

Conclusion

There is a lot of misinformation about the Demat account and how it works. Now that we have busted these myths about the Demat account, you can start investing without any false information misleading you. However, the initial step to starting investing is opening a Demat account and a trading account. With Angel One, you can open a Demat account as well as an all-in-one trading account allowing you to trade in multiple securities from the comfort of your home.

Disclaimer: This blog is exclusively for educational purposes.