Validating the IPO mandate is crucial. Suppose you spend weeks doing company research and apply for the IPO, but forget to validate your mandate. As a result, you will consequently miss the IPO.

UPI's role in transferring money, paying bills, and making purchases may be known to you. Wherever you are, whenever you want, you can do it using your mobile phone. However, did you know that UPI can be used to submit an IPO application?

SEBI has mandated that retail investors applying for IPO through registered brokers, DPs (depository participants), and RTAs (Registrar and transfer agents) must use UPI mandate as the payment mechanism.

If you reject or miss the UPI mandate request, your IPO application will be rejected. To help you avoid such a situation, we have detailed the process of finding an IPO mandate on service provider platforms like Google Pay, Phone Pe, Paytm, and Bhim UPI.

Key Takeaways

-

The UPI mandate for IPO allows investors to block funds directly from their bank account for smooth, paperless transactions.

-

A registered UPI ID for IPO simplifies the bidding process by enabling instant mandate approvals and real-time fund blocking.

-

Not accepting or missing the IPO mandate leads to automatic application rejection, requiring investors to reapply for the issue.

-

Using UPI for IPOs ensures faster refunds, greater transparency, and secure fund handling, streamlining coordination among banks, brokers, and exchanges.

UPI and IPOs: What's the Connection?

The UPI mandate for IPO applications has made the IPO bidding process easy among retail investors. A registered UPI ID for an IPO enables investors to block funds without any documentation or multiple logins, directly from their bank account. Upon approval of the UPI mandate for the IPO, the corresponding amount is frozen until allotment to ensure a seamless, transparent transaction. This system enhances speed, reduces processing errors and provides investors with a secure and centralised payment experience when applying through different broker systems using their UPI ID for IPO.

How to Find IPO Mandate in GPay, PhonePe, Paytm and BHIM?

Investors are required to accept the IPO mandate received on their UPI application to apply to an IPO successfully. Below, we discuss finding a UPI mandate on various platforms so you don’t miss it.

The significance of validating the IPO mandate is so great that failing to do so could undermine all of your company-related research. As a result, you will consequently miss the IPO.

UPI's role in transferring money, paying bills, and making purchases may be known to you. Wherever you are, whenever you want, you can do it using your mobile phone. However, did you know that UPI can be used to submit an IPO application?

SEBI has mandated retail investors to use UPI to invest in IPOs when applying through registered brokers, DPs (depository participants), and RTAs (Registrar and Transfer Agents). If you reject or miss the UPI mandate request, your IPO application will be rejected. To help you avoid such a situation, we have detailed the process of finding an IPO mandate on service provider platforms like Google Pay, Phone Pe, Paytm, and BHIM UPI.

How to Find UPI Mandate in UPI Platforms?

Google Pay

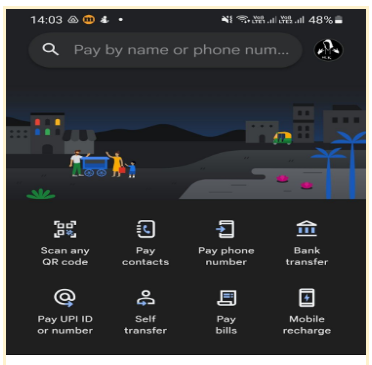

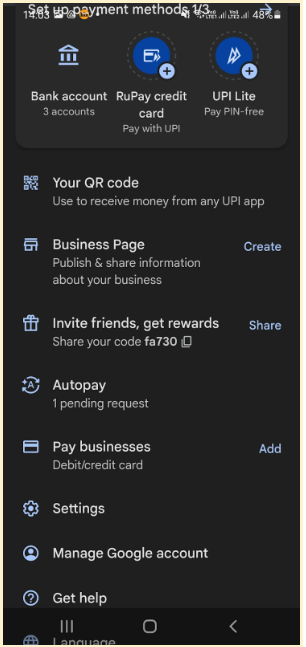

Gpay generally notifies you upon successfully setting a UPI mandate when submitting your IPO application. However, you can follow these steps to double-check:

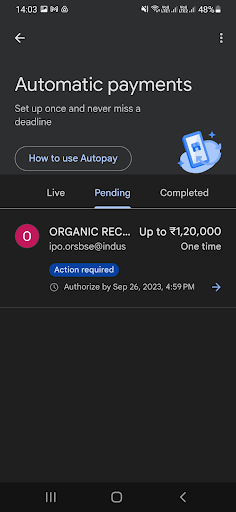

1. Select the profile option on the top-right corner of the home screen and scroll down to find Mandates.

2. Look for autopay in the pending section. Click on the autopay to authorise. Accept the autopay request by entering the UPI PIN to validate the application.

