Have you recently faced an error while adding funds to your Angel One trading account? Then you are at the right place. In this article, we will explore the reasons for such failure and what you need to do for seamless funds addition.

Angel One’s Super App/Platform offers you two digital payment modes to add funds, UPI and Net Banking, making the process even easier. Do you know why the digital transfer process is gaining popularity these days? Here are a few reasons -

- Faster Payment

- 24*7 Transfer Facility Available

- Higher Security

- Ease of Carrying Out Transactions

- Easy to Track & Maintain Record of Each Transaction

To know the complete process of adding funds digitally to your trading account, click here.

Why am I unable to add funds?

A. If you are unable to add funds to your trading balance via UPI

Angel One supports adding funds via UPI from all UPI apps, such as Google Pay, PhonePe, Paytm, and BHIM. If you are facing an issue in adding funds via UPI, it could be because of the following reasons.

1. The bank account you chose on the ‘Add Funds’ Screen differs from the one you selected on your UPI app/platform.

Let’s understand this with an example - A customer has a trading account with Angel One and has linked HDFC Bank Account A with it. Now, they can only add funds via UPI to their trading account via this bank account. Here’s why they might face a rejection:

Step 1: They selected HDFC Bank Account A on the ‘Add Funds’ Screen in the Angel One app.

Step 2: They chose the UPI mode of payment and are now redirected to the UPI app.

Step 3: Now, for instance, they select ICICI Bank Account or HDFC Bank Account B from their 3 bank accounts linked to the UPI app (HDFC Bank Account A, HDFC Bank Account B, and ICICI Bank Account) instead of HDFC Bank Account A to proceed with payment.

Step 4: The provider/bank will reject this transaction as the customer has selected HDFC Bank Account A for payment in the Angel One app/platform but, in the UPI app, has selected another bank account.

Step 5: This will be rejected as it is considered a payment through a non-registered bank account.

2. The UPI ID entered in the app/platform is mapped to a bank account not registered with Angel One. To add funds via this UPI ID, you need to register it beforehand.

3. You have insufficient balance in your bank account.

4. Your bank’s/app’s system may be down.

5. The UPI ID you added is incorrect.

6. You are trying to add funds to the trading account directly using your UPI app instead of using the ‘Add Funds’ option on the app/platform.

7. The UPI request sent to your UPI app to proceed with payment was not accepted within 10 minutes.

8. You may have entered an incorrect UPI PIN in the UPI app to process the payment.

9. You have exhausted your daily UPI transfer limits (transaction amount or no. of transactions) set by your bank, or you have reached your daily UPI transaction limit across all UPI apps (i.e., up to ₹2 lakhs per day or transaction, depending on your bank)

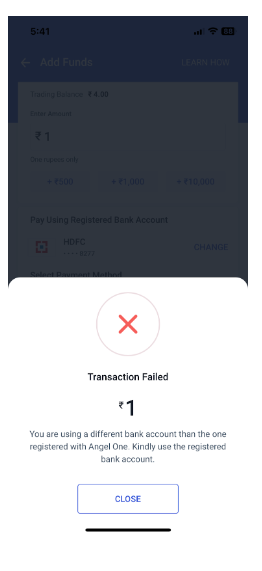

Below is an error message you might see in case of fund addition failure.

Image: Error screen when you are using an unregistered bank account with Angel One.

Common error codes for UPI Payments

Below are a few error codes you might encounter in case of transaction failure. This list will help you understand the error you are facing and take appropriate action.

| Error Code | NPCI Description | Error Description |

| B3 | TRANSACTION NOT PERMITTED TO THE ACCOUNT | You use a different bank account than the one registered with Angel One. Kindly use the registered bank account. |

| RNF | RECORD NOT FOUND | You have not completed the transaction. Kindly try again and complete the transaction. |

| U16 | RISK THRESHOLD EXCEEDED | Your first UPI payment can only be a maximum of 5000 rs. Kindly try again with a smaller amount. |

| U30 | DEBIT HAS BEEN FAILED | Your bank is temporarily not accepting the transfer request. Kindly try after some time. |

| U69 | COLLECT EXPIRED | The transaction was not completed within the specified time. Kindly re-initiate the transaction. |

| Z6 | NUMBER OF PIN TRIES EXCEEDED | You have exceeded the number of attempts to enter your PIN. Kindly try after some time. |

| Z7 | TRANSACTION FREQUENCY LIMIT EXCEEDED AS SET BY REMITTING MEMBER | You have exceeded the number of transactions for the day. Try again after 24 hours. |

| Z8 | PER TRANSACTION LIMIT EXCEEDED AS SET BY REMITTING MEMBER | You have exceeded the number of transactions for the day. Try again after 24 hours. |

| Z9 | INSUFFICIENT FUNDS IN CUSTOMER (REMITTER) ACCOUNT | You have an insufficient amount in your bank account. Kindly transfer the required amount and try again. |

| YC | DO NOT HONOUR (REMITTER) | Your payment failed due to a temporary technical issue at your bank. Kindly try after some time.

