Credit rating agencies like ICRA, CRISIL, CARE assign ratings to the debt instruments to help investors factor credit risk in their investment decision. In addition, these ratings are the symbolic indicator of the relative capability of the issuer entity to timely service debt and obligations concerning the instruments rated. Bonds are rated from AAA with the highest degree of safety and timely servicing of financial commitments to D with a higher credit risk, which is expected to be in default soon. When a rating agency raises a bond’s rating, it is an ‘upgrade’; when it lowers the rating, it is said to be a ‘downgrade.’

Bond ratings are changed for several reasons, such as the risk of default, change in the issuer’s balance sheet, the profit outlook of the issuer, macroeconomic conditions and others.

What are the factors that lead to an upgrade?

- Improvement in the issuer’s balance sheet with growing cash balances and falling debt

- Improving business conditions like rising profit margins and earnings, a growing economy

- Changing industry trends like an increase in demand for the goods/services, ease of regulations that may benefit the corporation

- Regulatory measures by the issuers to withstand adverse economic conditions

What are the factors that lead to a downgrade?

- The foremost factor that affects the bond rating is the risk of default if the issuer fails to make scheduled interest or principal payments

- Issuer’s deteriorating balance sheet with rising debt or falling cash flows

- Deteriorating business conditions such as dropping profit margin in case of corporations and weaker economic conditions in case of government

- Deteriorating future market outlooks such as recession in the near future, higher competition in the sectors, etc.

- If the company is facing any litigation/ investigation. For example, the dismissal of Vodafone’s petition over dues to the Indian government led to a downgrade with increased losses that had a significant blow on Franklin debt funds which had invested in Vodafone India's unsecured NCDs

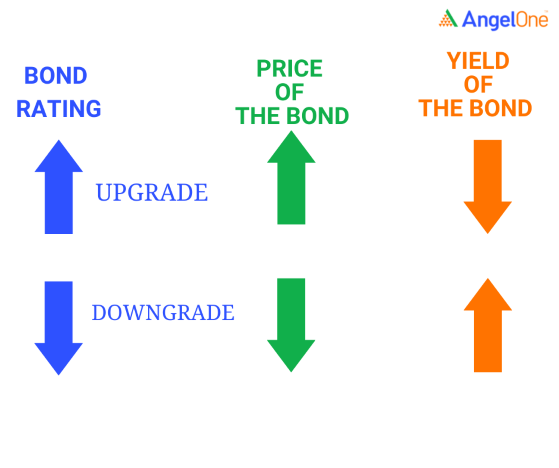

Impact of upgrades and downgrades on bond’s performance

The price of a bond generally responds to the upgrade or downgrade in the bond rating. When a bond’s rating is upgraded, investors are willing to pay a higher price for a bond, accepting a lower yield. Conversely, a downgrade leads to a fall in bond prices and an increase in demand for high yields. When a downgrade happens, new issues in the market will expose investors of existing bonds to opportunity cost, price risk, liquidity risk, and more.

Bonds with ratings above BBB to AAA are considered investment-grade bonds with a positive outlook. They are considered safe and stable investments with lower credit risk. Bonds with ratings below BBB are considered non-investment grade bonds. These bonds are high-risk investments that usually offer high yields to garner investors’ attention. These are primarily low-priced bonds. If the issuer's rating is downgraded, it indicates the deteriorating fundamentals of the issuing entity.

Upgrades or downgrades in bond rating may be a vital driver of a bond’s performance. Therefore, investors should pay attention to the bond ratings while making an investment decision. When a bond is downgraded, investors should note the implications of the rise in credit risk, price risk, liquidity risk, etc, and take appropriate action.

Learn Free Stock Market Course Online at Smart Money with Angel One.

Explore the Share Market Prices Today

| IRFC share price | Suzlon share price |

| IREDA share price | Tata Motors share price |

| Yes Bank share price | HDFC Bank share price |

| NHPC share price | RVNL share price |

| SBI share price | Tata Power share price |

Disclaimer: This blog is exclusively for educational purposes.