If you want to invest in a firm, you usually have two options: equity (also known as stocks or shares) or bonds (commonly known as debt).

What is equity?

Equity is the amount of capital that a company's owner has invested or owned. Financially speaking, the gap between a company's obligations and assets on its balance sheet is used to determine its equity. The current share price or a value set by investors is used to determine the quality of stock. Owners, stockholders, and shareholders equity are all names for this account.

In practice, when an investor buys stock in a firm, they become one of the company's many co-owners, with the ability to vote at Annual General Meetings and on other corporate strategy initiatives (depending on the type of share owned). Being a shareholder has the advantage of potentially increasing the value of the company's stock, allowing the investor to profit from the sale (capital appreciation). In addition, the investor may be entitled to a portion of the company's earnings in the form of dividends or stock buybacks. The disadvantage of investing in stocks is that there is no assurance of future earnings or if you will be able to recoup his or her investment. Furthermore, in the event of a company's insolvency, shareholders are among the last creditors to be reimbursed.

What are Bonds?

Bondholders are basically creditors of the firm, with the right to receive a periodical interest payment (coupon) and the whole amount invested when the bond matures (principal). In the case of insolvency or liquidation, investors who invest in bonds are better protected than those who engage in stocks since they will be among the first to claim the company's assets. Furthermore, if the bond issuer fails on his/her obligations, the bond may be recoverable, but the share price might sink to zero. Bond investors pay close attention to a security's credit rating since it serves as an indicator of the investment's possible dangers. Overall, bonds should not be expected to increase at the same rate as stocks, but rather to provide a more secure source of overall return and capital protection.

Types of bonds and stocks

In general, there are four different sorts of bonds:

- Bonds issued by corporations

- Bonds issued by municipalities

- Bonds issued by the government

- Bonds with no coupon

On the other hand, stocks are classified by market capitalization (size), sector, and growth rate. Start with India's top trading account from IIFL if you want to start investing in the stock market.