You might have online fund transfers blocked for the respective bank account/mobile number at your remitter bank. |

| YD | DO NOT HONOUR (BENEFICIARY) | Your payment failed due to a temporary technical issue at your bank. Kindly try after some time.

You might have online fund transfers blocked for your respective bank account/mobile number at your beneficiary bank end. |

| ZM | INVALID / INCORRECT MPIN | You have entered an invalid/ incorrect MPIN. Kindly re-initiate the transaction. |

| U67 | DEBIT TIMEOUT | The transaction request is timed out. Try again later. If your money is deducted, your bank will refund it within 1 working day. |

| ZA | TRANSACTION DECLINED BY CUSTOMER | You have declined the transaction request. Kindly re-initiate the transaction. |

| ZE | TRANSACTION NOT PERMITTED TO VPA by the PSP | Your bank is temporarily not accepting the transfer request. Kindly try after some time. |

| U66 | DEVICE FINGERPRINT MISMATCH | Your payment failed due to a fingerprint mismatch. Please try again. |

| U28 | PSP NOT AVAILABLE | Your bank is temporarily not accepting the transfer request. Kindly try after some time. |

| UT | REMITTER/ISSUER UNAVAILABLE (TIMEOUT) | Your payment failed due to a temporary technical issue at your bank. Kindly try after some time. |

| XH | ACCOUNT DOES NOT EXIST (REMITTER) | Your bank is temporarily not accepting the transfer request. Kindly try after some time. |

B. If you are unable to add funds to your trading balance via Net Banking

You can add funds to your Angel One trading account via net banking via almost all major banks in India. However, if you face rejection, it could be because of the following reasons.

1. You are making the payment through a non-registered bank account.

For instance - You have linked IDFC Bank Account 1 with Angel One’s trading account. However, after being redirected to the IDFC Bank Page, you add credentials of IDFC Bank Account 2 and proceed to payment. In this case, the bank will reject this transaction as you have selected Bank Account 1 on the app/platform but chose Bank Account 2 on the IDFC Bank net banking platform, which is not registered with Angel One.

2. The bank account you chose on the ‘Add Funds’ Screen differs from the one you entered your credentials for on the net banking page.

For example - You have 2 registered bank accounts (SBI and HDFC) with Angel One. Say you have selected SBI on the bank page and the net banking page and added details of HDFC Bank; the bank will reject the transaction, considering it an incorrectly selected bank account.

3. You may be entering incorrect credentials on the bank’s net banking page.

4. You may have insufficient balance in your account.

5. Your bank’s/app’s system may be down.

6. You have exhausted your daily transfer limits (transaction amount or no. of transactions) set by your bank.

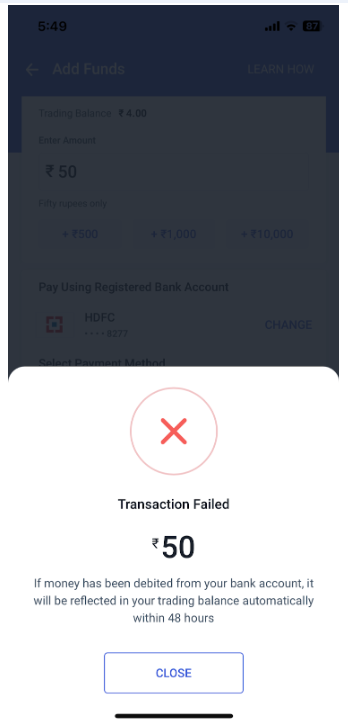

Below is an error message you might see in case of fund addition failure via net banking.

Image: The error message you receive when the addition of funds via net banking fails.

What shall I do in case of fund addition failure?

Below are a few important things you must do to avoid rejection of your funds addition transactions via UPI and/or Net Banking.

- Always choose the same bank account in the Angel One app and your UPI app

- Make sure to enter the credentials of the same bank on the net banking page you selected in the trading app

- Ensure that your UPI ID and net banking credentials are mapped to your bank account registered with us

- Always use our app/platform to add funds rather than using the bank/UPI app directly

- Check if you have sufficient funds in your bank account before initiating the process

- If you face technical issues, retry the transaction in a while

- Cross-check whether all the details you entered are correct

- Keep a tab on whether your daily transaction limit is available

Conclusion

Angel One offers convenient and safe ways to add funds to your trading account. However, if you face failure while transferring funds via UPI or net banking, you can check the aforementioned reasons and take appropriate action. To avoid such failure, you can take preventive measures such as ensuring adequate balance, double checking your UPI and net banking credentials, using the bank account mapped with us, and keeping a tab on your daily transaction limits.