How to Find Out Companies Playing Financial Numbers (Expenses Side) – Part 1

In the world of investing one important factor that investors look for is – Earnings, Earning and Earnings. Simple reason being it is the earnings that help them calculate the different ratios like Price/ Earning (P/E), Return on Equity (RoE) and also the Return on Capital Employed (RoCE). No wonder the companies strive to put best efforts to report strong numbers every quarter. While a few succeed in the effort as the businesses perform well and management makes right capital allocations, in some Cases the performance does not match up to the expectations.

In simple words every management strives to work hard to improve operating efficiency to generate profits. If the business strategy plays out well the same is visible at the bottom line. But in the scenario of the cut throat competition the peer pressure sometime results in few companies resort to tricks apart from the genuine efforts to showcase higher profitability. In the past we have seen how the promoters of leading Information Technology Company had faced such scenario just to showcase they are also growing either along with or ahead of the peer companies. While that company had witnessed fancy of investors after the wrong doing got unearthed, it only led to a debacle.

While that was a larger debacle, there are companies that tweak the Way they represent the financial numbers and this Results in inflated profitability. There are two ways a Company can play with the financial numbers. First is to showcase lower expenses and another way is to tweak the accounting policies. We are going to understand few such examples in our series of blogs.

While we mentioned that there are two ways companies can play with financials, it can be categorised in following sub heads.

- Playing around with Expenses. Where either the expenses are not shown in the Profit & Loss (P&L) Statement. In some cases they follow conventions that despite being shown in the P&L, such expenses would not result in reduction in profits.

- Playing around with the numbers from profit and loss from investments

- Avoiding few expenses that were necessary

- Constantly tweaking or changing the accounting policies.

While we are going to discuss in detail all four kinds of examples. The first two blogs would be focused on, how companies play around with expenses.

Let’s first discuss how companies inflate profits by playing around with expenses.

- Companies do not show some expenses in the P&L

As we mentioned earlier just to showcase higher profit, the companies try to keep the expenses lower. The lower expenses results in better operating efficiency and eventually results higher profits. But the readers would be wondering how the expenses are showcased lower than the actual ones? Answer to the same is simple - there are different accounting policies that used (rather misused) to play around with the numbers. And the concept of Capitalisation is one such way. If put in simple words, Capitalization means – an accounting treatment that allows the company to spread the cost of the asset over its useful life and avoid drastic impacts to the income statement in the period the asset was purchased. However it is applicable to fixed assets.But few companies capitalize even those expenses in fixed assets, as per investors should be recognized as an expense in the P&L. Let’s take few of the examples where it could be easily seen how the company had tweaked the numbers.

Example 1

There is one manufacturer of Indian Made Indian Liquor (IMIL) also in the segment of bottling for Indian made foreign liquor (IMFL). The aforementioned company owns various IMIL brands.As a practice the company had capitalised the advertising and promotional expenses as intangible assets in the fixed assets.Auditors had mentioned it in the qualification that the Rs 36 Crore should have been shown as expenses and Deducted from the P&L account. As a result the profit before tax for the company was higher by Rs 36 Crore. In the ideal world of accounting, the company should have put the same in P&L of every year when the expenses were actually made. Following qualification was made by the Auditors in the Annual Report.

Basis for Qualified Opinion

As on March 31, 20**, Fixed Assets include Intangible Assets aggregating to Rs 28.87 crore (March 31, 20** – Rs 36.08 crore) under the head “Knowhow and New Brand Development” representing intangibles internally generated by the Company through expenditure on advertisement and promotional expenses. Such recognition is not in accordance with Accounting Standard – 26 “Intangible Assets”. Had the Company complied with requirements of AS-26, Fixed Assets as at March 31, 20** would have been lower by Rs 28.87 Crore (March 31, 20** – Rs 36.08 Crore), Depreciation and amortisation expense for the year would be lower by Rs 7.22 crore, Net profit after taxes for the year would be converted into net losses after tax of Rs 14.78 crore and Reserves and Surplus would be lower by Rs 19.05 Crore.

The above example clearly suggests that it is important to understand Accounting Standards and even qualifications made. Capitalising expenses is like tweaking policies and resulting in better profit. Rather here the company would have suffered loss. Therefore, while analysing companies, an investor should pay specific attention to the expenses that companies capitalize in their fixed assets.

Example 2

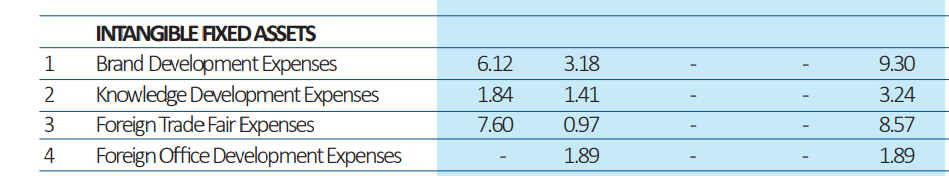

There is one company engaged in the manufacturing of technical textile products. This company had been capitalising expenses like brand development expenses, foreign trade fair expenses and knowledge development expenses, that basically look like expenses which should be charged to P&L and not capitalized.

We believe that the expenses incurred on the trade fairs (Especially Foreign Trade Fairs) should be deducted as an expense in the profit and loss statement.It is advised that an investor should examine these expenses further and may get a clarification from the company about the nature of these expenses, which warrants them to be capitalized.

We have given two examples for Expenses being capitalised over the period. And hence the bottom-line of the company seem to be inflated. It is important for the investors to read between the lines and then go through the Auditors qualifications mentioned in the annual report.