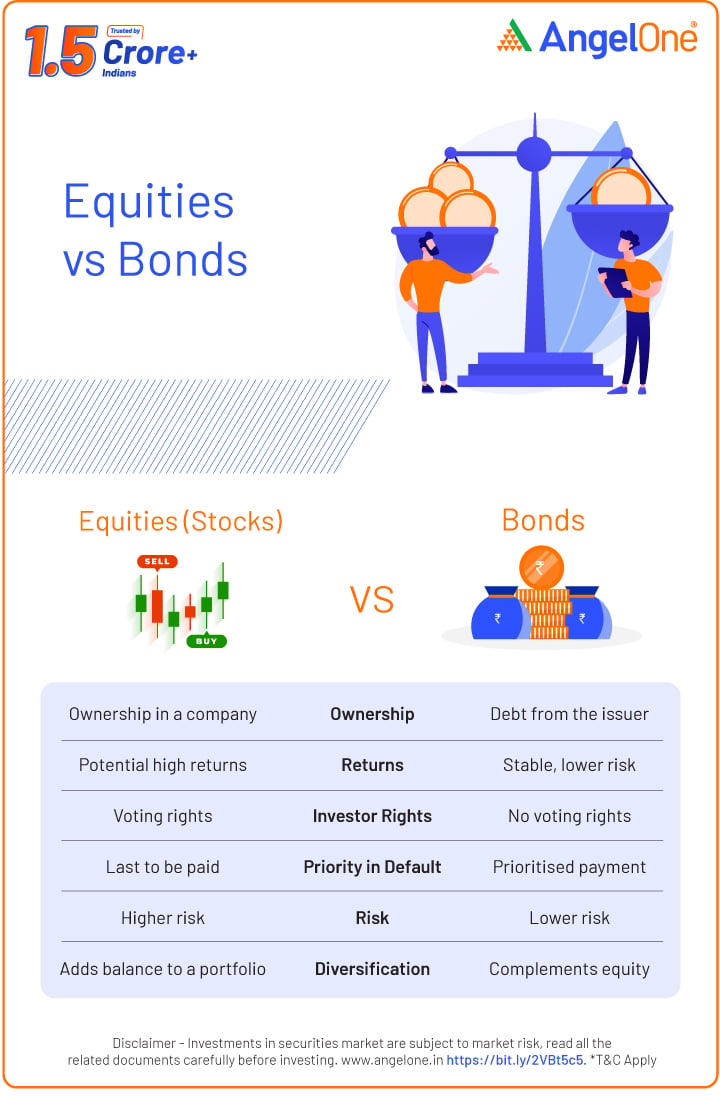

Difference between Bonds and Equities

It's not uncommon to become perplexed by financial lingo, especially if you're new to the field. Bonds and stocks differ significantly in terms of their legal foundation, risks, and rewards.

Rights of stockholders versus rights of bondholders

Let's start by examining our legal rights. Investors who purchase stock in a firm become one of many co-owners. Significant shareholders can affect the company's direction and have the opportunity to vote on and veto corporate initiatives as a result of their ownership. The benefit of being a shareholder is that the stock price might grow, allowing investors to profit from their investment. There isn’t any guarantee that this will happen. Companies can also distribute earnings to shareholders in the form of dividend payments; however, such payments are not usually required.

The disadvantage of owning stocks is that no economic return is guaranteed to stockholders. Share prices can plummet, leaving investors with the unenviable decision of selling at a loss or waiting for the shares to recover. In the worst-case scenario, the firm may be forced to liquidate, with shareholders being the last to be paid. In this case, the investor may lose all of his or her money.

Bondholders, on the other hand, are better off if the firm goes bankrupt. They are reimbursed before shareholders since they fall under the category of creditors. Furthermore, even if the issuer fails on its loans, most of the time, there is a prospect of recovery, although at a lower level.

Nature of returns

The nature of returns from stock and bonds are fundamentally different. In the case of stocks, it is mostly due to price appreciation, as the dividend yield is very low, say 1.5 percent each year.

On the other hand, the majority of bond earnings come through accrual or coupon payments. Bond price appreciation is on the modest side. As a result of the commitment of coupons, bond profits are more stable. It's all about discovering the firm and its profits potential in equity. At different times, the market's discounting of the many variable components rises and falls. As a result, equities returns are more volatile. However, when volatility is positive, equity returns exceed bonds handsomely.

What about risk?

There is a rule in investing when it comes to risk. The bigger the risk, the higher the possibility for profit, but the danger of loss is also larger. Because price movements are more extreme in shares than in bonds, they are considered riskier. This is usually the case, although it isn't always. Some bonds, particularly those issued by high-risk firms and governments, may be as volatile as stocks. Junk bonds, or high yield bonds, for example, are those issued by corporations that are more likely to fall. Credit rating organizations classify these investments as "high yield." Some government bonds, particularly those issued by emerging markets, are also considered high-risk investments. Emerging economies are frequently in the early stages of growth, and political uncertainty is common. Therefore, emerging market bonds are a good place to look at as they often have higher yields to compensate for these risks.

How to Utilize Bonds & Equities in your Portfolio?

Equities and bonds have lower correlations because they react to market events differently. As a result, they can work well together in a properly-diversified portfolio. Bonds usually give a smaller but more consistent return than stocks, which are riskier and have a more unpredictable return profile. The correct portfolio mix, on the other hand, should be established by the individual's time horizon, goals, and risk profile. Bonds often underperform when stocks outperform and vice versa. Investing in both asset classes may provide a consistent return even during economic downturns (bonds) as well as possible upside during periods of economic development (stocks) (equities).

Conclusion

By definition, the future is unpredictable. Over the long run, equity is predicted to provide a more significant return than bonds, reflecting the nominal growth rate of GDP, but we've already seen the statistics. As a result, it is prudent to maintain a balanced allocation between the two asset classes even over the long term. Another point of view is that bonds have a default risk that stocks do not. Investing in government securities or top-rated corporate bonds can help to mitigate this risk.

Learn Free Stock Market Course Online at Smart Money with Angel One.