3. The live section in mandates allows tracking the mandate.

Phone Pe

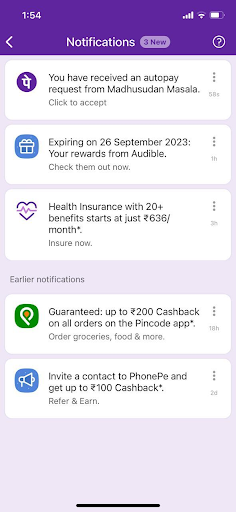

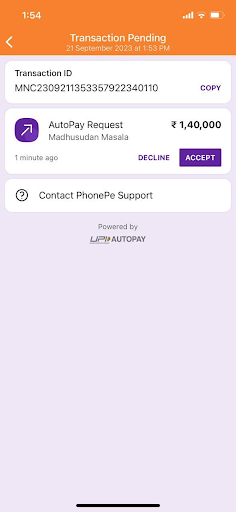

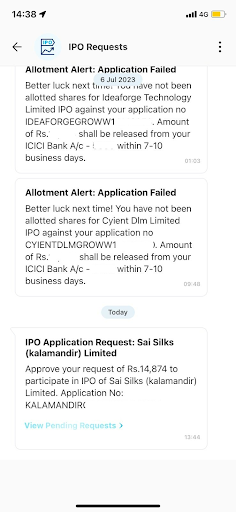

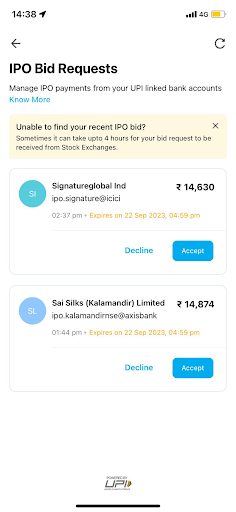

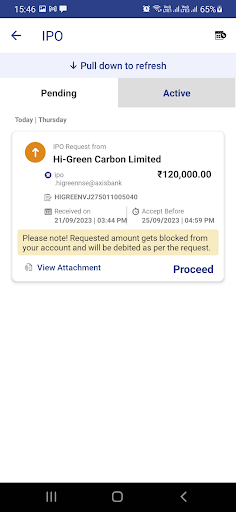

1. Once you receive the autopay approval request, go to the Phonepe app. You will be able to see a pop-up message of the autopay request. Click on ‘View Details’.

2. After verifying all the details, click ‘Accept’ to approve the mandate. The IPO application amount will be blocked in your account and debited once the shares have been allotted to you. The IPO dashboard on Angel One has a link where you may monitor the allotment status.

Paytm

You are required to go to the Paytm app to finish the mandate block if you selected a UPI ID that is linked to the Paytm app. The steps have been explained below:

1. Click on the notification stating the mandate request for the IPO applied.

2. Now, check the details and verify and accept the mandate request to successfully subscribe to the IPO.

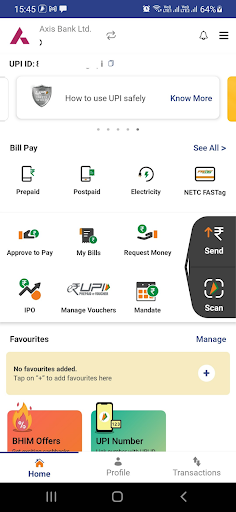

BHIM App

1. When using the BHIM app to pay the UPI mandate, you must launch the app and look for the Mandates area, often shown on the home screen.

2. Here, you’ll see all the mandates listed and their details. Select the applicable one and click on proceed.

What is UPI?

UPI is an instant payment system created by the National Payments Corporation of India (NPCI). The UPI has been a revolution in the payment industry, whereby instant transfer of funds between the bank accounts of any two parties is possible. However, you must have a UPI ID first before using it. It is a digital payment ID used to transfer and receive money straight from/into your bank account.

What is the Use of a UPI ID for Applying for an IPO?

You can use your UPI ID as a payment method while submitting an IPO application on the Bombay Stock Exchange (BSE) and National Stock Exchange (NSE). You must instruct your broker to utilise your UPI ID to submit the IPO application. Post submission, accepting the UPI mandate received on your UPI application is important to subscribe to the IPO successfully.

What is the UPI Mandate?

You can approve one-time or recurring payments with the help of a UPI Mandate (also known as autopay or e-mandate). The money will be deducted from your account at the specified time for which it has been scheduled. To set up a UPI Mandate, the service provider must be permitted to deduct the money from your bank account.

When the mandate has been raised for the IPO, your bank account is prevented from using the money, so it may not appear in your main account balance. Think of it as money blocked or reserved to pay for the IPO subscription in case you are allotted shares. If you receive the allotment, the money will be debited from the account. If not, the amount will be unblocked and reflected in your balance.

Benefits of Using UPI for IPO Application

-

Using UPI payments carries no additional fees.

-

You can request a prompt refund by contacting the payment gateway's customer service team if any transactions fail or there are any technical difficulties.

-

The payment gateways inform you of your UPI activity and regularly send notifications and alerts.

Advantages of Using UPI for IPO Bidding

Applying for an IPO via UPI provides convenience and security. The UPI app allows investors to approve payment mandates immediately without having to conduct manual verification or cheque payments. The UPI system enables quicker refunds in instances of non-allotment and thus manages the funds well. It also improves the transparency, where real-time notifications are sent for the approval of the mandates, as well as the status updates. This electronic flow reduces the risk of failure of transactions, accelerates allotment of securities and helps in the easier coordination between banks, brokers and exchanges in the IPO bidding process.

Consequences of Not Accepting IPO Mandate

As discussed earlier, not accepting the IPO mandate can result in the rejection of your IPO application. And in case you mistakenly reject the mandate request, the transaction will be rejected, and you will need to submit a new request.

Conclusion

The requirement of the UPI mandate for IPO has transformed the way investors apply for public issues with the help of speed, security and simplicity of the process. Incorporation of the UPI mandate for IPO applications enables investors to block and unblock funds in real time by using mobile applications, resulting in a paperless and transparent transaction. As the regulatory authorities are promoting the adoption of UPI with retail participation, the UPI mandate for IPO has turned out to be a prerequisite for efficient and trustworthy online investing.