While investing there are many parameters we analyse. Some are quantitative and few are qualitative as well. And one important parameter to analyse is shares pledged by the promoters. Though the concept is not new, the impact it made on few of the listed entities had taken the investors by surprise. Rather there was an example set for investors as one scrip (Then known as Akruti – now Hubtown) had to witness intense price volatility for three months of F&O Cycle. While we would discuss the same example in detail, let’s first understand what a share pledge is and how it impacts the shareholders.

Understanding Share Pledge Meaning

The world of finance looks very complex, especially with the kind of jargon used in the financial domain. And similar is the scenario with layman when it comes to understand the Share Pledge meaning. Here we try to make it simple for our readers so as to understand - what is a share pledge? Pledging of shares or share pledge in simple terms is – taking a loan against the shares one owns. Investment in equity shares is considered as an asset and based on prescribed norms and regulations; one can take a loan against such assets. When promoters of the company take loan against their holding – it is called a share pledge by promoter.

The basic question that arises here is – why share pledge by promoters happen? Then the purpose would be anything – May be for personal use, company working capital requirements, funding some additional ventures or in case of some acquisitions. This clearly indicates that the pledge could be for use of funds for the company or even for personal usage. Important factor here is to understand the purpose behind the share pledge by promoters.

Reasons behind the share Pledging

As stated earlier, pledging by promoters could be for personal usage or even company use. However it is considered as a last resort to raise funds when most of the other fundraising options are almost closed. When does such a scenario occur? It usually occurs during the economic meltdowns or when the company is facing tighter liquidity issues and not generating enough cash.

As regards the source of such funds for promoters, Non-banking financial institutions are more active than banks in providing such loans. Sometimes, promoters collateralize their shares for converting warrants into shares. Also, they might find share prices in the secondary market quite lucrative for fresh purchase and adopt this route for garnering funds for the consideration to be paid for the open market purchase. So there are lots of reasons behind share pledge by promoters.

But if we speak about our view on the pledging of shares, we opine – share pledge by promoters is not a good sign.

How the Shares pledge would impact the shareholders?

While we understood the share pledge meaning, One would think if the promoters are taking loan for company or personal usage, there is hardly any impact on the company P&L, how would that impact the shareholders of the company. Let’s understand the same in detail.

First and foremost factor is – shares pledged won’t get the promoters the loan at current market price. Based on the regulations there is a percentage of current value that is provided as loan amount. In simple manner if the shares are trading at Rs 100 per share, based on different parameters loans up to 50 -60 percent of value are provided.

| Share Price (Rs) | Shares | Current Value (Rs) | Pledged Value (Rs)(60%) | Pledged Value (Rs) (70%) |

| 100 | 1000 | 1,00,000 | 60,000 | 70,000 |

This cut in loan is on account of the volatility that is witnessed in the share price. This safeguards the lending institutions interest. There is a trigger price mentioned in the pledge agreement. Like if the share price declines to Rs 60 per share the lending institution would either ask the promoters to pledge more shares to act as a safety net. If the promoter is unable to provide more security or shares the lending institution would sell the shares pledged with them in open market.

This in simple terms means – There are no worried investors in Bull Market as the stock prices move northwards and the share pledge by promoters is not triggered. However if the stock price declines and minimum value prescribed doe not met up by the promoters, the institution starts selling those pledged shares in open market. This minimum collateral value is agreed upon in the contract between the lenders and the promoters. Hence, it gives the right to the lender to sell the pledged shares, if the value falls below the minimum value. Moreover, pledging of shares can create a disaster if the share price continues to fall. This is because the promoters have to consistently pledge more shares to cover up the difference in the collateral value.

As and when the institution starts selling in the open market – they sell in chunk and hence significant selling appears. As such selling occur even the retail investors sell in panic. Another factor is, as the institutions sell the pledged shares, promoters holding in the company declines and this is considered as a negative in long Term. This decline in shareholding may affect the voting power of the promoters as they are holding fewer shares now and their ability to make crucial decisions. In the past there are various examples when the stock prices witnessed steep decline and eroded investor wealth. So after understanding the share pledge meaning and its impact on the retail shareholders, it would be considered that share pledge by promoters is only a negative aspect.

Here there is another factor that emerges is not all pledging of shares is considered negative. It actually depends on the percentage of the promoters holding being pledged. This leads us to question, where to find the percentage of pledged shares?

After the significant issues faced by the retail investors and promoters were not providing data about pledged shares, SEBI made it mandatory to mention the pledging data in shareholding patterns and even in quarterly results.

The first and the simple way to find out the pledged data is to visit the BSE India website (www.bseindia.com) and at the right hand upper corner put the name of the company in Get Quote column.

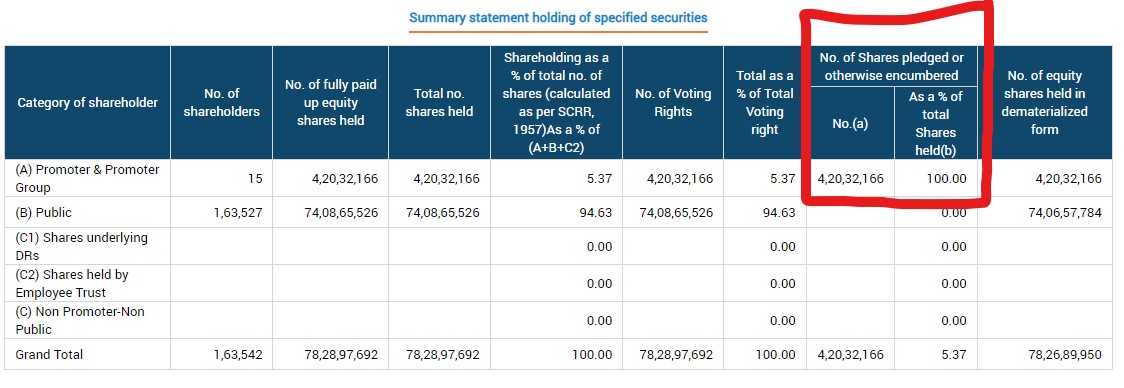

Place the company name and then the complete data points are visible. In those data points select the Shareholding pattern of the company. In that window the pledged shares data is given. Following image shows where the data is provided. In example given below, promoters have pledged 100 percent of their shares.

Data on pledged shares or pledging by promoters is also available in the quarterly results announced by the company. Here there are two important factors: first is to check the percent of shares pledged as a part of promoters holding.

Let’s now understand the share pledge meaning with an example. If there are 1 crore equity shares and promoters hold 60 percent of that. Means promoters have 60 lakh shares with them. Now suppose they pledge 15 lakh shares then the pledge percentage as part of promoters holding is 25 percent and total shares would be 15 percent. Usually any pledge is considered negative as this is considered as a last resort of funds for the company. However, as a rule, if the companies have more than 50 percent promoters holding under pledge – it should be looked at with a cautious approach. Further the annual report provides details of such agreements and it is important to read those details.

While in Part 1 here we understood the share pledge meaning and its impact on the retail shareholders, in Part 2 we would discuss how a company share was taken for a ride on account of Share Pledging - not only in the cash market but also in the F&O segment. Further we would understand what is meant by revocation.