The acronym FAANG is used to refer to five of the most well-known and successful technology companies in the world: Facebook, Amazon, Apple, Netflix, and Google (now Alphabet). These companies have come to dominate the tech industry over the past decade, with their products and services being used by billions of people worldwide. Five of the top technology firms listed on the American Stock Exchange have consistently provided returns for many years as they grow and expand their operations.

Earlier the acronym was FANG, and then Apple entered the club in 2017, hence it’s FAANG now. The companies in the acronym FAANG are still regarded as such even though Google is now Alphabet and Facebook is now Meta. In late 2021, the market capitalization of the FAANG companies as a whole exceeded $7 trillion.

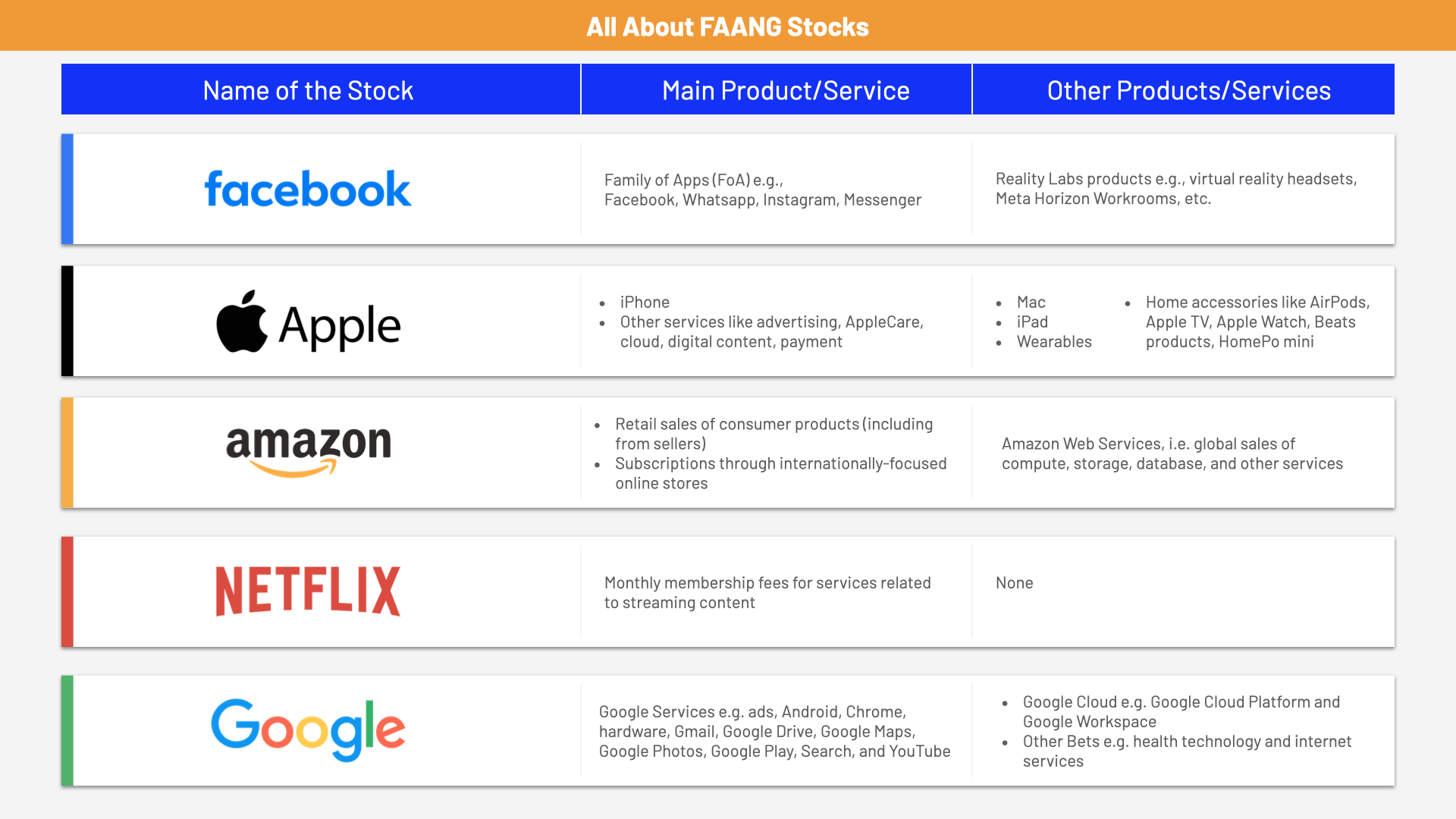

List of FAANG stocks

The acronym FANMAG refers to the FAANG company group, which consists of the stocks of Facebook, Amazon, Apple, Netflix, and Google as well as Microsoft on occasion. The FAANG companies made up 19% of the S&P 500, which is used as a proxy for the US economy as a whole.

The weight of FAANG companies in the NASDAQ 100 is one-third of the total index, or close to 33%. Each of the FAANG firms had the following weights in the index as of November 27, 2021:

Facebook (Now Meta) - 3.43%

Amazon - 7.66%

Apple - 11.31%

Netflix - 1.87%

Google (Now Alphabet) - 7.69%

The Google stock is divided into two stock classes, the first is GOOG and the second has the stock symbol GOOGL.

Brief description of FAANG stocks

Facebook:

Facebook is a well-known social networking website that was founded by Mark Zuckerberg in 2004. Facebook enables users to connect with friends and family, share updates and pictures, and participate in groups and events. It has over 2.8 billion monthly active users. The company is one of the most powerful players in the social media and technology sectors because it also controls Instagram, WhatsApp, and Oculus VR.

Amazon:

Jeff Bezos established Amazon in 1994 as an online bookstore, but it rapidly grew to become the world's largest e-commerce platform. With a significant global presence, Amazon offers everything from books to groceries to electronics. The business also provides subscription services like Amazon Prime, which gives free shipping, movie and TV show streaming, and other benefits.

Apple:

