Ever wondered what a demat account is? How to choose the best demat account for you? For you to become financially independent, you need to start building on your financial assets; these may be anything from equity, mutual funds, bonds, IPOs, debentures, gold, etc. You have to remain invested in a particular financial asset(s) for an extensive period. However, to achieve this, adequate financial planning is required. You need to endure a bit of risk as well as secure yourself to generate the maximum yield from your investment. For investing in the Indian stock market, you need to have a demat account. You should not settle for mediocrity for your demat account. But, choose the best option, which requires some homework and precision planning. To open a demat account, you have to select a depository that would be best suited for you to trade in the share exchanges. Consequently, you have to choose the best demat account for trading to begin your journey in investing shares. A demat account is opened to buy or sell shares. As per SEBI – Securities and Exchange Board of India, every individual who intends to invest via purchase or sale of shares either electronically or by way of physical share certificates through the stock exchanges are required to set up a demat account. You cannot trade in shares if you do not have a legitimate demat account. There are many banks and financial institutions which provide the facility to the investor to open a bank account. There are even private brokers who offer assistance to new investors. However, one has to choose the best for their investment purpose. Below are a few things to consider on choosing the best demat account in India:

Also read more about what a demat account is?

Key Takeaways

-

Trading or investing in shares in India requires a demat account, according to SEBI regulations.

-

Depository Participants (DPs) must provide Basic Services Demat Accounts (BSDA) with limited AMC charges depending on portfolio valuation.

-

A 2-in-1 or 3-in-1 account structure allows for integrated banking, trading, and demat operations.

-

Depository Participants offer data analytics services such real-time valuation, alerts, portfolio insights, and transaction tracking.

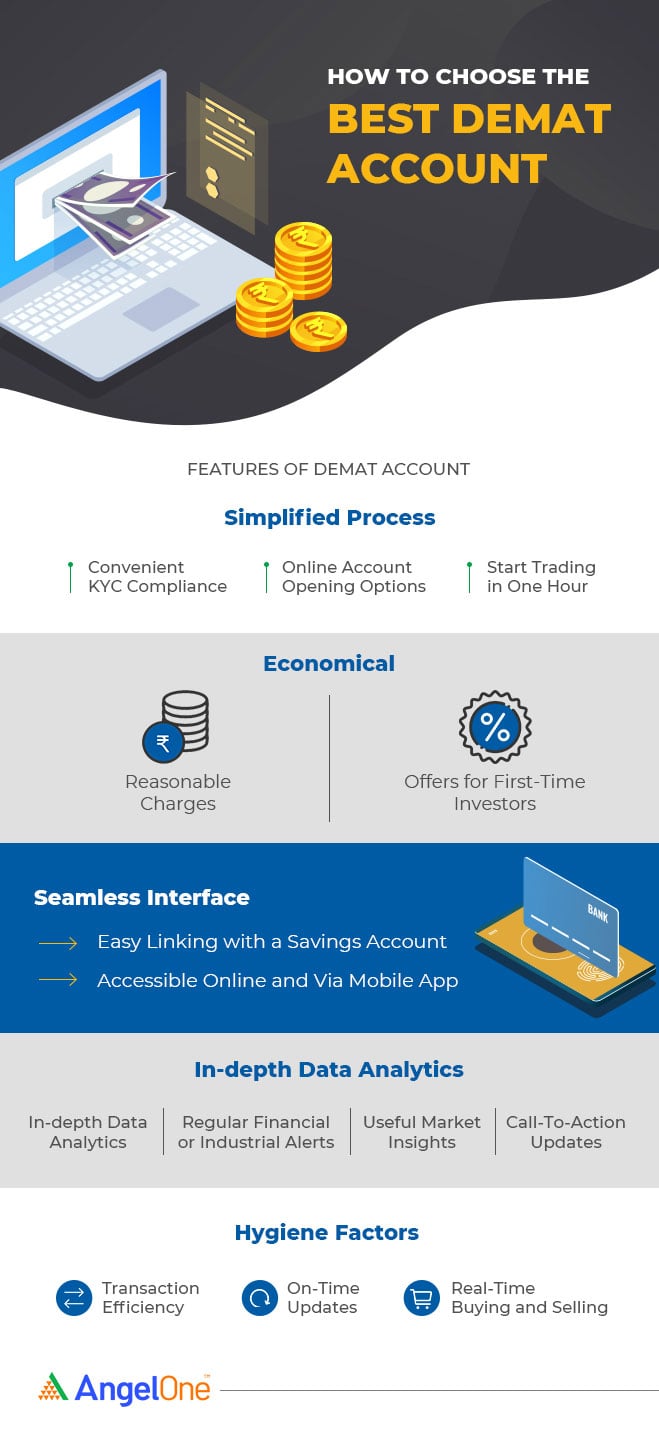

Simple Account opening:

The first step should be the simplest, that is the account opening formality should be extremely simple for you - the investor. SEBI has directed a detailed process of opening a demat account which the DP – Deposit Participant(s) must follow. Furthermore, DPs can further simplify this process to a great extent. For instance, the best demat account that is convenient for the investor can be opened through the e-KYC process, wherein the entire process of account opening is validated using the investor’s Aadhar data. This e-KYC process is carried out only online, and the investor needs only to do a final self- identification either through an in-person verification that is physical verification or through a video camera. However, a trade must be carried out in less than two days of account opening. Whereas, if an account has been opened through the physical format that is filling in a form and going in person, the trade must be conducted in less than five days. Furthermore, SEBI has mandated every DP to provide investors with the Basic Services Demat Account (BSDA), which promises to provide limited services at reduced costs to retail investors. It gives an option of an online demat account facility. These accounts are also known as no-frills or basic demat accounts. Moreover, SEBI states that every DP will make basic trading accounts available with limited and essential services at reduced costs. The Basic Services Demat account makes for one of the best online demat account options for the inexperienced investor. The charges for the BSDA account shall be highlighted in the following point.

