Everything that the market has witnessed in the recent past (FY 2019-20 and FY 2020-21) is more than what they achieved during the last 2 decades as the global liquidity levels increased to Foreign Funds Inflows (FPIs) and the number of Demat account holders increased manifold. This shows that people are now stepping out of their comfort zones and are ready to invest in the stock market. A few of the reasons for this increase in the number of traders may be the ability to trade in the equities market through digital platforms, awareness about personal finances, the introduction of different asset classes, and more. Read on to discover more reasons behind this growth in the market.

Exponential growth in the Indian equities market

Let’s now see how the equities market in India has grown in the recent past.

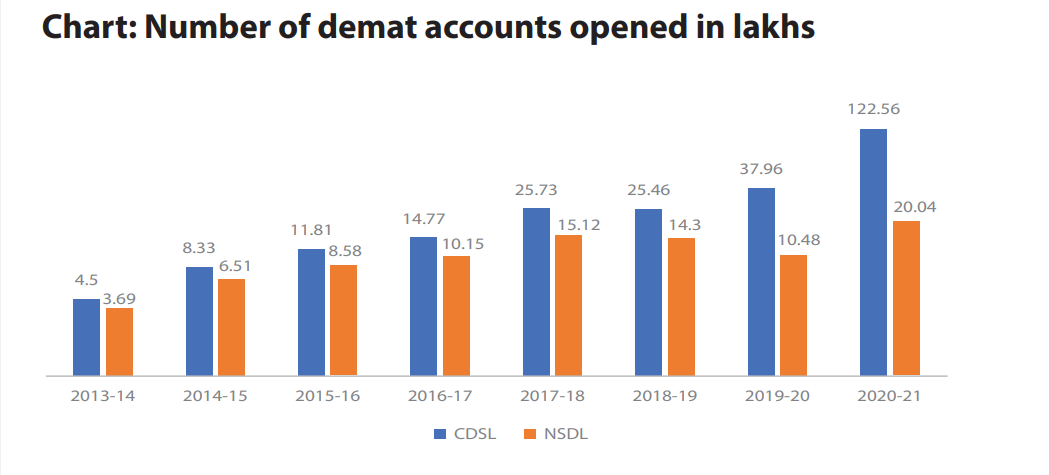

1. Increase in Demat account holders on year on year basis

Source: CDSL

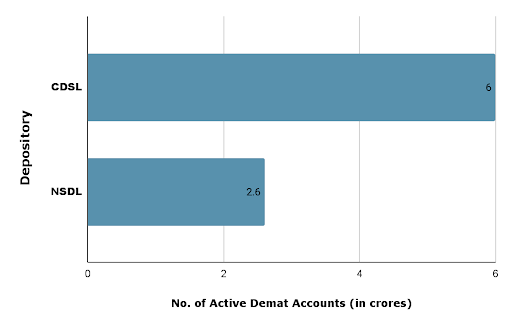

2. Number of Demat accounts as on February 28, 2022 at CDSL and NSDL

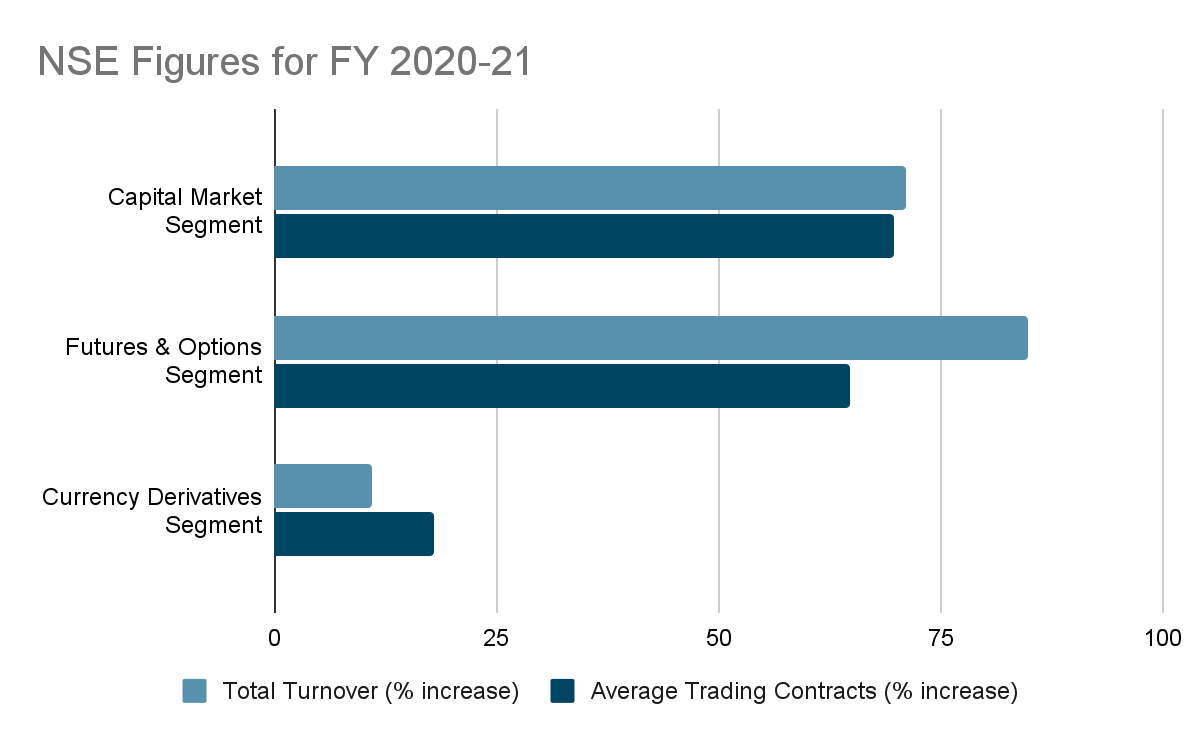

3. Growth at the NSE in FY 2020-21 compared to FY 2019-20 is mentioned as follows:

Source: NSE

- Below statistics show how BSE grew in FY 2020-21:

-

- The equity cash segment witnessed an increase of 68.01% in the average daily value of equity turnover as compared to FY 2019-20

- On November 26, 2020, BSE derivatives recorded the highest turnover of ₹3,89,758 crore

Source: BSE

With the above statistics, we can see that there is an increasing trend in the number of traders which means that more and more people have started investing post the COVID-19 outbreak.

Reasons behind such accelerating growth in the stock market

Apart from the strong FPI flows that drove the market initially, domestic institution participation also supported growth. Additionally, the retail participation trend shown above also aided the rally. There are plenty of reasons as to why individuals began parking their savings in the Indian stock market and started trading. A few of them are mentioned below:

- One of the major reasons is believed to be the COVID-19 pandemic. Here’s why:

