The introduction of UPI (Unified Payment Interface) has changed the landscape of banking in India. Since its advent, UPI’s popularity is growing every year and has grown into a popular mode of fund transfer crossing the $1 trillion*1 mark in FY 21-22 (source: NPCI). The quick hassle-free process of money transfer at the fingertips has made investment and trading in the stock market feasible like never before. The feature of UPI was only available for internet-enabled smartphones till now. With the introduction of UPI123PAY by RBI ( Reserve Bank of India) for feature phones*, 400 million more people ( source: RBI) will now have the opportunity for easy and quick payment service.

(* A feature phone is an earlier generation mobile phone that has press-button based inputs, a small non-touch display with limited set of functions and not extensive as internet enabled smartphones)

Let’s see what are the features of UPI123PAY and how to use it. Before diving into the details of UPI123PAY, let us sneak peek into the basics of UPI.

What is UPI?

Developed by the National Payments Corporation of India (NPCI), Unified Payment Interface or UPI is a real-time, single-window payment interface that allows you to transfer funds from one bank account to another or make merchant payments in one hood. Click here to learn more about how UPI works.

Features of UPI

- Immediate money transfer through mobile device round the clock 24*7 and 365 days.

- With one mobile application different bank accounts can be accessed

- Aligned with the Regulatory guidelines, provides a very strong authentication feature along with seamless payment at your fingertips

- Best answer to Cash on Delivery hassle, running to an ATM or rendering exact amount.

- Merchant Payment with Single Application or In-App Payments.

- Utility Bill Payments, Over the Counter Payments, QR Code (Scan and Pay) based payments

- Virtual Payment Address (VPA) of the customer for incremental security with customer not required to enter the details such as card number or account number for any fund transaction.

What is UPI123PAY?

UPI was only accessible to internet-enabled smartphone users. So, the Reserve Bank of India (RBI) launched UPI123Pay to allow feature phone users to make payments through a unified payments interface (UPI). The feature will also allow users to make UPI payments without the internet on their feature phones.

How does UPI work on feature phones?

You need to create a UPI ID to use the UPI123PAY service on your feature phone. To create a UPI ID on phone,

- Dial *99#, choose your bank name

- Enter the last six digits of your debit card and your card expiry number.

- After this is done, you will be asked to set up your UPI pin.

Once the UPI pin is set, your UPI id will get activated.

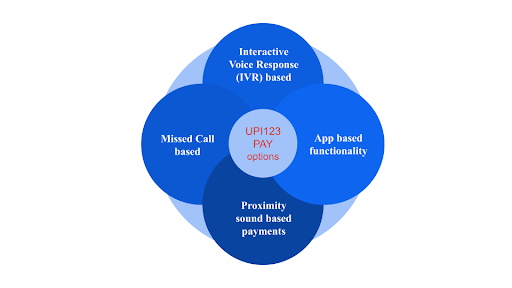

UPI123Pay includes 4 options:

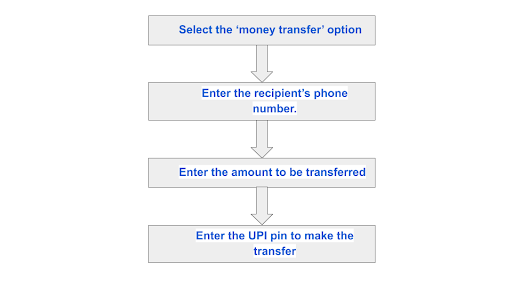

How to make IVR-based payments?

- To make payments, you will have to call an IVR number ‘080 4516 3666’

- Select the relevant payment option among money transfer, LPG gas refill, Fastag recharge, mobile recharge, EMI payment, balance check and more.

For example to transfer the money to a peer,

How to make missed call-based payments?

For missed call-based payments, you have to give a missed call on the number given to you by the merchant/shopkeeper. The number acts as the ID for the said merchant. A pop-up will appear on the phone screen, just like in other payment modes, asking you to add the amount to be transferred and confirm the payments by adding the UPI pin.

How does app-based functionality work?

Like in smartphones, an app will be available on feature phones that have several UPI functions.

How do sound-based payments work?

In this case, you will be allowed to make sound-based payments by tapping your phone on the sound-based payments device.

After tapping the device, you have to enter the amount to be transferred and validate the transaction with the UPI pin.

By making UPI available for feature phones, RBI has made banking services accessible at the fingertips of all those people who were left out of the benefits of UPI. UPI123PAY is also available in several Indian languages. The potential to deepen the digital ecosystem and financial inclusion in India has been enhanced with the launch of this initiative opening more banking possibilities for people.

Disclaimer: This blog is exclusively for educational purposes.