Economical Demat Account Charges:

Another pointer to consider is the price point of the DP and account charges. Opening a demat account has a cost, even if it means that no transactions are carried out throughout the year and your account is idle. Today, banks, financial institutions, depository participants, brokers, etc., most of the time, do not charge any fees for opening a demat account. However, when you calculate the cost of the demat account, you need to consider all the charges.  Let’s look at all the charges levied to consider for choosing an ideal demat account:

Let’s look at all the charges levied to consider for choosing an ideal demat account:

- There is an annual maintenance charge -AMC that is billed to the investors account year on year

- A fee is charged each time there is a debit from your demat account

- Charges are applied if you request for a physical copy of your demat holding or physical transaction copy

- If your Debit instruction Slip – DIS or Demat Request form – DRF is rejected your demat account incurs a cost

- If you hold shares in physical format, particular DPs charge to convert the share certificates from physical form to an electronic one

- If you opt for a BSDA account, the AMC structure is straightforward and provided via a slab basis. If your account value is up to INR 50,000, then there will be a NIL amount levied for AMC. However, for a value holding from INR 50,001 to INR 2,00,000, the AMC fee will be up to INR 100. This seems to be the most accurate fee structure to consider choosing the best demat account

However, some DPs also provide zero AMC demat accounts, wherein they waiver the AMC charges. Moreover, they either offer a limited time no AMC demat account, for instance, providing you with no AMC charges for the first year or a lifetime offer of no AMC demat account charges. These are a few points to consider regarding the charges when choosing or opting for the best demat account in India.

The seamless interface between Banking and Broking:

A very crucial aspect for choosing the best demat account for you should be a seamless process between your bank account and your broking account. This means that, when investing and trading in equities on a day to day basis, there is a shift towards the digital platform by investors for the ease of using the internet and trading apps to complete the trades. This requires a proper linkage of your bank account and your demat and trading account. 2 options are available, 2-in-1 accounts or 3-in-1 accounts. The 3-in-1 account links your bank account, your demat account and your trading account. This is mainly offered by those brokers who have group banking licenses; majority banking institutions provide the 3-in-1 account. How does a 3-in-1 account work? (i) The investor transfers a particular amount from the savings bank to the trading account; (ii) the trading account, that has its unique Id carries out the trade that is buying and selling of securities; (iii) the purchase of share credit is reflected in your demat account. The demat account is utilised as a bank wherein the shares bought are deposited, and the shared sold are withdrawn. Majority of the time, private DPs or financial institutions which provide the facility to the investors for a demat account as well as a trading account, offer a 2-in-1 account. This account extends a seamless system to transfer money and a link between the trading and demat account, which works most of the time. To summarise this tip, as long as the customer is provided with a seamless interface between the bank account, the trading account and demat account for an economical and straightforward transfer of money and service, the purpose is adequately fulfilled.

In-depth Data Analytics:

A vital factor to keep in mind is the availability of data. Today Depository Participants (DPs), financial institutions, banks, etc., are out-spreading their services beyond the plain vanilla account statements. These days DPs provide a host of online data analytics like real-time valuation, direct call to action requests for trading clients, analytics on demat inflow and outflow, timely alerts, dominant market players, industry concentration, thematic concentration, consolidated portfolio outputs among other things. In the current day and age, financial analysis is no longer only limited to examining share prices and share behaviour. These analyses are integrated with external factors which play a vital role in the performance of a share such as social and economic trends within the economy, the political environment and volatility, consumer behaviour, preferences etc. All this put together have the probability of affecting the company, industry which indirectly affects the share price. Hence, value additions such as data analytics, provide a great advantage for the decision making of the investor in choosing the best demat account available.

Hygiene factors are essential to consider are:

- How efficiently does your DP carry out the transaction?

- Does he provide you with the best possible share price and assist you in tracking the market?

- How quickly does your DP manage the dematerialisation of physical shares?

- Are the demat debit and credits processed on time?

- What is the overall view about the quality of services provided by the DP?

- Are there any service-related complaints of the DP pending with either SEBI, NSDL or CDSL?

- Is there is any negative news about the DP and his company?

These questions determine whether the DP is committed to offering high service standards.

These are the main features or tips to consider when choosing the best demat account in India:

- The most secure way to trade is through the assistance of versatile Depository Participants.

- The demat account registered with the DP should provide an efficient and quick service.

- Online platforms which are aplenty today are your one-stop destination for all trading and investment requirements on the go.

- Real-Time updates and tracking on mobile apps through online trading and demat account are very much in demand.

- Research reports and recommendations provided by the DP is a value-added service for the investor to assist him through his investment journey.

There is a plethora of companies, banks, financial institutions, Broking companies that offer all the above services or are limited to a few. It is best to keep in mind all the tips when considering to choose the best demat account, which is the best fit for you.

Conclusion

To select the best demat account, consider the DP's reliability, prices, platform performance, and analytical assistance. With SEBI-regulated systems and technology-driven tools, investors can now create and maintain demat accounts with greater ease than ever before. By evaluating features, prices, and service quality, you may choose an account that allows for easy trading and corresponds with your financial objectives.