- The pandemic-led nationwide lockdown gave people ample amount of time to learn about stock investing and try their hands on it

- The work from home culture helped people save a lot of money which motivated them to invest their savings in the equities market

- The lack of employment and income sources due to the COVID-19 outbreak induced people to explore alternative sources of income

- App-based trading platforms have made the process of opening a Demat account and trading on the stock market convenient which encouraged them to start trading from the comfort of their homes

- Nowadays all the required information about the company (vision, history, past performance, and more) and the stock market (current performance, industry-specific performance, and more) is available at the fingertips of the investor which helps them make an informed decision

- Investors’ education and awareness programs gave investors sufficient knowledge about the Indian stock market before they start investing which induced confidence among investors

- Stringent regulations introduced by SEBI (Securities and Exchange Board of India) to ensure that investors are treated fairly gained investors’ confidence

- Other financial instruments like Fixed Deposit, Provident Fund, Public Provident Fund, etc. were giving comparatively less returns, thus, the investors started gravitating towards equities and mutual funds

Conclusion

This growing trend in the equity market in India can be seen since the start of the pandemic as a large number of investors flocked towards the Indian stock market. With the online Demat accounts still opening at an increasing rate even after all the lockdown restrictions are lifted and businesses are going back to normal, we can expect this growth trend to sustain in the coming years as well. You too can become a part of this growing investor population while earning good returns from your savings.

Disclaimer: This blog is exclusively for educational purposes and does not provide any advice/tips on investment or recommend buying and selling any stock.

Learn Free Stock Market Course Online at Smart Money with Angel One.