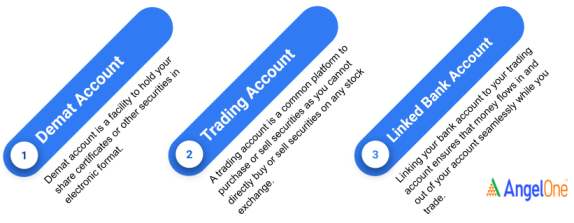

The year 2021 witnessed an unbelievable spike in new retail investors' participation in the capital market. As more and more people are interested in investing in the share market, we thought we should let the newbies know the necessary prerequisites for trading to prepare them for their full-fledged entry into the market. Here we give you a tour of the essentials to begin your trading journey. The three must-have accounts Demat AccountDemat account, short of Dematerialized account is a facility to hold your share certificates or other securities in electronic format. So, when you buy shares or securities from the market, your ownership of the shares or securities is reflected in the electronic format in your demat account. Trading Account So, a Demat account is a must to hold the securities you buy. To buy and sell shares, you need a trading account. A trading account is a common platform to purchase or sell securities. You can open a trading account with a registered broker as you cannot directly buy or sell securities on any stock exchange. To open a trading account with a registered broker, either you need to link your existing Demat account with your trading account or you can open a new Demat account. Linked Bank Account As you are choosing to invest in the securities market, you will be buying and selling securities over time through your trading account. Linking your bank account to your trading account ensures that money flows in and out of your account seamlessly while you trade. Linking a bank account is mandated by the regulator SEBI to bring transparency in trading. So, securities are purchased through a trading account, held in a Demat account, and payments are done through the linked bank account. A registered broker like Angel One will help you open a Demat account with a Depository Participant completing the formalities on your behalf while you open a trading account with them. Presuming that opening a bank account is not new for you, we will directly get into the essentials for opening a Demat Account and Trading Account.

Demat AccountDemat account, short of Dematerialized account is a facility to hold your share certificates or other securities in electronic format. So, when you buy shares or securities from the market, your ownership of the shares or securities is reflected in the electronic format in your demat account. Trading Account So, a Demat account is a must to hold the securities you buy. To buy and sell shares, you need a trading account. A trading account is a common platform to purchase or sell securities. You can open a trading account with a registered broker as you cannot directly buy or sell securities on any stock exchange. To open a trading account with a registered broker, either you need to link your existing Demat account with your trading account or you can open a new Demat account. Linked Bank Account As you are choosing to invest in the securities market, you will be buying and selling securities over time through your trading account. Linking your bank account to your trading account ensures that money flows in and out of your account seamlessly while you trade. Linking a bank account is mandated by the regulator SEBI to bring transparency in trading. So, securities are purchased through a trading account, held in a Demat account, and payments are done through the linked bank account. A registered broker like Angel One will help you open a Demat account with a Depository Participant completing the formalities on your behalf while you open a trading account with them. Presuming that opening a bank account is not new for you, we will directly get into the essentials for opening a Demat Account and Trading Account.

- Age

We all know that age is an eligibility criterion for many things. How about investing in the stock market? Though there is no minimum age limit to invest in the stock market, if you are below 18 years of age, a Demat account can only be opened in a minor’s name by the parents or the appointed guardian after submitting their respective documents. The parents or the guardians will be in charge of the account until you attain the age of 18.

- PAN

To do any financial transaction in India, you must have a Permanent Account Number (PAN) issued by the Income Tax department of the Government of India. PAN is a must to open a bank account, make investments, file income tax returns, among other things in India. Having PAN is mandatory for opening a Demat account. Other than PAN, the following are the other documents required to open a Demat account

- Proof of Identity (POI)

- Proof of Address (POA)

- Proof of Income

- Proof of Bank Account

Click here to know which documents are admissible as proof for the above. Now you know what you need to make an entry into the securities market. But, it doesn’t stop here. You need to equip yourself with the understanding of the following to make an informed investment decision in the securities market

- Risks involved in investing in the stock market

- Types of asset class available for investment

- Types of Orders available for trading

- Settlement Cycle, the time period between placing your order and getting your securities when you buy or the amount when you sell in your account

- Taxation for shareholders

- Your rights and responsibilities

and many more Above is the general understanding that is a must for an investor. The investment decision differs for each investor depending on their risk appetite, financial goals, stage of life, liquidity, and other factors. We recommend you arm yourself with the necessary prerequisites before entering into securities trading and do your homework before making every investment decision. Learn FreeStock Market Course Online at Smart Money with Angel One.