Individuals these days save and park their money in a range of financial products like savings accounts, fixed deposits, provident funds, mutual funds, and more in order to earn good returns and build a corpus. You must be one of them too, who have invested their hard-earned money in these financial products. But have you ever thought about what will happen to your carefully planned investments in the event of your untimely demise? Here’s when the nomination facility comes to your aid.

What is a nomination facility?

Before we understand where you can add nominees, let’s understand what nomination is. Financial instruments allow you to authorize a person as a legal heir(s) to access your investments in case of the death of a primary holder. The person authorized by you is known as a nominee and the process of appointing a nominee is known as a nomination. In simple words, in case of the demise of the account holder, the nominee (beneficiary appointed by you) will be able to access the proceeds of your financial instruments.

To appoint a nominee(s), you just have to submit a simple form. You should also note that you can cancel the nomination of a person anytime you wish to. Moreover, you should know that authorizing a nominee is not mandatory (except for life insurance policies and term policies) but recommendatory so that your funds remain accessible and come into use by your loved ones.

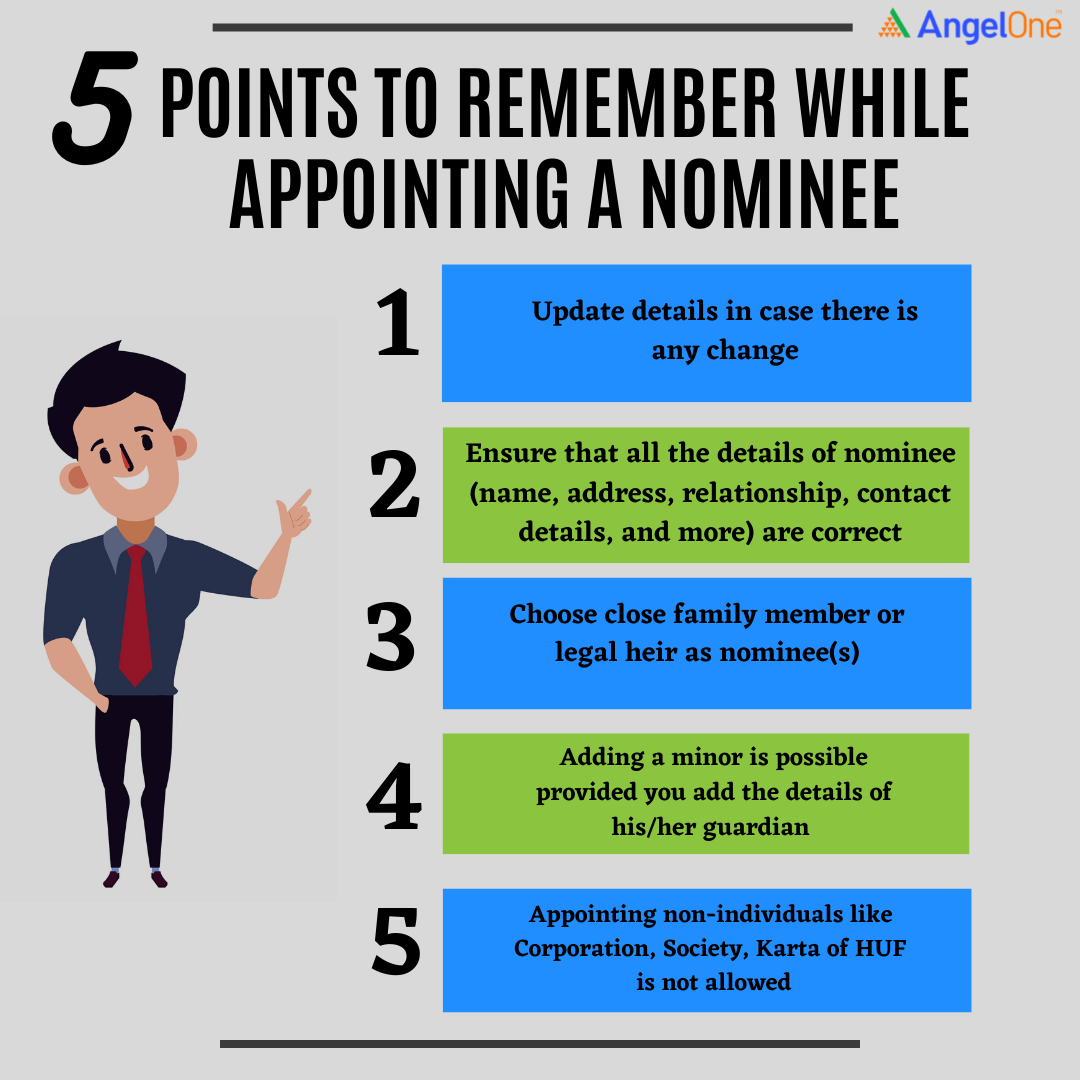

Points to remember while appointing a nominee

Following are the things you must not forget while appointing a nominee:

Financial instruments where you can add nominees

| Financial Instrument | Method of Adding Nominee | Other Details |

| Demat Account | Offline (via filling the offline form while account opening through the physical process or later on) and Online nomination (Click here to know the process of appointing a nominee with Angel One) | At Angel One, a maximum of 3 nominees can be appointed

|

| Mutual Funds | Online and offline nomination | A maximum of 3 nominees can be appointed

|

| Savings Bank Account | Online and offline nomination - depends on the bank you have an account with | Form DA1 needs to be filled for offline nomination

|

| Employee Provident Fund (EPF) | Online nomination | You must have a UAN (Universal Account Number) which must be linked with your Aadhar |

| Public Provident Fund (PPF) | Online and offline nomination - depends on the financial institution you have opened a PPF account with | For offline nomination, Form E needs to be filled |

| Life Insurance Policy | Online and offline nomination | Nominee/beneficiary needs to be added at the time of purchasing a life insurance policy but nominee/beneficiary name can be altered later on (after paying nominal charges)

|

| Fixed Deposits | Online and offline nomination - depends on the bank you have started FD with | 1. Even if you have added nominees to the savings account and your FD is linked to it, you need to add nominees to FD separately

2. If you have added a nominee, then a. In the case of single account holder, nominee can either continue the FD or withdraw it prematurely b. In the case of joint account holders, the survivor can choose to continue the FD or withdraw it prematurely |

Please note below points that are relevant to all the financial instruments:

- You can add a nominee later on if you haven’t already done so at the time of investing (except life insurance policy where a nominee is compulsory)

- The nominee will receive the amount only after:

- In the case of a single primary holder, after his/her death

- In the case of joint account holders, after the death of all the account holders

Conclusion

Despite planning everything carefully, something unexpected might disrupt all your planning. What if the account holder dies then what will happen to the carefully planned investments? In such a situation, the nomination facility for your financial instruments proves beneficial as it will provide financial support to your loved ones and secure their future. Now that you know the importance of appointing a nominee, do that for all your past and future investments and secure your loved ones from the unfortunate and/or untimely demise of the account holder. Click here to appoint a nominee to your Angel One Demat account.