In 1976, Ronald Wayne, Steve Wozniak, and Steve Jobs founded the electronics company Apple. Its hardware offerings, such as the iPhone, iPad, and Mac laptops, are what are most well-known. Apple has software products like the iOS and macOS operating systems in addition to services like the App Store, iTunes, and Apple Music. Apple is a brand which is respected in many dimensions, and has a valuation of $2 Trillion.

Netflix:

The way people enjoy entertainment has been revolutionised by Netflix, an online streaming service that was founded in 1997 by Reed Hastings and Marc Randolph. Netflix has more than 200 million subscribers globally and has a sizable selection of films, TV shows, and original content. Nowadays, people prefer to stream Netflix rather than sitting in front of TV. This is the revolution brought by Netflix.

Google (Alphabet):

Google is a search engine that was founded in 1998 by Larry Page and Sergey Brin. Gmail, Google Drive, and a number of work tools are now part of Google's growing list of available products (Google Docs, Sheets, and Slides). The company restructured and formed Alphabet in 2015, which is now the parent company of Google and several other subsidiaries.

Together, the FAANG stocks have had a significant impact on the tech industry and the world at large. They have transformed the way people communicate, shop, consume entertainment, and access information. The companies are also known for their high levels of innovation, with each one pushing the boundaries of what is possible in their respective fields. As the tech industry continues to evolve, it will be interesting to see how the FAANG stocks adapt and whether new players will emerge to challenge their dominance.

Investing in FAANG stocks.

A great method to get exposure to the technology industry and possibly profit from these companies' growth is by investing in FAANG stocks. Nevertheless, it's critical to realise that buying individual stocks can be risky and that past success does not ensure future outcomes.

One way to invest in FAANG stocks is through an exchange-traded fund (ETF) that tracks these companies' performance. For example, the Invesco QQQ ETF (QQQ) tracks the performance of the NASDAQ-100 Index, which includes Apple, Amazon, Facebook, and Google.

Final Words

If you want to invest in FAANG or other stocks, open Demat account with Angel One and start building your wealth.