Since the pandemic, various sectoral indices of NSE have seen major ups and downs. Sectors like healthcare and IT out-performed once the market understood the situation, while few others lagged. However, some sectors which had not recovered after the negative impact of the pandemic have made a major comeback as well. In this article, we will discuss the top-performing sectors of the Indian stock market, particularly since the start of 2022.

Performance of various sectoral indices of NSE

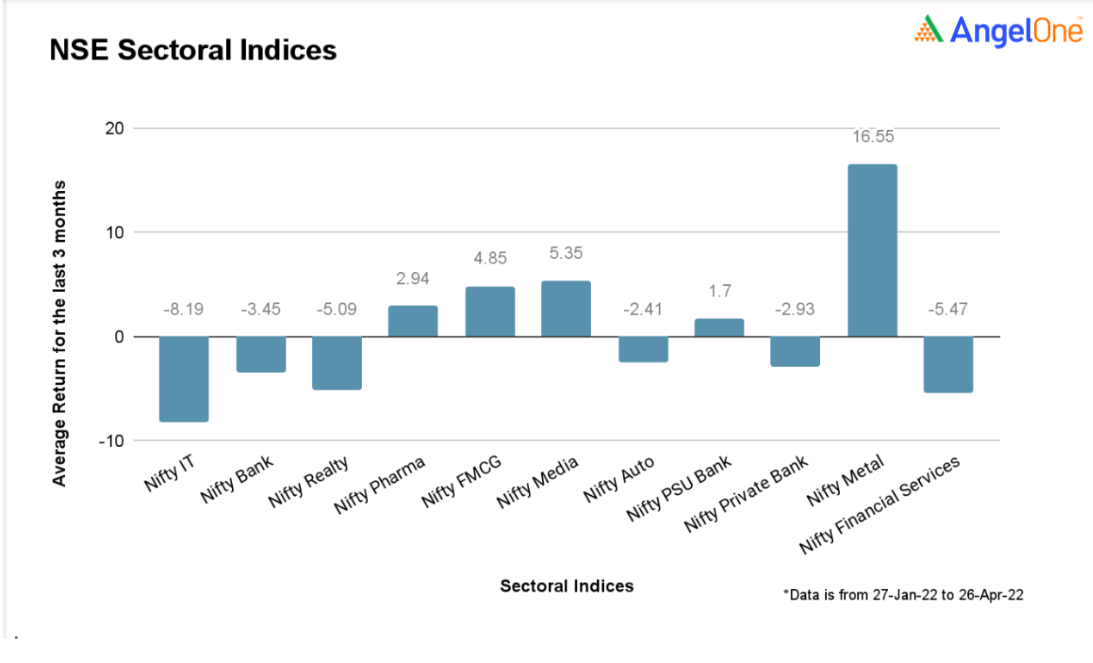

Take a look at the average performance of various sectors for the last 3 months as on 26-Apr-22.

Source: NSE

From the above statistics, we can determine that the sectors which are currently performing are Metal, Media, Pharma, and FMCG.

Top-performing sectors of the Indian stock market

Let’s dig deeper so as to understand the probable reasons behind the positive performance of the top 3 sectors.

- Metal Sector

If we talk about recent performance, the metal sector is the talk of the town. Amongst the various industries under this sector, steel is one of the core industries that contribute to its growth. The major reason for the rally in the metal sectors is the rise in the prices of steel arising due to the war between Russia and Ukraine, which are one of the largest suppliers of steel in Europe.

The above-mentioned reason has added pressure on the already stretched supply chains and has led to an increase in input prices (for materials like iron ore and coal). Discipline maintained by the industry, post the consolidation phase (which started to gather steam in 2018), has aided them in passing most of the increase in input costs. Apart from this, higher global prices with the recent turn of events have aided their volumes due to the absorption of volumes in exports. The top gainers for NIFTY Metal as on 26-Apr-22 are as below.

-

Scrip Name* Weightage in metal index (in %)

Closing Price as on 27-Jan-22 (in ₹)

Closing Price as on 26-Apr-22 (in ₹)

Gain (in %)

Vedanta Limited 10.04 328.20 411.60 25.41 Jindal Steel 15.49 626.10 721.20 15.19 Tata Steel 22.59 1088.35 1233.60 13.34

Source: NSE

*The securities quoted are exemplary and are not recommendatory.

- Media and Entertainment Sector

The media and entertainment sector acts as an umbrella sector for numerous sub-sectors such as television, films, radio, publishing, internet, advertising, music, and gaming. As per the Federation of Indian Chambers of Commerce and Industry (FICCI), the industry has been achieving new milestones and is growing at the rate of 12% CAGR. (Source: FICCI) All these sectors have expanded and grown in the recent past and are making noticeable progress in establishing their importance at the global level. A few of the common reasons for the rally in this sector are:

- The companies like PVR and Inox have merged in order to expand their business

- A few of the companies have also entered the OTT space in order to attract more consumers by offering them quality content at their fingertips

- Reopening of theaters along with the release of multiple hit films helped the industry gain the momentum again

- Pharmaceutical Sector

We all are familiar that India is a significant player in the global pharmaceutical industry by supplying healthcare products to over 200+ countries. It was one of the most successful industries in the post-pandemic era and it is expected to thrive in the future as well. Below-mentioned are a few of the reasons behind the growth of the pharmaceutical sector:

- Rising demands for new life-saving medications, immunity-boosters, and more healthcare products

- Better opportunities and advanced technology for research and innovation

- Launch of government schemes to promote domestic production of medicines

Apart from the above, the below sector is also witnessing major growth in the Indian stock market.

Paper Industry

One of the major reasons for the up move in the paper stocks is the reopening of educational institutes, schools, and offices which would increase the demand for paper. Moreover, increase in the price of chemicals, lower newsprint, waste paper collections, and pulp shortage along with higher transportation costs have compelled paper producers (printer paper as well as Kraft/Duplex) to undertake price hikes amidst stronger demand from the above-mentioned end-users as well as demand from FMCG. Moreover, supply shortages are aiding price hike absorption.

Conclusion

Some of the fast and consistently growing sectors for the long-term in India are technology-driven like Media, IT, and more. Apart from these, FMCG, pharmaceutical, and paper industries are also expected to rise in the future. Being a smart investor, it is imperative to understand that not every growing sector may give you good returns. All you have to do is do your research before investing and allocate your funds wisely in multiple sectors to balance and diversify your portfolio.

Explore the Share Market Prices Today

| IRFC share price | Suzlon share price |

| IREDA share price | Tata Motors share price |

| Yes Bank share price | HDFC Bank share price |

| NHPC share price | RVNL share price |

| SBI share price | Tata Power share price |

Disclaimer:

- Please note that the above statistics are for the last 3 months as on 26-Apr-22 and the performance of the sector may change at any time.

- This blog is exclusively for educational purposes.