Initial Public Offering or IPO has gained popularity in recent years. The year 2021 witnessed an IPO rush with the issue of over 60 IPOs. Increasing investor appetite for IPO is one of the many factors that led to the rise. As an investor, you would be knowing how to apply for an IPO (if not, read here) and the processes involved in an IPO issue. But, do you know that IPOs are graded?

Yes, IPO grading was introduced by SEBI as an endeavour to investors by making additional information available to facilitate their assessment of the fundamentals of the company offering an IPO. The IPO grade represents a relative assessment of the fundamentals of that issue in relation to the other listed securities in India. Read along to know everything about IPO Grading.

What is IPO grading?

IPO grading is the professional assessment done by a SEBI registered Credit Rating Agency (CRA) on the fundamentals of a company in relation to the other listed equity shares in India. CRAs assign a grade on a scale of 1-5 indicating the fundamentals of the company.

What are the factors considered in IPO grading?

The list of areas that are generally looked into by the Credit Rating Agency while arriving at an IPO grade includes:

- Business Prospects and Competitive Position

- Industry Prospects

- Company Prospects

- Financial Position

- Asset and liabilities

- Annual reports

- Balance Sheet

- Operating cash flows

- Management Quality

- Hedged risks

- Corporate Governance Practices

- Promoters’ profile

- Company’s marketing strategies

- Competitive advantage

- Growth prospects

- Technological initiatives

- Operational efficiency

- Compliance and Litigation History

- New Projects-Risks and Prospects

Remember that the IPO grading process varies on a case-to-case basis.

What are the grades?

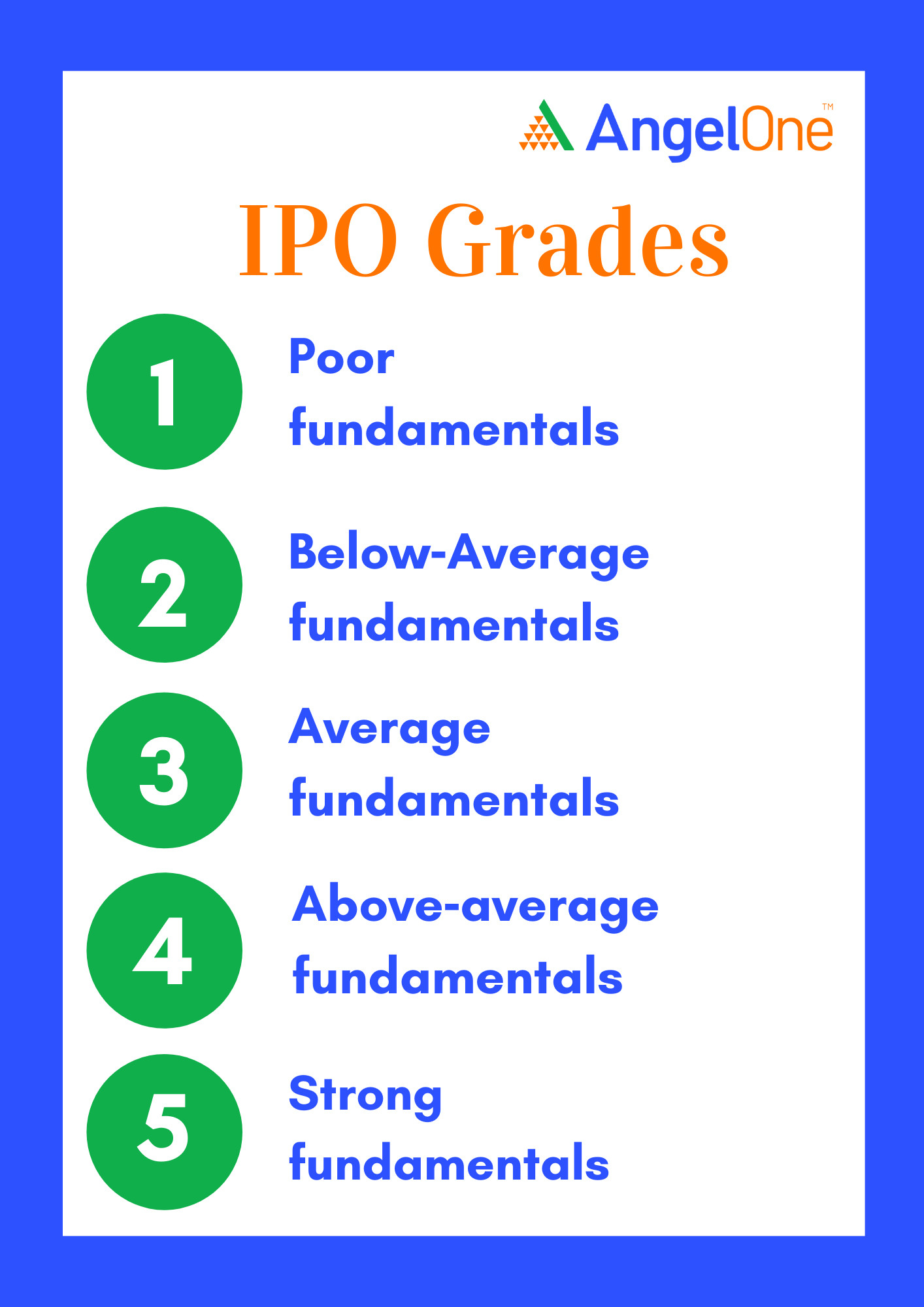

The grades are allocated on a 5‐point scale, the lowest being Grade 1 and the highest being Grade 5. The higher the grade, the stronger the fundamentals of the company.

Where can one find the grades obtained?

All grades obtained for the IPO along with a description of the grades can be found in the Prospectus, Abridged Prospectus, issue advertisement or any other place where the issuer company is making advertisements for its issue.

How does IPO grading help in deciding about investing in an IPO?

IPO grading is intended to provide the investor with an informed and objective opinion, expressed by a professional credit rating agency after analyzing factors like business and financial prospects, management quality, corporate governance practices, etc.

However, irrespective of the grade obtained by the issuer, the investor needs to make his/her own independent decision regarding investing in any issue after studying the contents of the prospectus including risk factors carefully.

Note:

- An IPO grade is NOT a suggestion or recommendation as to whether one should subscribe to the IPO or not. IPO grade needs to be read together with the disclosures made in the prospectus including the risk factors as well as the price at which the shares are offered in the issue.

- IPO grading is done without taking into account the price at which the security is offered in the IPO. Since IPO grading does not consider the issue price, the investor needs to make an independent judgment regarding the price at which to bid for the shares offered through the IPO.

- IPO grading is optional with effect from 04-Feb-2014.

It is essential to check the worthiness of the investment place before parking the money. IPO grading serves as an efficient tool to understand the company’s fundamentals. The IPO grading process facilitates the company to increase its transparency when it is all set to go public. IPO grade along with other disclosures of the company gives investors insight into the risk profile of the company enabling them to make an informed decision.

Disclaimer: This blog is exclusively for educational purposes and does not provide any advice/tips on investment or recommend buying and selling any stock.