It doesn't help if you keep investing money without tracking your portfolio returns. After all, the sole purpose is to make your money grow by investing in well-thought, planned, and structured asset classes. Once you calculate portfolio returns, you are better positioned to chalk out a plan of action.

Portfolio returns help you compare different investment options, thereby assisting you in maximizing your returns. So, let's understand how to calculate portfolio returns.

What exactly is a portfolio's return?

A portfolio is a group of investments made by an individual which comprises different investment instruments belonging to diverse industries - stocks, debentures, commodities, cryptos or even real estate. Diversification reduces the risk of a downside, improving the probability of positive portfolio returns.

Compare investing to any other typical business - and imagine that you are the owner of that business. Now, as the owner, you would be required to measure your business's profitability at constant intervals. Your profitability position will help you take crucial management decisions, strengthening your business's return generating abilities.

That is precisely how investing works as well. To calculate your business profit is tantamount to calculating your portfolio's returns.

How to calculate portfolio returns?

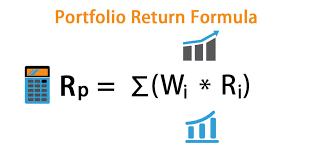

It's not that difficult to calculate. The portfolio return formula is as follows:

w = weight of each asset forming a part of the portfolio

r = return generated by each asset

Given below are the steps that you must follow for calculating portfolio returns:

1) Calculate the return of every investment that is your portfolio's component (as discussed in detail below).

2) Find the weightage of each investment. This is a simple calculation - divide the amount invested in that asset by the total portfolio's investment amount. You can leave the answer in decimal or convert it to a percentage.

3) Assign the weights to each asset by multiplying step 1 with step 2. Remember, you have to do this calculation for each investment.

4) Add up weighted returns of all investments. (sum of step 3)

The resulting figure is the portfolio return. If these calculations get overwhelming for you or you wish to make your work easier, you can use a portfolio returns calculator, which should be readily available online.

What period of time should you consider?

The period over which the returns will be calculated is a personal choice - it could be a week, month or even a year. But make sure that when you calculate your portfolio's returns, determine the return of every asset over the same period to maintain consistency.

Before you can calculate your portfolio's returns, you must understand the calculation of a security's return.

How to calculate the return of a security?

Security returns are used in calculating the return of an entire portfolio. The ROI metric,a.k.a. Return on Investment, is used by both amateurs and professionals as a portfolio returns calculator. ROI is calculated as:

[(Current Market Value of Asset + Dividends earned + Interest earned - Initial Investment) / Initial Investment ] * 100

The initial investment includes all the expenses incurred to acquire the asset. Remember to add the transaction costs to the purchase price - including management fees, commissions, taxes, and brokerage charges.

For listed securities, the current market price of the asset should be readily available online. However, for unlisted securities or for instruments whose fair value is not readily available, you will have to work around your way to finding it. See, the instrument's market value is the most crucial element in calculating portfolio returns and usually will also form a significant chunk of the calculation. Hence, if the security is unlisted, you cannot let go of calculating the instrument's market value. There are several proven ways of arriving at the market or fair value of unlisted securities - you can refer to the Indian Accounting Standards for Fair Value Measurement for detailed guidance.

The resulting figure is the Step 1 value. After calculating the returns of all the investments forming a part of your portfolio, follow the above mentioned steps to get to your portfolio's returns.

Estimating the future performance

The returns calculated can also be used to predict future returns from the same portfolio. After incorporating the historical returns, you will also have to account for any additional dividend or interest income you are expecting to be received. Estimated returns might not be accurate as they are affected by several factors - market sentiment, unexpected news announcements, and other political factors. Nonetheless, you must make these calculations as they help decide investment strategies and the action path.

Adjust cash flows

If you deposit money into your account in the middle of the month under consideration, then the NAV (net asset value) for that month-end will be higher by the additional amount deposited. However, this addition in the NAV is due to mere cash deposits and not earnings. Hence, the same should not be considered while calculating the returns of your portfolio.

You can use several methods to adjust mid-term cash flows - the modified Dietz method is one such formula that you can use to calculate returns accurately.

Don't forget to annualize your returns!

Annualizing returns means converting the returns to an equivalent of returns over one year. Annualisation is crucial to be able to compare the returns of different portfolios. In reality, you would have earned the returns over a multi-period tenure; but the annualized return is a geometric average of the returns earned every year.

Let's learn with an example

Mr A has invested Rs.2,00,000 in equity; Rs. 3,00,000 in debt and Rs. 2,00,000 in real estate. The total investment amount is thus Rs. 7,00,000. Mr. A calculates that returns from equity are 10%, from debt are 12%, and from real estate are 8%. On following the mechanism mentioned above, the portfolio return turns out to be 10.29%.

Summing up

The portfolio return calculation is the best way of evaluating the achievement of your portfolio. The calculation helps in strategic decision making, re-evaluating the composition of your portfolio and comparing returns of different portfolios and asset classes. Calculating returns is not as complex as it seems, and you are sure to master the calculation with little practice.